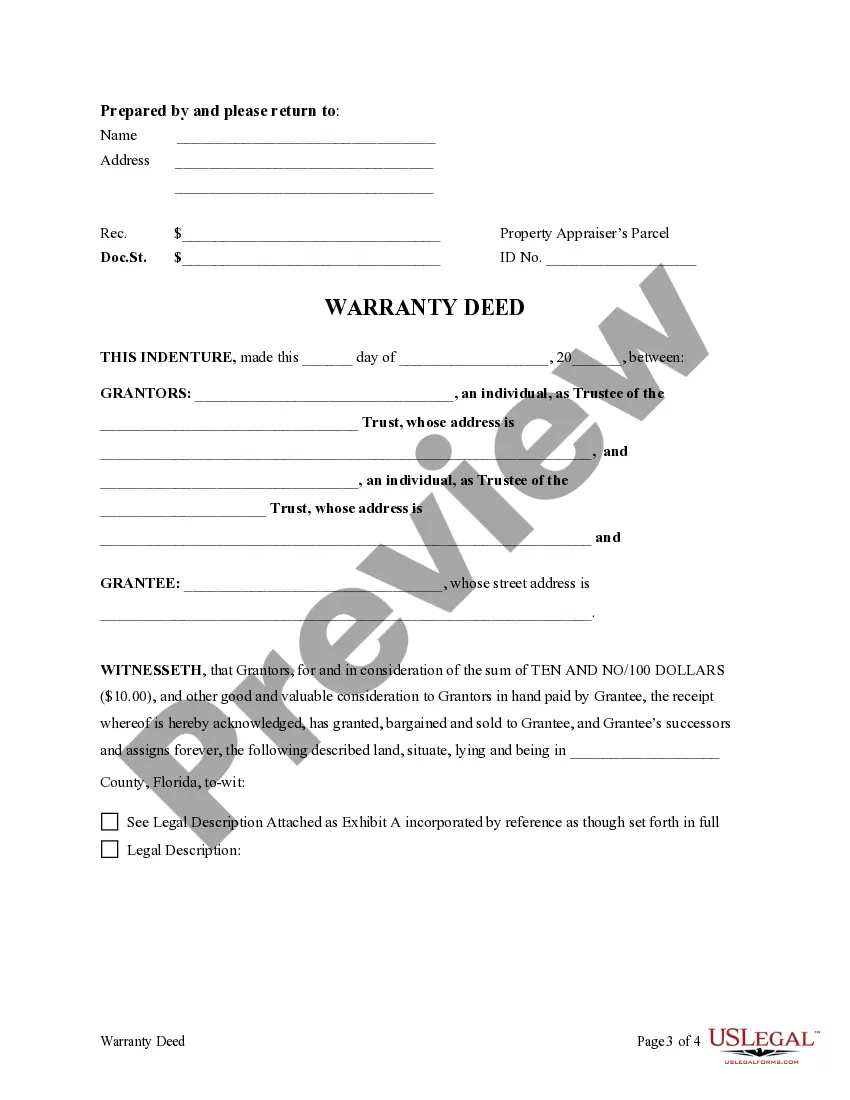

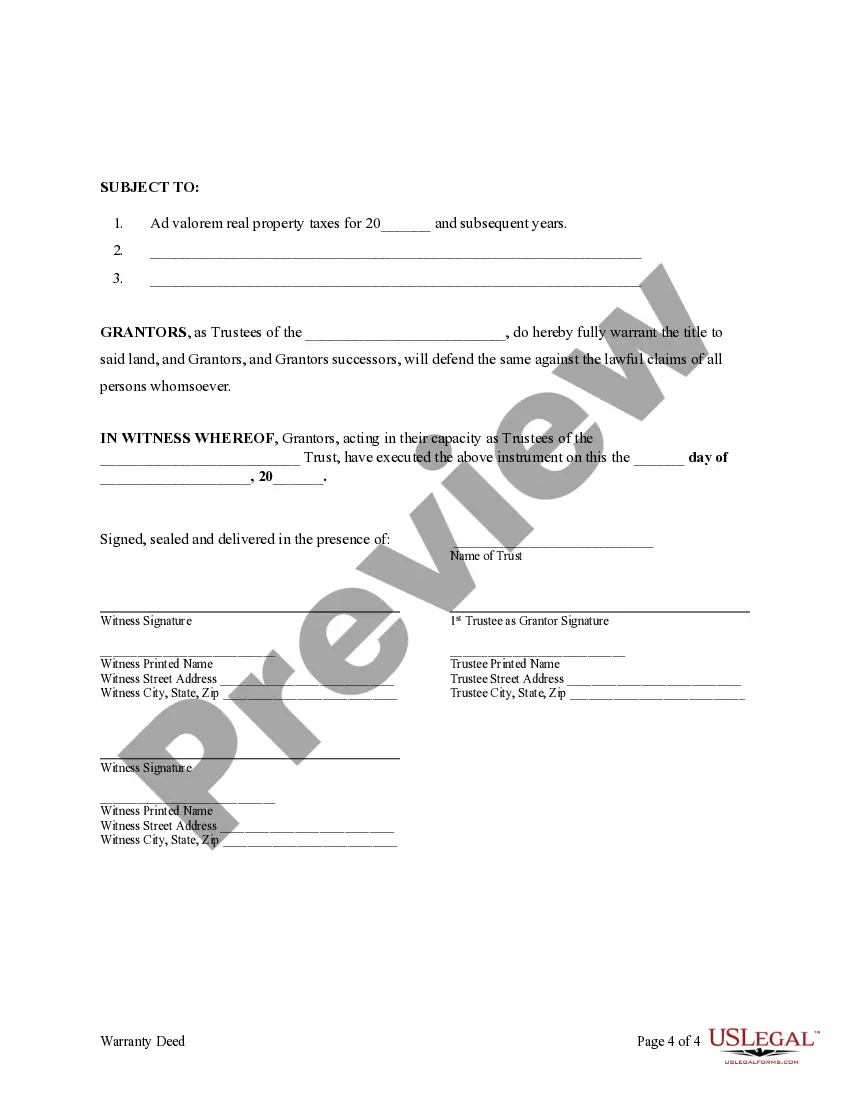

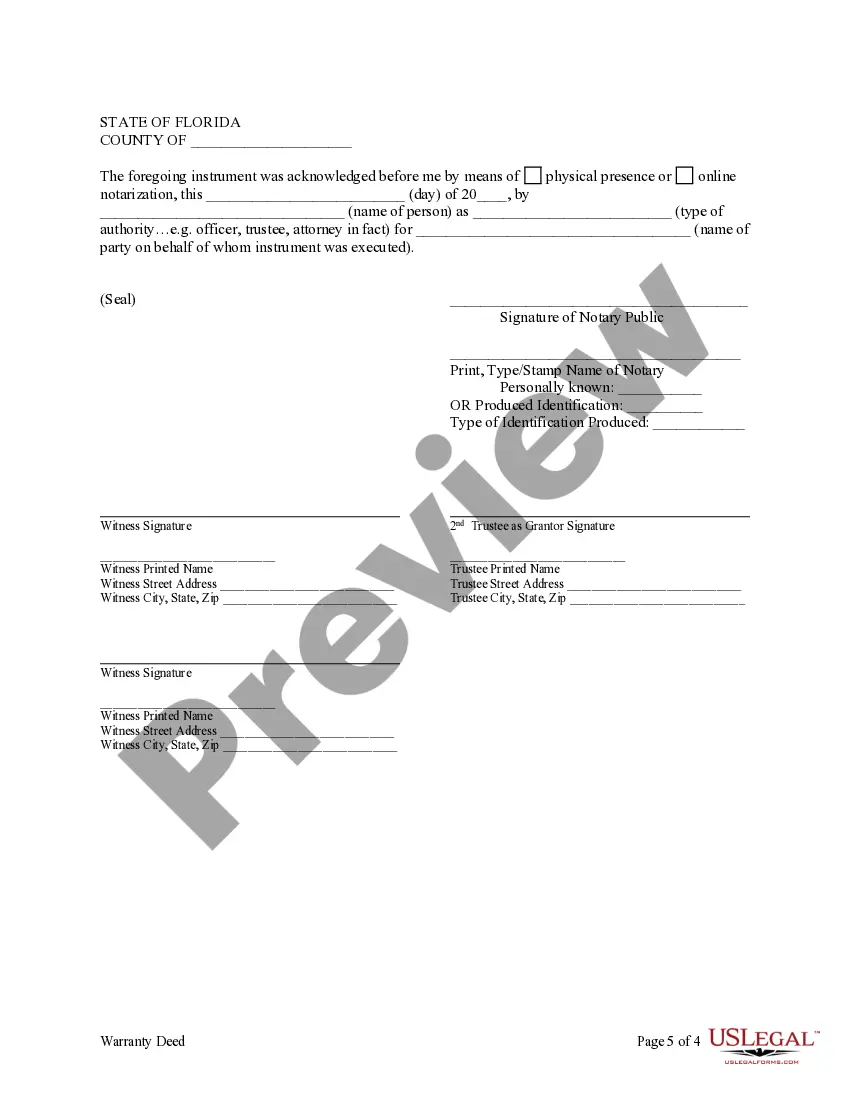

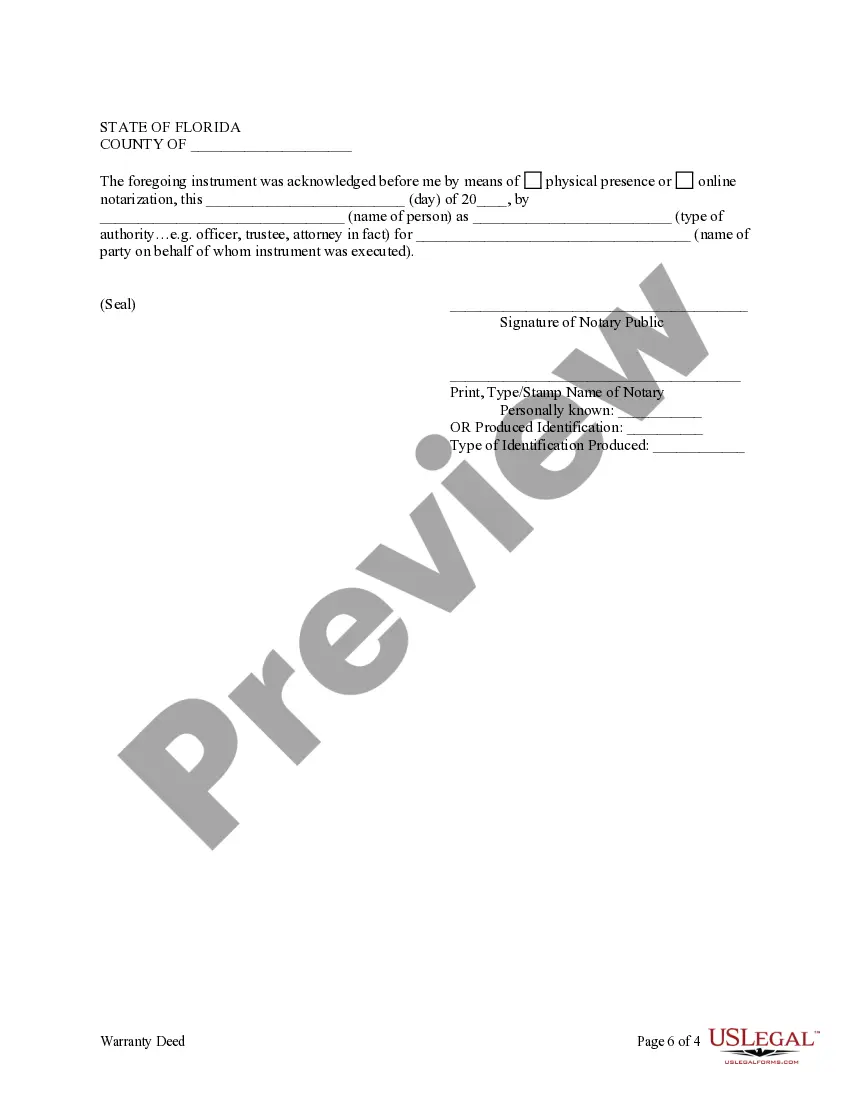

This form is a Warranty Deed where the Grantor is a Trust acting through two individual Trustees and the Grantee is an idividual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Title: Understanding Broward Florida Trust: Two Individual Trustees to an Individual Introduction: A Broward Florida Trust — Two Individual Trustees to an Individual refers to a specific type of trust arrangement in which two individuals are appointed as trustees to manage the assets and finances for the benefit of an individual, the beneficiary. This article aims to provide a comprehensive overview of Broward Florida Trusts with two individual trustees serving an individual, highlighting their significance and key aspects. 1. Definition and Purpose: A Broward Florida Trust — Two Individual Trustee— - to an Individual is a legal framework created to protect and manage an individual's assets, investments, and financial affairs. Its primary purpose is to ensure that the beneficiary's interests are safeguarded, providing financial stability and support. 2. Trustee Roles and Responsibilities: a. Primary Trustees: The two individual trustees appointed to manage the trust's affairs. They are responsible for carrying out the trust's intentions, making financial decisions, handling investments, and ensuring compliance with applicable laws and regulations. b. Successor Trustees: In case either of the primary trustees is unable or unwilling to fulfill their duties, an alternate trustee, known as a successor trustee, steps in to assume the responsibilities. 3. Types of Broward Florida Trust — Two Individual Trustee— - to an Individual: a. Revocable Living Trust: Offers flexibility, as the individual establishing the trust (granter) can change it or dissolve it during their lifetime. It allows for seamless wealth management and provides for a smooth transfer of assets upon the granter's death. b. Irrevocable Trust: Once established, this type of trust cannot be amended or revoked without the beneficiary's consent. It offers creditor protection, tax planning advantages, and can help with Medicaid planning or preserving assets for future generations. c. Testamentary Trust: Created via the individual's will and only takes effect upon their death. It may provide instructions for the management and distribution of assets, ensuring the beneficiary's financial security. 4. Benefits of Broward Florida Trust — Two Individual Trustee— - to an Individual: a. Estate Planning: Enables the granter to have more control over asset distribution, reducing the chances of probate disputes and ensuring their wishes are honored. b. Privacy: Unlike a will, trust administration occurs privately, without court involvement, providing a higher level of confidentiality. c. Continuity: Involving two individual trustees ensures a system of checks and balances, minimizing the risk of mismanagement or negligence. d. Flexibility and Customization: Trusts can adapt to changing circumstances, allowing for the granter's specific wishes to be considered during the lifetime or after their demise. Conclusion: Selecting the right Broward Florida Trust with two individual trustees to an individual is crucial for effective wealth management and asset protection. Whether it is a revocable living trust, irrevocable trust, or testamentary trust, involving knowledgeable legal counsel is essential. By establishing such a trust, individuals can provide for their financial future, preserve wealth, and secure the well-being of their loved ones.Title: Understanding Broward Florida Trust: Two Individual Trustees to an Individual Introduction: A Broward Florida Trust — Two Individual Trustees to an Individual refers to a specific type of trust arrangement in which two individuals are appointed as trustees to manage the assets and finances for the benefit of an individual, the beneficiary. This article aims to provide a comprehensive overview of Broward Florida Trusts with two individual trustees serving an individual, highlighting their significance and key aspects. 1. Definition and Purpose: A Broward Florida Trust — Two Individual Trustee— - to an Individual is a legal framework created to protect and manage an individual's assets, investments, and financial affairs. Its primary purpose is to ensure that the beneficiary's interests are safeguarded, providing financial stability and support. 2. Trustee Roles and Responsibilities: a. Primary Trustees: The two individual trustees appointed to manage the trust's affairs. They are responsible for carrying out the trust's intentions, making financial decisions, handling investments, and ensuring compliance with applicable laws and regulations. b. Successor Trustees: In case either of the primary trustees is unable or unwilling to fulfill their duties, an alternate trustee, known as a successor trustee, steps in to assume the responsibilities. 3. Types of Broward Florida Trust — Two Individual Trustee— - to an Individual: a. Revocable Living Trust: Offers flexibility, as the individual establishing the trust (granter) can change it or dissolve it during their lifetime. It allows for seamless wealth management and provides for a smooth transfer of assets upon the granter's death. b. Irrevocable Trust: Once established, this type of trust cannot be amended or revoked without the beneficiary's consent. It offers creditor protection, tax planning advantages, and can help with Medicaid planning or preserving assets for future generations. c. Testamentary Trust: Created via the individual's will and only takes effect upon their death. It may provide instructions for the management and distribution of assets, ensuring the beneficiary's financial security. 4. Benefits of Broward Florida Trust — Two Individual Trustee— - to an Individual: a. Estate Planning: Enables the granter to have more control over asset distribution, reducing the chances of probate disputes and ensuring their wishes are honored. b. Privacy: Unlike a will, trust administration occurs privately, without court involvement, providing a higher level of confidentiality. c. Continuity: Involving two individual trustees ensures a system of checks and balances, minimizing the risk of mismanagement or negligence. d. Flexibility and Customization: Trusts can adapt to changing circumstances, allowing for the granter's specific wishes to be considered during the lifetime or after their demise. Conclusion: Selecting the right Broward Florida Trust with two individual trustees to an individual is crucial for effective wealth management and asset protection. Whether it is a revocable living trust, irrevocable trust, or testamentary trust, involving knowledgeable legal counsel is essential. By establishing such a trust, individuals can provide for their financial future, preserve wealth, and secure the well-being of their loved ones.