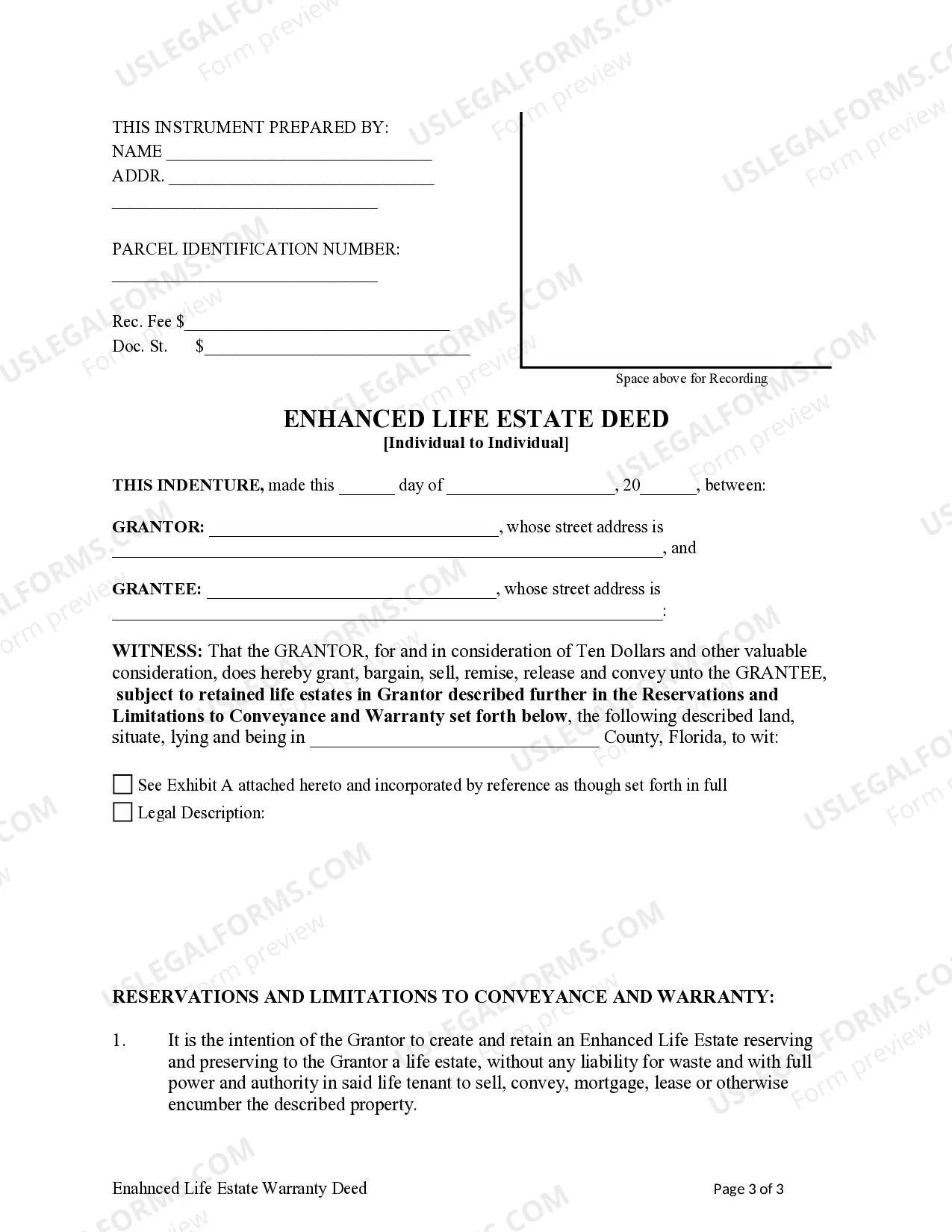

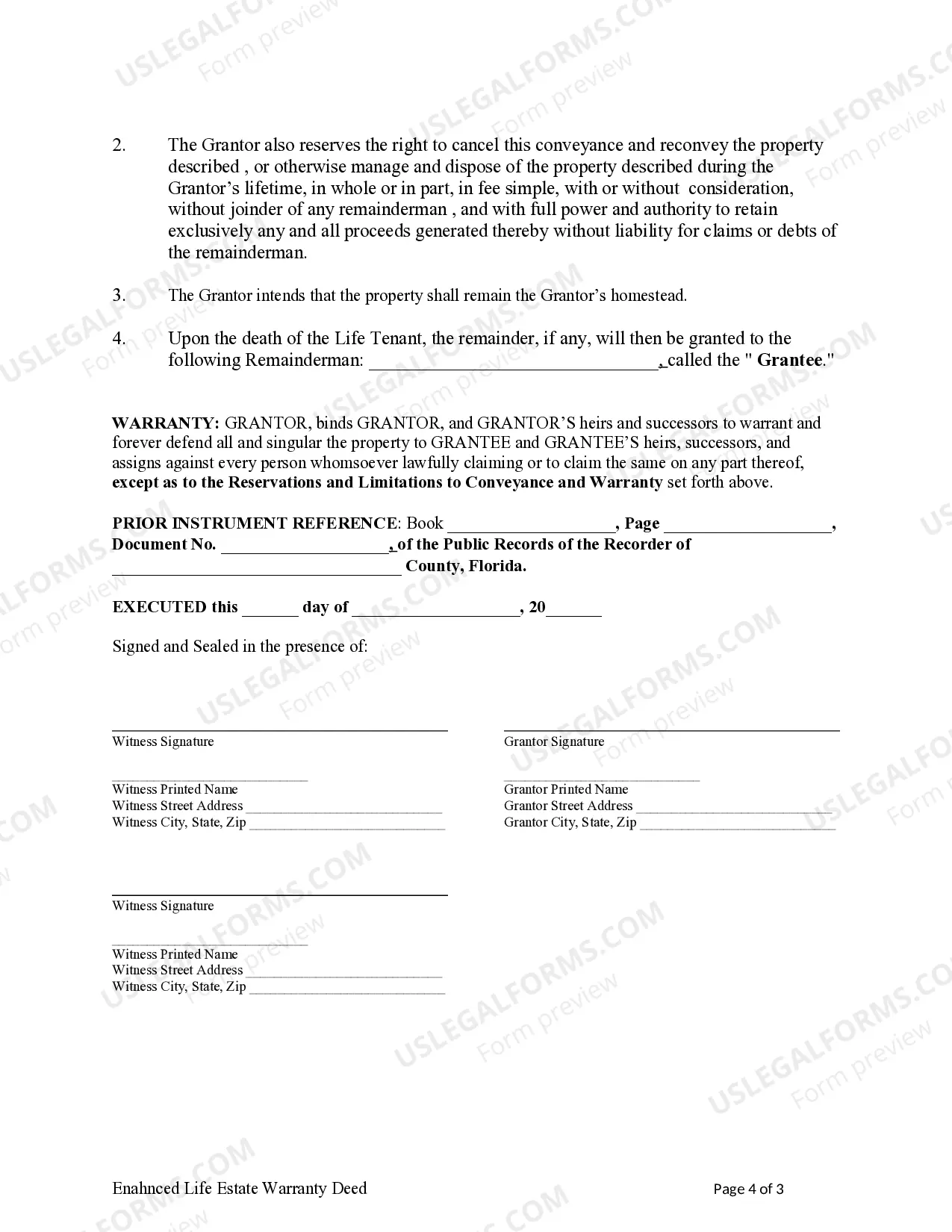

This form is an Enhanced Life Estate Deed where the Grantor is an Individual and the Grantee is an individual. Grantor conveys the property to Grantee subject to a retained life estate. Further, the Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Orange Florida Enhanced Life Estate or Lady Bird Deed, also known as an Enhanced Life Estate Deed, is a legal instrument that allows individuals to transfer real estate property with certain benefits and rights during their lifetime while ensuring a smooth transfer of ownership upon their death. This type of deed is commonly used in Orange, Florida and provides a variety of advantages for both the granter and the grantee. The Orange Florida Enhanced Life Estate enables an individual (the granter) to retain control and possession of their property during their lifetime, while also designating a specific beneficiary (the grantee) who will automatically gain ownership upon the granter's death. The granter retains the right to sell, mortgage, or lease the property without requiring the grantee's consent. This flexibility allows the granter to maintain full control over their property and make changes as per their needs. One of the notable benefits of an Orange Florida Enhanced Life Estate Deed is the avoidance of probate. Upon the granter's death, the property automatically transfers to the designated beneficiary without the need for probate court involvement. This saves time and money for both parties involved. Additionally, this type of deed provides protection for the granter's Medicaid eligibility as it ensures the property does not count towards their assets. There are different variations of Orange Florida Enhanced Life Estate or Lady Bird Deed — Individual to Individual, with some key distinctions: 1. Traditional Life Estate Deed: This type of deed allows the granter to maintain control and possession of the property during their lifetime and automatically transfers ownership to the grantee upon the granter's death. However, it does not offer the enhanced features that the Lady Bird Deed offers. 2. Enhanced Life Estate Deed with Reserved Powers: In this variation, the granter retains specific powers, such as the ability to sell or mortgage the property without the grantee's consent. This provides the granter with enhanced control over their property while still ensuring a seamless transition of ownership upon the granter's death. 3. Lady Bird Deed: The Lady Bird Deed is a specific type of Enhanced Life Estate Deed that allows the granter to retain complete control and ownership of the property during their lifetime, including the ability to change beneficiaries. This flexibility distinguishes it from other types of life estate deeds. In summary, Orange Florida Enhanced Life Estate or Lady Bird Deed — Individual to Individual is a valuable legal instrument that grants the granter control and possession of their property while ensuring a smooth transfer of ownership to the designated beneficiary upon the granter's death. Its primary benefits include the avoidance of probate, protection of Medicaid eligibility, and the ability to maintain control over the property during the granter's lifetime.Orange Florida Enhanced Life Estate or Lady Bird Deed, also known as an Enhanced Life Estate Deed, is a legal instrument that allows individuals to transfer real estate property with certain benefits and rights during their lifetime while ensuring a smooth transfer of ownership upon their death. This type of deed is commonly used in Orange, Florida and provides a variety of advantages for both the granter and the grantee. The Orange Florida Enhanced Life Estate enables an individual (the granter) to retain control and possession of their property during their lifetime, while also designating a specific beneficiary (the grantee) who will automatically gain ownership upon the granter's death. The granter retains the right to sell, mortgage, or lease the property without requiring the grantee's consent. This flexibility allows the granter to maintain full control over their property and make changes as per their needs. One of the notable benefits of an Orange Florida Enhanced Life Estate Deed is the avoidance of probate. Upon the granter's death, the property automatically transfers to the designated beneficiary without the need for probate court involvement. This saves time and money for both parties involved. Additionally, this type of deed provides protection for the granter's Medicaid eligibility as it ensures the property does not count towards their assets. There are different variations of Orange Florida Enhanced Life Estate or Lady Bird Deed — Individual to Individual, with some key distinctions: 1. Traditional Life Estate Deed: This type of deed allows the granter to maintain control and possession of the property during their lifetime and automatically transfers ownership to the grantee upon the granter's death. However, it does not offer the enhanced features that the Lady Bird Deed offers. 2. Enhanced Life Estate Deed with Reserved Powers: In this variation, the granter retains specific powers, such as the ability to sell or mortgage the property without the grantee's consent. This provides the granter with enhanced control over their property while still ensuring a seamless transition of ownership upon the granter's death. 3. Lady Bird Deed: The Lady Bird Deed is a specific type of Enhanced Life Estate Deed that allows the granter to retain complete control and ownership of the property during their lifetime, including the ability to change beneficiaries. This flexibility distinguishes it from other types of life estate deeds. In summary, Orange Florida Enhanced Life Estate or Lady Bird Deed — Individual to Individual is a valuable legal instrument that grants the granter control and possession of their property while ensuring a smooth transfer of ownership to the designated beneficiary upon the granter's death. Its primary benefits include the avoidance of probate, protection of Medicaid eligibility, and the ability to maintain control over the property during the granter's lifetime.