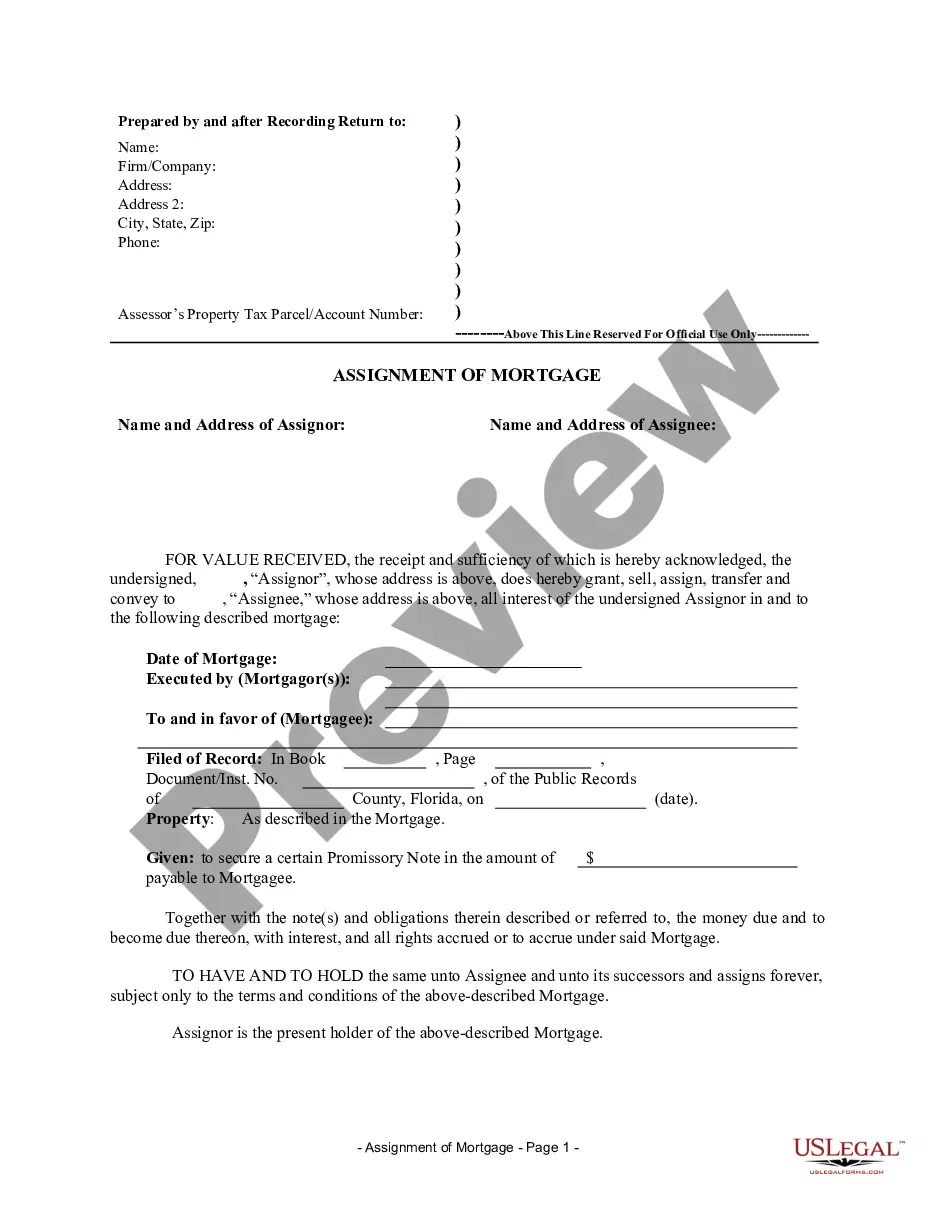

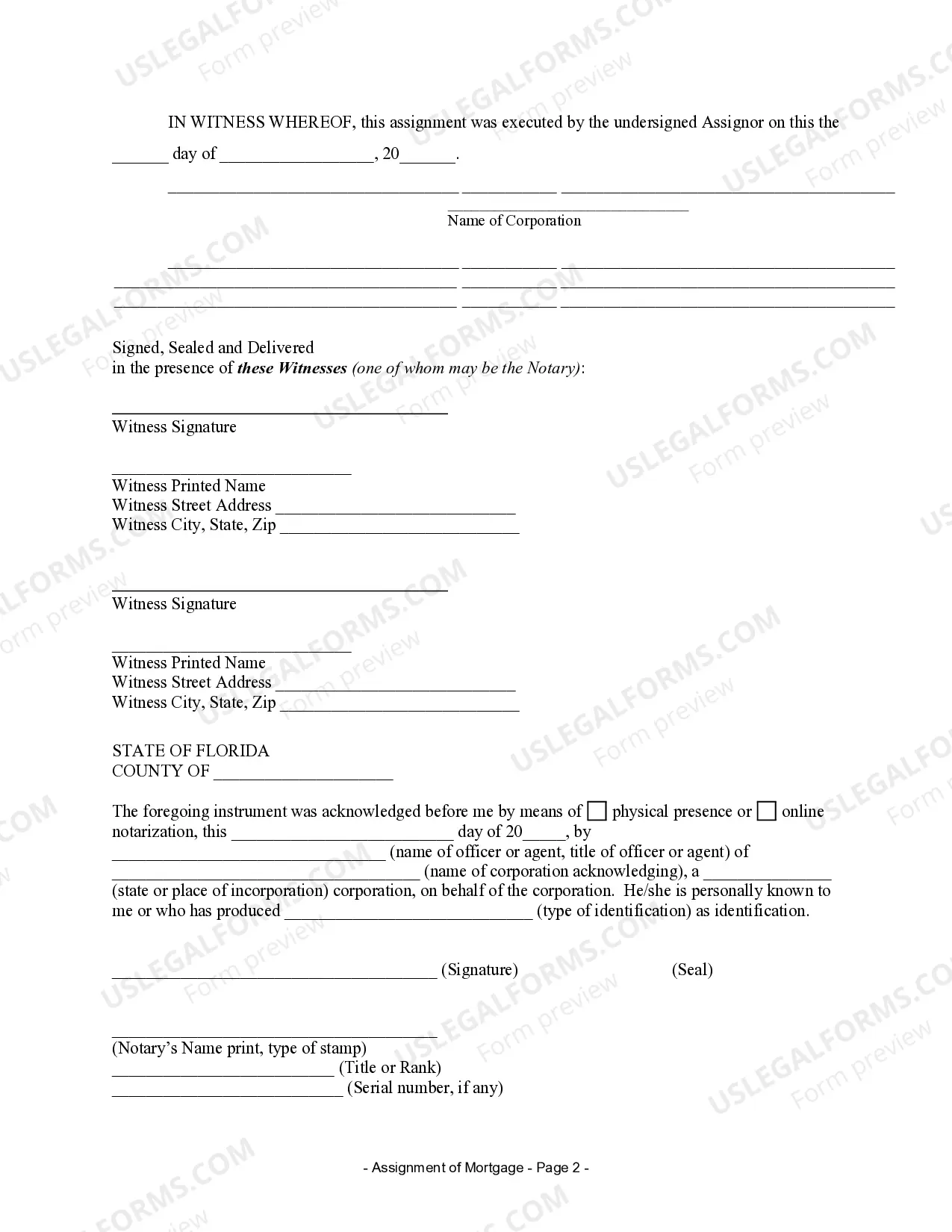

Miami-Dade Florida Assignment of Mortgage by Corporate Mortgage Holder: A Comprehensive Guide Keywords: Miami-Dade, Florida, Assignment of Mortgage, Corporate Mortgage Holder Introduction: The Miami-Dade Florida Assignment of Mortgage by Corporate Mortgage Holder is a legal document that allows a corporate mortgage holder to transfer their rights and interests in a mortgage to another party. This process ensures that the new party receives the benefits and responsibilities associated with the mortgage. Understanding the different types of assignments available in Miami-Dade, Florida can help both corporate mortgage holders and potential assignees navigate the process smoothly. 1. Standard Assignment of Mortgage: The most common type of assignment is the Standard Assignment of Mortgage. This occurs when a corporate mortgage holder transfers their rights, title, and interest in a mortgage to another party. The assignee gains all the rights and obligations associated with the mortgage, including the right to collect payments, modify the terms, and initiate foreclosure proceedings if necessary. 2. Assignment of Mortgage with Assumption: In some cases, a corporate mortgage holder may choose to include an assumption clause in the assignment. This allows the new party to assume the existing mortgage with its original terms and conditions. The assignee becomes responsible for making payments and complying with the terms of the mortgage as if they were the original borrower. 3. Partial Assignment of Mortgage: A corporate mortgage holder may opt for a partial assignment when they wish to transfer only a portion of their rights and interests in a mortgage to another party. This often occurs when multiple parties have a stake in a mortgage, and one party decides to assign a portion of their share to another entity. Both the assignor and assignee retain specific rights and obligations related to the mortgage. 4. Assignment of Mortgage through Corporate Merger or Acquisition: Sometimes, a corporate mortgage holder may undergo a merger or acquisition, leading to the need for an assignment of the mortgage. In such cases, the assignor entity is replaced by the acquiring entity, which assumes all the rights and responsibilities associated with the mortgage. This type of assignment often requires careful documentation to ensure a smooth transition. 5. Assignment of Mortgage by Corporate Mortgage Holder to a Trust: Corporate mortgage holders may also choose to assign a mortgage to a trust. This type of assignment allows the mortgage to be managed by the trust, and the trust beneficiaries become entitled to the mortgage payments and benefits. Conclusion: Understanding the various types of Miami-Dade Florida Assignment of Mortgage by Corporate Mortgage Holder is crucial for all parties involved in the assignment process. Whether it is a standard assignment, an assignment with assumption, a partial assignment, an assignment due to a merger or acquisition, or an assignment to a trust, ensuring proper documentation and legal compliance is essential. Consultation with legal professionals is recommended to navigate this complex process successfully.

Miami-Dade Florida Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Miami-Dade Florida Assignment Of Mortgage By Corporate Mortgage Holder?

If you are searching for a valid form template, it’s extremely hard to find a better service than the US Legal Forms website – one of the most considerable libraries on the web. Here you can find a large number of form samples for company and individual purposes by types and regions, or key phrases. Using our advanced search function, finding the latest Miami-Dade Florida Assignment of Mortgage by Corporate Mortgage Holder is as easy as 1-2-3. Additionally, the relevance of each and every record is proved by a group of professional attorneys that on a regular basis check the templates on our website and revise them according to the most recent state and county laws.

If you already know about our system and have an account, all you need to receive the Miami-Dade Florida Assignment of Mortgage by Corporate Mortgage Holder is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have discovered the sample you require. Read its description and use the Preview function to see its content. If it doesn’t meet your needs, use the Search option at the top of the screen to get the appropriate document.

- Confirm your choice. Choose the Buy now option. Next, choose your preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Utilize your bank card or PayPal account to complete the registration procedure.

- Obtain the template. Choose the format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the received Miami-Dade Florida Assignment of Mortgage by Corporate Mortgage Holder.

Each template you save in your profile does not have an expiry date and is yours permanently. It is possible to access them using the My Forms menu, so if you want to get an extra duplicate for enhancing or creating a hard copy, you may come back and save it again at any time.

Take advantage of the US Legal Forms professional collection to gain access to the Miami-Dade Florida Assignment of Mortgage by Corporate Mortgage Holder you were looking for and a large number of other professional and state-specific samples on a single platform!