Port St. Lucie, located on the east coast of Florida, is a thriving city that attracts a significant number of businesses and entrepreneurs. When it comes to legal matters, it is essential for corporations or limited liability companies (LCS) operating in Port St. Lucie to understand the demand for a copy of bond. This demand can arise in various scenarios, such as licensing requirements, contractual agreements, or legal disputes. Let's delve into the different types of Port St. Lucie Florida demand for a copy of bond for corporations and LCS: 1. License Bond: Starting a business in Port St. Lucie often requires obtaining specific licenses and permits. Depending on the industry, these licenses may include a contractor's license, professional license, or a permit for operating specific businesses. In such cases, local authorities or regulatory bodies may demand a copy of a bond, known as a license bond, to ensure compliance with applicable laws and regulations. This bond acts as a guarantee that the business will operate ethically and fulfill its obligations. 2. Performance Bond: Contracts are an integral part of any business, and in certain cases, a corporation or LLC may be required to provide a performance bond. This bond guarantees that the company will complete the contracted job or project as agreed upon. It protects the project owner by providing compensation in case the company fails to fulfill its obligations, such as delays or subpar quality work. Demand for a copy of a performance bond can come from contractors, government organizations, or private clients. 3. Payment Bond: When a corporation or LLC engages in construction projects or other ventures requiring subcontractors or suppliers, a payment bond may be demanded. This bond ensures that the company will pay all subcontractors, laborers, and vendors involved in the project. It acts as a safeguard against non-payment and ensures smooth operations within the industry. If a payment dispute arises, stakeholders can demand a copy of the payment bond to initiate legal proceedings. 4. Court-Ordered Bond: In legal cases or disputes, a court may demand a copy of bond from a corporation or LLC to ensure proper compensation to the opposing party if they win the case. This bond is often referred to as a court-ordered bond, and it helps guarantee financial security for plaintiffs or claimants who may be entitled to damages. Court-ordered bonds can include appeal bonds, indemnity bonds, or injunction bonds, depending on the specific legal requirements. It is crucial for corporations and LCS operating in Port St. Lucie, Florida, to understand the different types of demands for a copy of bond they may encounter. These demands protect the interests of stakeholders, ensure compliance with regulations, and safeguard against potential financial losses. A thorough understanding of these demands will help businesses navigate legal requirements and maintain their reputation within the community.

Port St. Lucie Florida Demand for Copy of Bond - Corporation or LLC

Category:

State:

Florida

City:

Port St. Lucie

Control #:

FL-03231A

Format:

Word;

Rich Text

Instant download

Description

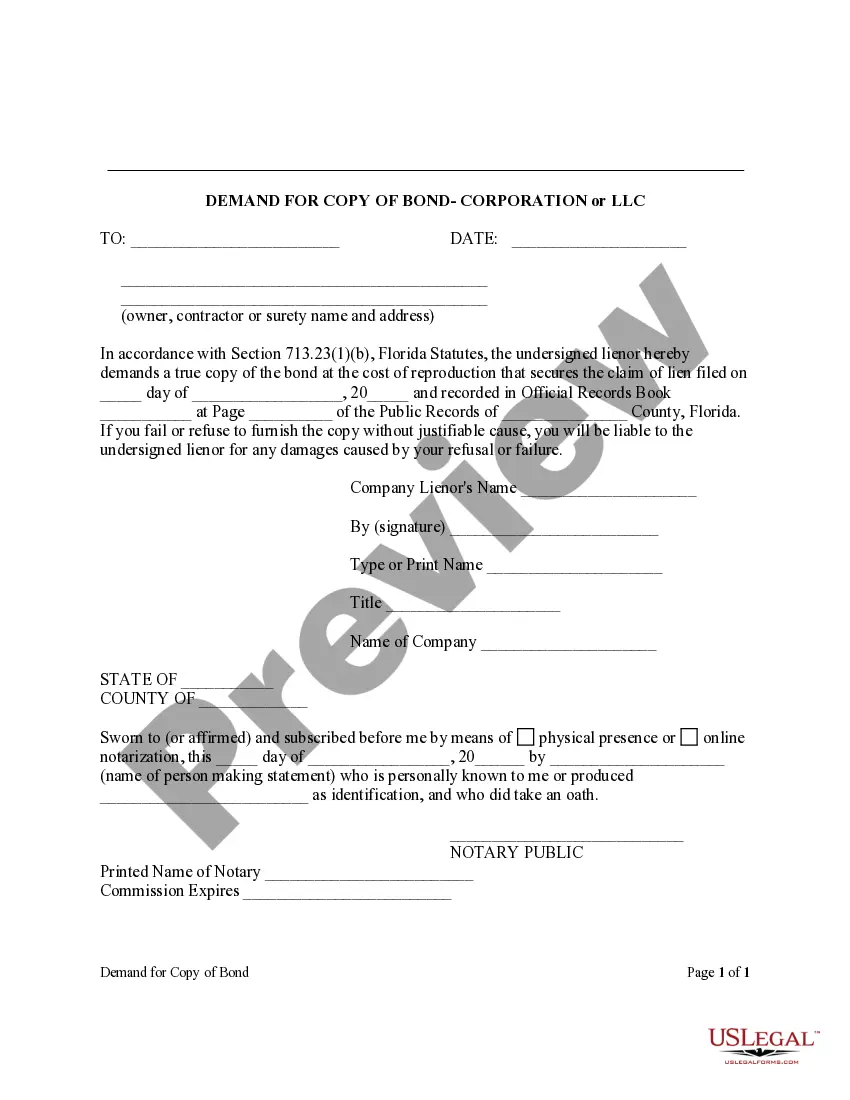

This Demand for Copy of Bond is for use by a corporate or LLC lienor to demand from an owner, contractor or surety a true copy of the bond at the cost of reproduction that secures a claim of lien.

Port St. Lucie, located on the east coast of Florida, is a thriving city that attracts a significant number of businesses and entrepreneurs. When it comes to legal matters, it is essential for corporations or limited liability companies (LCS) operating in Port St. Lucie to understand the demand for a copy of bond. This demand can arise in various scenarios, such as licensing requirements, contractual agreements, or legal disputes. Let's delve into the different types of Port St. Lucie Florida demand for a copy of bond for corporations and LCS: 1. License Bond: Starting a business in Port St. Lucie often requires obtaining specific licenses and permits. Depending on the industry, these licenses may include a contractor's license, professional license, or a permit for operating specific businesses. In such cases, local authorities or regulatory bodies may demand a copy of a bond, known as a license bond, to ensure compliance with applicable laws and regulations. This bond acts as a guarantee that the business will operate ethically and fulfill its obligations. 2. Performance Bond: Contracts are an integral part of any business, and in certain cases, a corporation or LLC may be required to provide a performance bond. This bond guarantees that the company will complete the contracted job or project as agreed upon. It protects the project owner by providing compensation in case the company fails to fulfill its obligations, such as delays or subpar quality work. Demand for a copy of a performance bond can come from contractors, government organizations, or private clients. 3. Payment Bond: When a corporation or LLC engages in construction projects or other ventures requiring subcontractors or suppliers, a payment bond may be demanded. This bond ensures that the company will pay all subcontractors, laborers, and vendors involved in the project. It acts as a safeguard against non-payment and ensures smooth operations within the industry. If a payment dispute arises, stakeholders can demand a copy of the payment bond to initiate legal proceedings. 4. Court-Ordered Bond: In legal cases or disputes, a court may demand a copy of bond from a corporation or LLC to ensure proper compensation to the opposing party if they win the case. This bond is often referred to as a court-ordered bond, and it helps guarantee financial security for plaintiffs or claimants who may be entitled to damages. Court-ordered bonds can include appeal bonds, indemnity bonds, or injunction bonds, depending on the specific legal requirements. It is crucial for corporations and LCS operating in Port St. Lucie, Florida, to understand the different types of demands for a copy of bond they may encounter. These demands protect the interests of stakeholders, ensure compliance with regulations, and safeguard against potential financial losses. A thorough understanding of these demands will help businesses navigate legal requirements and maintain their reputation within the community.

How to fill out Port St. Lucie Florida Demand For Copy Of Bond - Corporation Or LLC?

If you’ve already used our service before, log in to your account and save the Port St. Lucie Florida Demand for Copy of Bond - Corporation or LLC on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Port St. Lucie Florida Demand for Copy of Bond - Corporation or LLC. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!