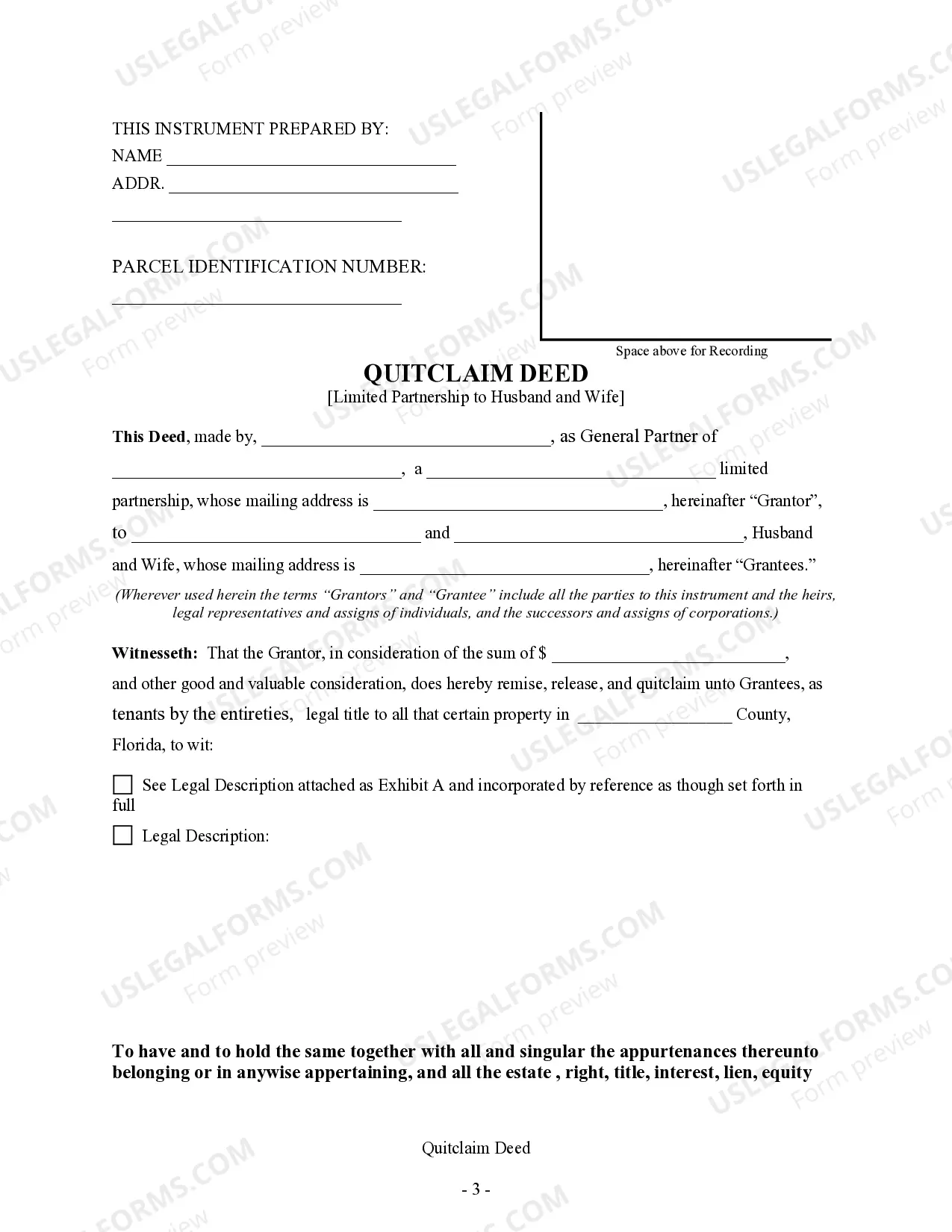

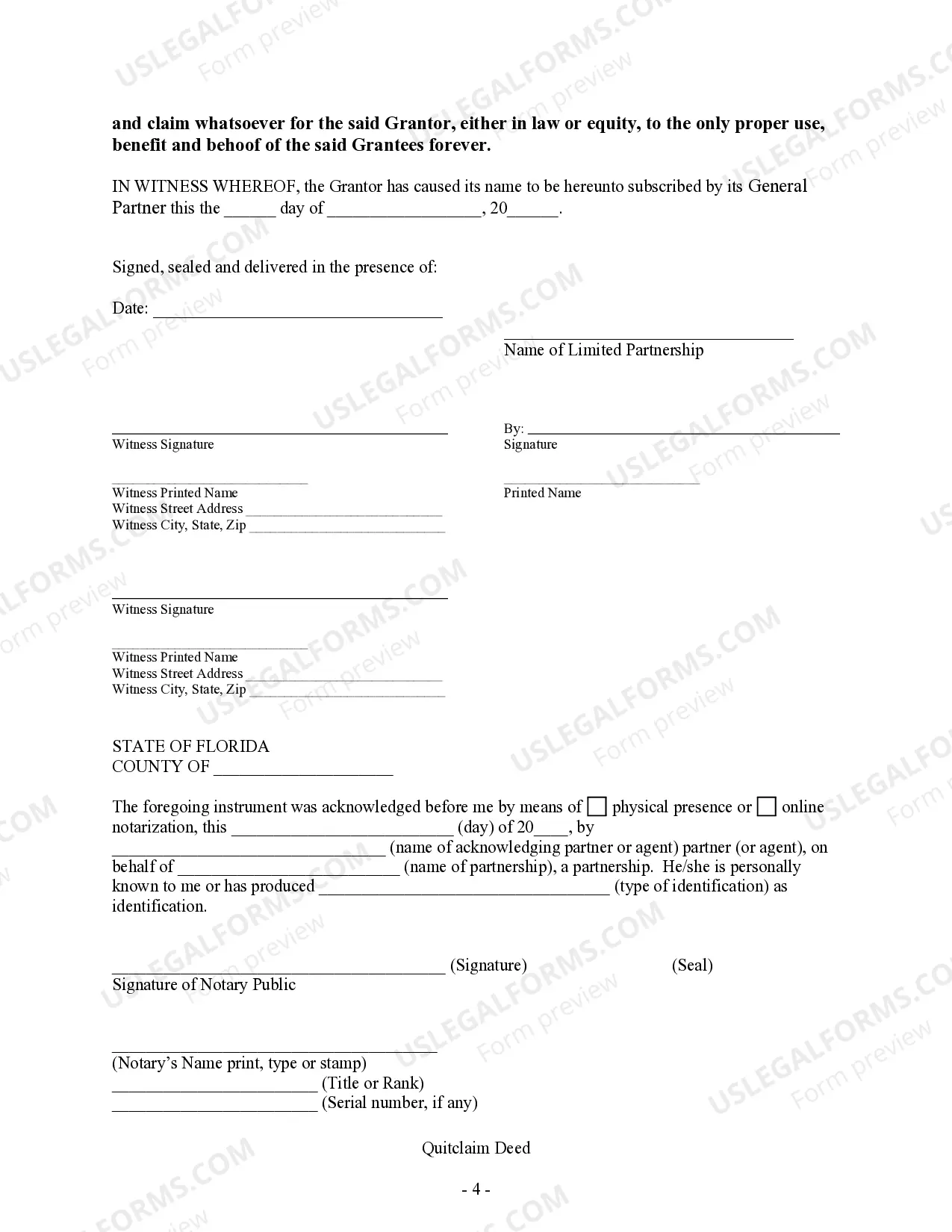

This form is a Quitclaim Deed where the grantor is a limited liability company and the grantees are husband and wife. Grantor conveys and quitclaims any interest grantor might have in the described property to grantees. Grantees take the property as tenants by the entireties, joint tenants with the right of survivorship or as tenants in common. This deed complies with all state statutory laws.

A Miami-Dade Florida Quitclaim Deed is a legal document used to transfer ownership of a property from a limited partnership to a husband and wife. This particular type of deed is commonly employed when property is being transferred between these parties. A quitclaim deed, in general, conveys whatever interest the granter (in this case, the limited partnership) has in the property to the grantee (the husband and wife), without providing any guarantees or warranties regarding the property's title. It is essential to understand that quitclaim deeds do not guarantee ownership or clear title; they merely transfer the granter's interest, if any, to the grantee. There are various scenarios that could be categorized as different types of Miami-Dade Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife, namely: 1. Concurrent Estate Transfer: This type of quitclaim deed occurs when both the husband and wife are listed as joint tenants or tenants in common. Joint tenancy grants equal undivided ownership to both spouses, while tenants in common allows for unequal ownership shares. It's crucial to specify the type of co-ownership when executing a quitclaim deed. 2. Interspousal Transfer: An interspousal quitclaim deed occurs when a spouse conveys their interest in a property to their partner during a divorce, separation, or for estate planning purposes. This type of deed does not trigger a tax reassessment, making it an advantageous method for transferring property between spouses. 3. Trust Transfer: In some cases, a limited partnership may transfer property to a husband and wife who serve as trustees of a revocable living trust. This type of quitclaim deed allows for seamless transfers of property between the trust and the couple, providing a flexible estate planning strategy. 4. Inherited Property Transfer: In situations where a limited partnership includes a deceased individual, the remaining spouse may receive ownership by executing a quitclaim deed. This transfer allows for the smooth transition of inherited property rights from the limited partnership to the surviving spouse. It is important to consult with an attorney or a qualified professional for the drafting and execution of any quitclaim deed to ensure compliance with specific local laws and regulations. Additionally, conducting a thorough title search is crucial to fully comprehend the property's ownership rights and any existing encumbrances or liens.A Miami-Dade Florida Quitclaim Deed is a legal document used to transfer ownership of a property from a limited partnership to a husband and wife. This particular type of deed is commonly employed when property is being transferred between these parties. A quitclaim deed, in general, conveys whatever interest the granter (in this case, the limited partnership) has in the property to the grantee (the husband and wife), without providing any guarantees or warranties regarding the property's title. It is essential to understand that quitclaim deeds do not guarantee ownership or clear title; they merely transfer the granter's interest, if any, to the grantee. There are various scenarios that could be categorized as different types of Miami-Dade Florida Quitclaim Deed from a Limited Partnership to a Husband and Wife, namely: 1. Concurrent Estate Transfer: This type of quitclaim deed occurs when both the husband and wife are listed as joint tenants or tenants in common. Joint tenancy grants equal undivided ownership to both spouses, while tenants in common allows for unequal ownership shares. It's crucial to specify the type of co-ownership when executing a quitclaim deed. 2. Interspousal Transfer: An interspousal quitclaim deed occurs when a spouse conveys their interest in a property to their partner during a divorce, separation, or for estate planning purposes. This type of deed does not trigger a tax reassessment, making it an advantageous method for transferring property between spouses. 3. Trust Transfer: In some cases, a limited partnership may transfer property to a husband and wife who serve as trustees of a revocable living trust. This type of quitclaim deed allows for seamless transfers of property between the trust and the couple, providing a flexible estate planning strategy. 4. Inherited Property Transfer: In situations where a limited partnership includes a deceased individual, the remaining spouse may receive ownership by executing a quitclaim deed. This transfer allows for the smooth transition of inherited property rights from the limited partnership to the surviving spouse. It is important to consult with an attorney or a qualified professional for the drafting and execution of any quitclaim deed to ensure compliance with specific local laws and regulations. Additionally, conducting a thorough title search is crucial to fully comprehend the property's ownership rights and any existing encumbrances or liens.