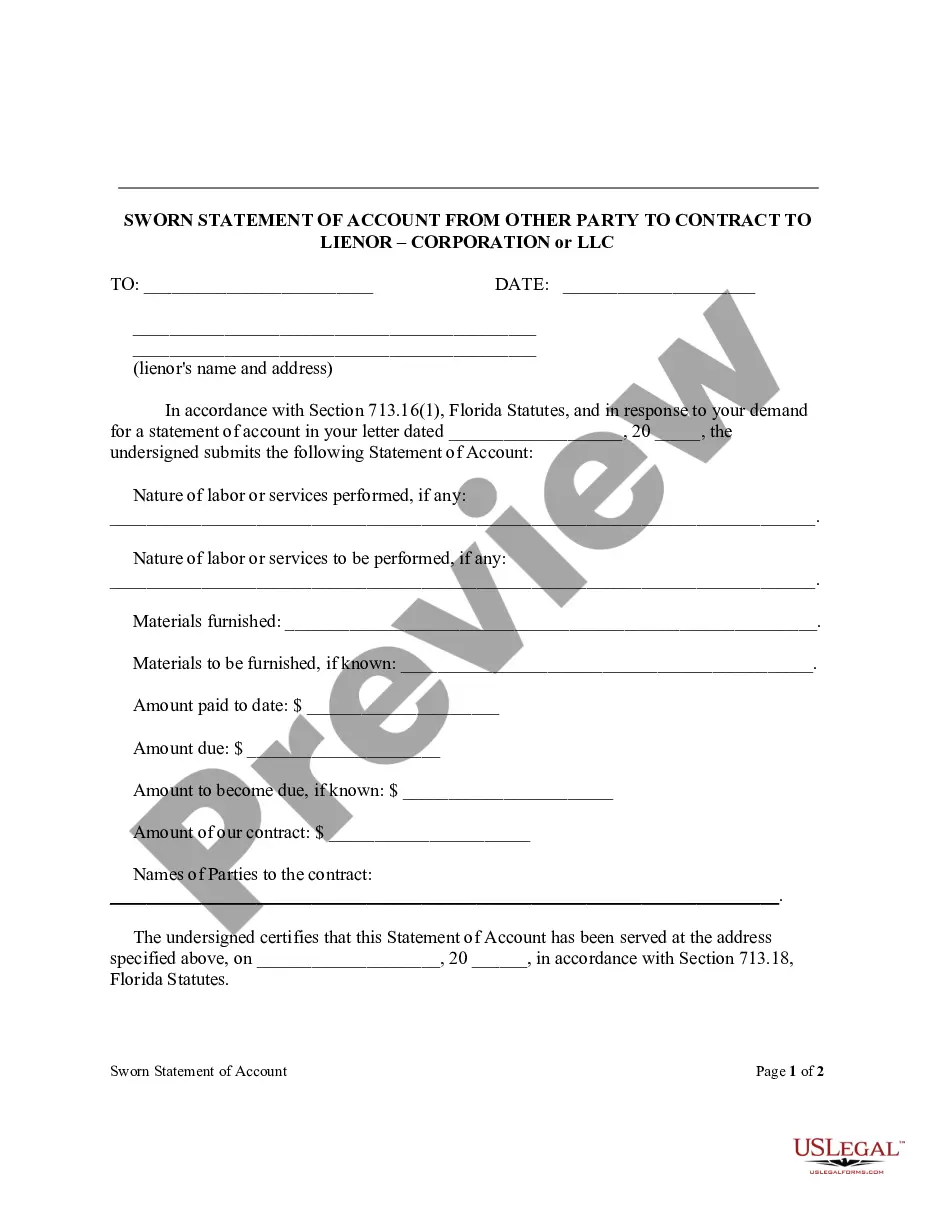

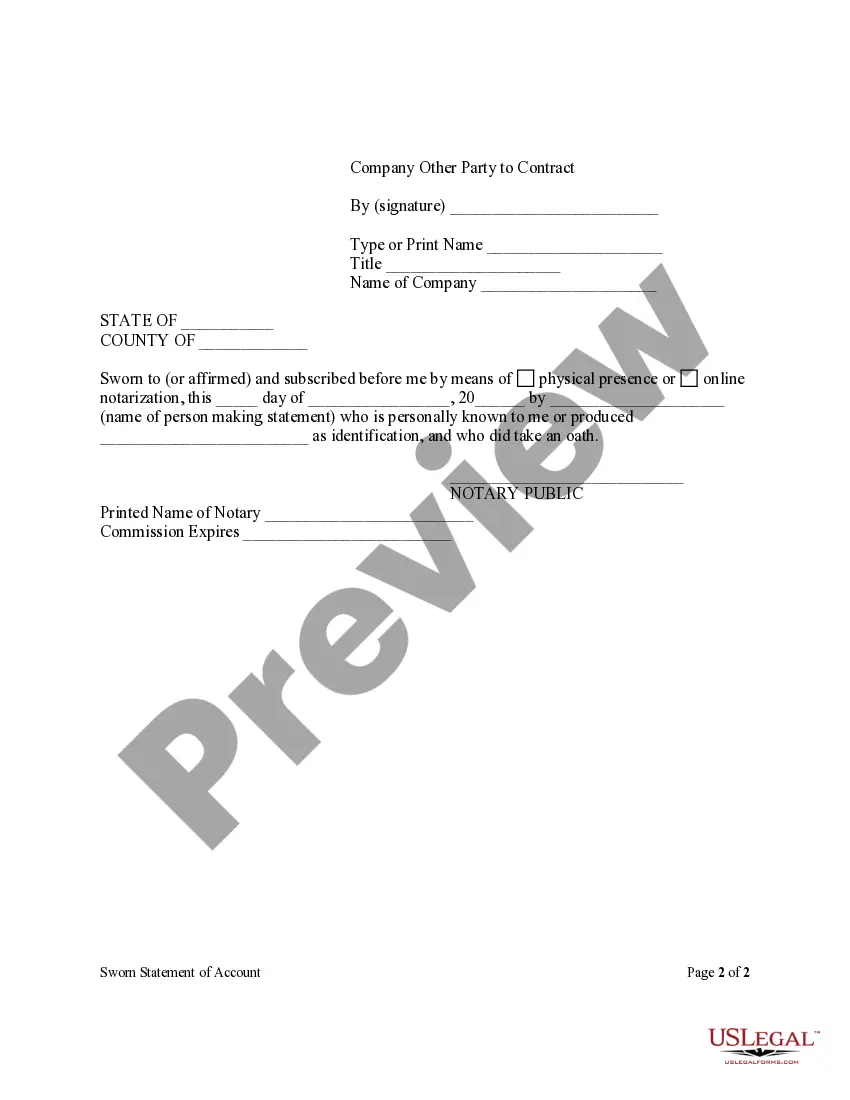

The Jacksonville Florida Sworn Statement of Account from Other Party to Contract to Lie nor — Corporation or LLC is a legal document that serves as a declaration of the outstanding debt owed by one party (the Other Party to Contract) to another party (the Lie nor), with the Lie nor being a corporate entity like a Corporation or Limited Liability Company (LLC). This statement is an essential part of the lien process in Jacksonville, Florida, and is utilized in the construction industry to protect the rights and interests of contractors and suppliers. The purpose of the Jacksonville Florida Sworn Statement of Account from Other Party to Contract to Lie nor — Corporation or LLC is to provide a detailed breakdown of the items and services for which payment is being claimed. It outlines the materials, labor, equipment, and any other relevant costs incurred by the Lie nor in relation to the contractual agreement between the Other Party and the Lie nor. By disclosing this information, the Sworn Statement of Account ensures transparency and allows the Other Party to evaluate the legitimacy of the claimed debt. There can be different types of Jacksonville Florida Sworn Statements of Account from Other Party to Contract to Lie nor — Corporation or LLC, each representing a distinct stage of the lien process. Some common types may include: 1. Preliminary Sworn Statement: This is typically the initial statement provided by the Lie nor at the beginning of a project or before the commencement of work. It serves as a notice to the Other Party that the Lie nor will be seeking payment for the services rendered. 2. Interim Sworn Statement: This type of statement is issued during the course of the project to update the Other Party on the ongoing costs and progress. It lists the accumulated work completed and expenses to date. 3. Final Sworn Statement: As the name suggests, this statement is submitted upon the completion of the project or termination of the contract. It provides the final calculation and breakdown of all charges, including any retained sums, change orders, or additional costs incurred. In order for the Jacksonville Florida Sworn Statement of Account from Other Party to Contract to Lie nor — Corporation or LLC to be legally binding, it must meet certain requirements. The statement needs to be in writing, signed under oath by the Lie nor, and notarized by a notary public. It should contain accurate and comprehensive information, including the names and addresses of the contracting parties, a description of the property, and a detailed breakdown of the debt claimed. It is important to note that while this description provides a general understanding of the Jacksonville Florida Sworn Statement of Account from Other Party to Contract to Lie nor — Corporation or LLC, it is alwayrecommended consulting with an attorney or legal professional to ensure compliance with specific laws and regulations.

Jacksonville Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC

Description

How to fill out Jacksonville Florida Sworn Statement Of Account From Other Party To Contract To Lienor - Corporation Or LLC?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Jacksonville Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Jacksonville Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Jacksonville Florida Sworn Statement of Account from Other Party to Contract to Lienor - Corporation or LLC. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!