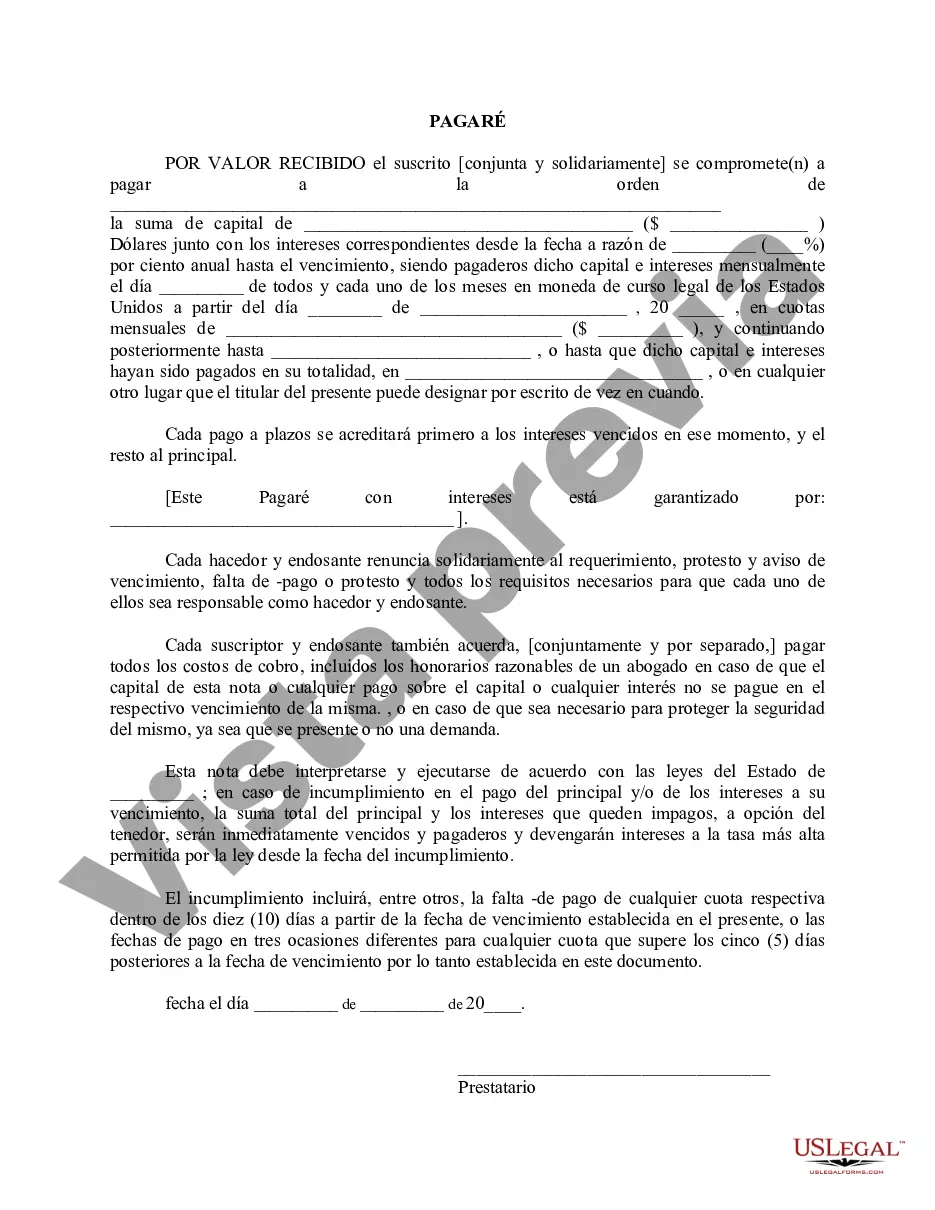

A promissory note is a written promise to pay a debt. In this particular agreement, the undersigned (jointly and severally) promise(s) to pay a certain sum of money with interest. The principal and interest will be paid in monthly installments until the amount is paid in full. Each maker and endorser will pay all costs of collection, including a reasonable attorney's fee in case the principal of this note or any payment on the principal or any interest is not paid at the respective maturity date.

A Lakeland Florida promissory note is a legal document that outlines the terms of a loan agreement between two parties. It serves as a written promise to repay a specific amount of money borrowed, typically with interest, within a specific timeframe. A promissory note can be either secured or unsecured, depending on the agreement between the borrower and the lender. In the case of a secured promissory note in Lakeland Florida, it means that the borrower pledges some form of collateral to secure the loan. The collateral can be any valuable asset, such as real estate, vehicles, or other valuable property, which the lender can claim ownership of if the borrower fails to repay the loan as agreed. The use of collateral provides added security for the lender, reducing the risk of non-payment and potentially allowing for more favorable loan terms. On the other hand, an unsecured promissory note does not require collateral. It is solely based on the borrower's creditworthiness and their ability to repay the loan. Unsecured notes generally involve higher interest rates since they pose a higher risk to lenders. This type of note is commonly used when the borrower does not possess sufficient assets to secure the loan or when the lender agrees to extend credit based on the borrower's credit history and financial standing. In Lakeland Florida, there may be various types of promissory notes based on their specific purpose, industry, or circumstances. Some common types include: 1. Real Estate Promissory Note: This note is used when financing the purchase, construction, or renovation of a property. Typically, it includes specific provisions related to the property, such as mortgage terms and property descriptions. 2. Business Promissory Note: This note is designed for loans related to business purposes, such as start-up capital, equipment purchases, or expansions. It may have additional clauses related to business assets or revenue streams. 3. Personal Promissory Note: This type of note is used for personal loans between individuals, friends, or family members. It can cover various personal financial needs, such as debt consolidation, education expenses, or unexpected costs. 4. Convertible Promissory Note: This note allows the lender to convert the debt into equity ownership in the borrower's business at some point in the future. It is commonly used for startup financing or funding rounds in entrepreneurial ventures. Whether you are a borrower or a lender in Lakeland Florida, understanding the distinction between secured and unsecured promissory notes is crucial for making informed financial decisions. Seeking legal advice and thoroughly reviewing loan agreements is highly recommended ensuring compliance with local laws and protect your interests.A Lakeland Florida promissory note is a legal document that outlines the terms of a loan agreement between two parties. It serves as a written promise to repay a specific amount of money borrowed, typically with interest, within a specific timeframe. A promissory note can be either secured or unsecured, depending on the agreement between the borrower and the lender. In the case of a secured promissory note in Lakeland Florida, it means that the borrower pledges some form of collateral to secure the loan. The collateral can be any valuable asset, such as real estate, vehicles, or other valuable property, which the lender can claim ownership of if the borrower fails to repay the loan as agreed. The use of collateral provides added security for the lender, reducing the risk of non-payment and potentially allowing for more favorable loan terms. On the other hand, an unsecured promissory note does not require collateral. It is solely based on the borrower's creditworthiness and their ability to repay the loan. Unsecured notes generally involve higher interest rates since they pose a higher risk to lenders. This type of note is commonly used when the borrower does not possess sufficient assets to secure the loan or when the lender agrees to extend credit based on the borrower's credit history and financial standing. In Lakeland Florida, there may be various types of promissory notes based on their specific purpose, industry, or circumstances. Some common types include: 1. Real Estate Promissory Note: This note is used when financing the purchase, construction, or renovation of a property. Typically, it includes specific provisions related to the property, such as mortgage terms and property descriptions. 2. Business Promissory Note: This note is designed for loans related to business purposes, such as start-up capital, equipment purchases, or expansions. It may have additional clauses related to business assets or revenue streams. 3. Personal Promissory Note: This type of note is used for personal loans between individuals, friends, or family members. It can cover various personal financial needs, such as debt consolidation, education expenses, or unexpected costs. 4. Convertible Promissory Note: This note allows the lender to convert the debt into equity ownership in the borrower's business at some point in the future. It is commonly used for startup financing or funding rounds in entrepreneurial ventures. Whether you are a borrower or a lender in Lakeland Florida, understanding the distinction between secured and unsecured promissory notes is crucial for making informed financial decisions. Seeking legal advice and thoroughly reviewing loan agreements is highly recommended ensuring compliance with local laws and protect your interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.