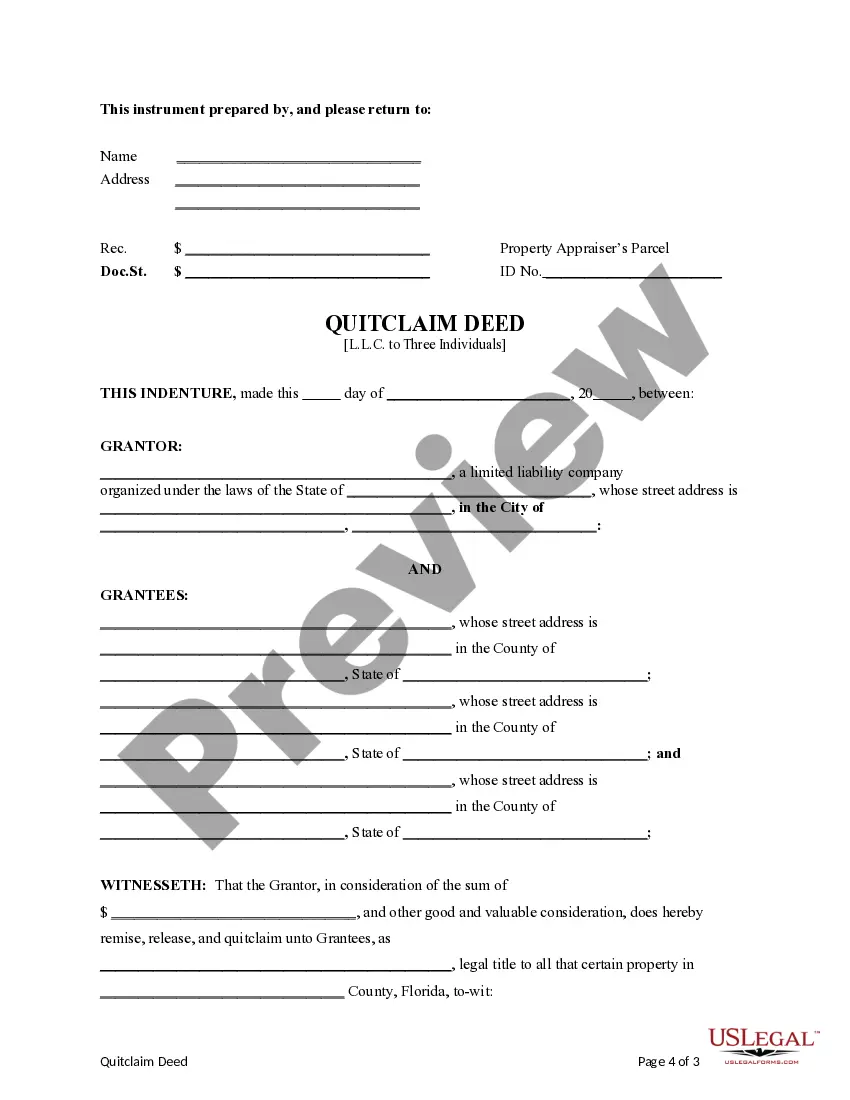

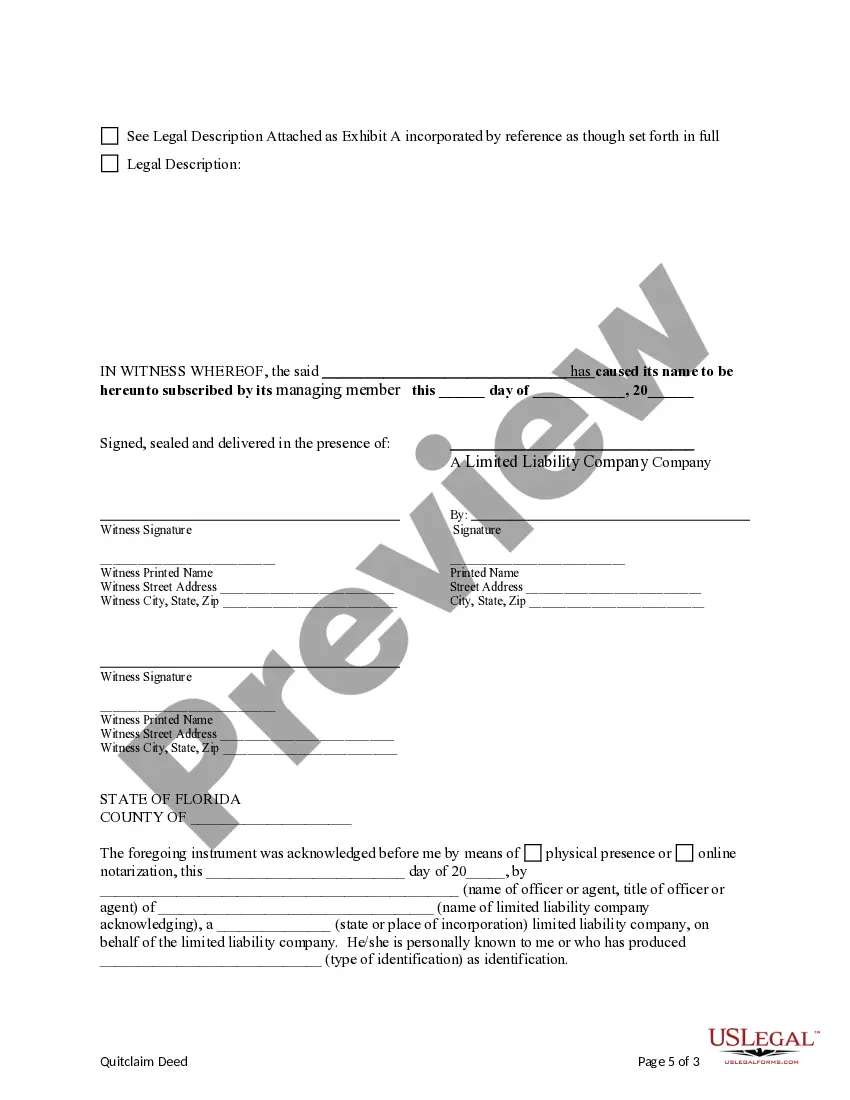

This form is a Quitclaim Deed where the Grantor is a limited liability company and the Grantees are three individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

Title: Gainesville Florida Quitclaim Deed from a Limited Liability Company to Three Individuals: Types and Detailed Description Introduction: In Gainesville, Florida, a quitclaim deed is a legal document used to transfer property ownership rights from a Limited Liability Company (LLC) to three individuals. A quitclaim deed is commonly used when the transfer is being made without any guarantees or warranties regarding the property's title. This article will provide a comprehensive overview of the different types of Gainesville Florida Quitclaim Deeds from an LLC to three individuals, their characteristics, and the legal implications involved. 1. General Description: A Gainesville Florida Quitclaim Deed is a legally binding document that allows an LLC to convey its ownership interest in a property to three individuals without any warranties or guarantees. Unlike other types of deeds, a quitclaim deed does not provide any assurance of clear title or guarantee against any potential claims or encumbrances on the property. 2. Types of Gainesville Florida Quitclaim Deeds: a) Simple Quitclaim Deed: This is the most common type of quitclaim deed used in Gainesville, Florida, where an LLC transfers its ownership interest to three individuals. It is a straightforward document that simply transfers the property to the new owners without any warranties, representations, or guarantees. b) Joint Tenancy Quitclaim Deed: In this type of quitclaim deed, the LLC transfers the ownership interest to three individuals as joint tenants. This means that if one of the individuals passes away, their share automatically passes to the surviving co-owners. c) Tenancy in Common Quitclaim Deed: With this type of quitclaim deed, the LLC transfers the ownership interest to three individuals as tenants in common. Each individual holds a separate and distinct share of the property, which can be inherited or sold independently. d) LLC Member Quitclaim Deed: This type of quitclaim deed is used when the LLC has multiple members, and three specific individuals are being granted ownership rights. It allows the LLC member(s) to transfer their interest in the property to the three individuals without affecting the LLC's overall ownership structure. 3. Legal Considerations and Implications: a) Title Insurance: Since a quitclaim deed does not provide any warranties regarding the property's title, it is crucial for the three individuals to obtain title insurance to protect against any potential title defects or undisclosed claims. b) Liens and Encumbrances: It is essential to conduct a thorough title search before completing a quitclaim deed transaction. This will ensure that there are no outstanding liens, mortgages, or encumbrances on the property that could potentially affect the new owners' ownership rights. c) Consulting Legal Professionals: Given the complexity of property transactions and the legal implications involved, it is advisable for the LLC and the three individuals to seek guidance from a qualified real estate attorney to ensure that the quitclaim deed is properly prepared, executed, and recorded. Conclusion: A Gainesville Florida Quitclaim Deed from a Limited Liability Company to Three Individuals allows for the transfer of property ownership without any warranties or guarantees. Understanding the different types of quitclaim deeds and consulting legal professionals throughout the process is crucial to ensure a smooth and legally compliant transfer of ownership. Proper research, title insurance, and compliance with legal requirements are vital for the protection of the new owners' interests.Title: Gainesville Florida Quitclaim Deed from a Limited Liability Company to Three Individuals: Types and Detailed Description Introduction: In Gainesville, Florida, a quitclaim deed is a legal document used to transfer property ownership rights from a Limited Liability Company (LLC) to three individuals. A quitclaim deed is commonly used when the transfer is being made without any guarantees or warranties regarding the property's title. This article will provide a comprehensive overview of the different types of Gainesville Florida Quitclaim Deeds from an LLC to three individuals, their characteristics, and the legal implications involved. 1. General Description: A Gainesville Florida Quitclaim Deed is a legally binding document that allows an LLC to convey its ownership interest in a property to three individuals without any warranties or guarantees. Unlike other types of deeds, a quitclaim deed does not provide any assurance of clear title or guarantee against any potential claims or encumbrances on the property. 2. Types of Gainesville Florida Quitclaim Deeds: a) Simple Quitclaim Deed: This is the most common type of quitclaim deed used in Gainesville, Florida, where an LLC transfers its ownership interest to three individuals. It is a straightforward document that simply transfers the property to the new owners without any warranties, representations, or guarantees. b) Joint Tenancy Quitclaim Deed: In this type of quitclaim deed, the LLC transfers the ownership interest to three individuals as joint tenants. This means that if one of the individuals passes away, their share automatically passes to the surviving co-owners. c) Tenancy in Common Quitclaim Deed: With this type of quitclaim deed, the LLC transfers the ownership interest to three individuals as tenants in common. Each individual holds a separate and distinct share of the property, which can be inherited or sold independently. d) LLC Member Quitclaim Deed: This type of quitclaim deed is used when the LLC has multiple members, and three specific individuals are being granted ownership rights. It allows the LLC member(s) to transfer their interest in the property to the three individuals without affecting the LLC's overall ownership structure. 3. Legal Considerations and Implications: a) Title Insurance: Since a quitclaim deed does not provide any warranties regarding the property's title, it is crucial for the three individuals to obtain title insurance to protect against any potential title defects or undisclosed claims. b) Liens and Encumbrances: It is essential to conduct a thorough title search before completing a quitclaim deed transaction. This will ensure that there are no outstanding liens, mortgages, or encumbrances on the property that could potentially affect the new owners' ownership rights. c) Consulting Legal Professionals: Given the complexity of property transactions and the legal implications involved, it is advisable for the LLC and the three individuals to seek guidance from a qualified real estate attorney to ensure that the quitclaim deed is properly prepared, executed, and recorded. Conclusion: A Gainesville Florida Quitclaim Deed from a Limited Liability Company to Three Individuals allows for the transfer of property ownership without any warranties or guarantees. Understanding the different types of quitclaim deeds and consulting legal professionals throughout the process is crucial to ensure a smooth and legally compliant transfer of ownership. Proper research, title insurance, and compliance with legal requirements are vital for the protection of the new owners' interests.