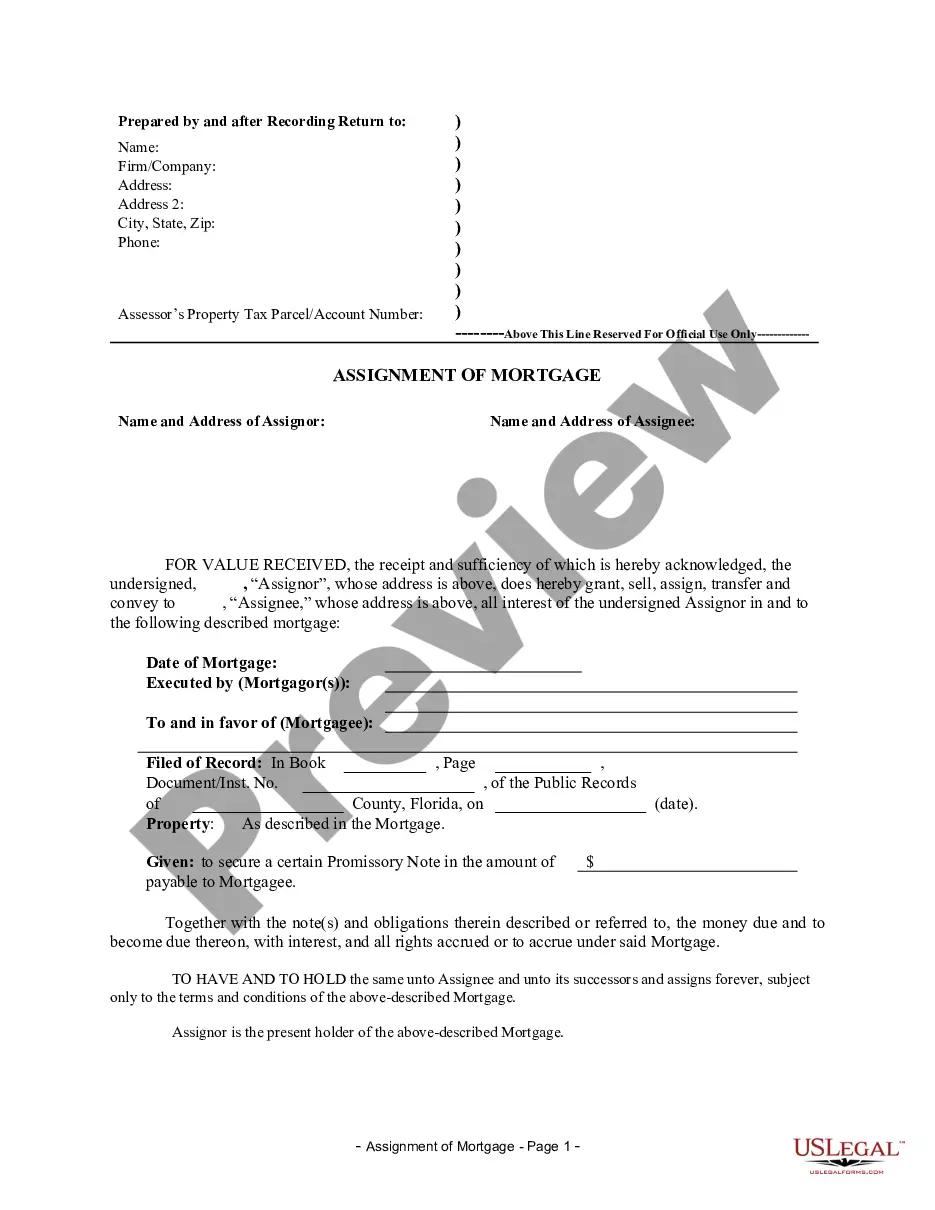

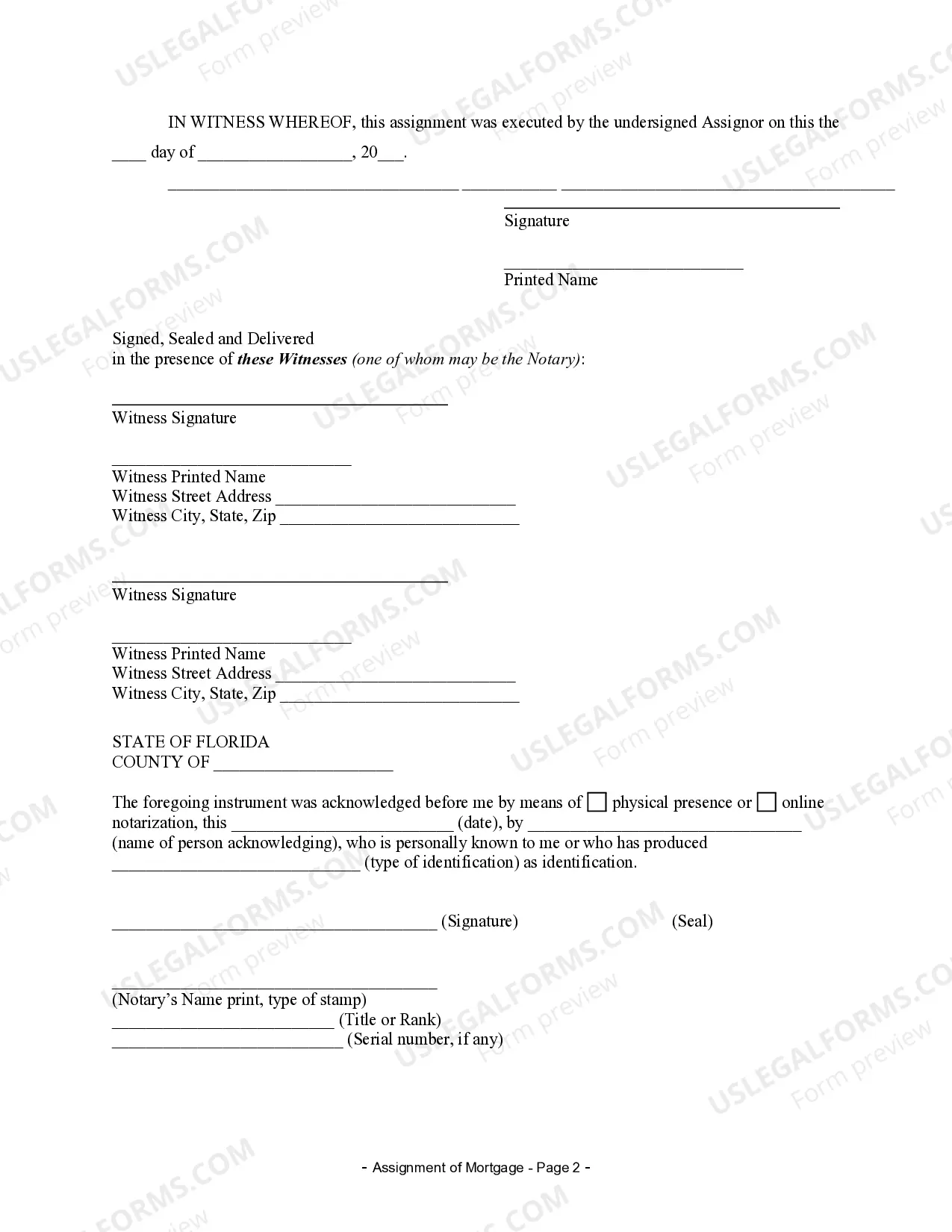

Title: Port St. Lucie Florida Assignment of Mortgage by Individual Mortgage Holder: Explained Introduction: The Port St. Lucie Florida Assignment of Mortgage by Individual Mortgage Holder is a crucial legal process that involves the transfer of an existing mortgage from one individual mortgage holder to another. This mechanism allows individuals to legally acquire or transfer ownership of a mortgage in Port St. Lucie, Florida. In this article, we will delve into the various types of assignment of mortgages by individual mortgage holders and discuss their significance. 1. Full Assignment: A full assignment involves the complete transfer of ownership rights and responsibilities of a mortgage from one individual mortgage holder to another. This type of assignment is typically used when the original mortgage holder wishes to sell, transfer, or gift their mortgage to another individual in Port St. Lucie. 2. Assignment with Recourse: An assignment with recourse implies that the individual mortgage holder remains partially responsible for any financial losses incurred by the new mortgage holder in the event of default. This safeguard ensures that the assignee does not bear the entire risk, providing a level of security to both parties involved in the assignment. 3. Assignment without Recourse: Contrary to assignment with recourse, an assignment without recourse relieves the original individual mortgage holder of any liability or responsibility for any potential losses or defaults associated with the mortgage. This type of assignment is generally considered more favorable to the assignee, as they bear the entire risk and associated financial obligations. Key Guidelines for the Port St. Lucie Florida Assignment of Mortgage by Individual Mortgage Holder: 1. Legal Formalities: The assignment process must adhere to Florida's legal formalities, including the creation of a written agreement that outlines the terms of the assignment, the consideration involved, and signatures of all parties involved. 2. Consent and Agreement: Both the assignor (original mortgage holder) and assignee (new mortgage holder) must mutually consent and agree to the assignment. This agreement typically requires thorough documentation, including the explicit intent to transfer the mortgage. 3. Mortgage Recording: To ensure the assignment is legally enforceable, it is vital to record the assignment with the appropriate government agency, such as the St. Lucie County Clerk of Court's office. Recording serves as public notice and protects the assignee's interests against competing claims. 4. Due Diligence: Prior to the assignment, both parties must conduct a meticulous review of the mortgage agreement, outstanding loan balance, repayment terms, and any potential constraints or limitations associated with the transfer. Conclusion: In Port St. Lucie, Florida, the Assignment of Mortgage by Individual Mortgage Holder provides a means for transferring ownership of a mortgage to another individual. Understanding the different types of assignments, such as full assignments, assignments with recourse, and assignments without recourse, ensures a smoother legal transition for both the original mortgage holder and the assignee. Adhering to the established guidelines and legal formalities is crucial for a valid and enforceable assignment.

Port St. Lucie Florida Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Port St. Lucie Florida Assignment Of Mortgage By Individual Mortgage Holder?

We always want to minimize or prevent legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal services that, as a rule, are very costly. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to legal counsel. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Port St. Lucie Florida Assignment of Mortgage by Individual Mortgage Holder or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Port St. Lucie Florida Assignment of Mortgage by Individual Mortgage Holder complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Port St. Lucie Florida Assignment of Mortgage by Individual Mortgage Holder is suitable for you, you can pick the subscription option and proceed to payment.

- Then you can download the document in any available format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!