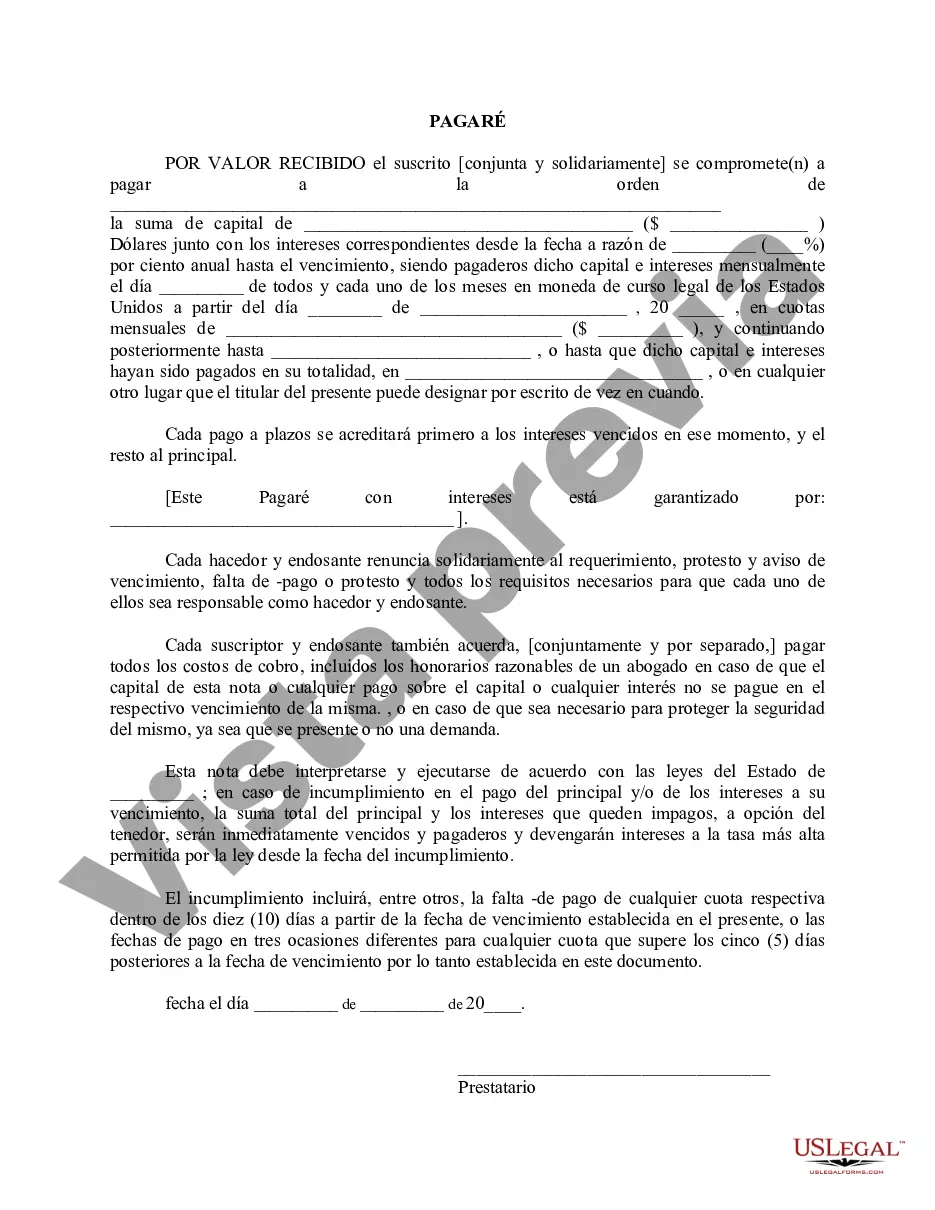

A promissory note is a written promise to pay a debt. In this particular agreement, the undersigned (jointly and severally) promise(s) to pay a certain sum of money with interest. The principal and interest will be paid in monthly installments until the amount is paid in full. Each maker and endorser will pay all costs of collection, including a reasonable attorney's fee in case the principal of this note or any payment on the principal or any interest is not paid at the respective maturity date.

A Gainesville Florida promissory note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. It serves as a written promise from the borrower to repay a specific amount of money within a specified timeframe. When it comes to promissory notes in Gainesville, Florida, there are two main types: secured and unsecured. 1. Gainesville Florida Secured Promissory Note: This type of promissory note includes collateral, such as real estate or personal property, to secure the loan. In case the borrower fails to repay the loan, the lender has the right to claim the collateral to recover their funds. The presence of collateral reduces the risk for the lender, making it easier to obtain loans with lower interest rates and better terms. 2. Gainesville Florida Unsecured Promissory Note: Unlike a secured promissory note, an unsecured one does not require collateral to secure the loan. In this case, the borrower's creditworthiness and reputation play a significant role, as the lender relies solely on the borrower's promise to repay the borrowed amount. Due to the higher risk involved for the lender, unsecured loans generally have higher interest rates and more stringent lending criteria. Determining whether to opt for a secured or unsecured promissory note in Gainesville, Florida depends on various factors, including the borrower's credit history, assets, and the amount of money being borrowed. It is essential to carefully consider one's financial situation and consult with legal and financial professionals to make an informed decision. In Gainesville, Florida, both secured and unsecured promissory notes must adhere to state and federal laws governing lending practices. The terms and conditions of the promissory note, including repayment schedule, interest rate, and any applicable fees or penalties, should be clearly stated within the document. Whether you are a lender or a borrower, it is crucial to draft a detailed and comprehensive Gainesville Florida promissory note to protect both parties' interests. Seeking legal advice when creating or signing a promissory note is highly recommended ensuring compliance with all relevant laws and regulations. Young Entrepreneur Council (YEC) provides excellent insights into the creation of promissory notes and other legal documents that can help guide borrowers and lenders through the process.A Gainesville Florida promissory note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. It serves as a written promise from the borrower to repay a specific amount of money within a specified timeframe. When it comes to promissory notes in Gainesville, Florida, there are two main types: secured and unsecured. 1. Gainesville Florida Secured Promissory Note: This type of promissory note includes collateral, such as real estate or personal property, to secure the loan. In case the borrower fails to repay the loan, the lender has the right to claim the collateral to recover their funds. The presence of collateral reduces the risk for the lender, making it easier to obtain loans with lower interest rates and better terms. 2. Gainesville Florida Unsecured Promissory Note: Unlike a secured promissory note, an unsecured one does not require collateral to secure the loan. In this case, the borrower's creditworthiness and reputation play a significant role, as the lender relies solely on the borrower's promise to repay the borrowed amount. Due to the higher risk involved for the lender, unsecured loans generally have higher interest rates and more stringent lending criteria. Determining whether to opt for a secured or unsecured promissory note in Gainesville, Florida depends on various factors, including the borrower's credit history, assets, and the amount of money being borrowed. It is essential to carefully consider one's financial situation and consult with legal and financial professionals to make an informed decision. In Gainesville, Florida, both secured and unsecured promissory notes must adhere to state and federal laws governing lending practices. The terms and conditions of the promissory note, including repayment schedule, interest rate, and any applicable fees or penalties, should be clearly stated within the document. Whether you are a lender or a borrower, it is crucial to draft a detailed and comprehensive Gainesville Florida promissory note to protect both parties' interests. Seeking legal advice when creating or signing a promissory note is highly recommended ensuring compliance with all relevant laws and regulations. Young Entrepreneur Council (YEC) provides excellent insights into the creation of promissory notes and other legal documents that can help guide borrowers and lenders through the process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.