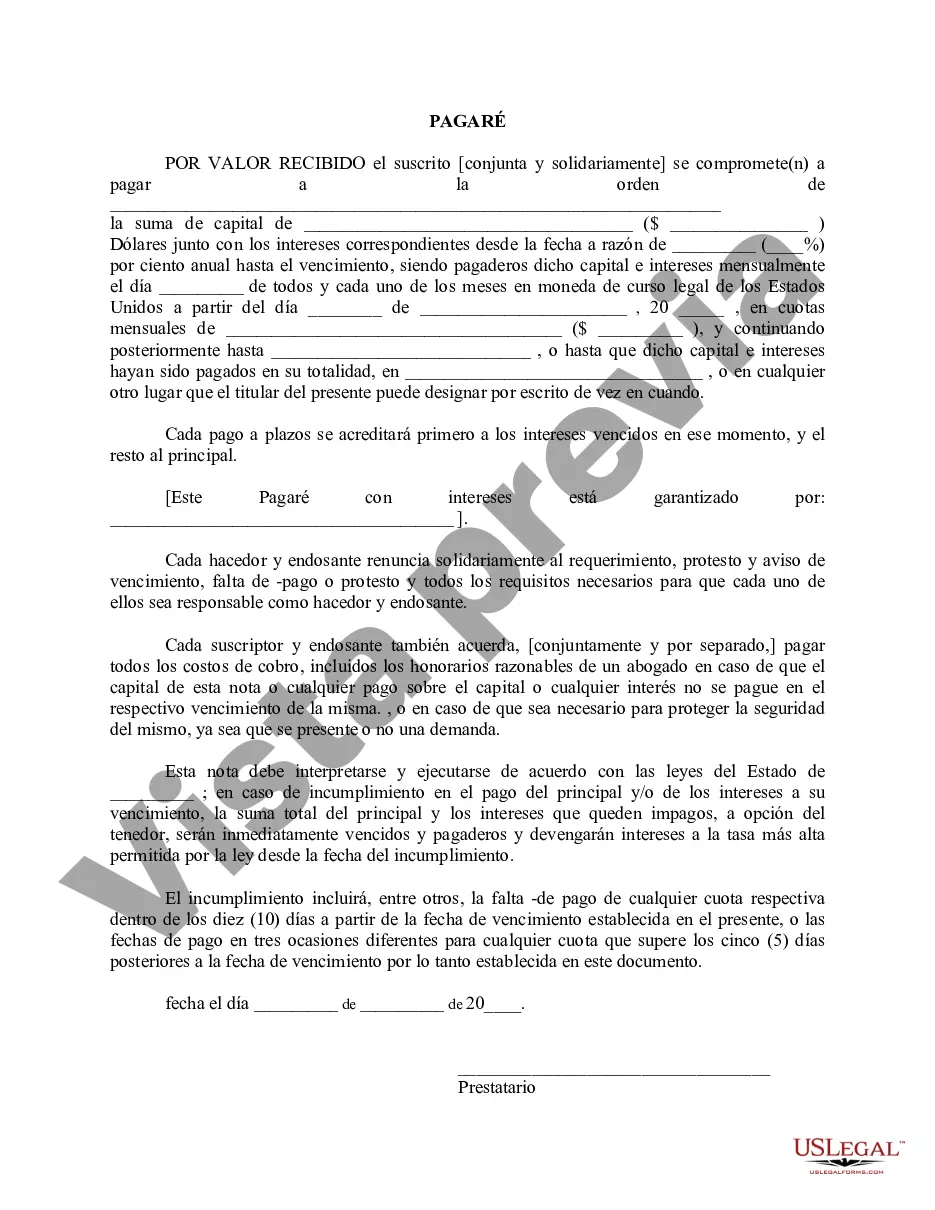

A promissory note is a written promise to pay a debt. In this particular agreement, the undersigned (jointly and severally) promise(s) to pay a certain sum of money with interest. The principal and interest will be paid in monthly installments until the amount is paid in full. Each maker and endorser will pay all costs of collection, including a reasonable attorney's fee in case the principal of this note or any payment on the principal or any interest is not paid at the respective maturity date.

A Jacksonville Florida Promissory Note, whether secured or unsecured, is a legal document used to outline the terms and conditions of a loan agreement between a lender and a borrower in the city of Jacksonville, Florida. It serves as a written evidence of the borrower's promise to repay the loaned amount to the lender, usually with interest, within a specified period of time. In terms of security, there are two main types of promissory notes in Jacksonville, Florida: secured and unsecured. 1. Secured Promissory Note: A secured promissory note is a document that includes a provision for collateral. This means that the borrower pledges an asset or property of value, such as a house, car, or valuable item, as security for the loan. In the event of default, the lender may have the right to claim the collateral to recover their loaned amount. The specific details regarding the collateral, such as its identification, value, and location, can be described in the secured promissory note. 2. Unsecured Promissory Note: On the other hand, an unsecured promissory note does not require any collateral. It is solely based on the borrower's promise to repay the loaned amount without any specific assets being put at risk. However, in the case of default, the lender may need to take legal action to recover the amount owed, as they do not have the immediate right to seize any asset. When drafting a Jacksonville Florida Promissory Note, it is important to include certain key elements to ensure its enforceability and clarity. These elements may include the loan amount, interest rate, repayment terms (such as monthly installments or balloon payment), due date, late fees or penalties, dispute resolution mechanisms, governing law, and the names and contact information of both the lender and borrower. It is crucial for both parties to thoroughly understand the terms and conditions of the promissory note before signing it, as it establishes a legally binding agreement between them. Additionally, seeking legal advice or consulting a professional in Jacksonville, Florida regarding the drafting and execution of a promissory note can provide further clarity and protection for both parties involved.A Jacksonville Florida Promissory Note, whether secured or unsecured, is a legal document used to outline the terms and conditions of a loan agreement between a lender and a borrower in the city of Jacksonville, Florida. It serves as a written evidence of the borrower's promise to repay the loaned amount to the lender, usually with interest, within a specified period of time. In terms of security, there are two main types of promissory notes in Jacksonville, Florida: secured and unsecured. 1. Secured Promissory Note: A secured promissory note is a document that includes a provision for collateral. This means that the borrower pledges an asset or property of value, such as a house, car, or valuable item, as security for the loan. In the event of default, the lender may have the right to claim the collateral to recover their loaned amount. The specific details regarding the collateral, such as its identification, value, and location, can be described in the secured promissory note. 2. Unsecured Promissory Note: On the other hand, an unsecured promissory note does not require any collateral. It is solely based on the borrower's promise to repay the loaned amount without any specific assets being put at risk. However, in the case of default, the lender may need to take legal action to recover the amount owed, as they do not have the immediate right to seize any asset. When drafting a Jacksonville Florida Promissory Note, it is important to include certain key elements to ensure its enforceability and clarity. These elements may include the loan amount, interest rate, repayment terms (such as monthly installments or balloon payment), due date, late fees or penalties, dispute resolution mechanisms, governing law, and the names and contact information of both the lender and borrower. It is crucial for both parties to thoroughly understand the terms and conditions of the promissory note before signing it, as it establishes a legally binding agreement between them. Additionally, seeking legal advice or consulting a professional in Jacksonville, Florida regarding the drafting and execution of a promissory note can provide further clarity and protection for both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.