A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

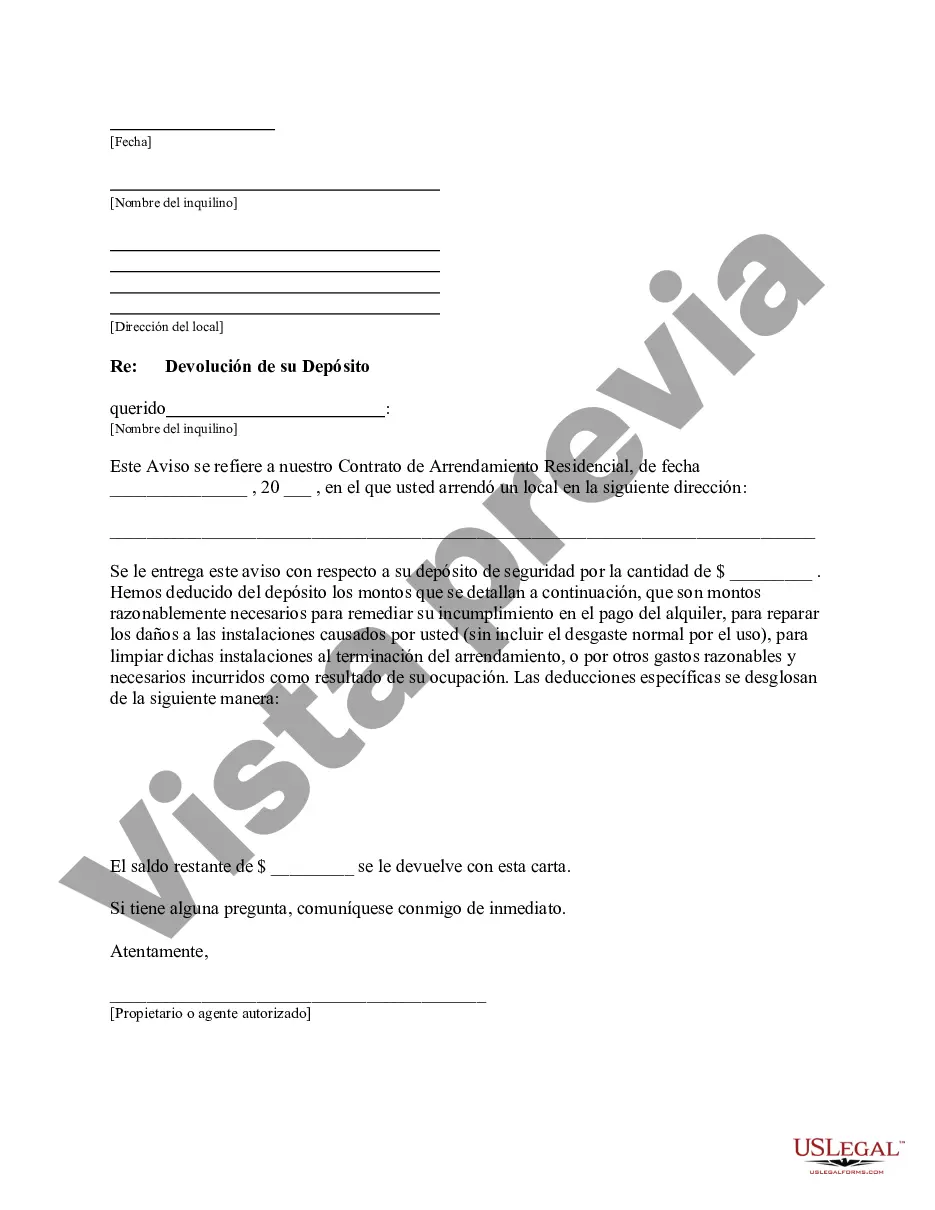

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant. Title: Miramar Florida Letter from Landlord to Tenant Returning Security Deposit Less Deductions: A Comprehensive Guide Introduction: In Miramar, Florida, landlords are required by law to return the tenant's security deposit within a specified time frame. However, deductions may be made to cover legitimate expenses related to damages beyond normal wear and tear or unpaid rent. This article aims to provide a detailed description of the Miramar Florida Letter from Landlord to Tenant Returning Security Deposit Less Deductions, including various types of such letters. 1. Purpose of the Letter: The purpose of the Miramar Florida Letter from Landlord to Tenant Returning Security Deposit Less Deductions is to inform the tenant of the amount being returned and justify any deductions made to the security deposit. This letter serves as documentation in case of disputes and ensures transparency in the deposit return process. 2. Key Elements in the Letter: a. Date: The letter should contain the date it is drafted. b. Tenant's Information: Address the letter to the tenant(s), including their names and current address. c. Landlord's Information: Include the landlord's name, contact information, and return address. d. Security Deposit Amount: Clearly state the initial security deposit amount. e. Deductions: Detail the specific deductions, noting the reasons for each, such as unpaid rent, damages, or cleaning fees. f. Itemized Statement: Provide an itemized breakdown of deductions along with corresponding costs. g. Net Amount Returned: Calculate and declare the final amount being returned to the tenant, after deducting the owed expenses. h. Deadline and Payment Method: Specify the deadline for the tenant to receive the refund and the preferred payment method (e.g., check, bank transfer). i. Security Deposit Return Agreement: Include a statement acknowledging the tenant's agreement and acceptance of the deductions made. 3. Types of Letters: a. Miramar Florida Letter from Landlord to Tenant Returning Partial Security Deposit: Used when only a portion of the security deposit is returned due to deductions. b. Miramar Florida Letter from Landlord to Tenant Returning Full Security Deposit: Applicable when no deductions are made, and the entire security deposit is being returned to the tenant. c. Miramar Florida Letter from Landlord to Tenant Explaining Additional Deductions: Sent in cases where further expenses are identified after initially returning a partial security deposit. Conclusion: Writing an accurate and detailed Miramar Florida Letter from Landlord to Tenant Returning Security Deposit Less Deductions is crucial for ensuring a smooth deposit refund process. By including the essential elements and adhering to the specific laws and regulations of Miramar, Florida, landlords can maintain transparency and avoid potential disputes with tenants.

Title: Miramar Florida Letter from Landlord to Tenant Returning Security Deposit Less Deductions: A Comprehensive Guide Introduction: In Miramar, Florida, landlords are required by law to return the tenant's security deposit within a specified time frame. However, deductions may be made to cover legitimate expenses related to damages beyond normal wear and tear or unpaid rent. This article aims to provide a detailed description of the Miramar Florida Letter from Landlord to Tenant Returning Security Deposit Less Deductions, including various types of such letters. 1. Purpose of the Letter: The purpose of the Miramar Florida Letter from Landlord to Tenant Returning Security Deposit Less Deductions is to inform the tenant of the amount being returned and justify any deductions made to the security deposit. This letter serves as documentation in case of disputes and ensures transparency in the deposit return process. 2. Key Elements in the Letter: a. Date: The letter should contain the date it is drafted. b. Tenant's Information: Address the letter to the tenant(s), including their names and current address. c. Landlord's Information: Include the landlord's name, contact information, and return address. d. Security Deposit Amount: Clearly state the initial security deposit amount. e. Deductions: Detail the specific deductions, noting the reasons for each, such as unpaid rent, damages, or cleaning fees. f. Itemized Statement: Provide an itemized breakdown of deductions along with corresponding costs. g. Net Amount Returned: Calculate and declare the final amount being returned to the tenant, after deducting the owed expenses. h. Deadline and Payment Method: Specify the deadline for the tenant to receive the refund and the preferred payment method (e.g., check, bank transfer). i. Security Deposit Return Agreement: Include a statement acknowledging the tenant's agreement and acceptance of the deductions made. 3. Types of Letters: a. Miramar Florida Letter from Landlord to Tenant Returning Partial Security Deposit: Used when only a portion of the security deposit is returned due to deductions. b. Miramar Florida Letter from Landlord to Tenant Returning Full Security Deposit: Applicable when no deductions are made, and the entire security deposit is being returned to the tenant. c. Miramar Florida Letter from Landlord to Tenant Explaining Additional Deductions: Sent in cases where further expenses are identified after initially returning a partial security deposit. Conclusion: Writing an accurate and detailed Miramar Florida Letter from Landlord to Tenant Returning Security Deposit Less Deductions is crucial for ensuring a smooth deposit refund process. By including the essential elements and adhering to the specific laws and regulations of Miramar, Florida, landlords can maintain transparency and avoid potential disputes with tenants.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.