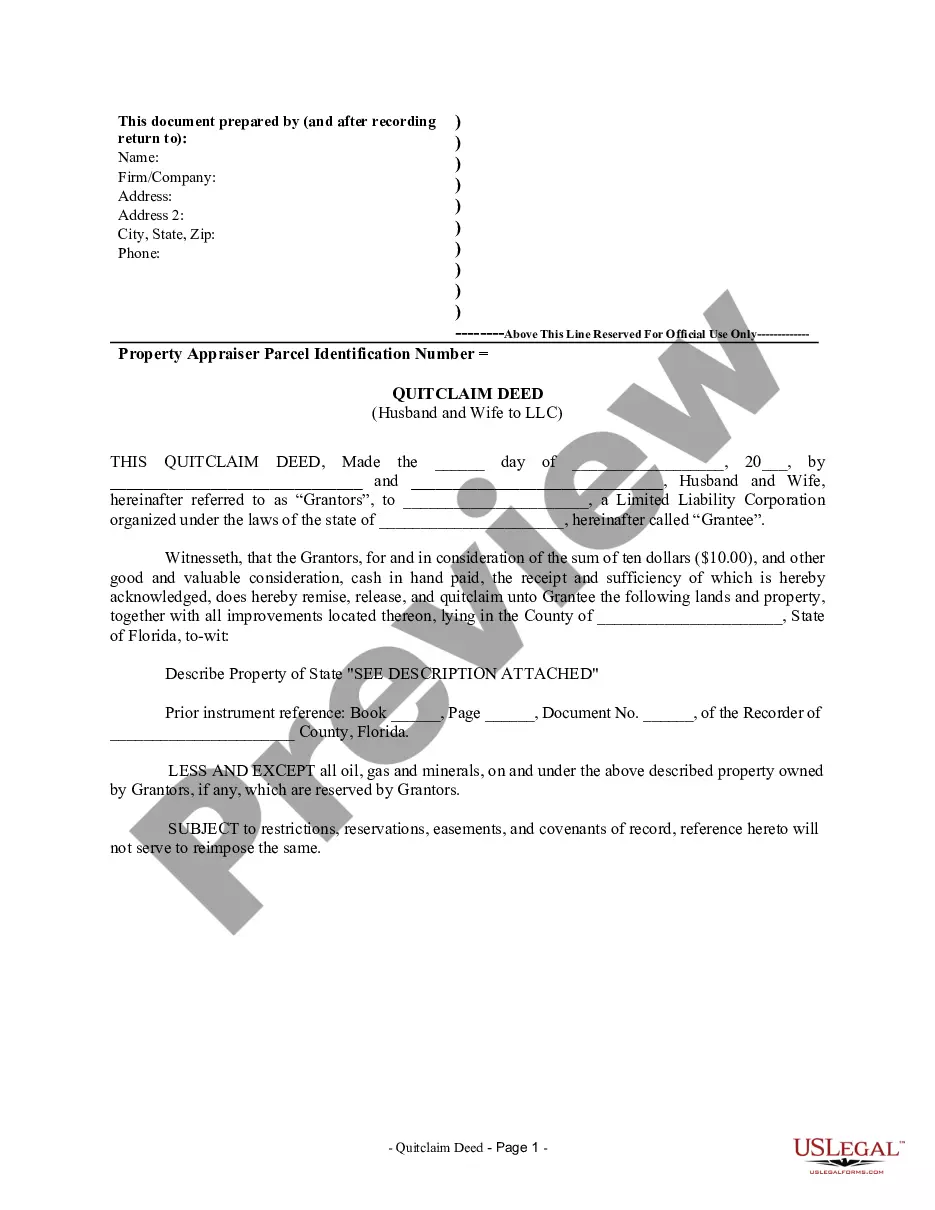

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Fort Lauderdale Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that allows a married couple to transfer their ownership interest in a property to a limited liability company (LLC) located in Fort Lauderdale, Florida. This type of deed is relatively common when couples want to protect their personal assets by transferring ownership to a business entity. The Fort Lauderdale Florida Quitclaim Deed from Husband and Wife to LLC is used to transfer real property located within the city limits of Fort Lauderdale. It is crucial to consult with a knowledgeable attorney or a licensed title company to ensure compliance with all applicable laws and regulations. There are a few different types of Fort Lauderdale Florida Quitclaim Deed from Husband and Wife to LLC that individuals may encounter, based on their specific situation and requirements: 1. Whole Ownership Transfer to LLC: This type of quitclaim deed involves the transfer of the entire property ownership from both husband and wife to the LLC. It ensures complete legal and financial separation between the couple and the property, allowing them to shield their personal assets from potential liabilities associated with the property. 2. Partial Ownership Transfer to LLC: In some cases, a couple may want to retain partial ownership of the property while transferring a percentage to the LLC. This type of quitclaim deed outlines the specific share of ownership being transferred and clarifies the rights and responsibilities of each party involved. 3. Transfer with Specific Conditions: Sometimes, couples may decide to transfer the property to the LLC under certain conditions. For instance, they may include provisions specifying that the LLC can only sell or mortgage the property with the joint agreement of both spouses. This type of quitclaim deed ensures that both parties have a say in any significant decisions concerning the property. It is crucial to conduct thorough research and seek professional legal advice before preparing or executing a Fort Lauderdale Florida Quitclaim Deed from Husband and Wife to LLC. The property laws and regulations in Florida can be complex, so it is essential to ensure all necessary documentation and procedures are followed accurately and in compliance with the law.A Fort Lauderdale Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that allows a married couple to transfer their ownership interest in a property to a limited liability company (LLC) located in Fort Lauderdale, Florida. This type of deed is relatively common when couples want to protect their personal assets by transferring ownership to a business entity. The Fort Lauderdale Florida Quitclaim Deed from Husband and Wife to LLC is used to transfer real property located within the city limits of Fort Lauderdale. It is crucial to consult with a knowledgeable attorney or a licensed title company to ensure compliance with all applicable laws and regulations. There are a few different types of Fort Lauderdale Florida Quitclaim Deed from Husband and Wife to LLC that individuals may encounter, based on their specific situation and requirements: 1. Whole Ownership Transfer to LLC: This type of quitclaim deed involves the transfer of the entire property ownership from both husband and wife to the LLC. It ensures complete legal and financial separation between the couple and the property, allowing them to shield their personal assets from potential liabilities associated with the property. 2. Partial Ownership Transfer to LLC: In some cases, a couple may want to retain partial ownership of the property while transferring a percentage to the LLC. This type of quitclaim deed outlines the specific share of ownership being transferred and clarifies the rights and responsibilities of each party involved. 3. Transfer with Specific Conditions: Sometimes, couples may decide to transfer the property to the LLC under certain conditions. For instance, they may include provisions specifying that the LLC can only sell or mortgage the property with the joint agreement of both spouses. This type of quitclaim deed ensures that both parties have a say in any significant decisions concerning the property. It is crucial to conduct thorough research and seek professional legal advice before preparing or executing a Fort Lauderdale Florida Quitclaim Deed from Husband and Wife to LLC. The property laws and regulations in Florida can be complex, so it is essential to ensure all necessary documentation and procedures are followed accurately and in compliance with the law.