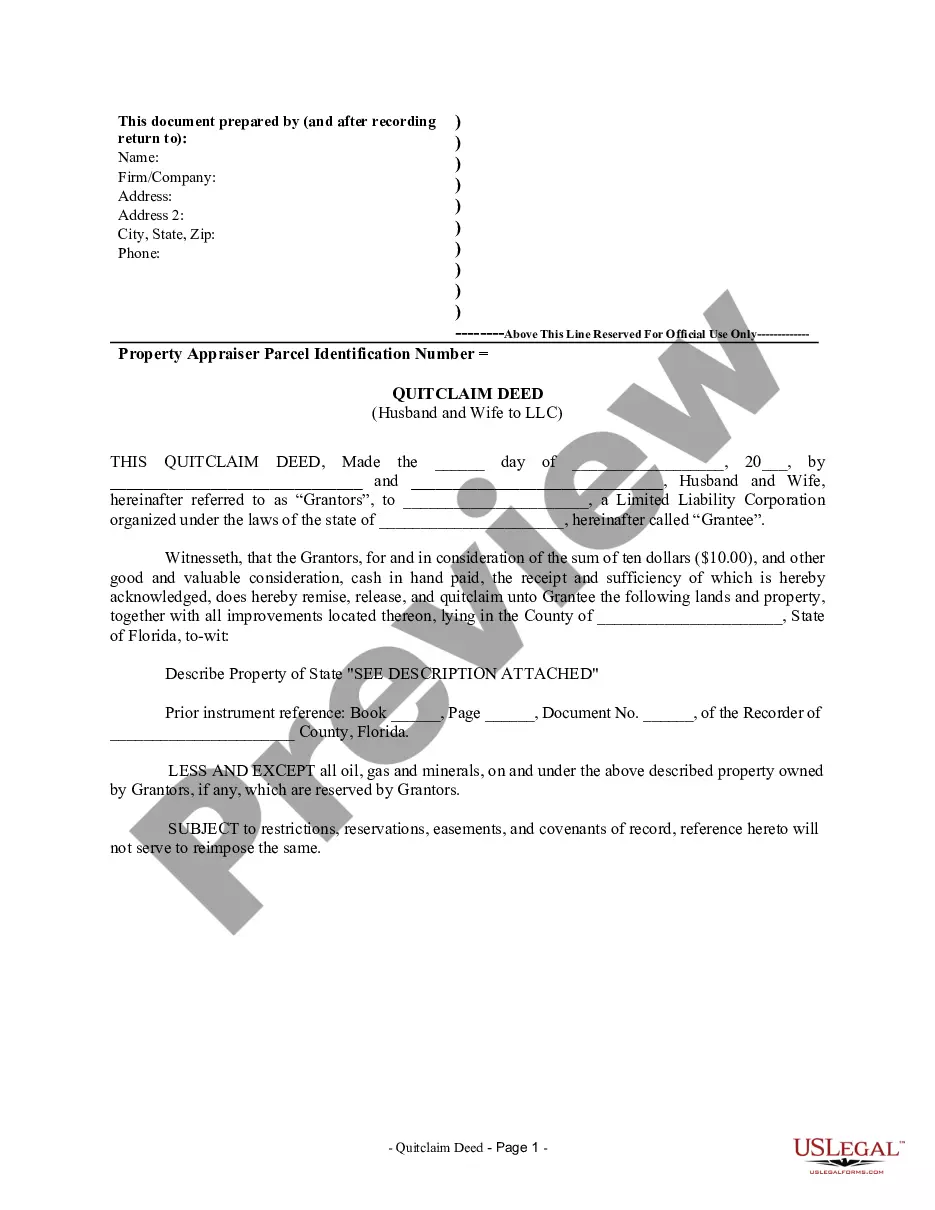

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Broward Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that allows a married couple to transfer ownership of a property to a Limited Liability Company (LLC) through the use of a quitclaim deed. This type of deed is commonly used when a couple wants to transfer their property to their LLC for various reasons, such as asset protection, liability limitation, or better management of real estate assets. The Broward Florida Quitclaim Deed from Husband and Wife to LLC is a specific type of quitclaim deed that is recognized and governed by the laws and regulations of Broward County, Florida. It is crucial to understand the specific requirements and legal process involved when executing such a deed in this jurisdiction. There are several types of Broward Florida Quitclaim Deeds from Husband and Wife to LLC, including: 1. Standard Broward Florida Quitclaim Deed: This is the most common type of quitclaim deed used when a husband and wife transfer property ownership to their LLC. It conveys all the couple's rights and interests in the property to the LLC, without any warranties or guarantees. 2. Enhanced Life Estate Broward Florida Quitclaim Deed: Also known as a "Lady Bird Deed," this type of deed allows the husband and wife to transfer ownership of the property to their LLC while retaining a life estate. This means that they can continue to live on the property and maintain control until their passing, at which point the property transfers to the LLC automatically, avoiding probate. 3. Joint Tenants with Right of Survivorship Broward Florida Quitclaim Deed: This type of deed enables the husband and wife to transfer ownership to their LLC while maintaining a joint tenancy with right of survivorship. This means that in the event of the death of one spouse, the surviving spouse automatically becomes the sole owner of the property without the need for probate. Executing a Broward Florida Quitclaim Deed from Husband and Wife to LLC requires careful consideration and legal advice. It is essential to consult with a real estate attorney or a title company experienced in Florida real estate transactions to ensure compliance with all applicable laws and to protect the interests of all parties involved. Keywords: Broward Florida, Quitclaim Deed, Husband and Wife, LLC, transfer of ownership, legal document, real estate assets, asset protection, liability limitation, Broward County, legal requirements, enhanced life estate, Lady Bird Deed, joint tenants with right of survivorship, probate, real estate attorney, title company.A Broward Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that allows a married couple to transfer ownership of a property to a Limited Liability Company (LLC) through the use of a quitclaim deed. This type of deed is commonly used when a couple wants to transfer their property to their LLC for various reasons, such as asset protection, liability limitation, or better management of real estate assets. The Broward Florida Quitclaim Deed from Husband and Wife to LLC is a specific type of quitclaim deed that is recognized and governed by the laws and regulations of Broward County, Florida. It is crucial to understand the specific requirements and legal process involved when executing such a deed in this jurisdiction. There are several types of Broward Florida Quitclaim Deeds from Husband and Wife to LLC, including: 1. Standard Broward Florida Quitclaim Deed: This is the most common type of quitclaim deed used when a husband and wife transfer property ownership to their LLC. It conveys all the couple's rights and interests in the property to the LLC, without any warranties or guarantees. 2. Enhanced Life Estate Broward Florida Quitclaim Deed: Also known as a "Lady Bird Deed," this type of deed allows the husband and wife to transfer ownership of the property to their LLC while retaining a life estate. This means that they can continue to live on the property and maintain control until their passing, at which point the property transfers to the LLC automatically, avoiding probate. 3. Joint Tenants with Right of Survivorship Broward Florida Quitclaim Deed: This type of deed enables the husband and wife to transfer ownership to their LLC while maintaining a joint tenancy with right of survivorship. This means that in the event of the death of one spouse, the surviving spouse automatically becomes the sole owner of the property without the need for probate. Executing a Broward Florida Quitclaim Deed from Husband and Wife to LLC requires careful consideration and legal advice. It is essential to consult with a real estate attorney or a title company experienced in Florida real estate transactions to ensure compliance with all applicable laws and to protect the interests of all parties involved. Keywords: Broward Florida, Quitclaim Deed, Husband and Wife, LLC, transfer of ownership, legal document, real estate assets, asset protection, liability limitation, Broward County, legal requirements, enhanced life estate, Lady Bird Deed, joint tenants with right of survivorship, probate, real estate attorney, title company.