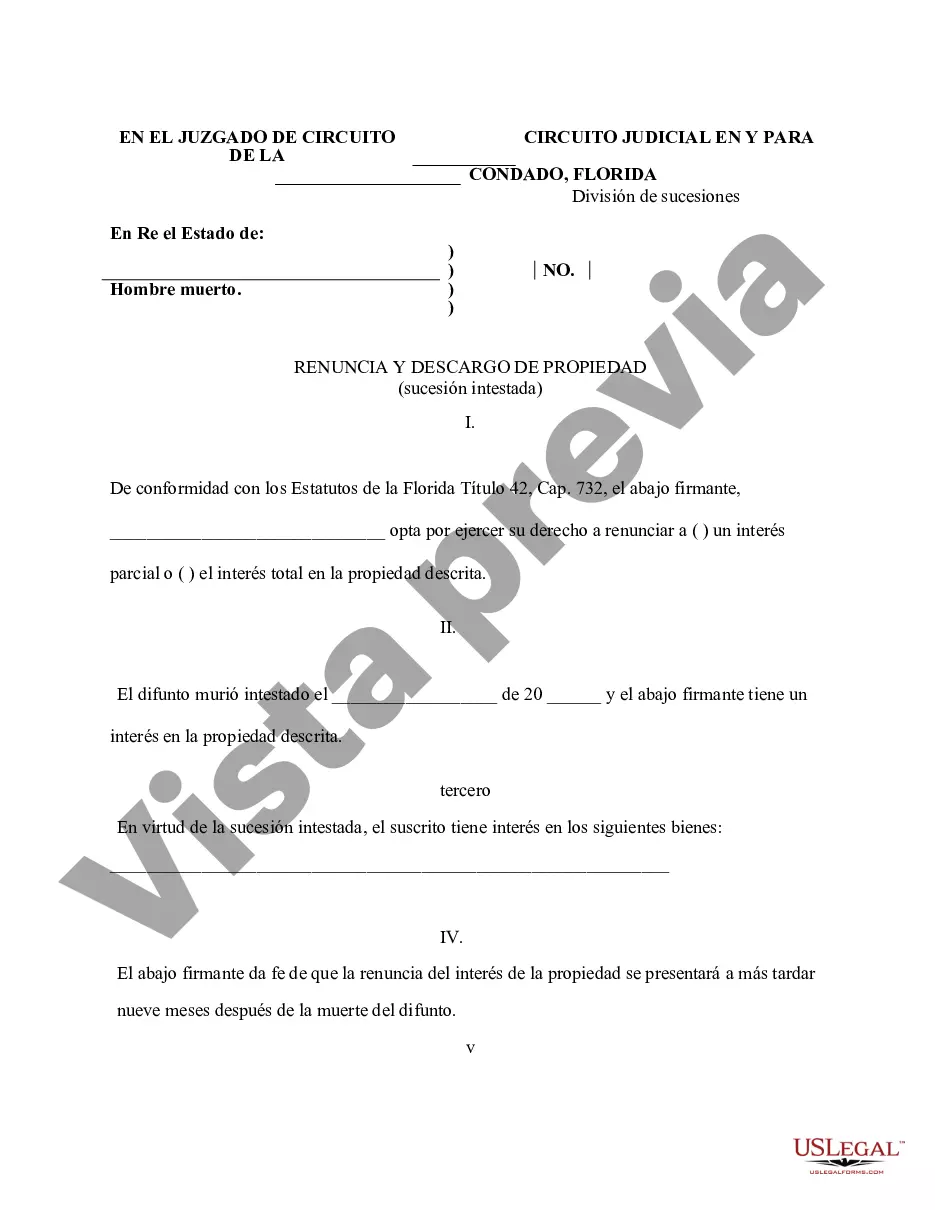

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Title: Understanding West Palm Beach Florida Renunciation and Disclaimer of Property received by Intestate Succession Keywords: West Palm Beach, Florida, renunciation, disclaimer, property, intestate succession Introduction: In West Palm Beach, Florida, when a person passes away without a valid will, their estate goes through a legal process known as intestate succession. During this process, the deceased person's assets and property are distributed among their heirs as determined by the state's laws. However, individuals who are entitled to inherit property through intestate succession have the option to renounce or disclaim their share. This article aims to provide a detailed description of West Palm Beach Florida Renunciation and Disclaimer of Property received by Intestate Succession. 1. Renunciation of Property: Renunciation, in the context of intestate succession, refers to the act of voluntarily giving up one's right to inherit property from a deceased person's estate. In West Palm Beach, Florida, an individual who renounces their share effectively declines their entitlement, allowing the property to pass to the next eligible heir. Renunciation must be done in writing and filed with the appropriate court within a specified timeframe. Once renounced, the renouncing individual will have no claim to the renounced property. 2. Disclaimer of Property: Similar to renunciation, a disclaimer allows an individual to relinquish their right to inherit property. By disclaiming a share, the individual effectively refuses to accept the assets, which then pass to the next eligible heir. To be valid, a disclaimer must be in writing, signed by the disclaim ant, and filed with the court within a specified timeframe. Once disclaimed, the disclaiming individual has no further claim or interest in the disclaimed property. Types of West Palm Beach Florida Renunciation and Disclaimer of Property received by Intestate Succession: a. Partial Renunciation/Disclaimer: In some cases, an heir may choose to renounce or disclaim only a portion of their entitled share. This allows them to accept some assets while relinquishing others. This option could be chosen if the heir has specific reasons, such as avoiding tax consequences or potential debts associated with the renounced or disclaimed portion. b. Full Renunciation/Disclaimer: Alternatively, an heir may choose to completely renounce or disclaim their entire share of the intestate estate. This decision may arise due to personal circumstances, financial considerations, or simply a desire to avoid the complexities involved in managing an inherited estate. By fully renouncing or disclaiming, the heir ensures that the property passes to the next eligible person in line. Conclusion: Understanding West Palm Beach Florida Renunciation and Disclaimer of Property received by Intestate Succession is crucial for individuals who are entitled to inherit property through intestate succession. Whether choosing to renounce a portion or disclaim the entire share, it is essential to comply with the legal procedures and timelines set forth by Florida law. Seeking legal advice from an experienced estate attorney can provide invaluable guidance in navigating these processes and ensuring a smooth transition of assets.Title: Understanding West Palm Beach Florida Renunciation and Disclaimer of Property received by Intestate Succession Keywords: West Palm Beach, Florida, renunciation, disclaimer, property, intestate succession Introduction: In West Palm Beach, Florida, when a person passes away without a valid will, their estate goes through a legal process known as intestate succession. During this process, the deceased person's assets and property are distributed among their heirs as determined by the state's laws. However, individuals who are entitled to inherit property through intestate succession have the option to renounce or disclaim their share. This article aims to provide a detailed description of West Palm Beach Florida Renunciation and Disclaimer of Property received by Intestate Succession. 1. Renunciation of Property: Renunciation, in the context of intestate succession, refers to the act of voluntarily giving up one's right to inherit property from a deceased person's estate. In West Palm Beach, Florida, an individual who renounces their share effectively declines their entitlement, allowing the property to pass to the next eligible heir. Renunciation must be done in writing and filed with the appropriate court within a specified timeframe. Once renounced, the renouncing individual will have no claim to the renounced property. 2. Disclaimer of Property: Similar to renunciation, a disclaimer allows an individual to relinquish their right to inherit property. By disclaiming a share, the individual effectively refuses to accept the assets, which then pass to the next eligible heir. To be valid, a disclaimer must be in writing, signed by the disclaim ant, and filed with the court within a specified timeframe. Once disclaimed, the disclaiming individual has no further claim or interest in the disclaimed property. Types of West Palm Beach Florida Renunciation and Disclaimer of Property received by Intestate Succession: a. Partial Renunciation/Disclaimer: In some cases, an heir may choose to renounce or disclaim only a portion of their entitled share. This allows them to accept some assets while relinquishing others. This option could be chosen if the heir has specific reasons, such as avoiding tax consequences or potential debts associated with the renounced or disclaimed portion. b. Full Renunciation/Disclaimer: Alternatively, an heir may choose to completely renounce or disclaim their entire share of the intestate estate. This decision may arise due to personal circumstances, financial considerations, or simply a desire to avoid the complexities involved in managing an inherited estate. By fully renouncing or disclaiming, the heir ensures that the property passes to the next eligible person in line. Conclusion: Understanding West Palm Beach Florida Renunciation and Disclaimer of Property received by Intestate Succession is crucial for individuals who are entitled to inherit property through intestate succession. Whether choosing to renounce a portion or disclaim the entire share, it is essential to comply with the legal procedures and timelines set forth by Florida law. Seeking legal advice from an experienced estate attorney can provide invaluable guidance in navigating these processes and ensuring a smooth transition of assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.