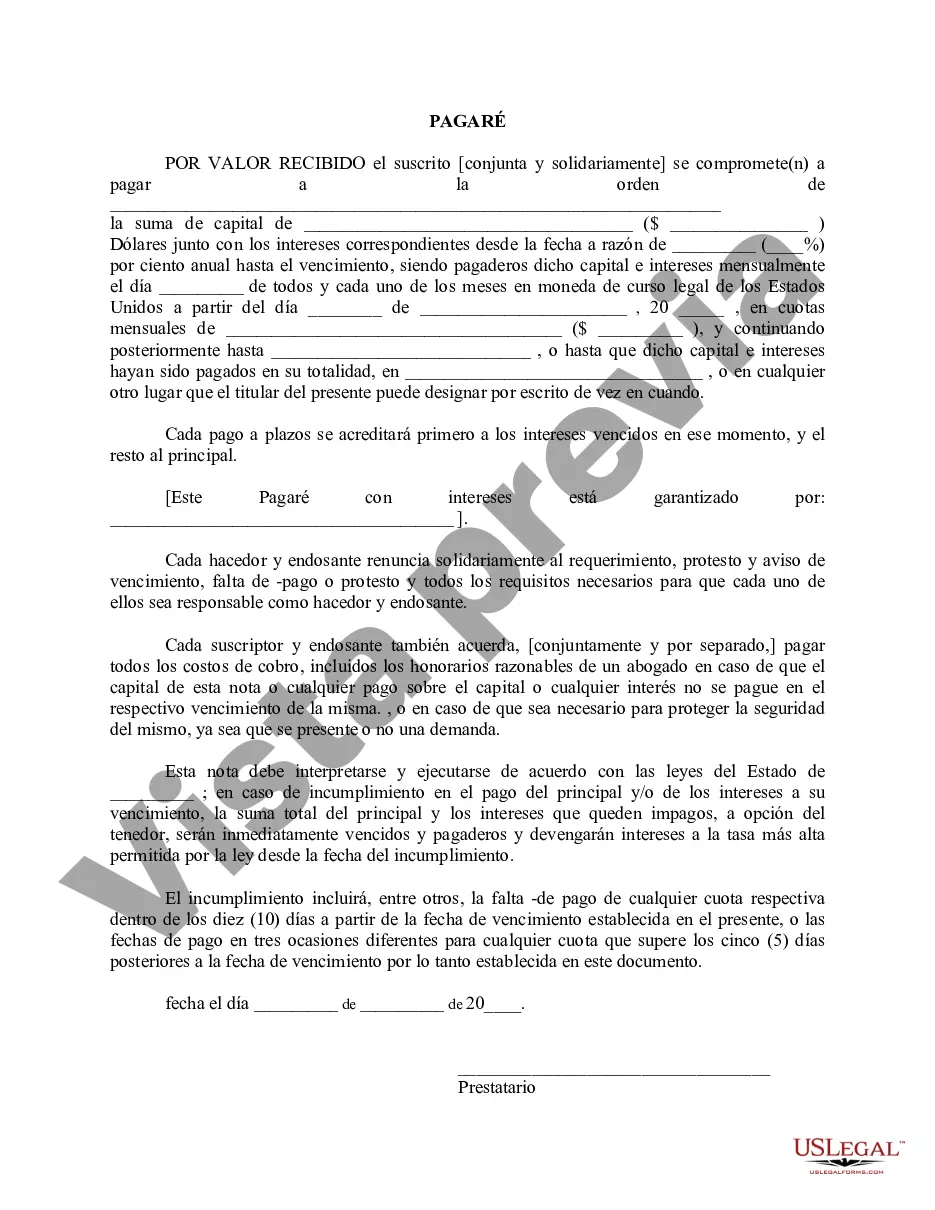

A promissory note is a written promise to pay a debt. In this particular agreement, the undersigned (jointly and severally) promise(s) to pay a certain sum of money with interest. The principal and interest will be paid in monthly installments until the amount is paid in full. Each maker and endorser will pay all costs of collection, including a reasonable attorney's fee in case the principal of this note or any payment on the principal or any interest is not paid at the respective maturity date.

Coral Springs, Florida Promissory Note — Secured or Unsecured: A Comprehensive Overview A promissory note is a legal document that signifies a promise from a borrower to repay a specific amount of money to a lender within a specified timeframe. In Coral Springs, Florida, promissory notes can be classified into two categories: secured and unsecured. Secured Promissory Note: A secured promissory note in Coral Springs, Florida, involves collateral to protect the lender's interests. Collateral can be any valuable asset, such as real estate, vehicles, or other personal property. If the borrower fails to repay the loan, the lender has the legal right to claim the collateral to satisfy the outstanding debt. This type of promissory note typically provides greater protection for lenders, as it reduces the risk of default. Unsecured Promissory Note: Alternatively, an unsecured promissory note does not require any collateral and solely relies on the borrower's creditworthiness and their commitment to repay the loan. This type of note is more common in situations where the borrower's assets may not be sufficient, or they may not wish to pledge collateral. However, due to the higher risk involved for lenders, unsecured promissory notes may have higher interest rates and stricter repayment terms. Coral Springs, Florida offers various subcategories of secured and unsecured promissory notes, including: 1. Real Estate Secured Promissory Note: This type of secured note utilizes real estate property as collateral. It is commonly used in mortgage agreements, where the property acts as security for the loan. If the borrower defaults, the lender can initiate foreclosure proceedings to reclaim the property. 2. Vehicle Secured Promissory Note: Specifically designed for loans involving vehicles, this type of secured note requires the borrower to use the vehicle as collateral. If the borrower fails to make payments, the lender can repossess the vehicle to recoup their investment. 3. Personal Property Secured Promissory Note: In this form of secured note, personal property such as jewelry, electronics, or valuable assets are used as collateral. If the borrower defaults on the loan, the lender can seize and sell the specified property to recover their losses. 4. Convertible Unsecured Promissory Note: This type of unsecured note allows the lender, under specific circumstances, to convert the debt into equity in the borrower's business. This effectively grants the lender ownership interests in the borrower's company instead of immediate repayment. When drafting a promissory note in Coral Springs, Florida, it is crucial to consult with legal professionals who specialize in contract law and understand the state's regulations. By tailoring the promissory note to the specific needs and circumstances of both the borrower and lender, they can ensure that all parties are protected and the terms of the agreement are clear and legally binding. In conclusion, Coral Springs, Florida promissory notes can be secured or unsecured, depending on the presence or absence of collateral. Secured notes offer protection through collateral, while unsecured notes rely solely on the borrower's creditworthiness. Understanding the various types of promissory notes and their implications is essential for borrowers and lenders alike in Coral Springs, Florida.Coral Springs, Florida Promissory Note — Secured or Unsecured: A Comprehensive Overview A promissory note is a legal document that signifies a promise from a borrower to repay a specific amount of money to a lender within a specified timeframe. In Coral Springs, Florida, promissory notes can be classified into two categories: secured and unsecured. Secured Promissory Note: A secured promissory note in Coral Springs, Florida, involves collateral to protect the lender's interests. Collateral can be any valuable asset, such as real estate, vehicles, or other personal property. If the borrower fails to repay the loan, the lender has the legal right to claim the collateral to satisfy the outstanding debt. This type of promissory note typically provides greater protection for lenders, as it reduces the risk of default. Unsecured Promissory Note: Alternatively, an unsecured promissory note does not require any collateral and solely relies on the borrower's creditworthiness and their commitment to repay the loan. This type of note is more common in situations where the borrower's assets may not be sufficient, or they may not wish to pledge collateral. However, due to the higher risk involved for lenders, unsecured promissory notes may have higher interest rates and stricter repayment terms. Coral Springs, Florida offers various subcategories of secured and unsecured promissory notes, including: 1. Real Estate Secured Promissory Note: This type of secured note utilizes real estate property as collateral. It is commonly used in mortgage agreements, where the property acts as security for the loan. If the borrower defaults, the lender can initiate foreclosure proceedings to reclaim the property. 2. Vehicle Secured Promissory Note: Specifically designed for loans involving vehicles, this type of secured note requires the borrower to use the vehicle as collateral. If the borrower fails to make payments, the lender can repossess the vehicle to recoup their investment. 3. Personal Property Secured Promissory Note: In this form of secured note, personal property such as jewelry, electronics, or valuable assets are used as collateral. If the borrower defaults on the loan, the lender can seize and sell the specified property to recover their losses. 4. Convertible Unsecured Promissory Note: This type of unsecured note allows the lender, under specific circumstances, to convert the debt into equity in the borrower's business. This effectively grants the lender ownership interests in the borrower's company instead of immediate repayment. When drafting a promissory note in Coral Springs, Florida, it is crucial to consult with legal professionals who specialize in contract law and understand the state's regulations. By tailoring the promissory note to the specific needs and circumstances of both the borrower and lender, they can ensure that all parties are protected and the terms of the agreement are clear and legally binding. In conclusion, Coral Springs, Florida promissory notes can be secured or unsecured, depending on the presence or absence of collateral. Secured notes offer protection through collateral, while unsecured notes rely solely on the borrower's creditworthiness. Understanding the various types of promissory notes and their implications is essential for borrowers and lenders alike in Coral Springs, Florida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.