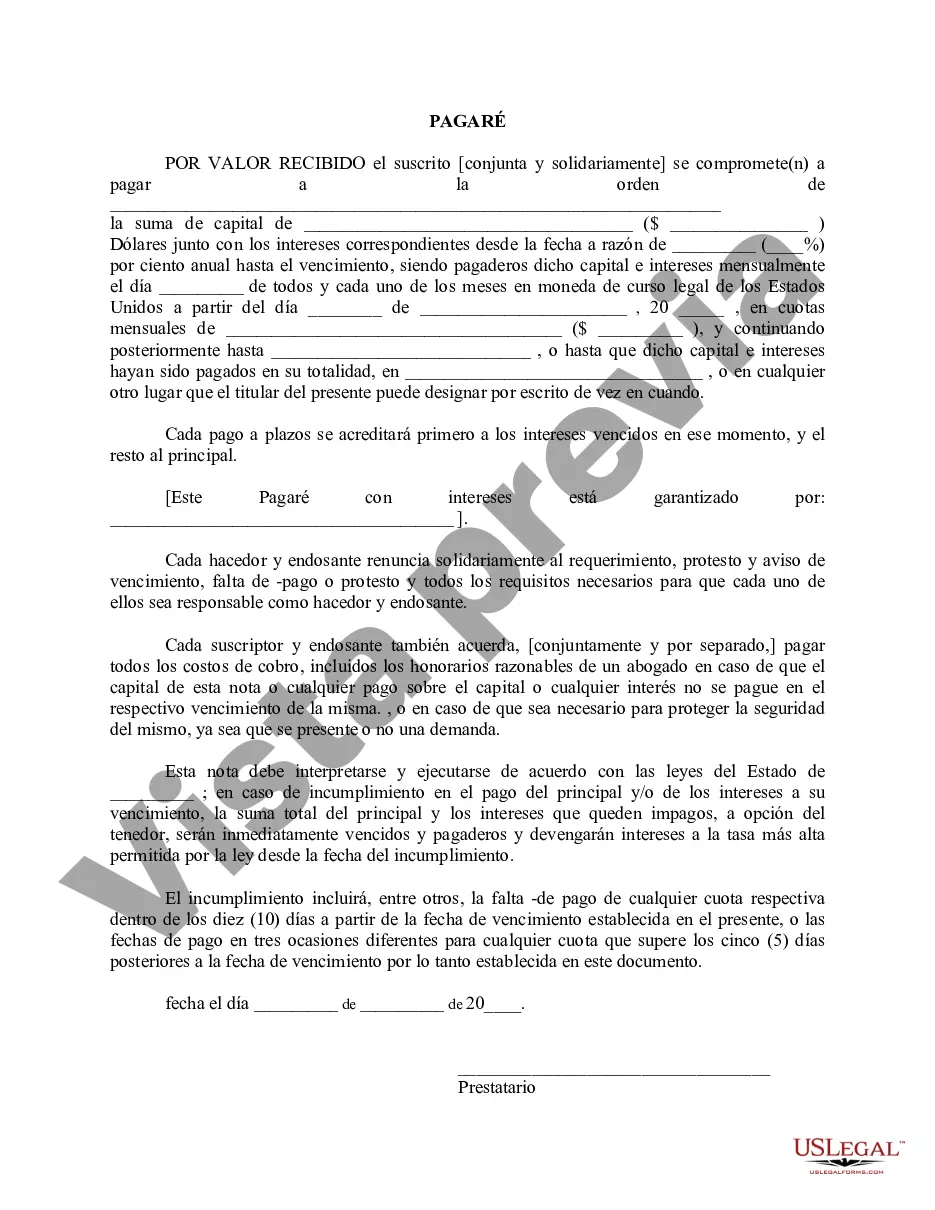

A promissory note is a written promise to pay a debt. In this particular agreement, the undersigned (jointly and severally) promise(s) to pay a certain sum of money with interest. The principal and interest will be paid in monthly installments until the amount is paid in full. Each maker and endorser will pay all costs of collection, including a reasonable attorney's fee in case the principal of this note or any payment on the principal or any interest is not paid at the respective maturity date.

A Tallahassee, Florida Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Tallahassee, Florida. It serves as a binding agreement and ensures both parties are aware of their obligations and rights pertaining to the loan. Promissory notes can be either secured or unsecured, depending on whether collateral is involved or not. In a secured promissory note, the borrower pledges an asset as collateral to secure the loan, providing the lender with a form of security in case of default. On the other hand, an unsecured promissory note does not require collateral, relying solely on the borrower's promise to repay. In Tallahassee, Florida, several types of promissory notes can be utilized, including: 1. Real Estate Promissory Note: This type of promissory note is commonly used in real estate transactions, where the property acts as collateral. It includes details about the property, loan amount, interest rate, repayment terms, and consequences of default. 2. Business Promissory Note: This type of promissory note is often used for business loans. It outlines the loan amount, repayment schedule, interest rate, and other relevant terms specific to the business transaction. 3. Personal Promissory Note: A personal promissory note is typically used for personal loans between individuals. It includes important details such as the loan amount, repayment schedule, interest rate, and consequences of non-payment. 4. Student Loan Promissory Note: This type of promissory note is specific to student loans and is typically issued by educational institutions or financial institutions. It covers the loan amount, repayment terms, interest rates, and applicable deferment or forbearance options. Regardless of the type, a Tallahassee, Florida Promissory Note should contain essential information, including the names and contact details of the lender and borrower, the loan amount, interest rate, repayment terms, any applicable fees or penalties, and the date of agreement. Before signing any promissory note, it is crucial for both parties to carefully review and understand the terms to ensure they are comfortable with the obligations and expectations laid out in the document. Consulting with a legal professional in Tallahassee, Florida, may be recommended to ensure compliance with local laws and regulations.A Tallahassee, Florida Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Tallahassee, Florida. It serves as a binding agreement and ensures both parties are aware of their obligations and rights pertaining to the loan. Promissory notes can be either secured or unsecured, depending on whether collateral is involved or not. In a secured promissory note, the borrower pledges an asset as collateral to secure the loan, providing the lender with a form of security in case of default. On the other hand, an unsecured promissory note does not require collateral, relying solely on the borrower's promise to repay. In Tallahassee, Florida, several types of promissory notes can be utilized, including: 1. Real Estate Promissory Note: This type of promissory note is commonly used in real estate transactions, where the property acts as collateral. It includes details about the property, loan amount, interest rate, repayment terms, and consequences of default. 2. Business Promissory Note: This type of promissory note is often used for business loans. It outlines the loan amount, repayment schedule, interest rate, and other relevant terms specific to the business transaction. 3. Personal Promissory Note: A personal promissory note is typically used for personal loans between individuals. It includes important details such as the loan amount, repayment schedule, interest rate, and consequences of non-payment. 4. Student Loan Promissory Note: This type of promissory note is specific to student loans and is typically issued by educational institutions or financial institutions. It covers the loan amount, repayment terms, interest rates, and applicable deferment or forbearance options. Regardless of the type, a Tallahassee, Florida Promissory Note should contain essential information, including the names and contact details of the lender and borrower, the loan amount, interest rate, repayment terms, any applicable fees or penalties, and the date of agreement. Before signing any promissory note, it is crucial for both parties to carefully review and understand the terms to ensure they are comfortable with the obligations and expectations laid out in the document. Consulting with a legal professional in Tallahassee, Florida, may be recommended to ensure compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.