A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

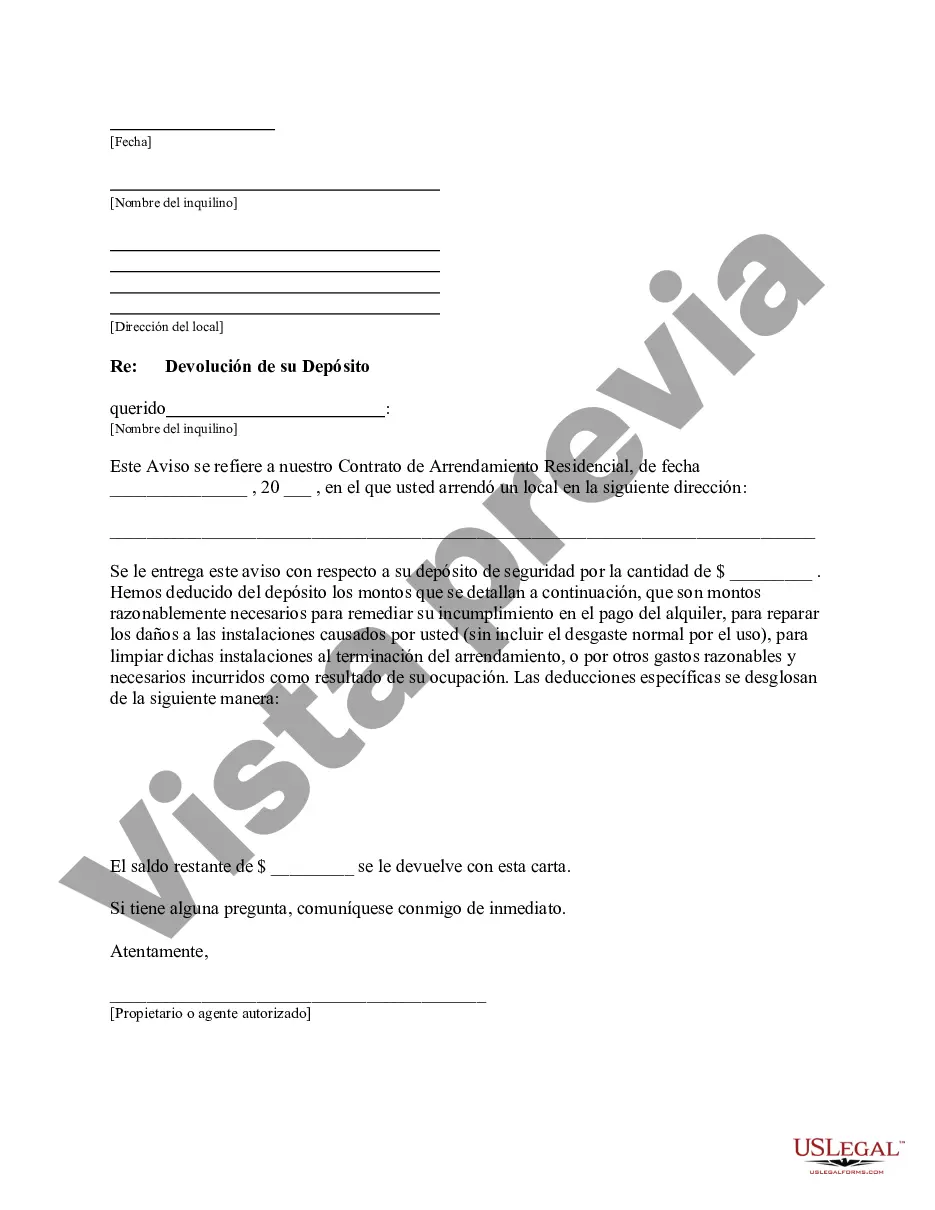

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant. Title: Tampa, Florida Letter from Landlord to Tenant Returning Security Deposit Less Deductions Keywords: Tampa, Florida, landlord, tenant, security deposit, deductions Introduction: In Tampa, Florida, it is common for landlords to refund tenants' security deposits after deducting necessary expenses. This detailed description will outline the essential elements of a letter from a landlord to a tenant returning the security deposit less deductions. Understanding these key points will ensure a smooth and transparent process between both parties involved in the rental agreement. 1. Identifying Information: In the letter, the landlord should provide accurate and current information regarding the rental property, such as the property address, unit number, and tenant's name. This information ensures clarity and avoids any miscommunication. 2. Reference to Lease Agreement: The letter should refer to the initial lease agreement signed by the tenant. This establishes the legal basis for retaining a portion of the security deposit and ensures the tenant's awareness of the terms agreed upon. 3. Date of Termination: The letter should clearly state the date the tenancy officially ended or when the tenant vacated the property. This serves as the reference point for assessing deductions and calculating the amount refundable to the tenant. 4. Itemized Deductions: A landlord must list each deduction from the security deposit accurately, providing a detailed breakdown of expenses incurred. Common deductions may include unpaid rent, repair costs for damages beyond normal wear and tear, cleaning charges, and outstanding utility bills. 5. Supporting Documentation: Attach relevant invoices, receipts, work orders, or estimates, which validate the expenses incurred. Transparently providing documentation helps the tenant understand the basis for each deduction and facilitates an open dialogue. 6. Calculation of Refundable Amount: Once deductions have been listed and substantiated, the landlord should calculate the remaining amount to be refunded to the tenant. This amount should consider the deductions made and any applicable legal requirements, such as interest or applicable fees. 7. Method of Payment: The letter should outline the preferred method of payment for the refunded security deposit. Common methods include a personal check, cash, certified check, or direct deposit. Additionally, provide instructions for the tenant to confirm their correct mailing address or bank account details if required. 8. Contact Information: Include contact information for the landlord or property management company at the end of the letter. This ensures the tenant can easily communicate any questions or concerns regarding the refund process. Different Types of Tampa, Florida Letters from Landlord to Tenant Returning Security Deposit Less Deductions: 1. Standard Security Deposit Deduction Letter: This is a general letter that adheres to the local Tampa, Florida laws and regulations for returning security deposits after making permissible deductions for valid reasons. 2. Itemized Security Deposit Deduction Letter: This type of letter provides an in-depth breakdown of each deduction made from the tenant's security deposit, along with supporting documentation. It is especially useful when significant deductions have been made or when transparency is a priority. 3. Letter with Request for Additional Information: If the landlord requires additional information from the tenant, like a forwarding address or updated contact details, this letter contains a request for such information to facilitate the refund process smoothly. Conclusion: Writing a comprehensive letter from a landlord to a tenant returning the security deposit less deductions is vital to ensure transparency and promote a positive landlord-tenant relationship. By adhering to the relevant Tampa, Florida laws and including essential information and documentation, both parties can confidently navigate the refund process.

Title: Tampa, Florida Letter from Landlord to Tenant Returning Security Deposit Less Deductions Keywords: Tampa, Florida, landlord, tenant, security deposit, deductions Introduction: In Tampa, Florida, it is common for landlords to refund tenants' security deposits after deducting necessary expenses. This detailed description will outline the essential elements of a letter from a landlord to a tenant returning the security deposit less deductions. Understanding these key points will ensure a smooth and transparent process between both parties involved in the rental agreement. 1. Identifying Information: In the letter, the landlord should provide accurate and current information regarding the rental property, such as the property address, unit number, and tenant's name. This information ensures clarity and avoids any miscommunication. 2. Reference to Lease Agreement: The letter should refer to the initial lease agreement signed by the tenant. This establishes the legal basis for retaining a portion of the security deposit and ensures the tenant's awareness of the terms agreed upon. 3. Date of Termination: The letter should clearly state the date the tenancy officially ended or when the tenant vacated the property. This serves as the reference point for assessing deductions and calculating the amount refundable to the tenant. 4. Itemized Deductions: A landlord must list each deduction from the security deposit accurately, providing a detailed breakdown of expenses incurred. Common deductions may include unpaid rent, repair costs for damages beyond normal wear and tear, cleaning charges, and outstanding utility bills. 5. Supporting Documentation: Attach relevant invoices, receipts, work orders, or estimates, which validate the expenses incurred. Transparently providing documentation helps the tenant understand the basis for each deduction and facilitates an open dialogue. 6. Calculation of Refundable Amount: Once deductions have been listed and substantiated, the landlord should calculate the remaining amount to be refunded to the tenant. This amount should consider the deductions made and any applicable legal requirements, such as interest or applicable fees. 7. Method of Payment: The letter should outline the preferred method of payment for the refunded security deposit. Common methods include a personal check, cash, certified check, or direct deposit. Additionally, provide instructions for the tenant to confirm their correct mailing address or bank account details if required. 8. Contact Information: Include contact information for the landlord or property management company at the end of the letter. This ensures the tenant can easily communicate any questions or concerns regarding the refund process. Different Types of Tampa, Florida Letters from Landlord to Tenant Returning Security Deposit Less Deductions: 1. Standard Security Deposit Deduction Letter: This is a general letter that adheres to the local Tampa, Florida laws and regulations for returning security deposits after making permissible deductions for valid reasons. 2. Itemized Security Deposit Deduction Letter: This type of letter provides an in-depth breakdown of each deduction made from the tenant's security deposit, along with supporting documentation. It is especially useful when significant deductions have been made or when transparency is a priority. 3. Letter with Request for Additional Information: If the landlord requires additional information from the tenant, like a forwarding address or updated contact details, this letter contains a request for such information to facilitate the refund process smoothly. Conclusion: Writing a comprehensive letter from a landlord to a tenant returning the security deposit less deductions is vital to ensure transparency and promote a positive landlord-tenant relationship. By adhering to the relevant Tampa, Florida laws and including essential information and documentation, both parties can confidently navigate the refund process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.