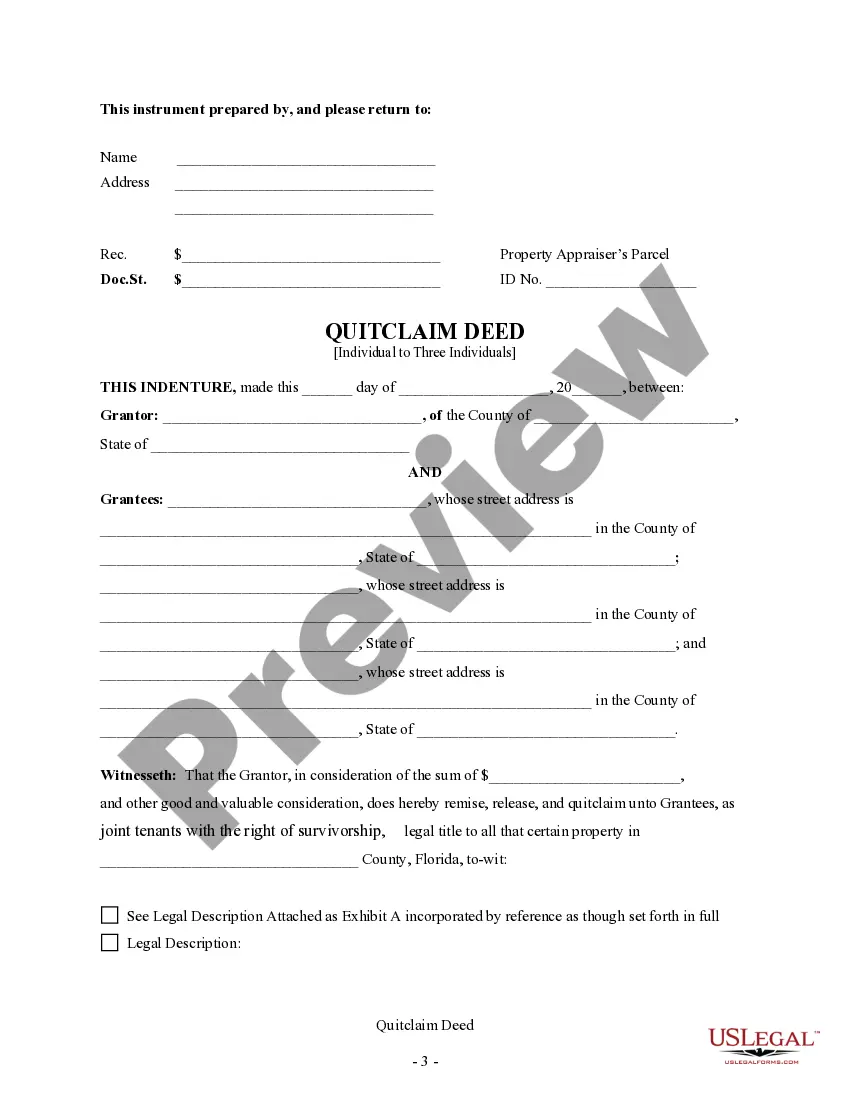

This form is a Quitclaim Deed where the Grantor is an individual and the Grantees are three individuals. Grantor conveys and quitclaims the described property to Grantees. The Grantees take the property as joint tenants with the right of survivorship or as tenants in common. This deed complies with all state statutory laws.

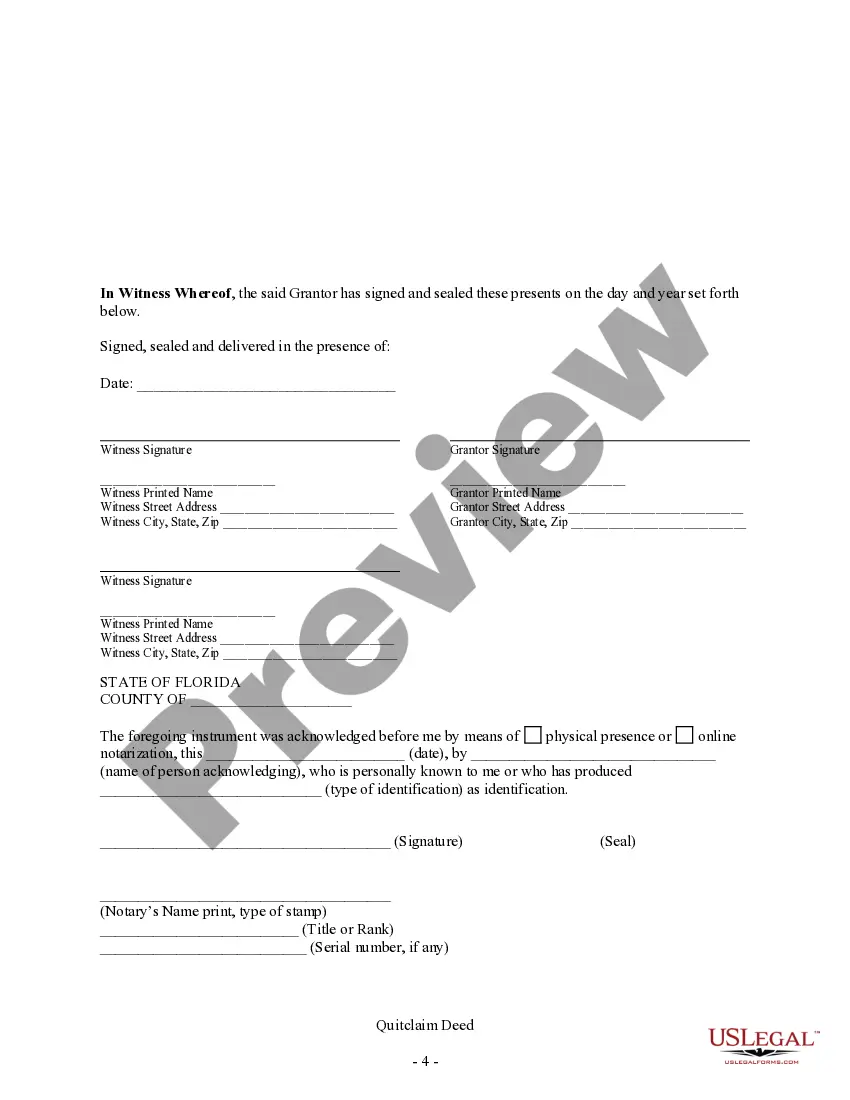

A Jacksonville Florida Quitclaim Deed from Individual Granter to Three Individual Grantees is a legal document that transfers the ownership interest of a property from one individual (the granter) to three other individuals (the grantees) without any warranties or guarantees regarding the title or condition of the property. This type of quitclaim deed is commonly used in Jacksonville, Florida when the granter wishes to transfer their ownership rights in a property to multiple grantees, whether they are family members, business partners, or friends. It is important to emphasize that a quitclaim deed does not provide any assurances or guarantees about the property's title status or whether there are any existing liens, encumbrances, or legal issues associated with it. The Jacksonville Florida Quitclaim Deed from Individual Granter to Three Individual Grantees must include certain essential components to be considered legally valid. These include the names and addresses of all parties involved, a detailed legal description of the property being transferred, the date of the transfer, and the signature of the granter in the presence of a notary public, who will acknowledge the granter's signature. It is worth noting that there may be different variations of the Jacksonville Florida Quitclaim Deed from Individual Granter to Three Individual Grantees, depending on specific circumstances or requirements. For example, the deed may specify the percentage of ownership interest being transferred to each grantee, or it may outline any conditions or restrictions placed on the property by the granter. These variations can be further classified based on their specific characteristics, such as partial, specific-purpose, or joint quitclaim deeds. In conclusion, a Jacksonville Florida Quitclaim Deed from Individual Granter to Three Individual Grantees is a legal document used to transfer ownership of a property from one individual to three other individuals without any warranties or guarantees. It is important to consult with a legal professional or real estate attorney to ensure that the deed is accurately prepared and meets all legal requirements in order to protect the interests of all parties involved.