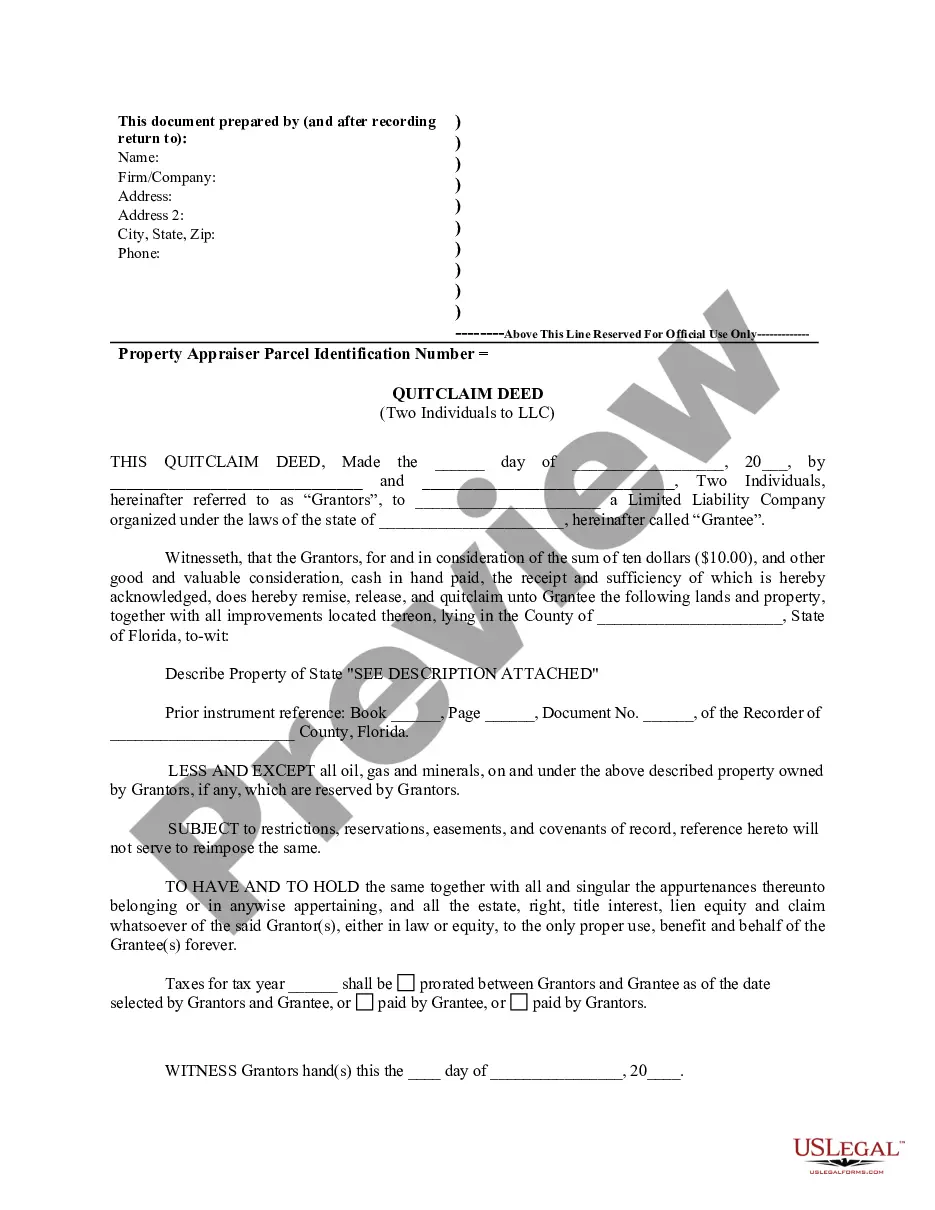

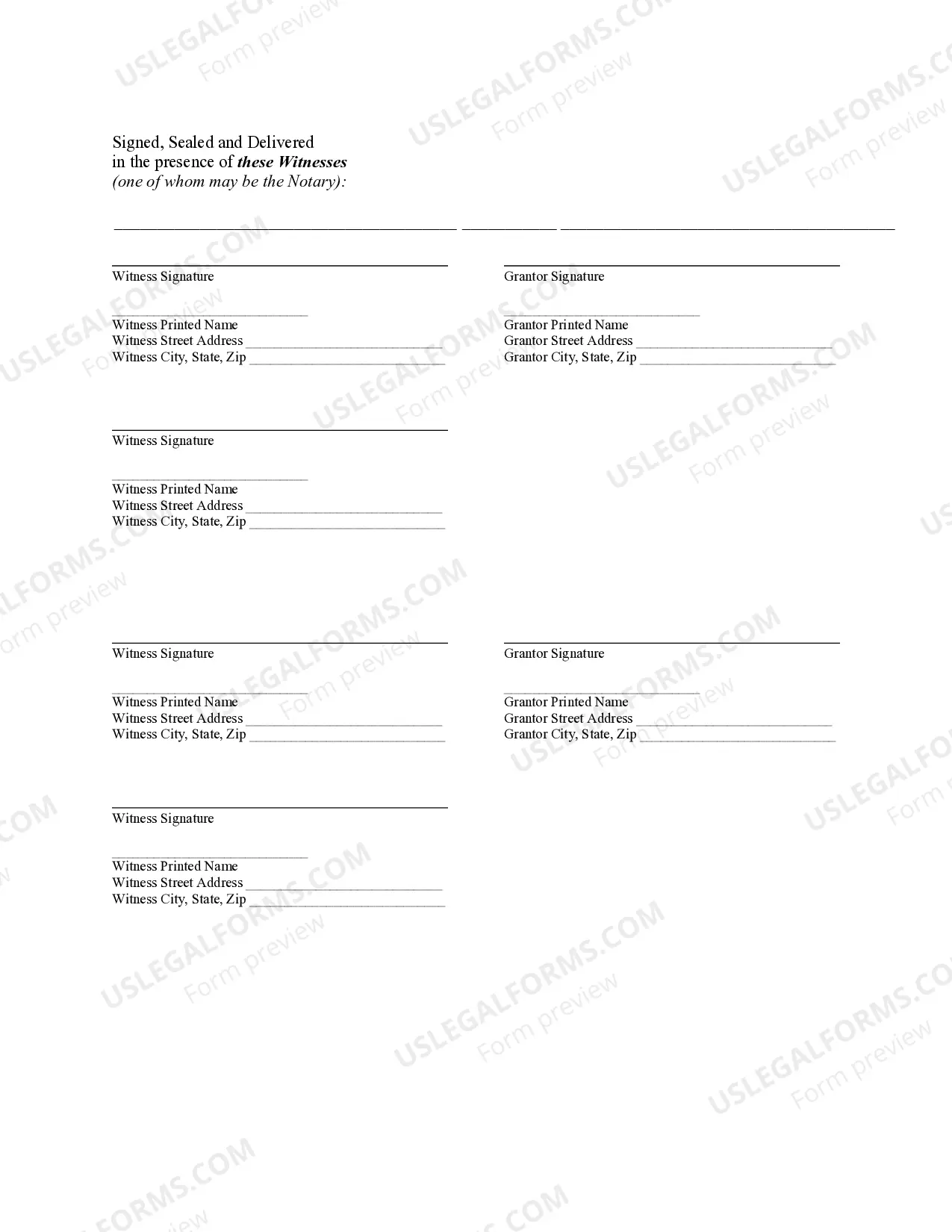

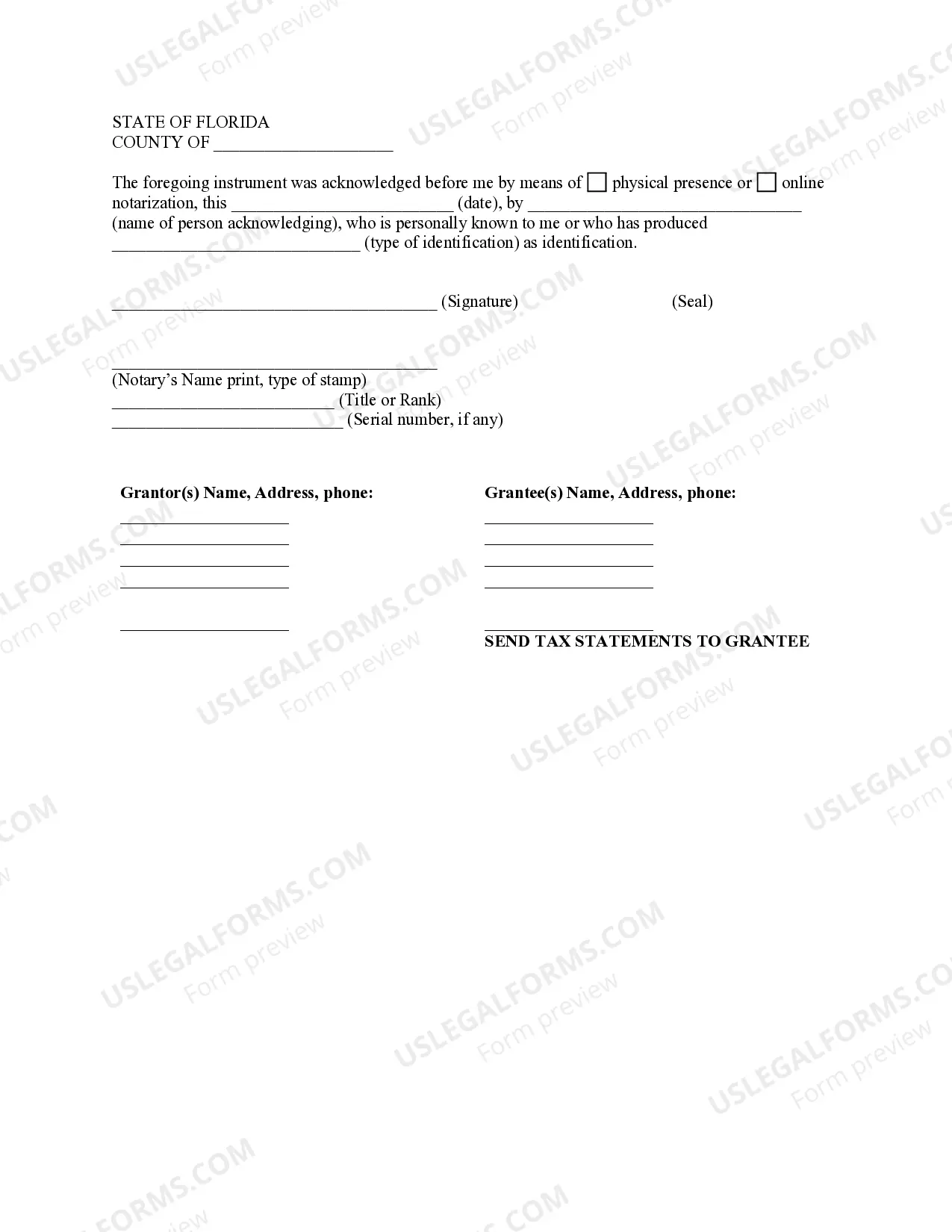

This Quitclaim Deed is used where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

A quitclaim deed is a legal document that allows individuals to transfer their interest in a property to another party. In the case of Port St. Lucie, Florida, when two individuals transfer their property to a Limited Liability Company (LLC) using a quitclaim deed, it signifies their intention to place the property under the LLC's ownership and management. Port St. Lucie, Florida, a beautiful coastal city renowned for its idyllic beaches and vibrant community, has seen an increasing number of individuals choosing to transfer their property to an LLC through a quitclaim deed. This legal process provides various benefits and opportunities for the parties involved. It is essential to understand the different types of quitclaim deeds available in Port St. Lucie to ensure a smooth and successful transfer of property ownership. 1. Traditional Quitclaim Deed: This type involves two individuals, often referred to as granters, transferring their property to an LLC, acting as the grantee. The deed states the two granters' names, describing their current ownership interests and the LLC's name, where they wish to transfer the property. The document relinquishes the granters' rights and interests in the property, ensuring a clean transfer to the LLC. 2. Joint Tenancy Quitclaim Deed: If the two individuals currently hold the property as joint tenants, they can choose to transfer their ownership interest to an LLC in equal shares through this type of quitclaim deed. Joint tenancy allows for the automatic transfer of ownership to the remaining joint tenant in the event of one joint tenant's death, but the quitclaim deed provides a way to transfer the property to the LLC. 3. Tenants in Common Quitclaim Deed: In instances where the two individuals currently own the property as tenants in common, this type of quitclaim deed is appropriate. It allows for a proportional division of ownership interests based on each individual's contribution to the property or any other agreed-upon terms. Through this deed, the two individuals can transfer their respective ownership interests to the LLC, providing a clear and documented means of transferring ownership. Using a quitclaim deed for transferring property to an LLC in Port St. Lucie, Florida, provides advantages like liability protection, tax flexibility, and the ability to attract potential investors. By naming the LLC as the new property owner, the individuals transfer their personal liabilities to the company, detaching themselves legally and financially from the property. Moreover, an LLC structure allows for favorable tax treatment and potential deductions, enabling the property to be leveraged for future growth and investment opportunities. In conclusion, the Port St. Lucie, Florida quitclaim deed by two individuals to an LLC presents a strategic approach to property ownership and management. With various types of quitclaim deeds available, individuals can select the appropriate deed based on their existing ownership structure and the desired outcome. By taking advantage of the benefits offered by an LLC, property owners can pave the way for future growth and development while safeguarding their personal interests.A quitclaim deed is a legal document that allows individuals to transfer their interest in a property to another party. In the case of Port St. Lucie, Florida, when two individuals transfer their property to a Limited Liability Company (LLC) using a quitclaim deed, it signifies their intention to place the property under the LLC's ownership and management. Port St. Lucie, Florida, a beautiful coastal city renowned for its idyllic beaches and vibrant community, has seen an increasing number of individuals choosing to transfer their property to an LLC through a quitclaim deed. This legal process provides various benefits and opportunities for the parties involved. It is essential to understand the different types of quitclaim deeds available in Port St. Lucie to ensure a smooth and successful transfer of property ownership. 1. Traditional Quitclaim Deed: This type involves two individuals, often referred to as granters, transferring their property to an LLC, acting as the grantee. The deed states the two granters' names, describing their current ownership interests and the LLC's name, where they wish to transfer the property. The document relinquishes the granters' rights and interests in the property, ensuring a clean transfer to the LLC. 2. Joint Tenancy Quitclaim Deed: If the two individuals currently hold the property as joint tenants, they can choose to transfer their ownership interest to an LLC in equal shares through this type of quitclaim deed. Joint tenancy allows for the automatic transfer of ownership to the remaining joint tenant in the event of one joint tenant's death, but the quitclaim deed provides a way to transfer the property to the LLC. 3. Tenants in Common Quitclaim Deed: In instances where the two individuals currently own the property as tenants in common, this type of quitclaim deed is appropriate. It allows for a proportional division of ownership interests based on each individual's contribution to the property or any other agreed-upon terms. Through this deed, the two individuals can transfer their respective ownership interests to the LLC, providing a clear and documented means of transferring ownership. Using a quitclaim deed for transferring property to an LLC in Port St. Lucie, Florida, provides advantages like liability protection, tax flexibility, and the ability to attract potential investors. By naming the LLC as the new property owner, the individuals transfer their personal liabilities to the company, detaching themselves legally and financially from the property. Moreover, an LLC structure allows for favorable tax treatment and potential deductions, enabling the property to be leveraged for future growth and investment opportunities. In conclusion, the Port St. Lucie, Florida quitclaim deed by two individuals to an LLC presents a strategic approach to property ownership and management. With various types of quitclaim deeds available, individuals can select the appropriate deed based on their existing ownership structure and the desired outcome. By taking advantage of the benefits offered by an LLC, property owners can pave the way for future growth and development while safeguarding their personal interests.