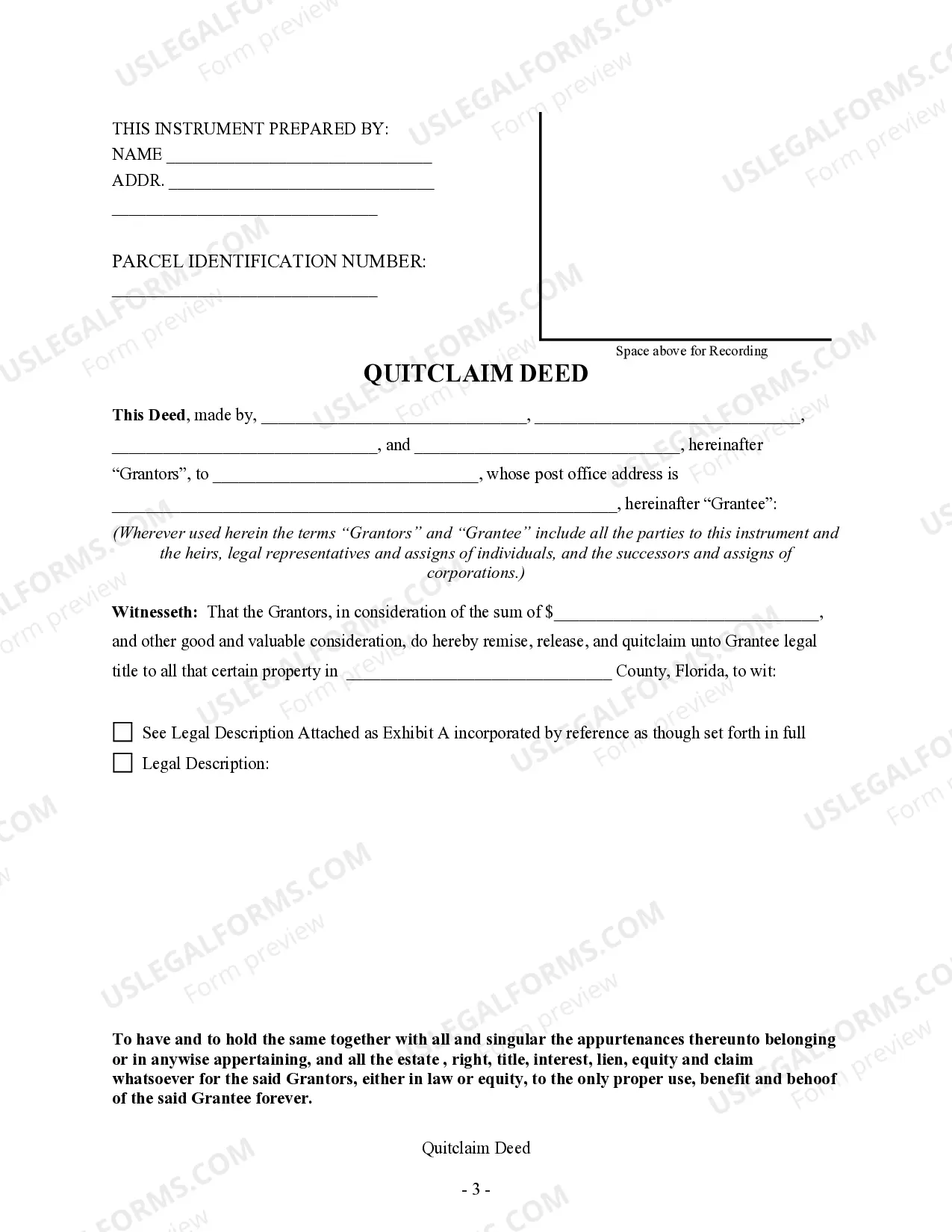

This form is a Quitclaim Deed where the grantors are four individuals and the grantee is an individual. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

A Broward Florida Quitclaim Deed — Four Individuals to One Individual is a legal document used to transfer ownership of a property from four individuals to a single individual. This type of deed is commonly used when multiple owners want to transfer their interests in a property to one person. This particular quitclaim deed is specific to Broward County, Florida, and follows the guidelines and regulations set forth by the county. It ensures a transparent and legally binding transfer of ownership while waiving any claims or warranties regarding the property's title. By utilizing a quitclaim deed, the four individuals involved willingly relinquish their rights, interests, and claims in the property to the individual named as the grantee. This transfer occurs without any warranties or guarantees, leaving the grantee solely responsible for any existing liens, encumbrances, or title defects associated with the property. It is important to note that there might be different variations of Broward Florida Quitclaim Deed — Four Individuals to One Individual, including: 1. Traditional Broward Florida Quitclaim Deed — Four Individuals to One Individual: This is the standard format adhering to the legal requirements and regulations of Broward County. It includes the necessary language and sections needed to effectively transfer ownership. 2. Broward Florida Quitclaim Deed with Affidavit of Consideration — Four Individuals to One Individual: This type of quitclaim deed includes an additional affidavit of consideration, which verifies the value or consideration exchanged during the transaction. This affidavit is often required by the county to determine any applicable tax obligations. 3. Broward Florida Quitclaim Deed with Property Tax Affidavit — Four Individuals to One Individual: In some cases, Broward County may require a property tax affidavit to be attached to the quitclaim deed. This affidavit provides information on the property's tax status, exemptions, and any outstanding taxes due. When drafting or utilizing a Broward Florida Quitclaim Deed — Four Individuals to One Individual, it is advisable to consult with a qualified real estate attorney to ensure compliance with local laws, to accurately record the transfer of ownership, and to protect all parties involved.A Broward Florida Quitclaim Deed — Four Individuals to One Individual is a legal document used to transfer ownership of a property from four individuals to a single individual. This type of deed is commonly used when multiple owners want to transfer their interests in a property to one person. This particular quitclaim deed is specific to Broward County, Florida, and follows the guidelines and regulations set forth by the county. It ensures a transparent and legally binding transfer of ownership while waiving any claims or warranties regarding the property's title. By utilizing a quitclaim deed, the four individuals involved willingly relinquish their rights, interests, and claims in the property to the individual named as the grantee. This transfer occurs without any warranties or guarantees, leaving the grantee solely responsible for any existing liens, encumbrances, or title defects associated with the property. It is important to note that there might be different variations of Broward Florida Quitclaim Deed — Four Individuals to One Individual, including: 1. Traditional Broward Florida Quitclaim Deed — Four Individuals to One Individual: This is the standard format adhering to the legal requirements and regulations of Broward County. It includes the necessary language and sections needed to effectively transfer ownership. 2. Broward Florida Quitclaim Deed with Affidavit of Consideration — Four Individuals to One Individual: This type of quitclaim deed includes an additional affidavit of consideration, which verifies the value or consideration exchanged during the transaction. This affidavit is often required by the county to determine any applicable tax obligations. 3. Broward Florida Quitclaim Deed with Property Tax Affidavit — Four Individuals to One Individual: In some cases, Broward County may require a property tax affidavit to be attached to the quitclaim deed. This affidavit provides information on the property's tax status, exemptions, and any outstanding taxes due. When drafting or utilizing a Broward Florida Quitclaim Deed — Four Individuals to One Individual, it is advisable to consult with a qualified real estate attorney to ensure compliance with local laws, to accurately record the transfer of ownership, and to protect all parties involved.