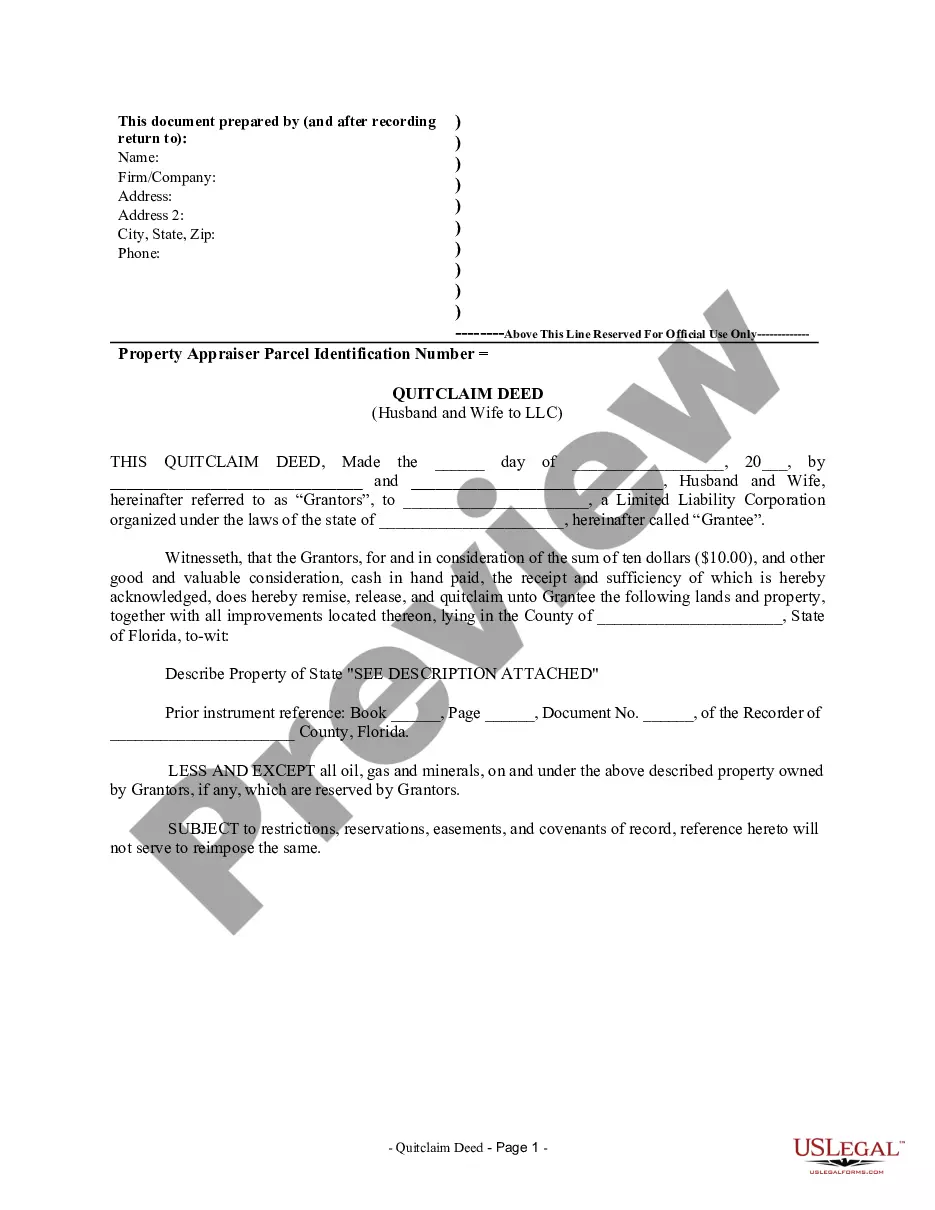

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Jacksonville Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a married couple to a limited liability company (LLC) in Jacksonville, Florida. This type of deed is commonly used in real estate transactions where a married couple wishes to transfer their property into an LLC for various reasons, such as asset protection, liability limitation, or tax planning. The quitclaim deed is a legal instrument used to transfer whatever interest the granters (in this case, the husband and wife) have in the property to the grantee (the LLC). It should be noted that a quitclaim deed does not guarantee that the granters actually own the property or that the property is free of any liens or encumbrances. It simply transfers the granters' interest, if any, to the grantee. There are different types of Jacksonville Florida Quitclaim Deed from Husband and Wife to LLC, including: 1. General Quitclaim Deed: This is the most common type of quitclaim deed, where the granters transfer their interest in the property without any warranties or guarantees regarding the property's title. 2. Special Warranty Quitclaim Deed: This type of quitclaim deed provides limited warranty to the grantee. The granters guarantee that they have not done anything to impair the title while they owned the property, but they do not warrant against any previous defects or issues. 3. Enhanced Life Estate Deed: Also known as a "Lady Bird Deed," this special type of quitclaim deed allows the granters (husband and wife) to retain full control and ownership of the property during their lifetimes. The property automatically transfers to the grantee (LLC) upon the death of the surviving spouse, bypassing probate. Regardless of the specific type of quitclaim deed used, it is essential to consult with a qualified real estate attorney and follow the proper legal procedures to ensure that the transfer is valid and legally binding. It is also advisable to conduct a title search and obtain title insurance to protect against any potential issues or claims on the property. This will help ensure a smooth transfer of ownership from the husband and wife to the LLC in Jacksonville, Florida.A Jacksonville Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a married couple to a limited liability company (LLC) in Jacksonville, Florida. This type of deed is commonly used in real estate transactions where a married couple wishes to transfer their property into an LLC for various reasons, such as asset protection, liability limitation, or tax planning. The quitclaim deed is a legal instrument used to transfer whatever interest the granters (in this case, the husband and wife) have in the property to the grantee (the LLC). It should be noted that a quitclaim deed does not guarantee that the granters actually own the property or that the property is free of any liens or encumbrances. It simply transfers the granters' interest, if any, to the grantee. There are different types of Jacksonville Florida Quitclaim Deed from Husband and Wife to LLC, including: 1. General Quitclaim Deed: This is the most common type of quitclaim deed, where the granters transfer their interest in the property without any warranties or guarantees regarding the property's title. 2. Special Warranty Quitclaim Deed: This type of quitclaim deed provides limited warranty to the grantee. The granters guarantee that they have not done anything to impair the title while they owned the property, but they do not warrant against any previous defects or issues. 3. Enhanced Life Estate Deed: Also known as a "Lady Bird Deed," this special type of quitclaim deed allows the granters (husband and wife) to retain full control and ownership of the property during their lifetimes. The property automatically transfers to the grantee (LLC) upon the death of the surviving spouse, bypassing probate. Regardless of the specific type of quitclaim deed used, it is essential to consult with a qualified real estate attorney and follow the proper legal procedures to ensure that the transfer is valid and legally binding. It is also advisable to conduct a title search and obtain title insurance to protect against any potential issues or claims on the property. This will help ensure a smooth transfer of ownership from the husband and wife to the LLC in Jacksonville, Florida.