The Port St. Lucie Florida Notice of Dishonored Check — Civil is a crucial legal document used when a check bounces or is deemed "bad" due to insufficient funds. It is important for both individuals and businesses to understand the consequences of writing or receiving a bad or bounced check, as outlined in the laws of Port St. Lucie, Florida. A bad check, also known as a dishonored or bounced check, occurs when the issuer's bank refuses to honor the check due to lack of funds in the account. This can happen unintentionally, such as if a person mistakenly writes a check without considering their available balance, or intentionally, when a person knowingly writes a check with insufficient funds. Regardless of the intent, a dishonored check can lead to legal implications. When a check bounces, the payee (the person or entity who received the check) typically issues a Port St. Lucie Notice of Dishonored Check — Civil to the check issuer, notifying them of the insufficient funds and demanding payment to rectify the situation. This notice serves as a formal warning, informing the check writer of the consequences they may face if they fail to resolve the matter promptly. In Port St. Lucie, Florida, the laws regarding bad checks are governed by the Florida Statutes under Chapter 832. According to these laws, when a person fails to pay or make the check right within 30 days of receiving the Port St. Lucie Notice of Dishonored Check — Civil, they may be subjected to both civil and criminal penalties. Civil penalties for a bad check in Port St. Lucie include mandatory damages up to three times the amount of the check (with a minimum of $50 and a maximum of $500), plus attorney's fees and court costs. The payee may also have the option to directly file a civil lawsuit against the check writer to recover the money owed. Criminal penalties, on the other hand, can result in misdemeanor or felony charges, depending on the circumstances. Typically, if the value of the bad check is less than $150, it is considered a first-degree misdemeanor, punishable by incarceration for up to one year and/or fines of up to $1,000. For checks exceeding $150, the offense may be classified as a third-degree felony, leading to potential imprisonment for up to five years and/or fines not exceeding $5,000. It is important to note that a Port St. Lucie Notice of Dishonored Check — Civil should be taken seriously. Ignoring or failing to respond to the notice can escalate the situation and lead to further legal complications. It is advisable for the check writer to immediately contact the payee and arrange payment or discuss a resolution to avoid more severe penalties. In conclusion, a Port St. Lucie Florida Notice of Dishonored Check — Civil is a legally binding document sent to individuals or entities who have written a bad check within the jurisdiction. Understanding the consequences of bouncing a check is essential to avoid civil and criminal penalties, which may include substantial fines, potential incarceration, and even a tarnished personal or business reputation.

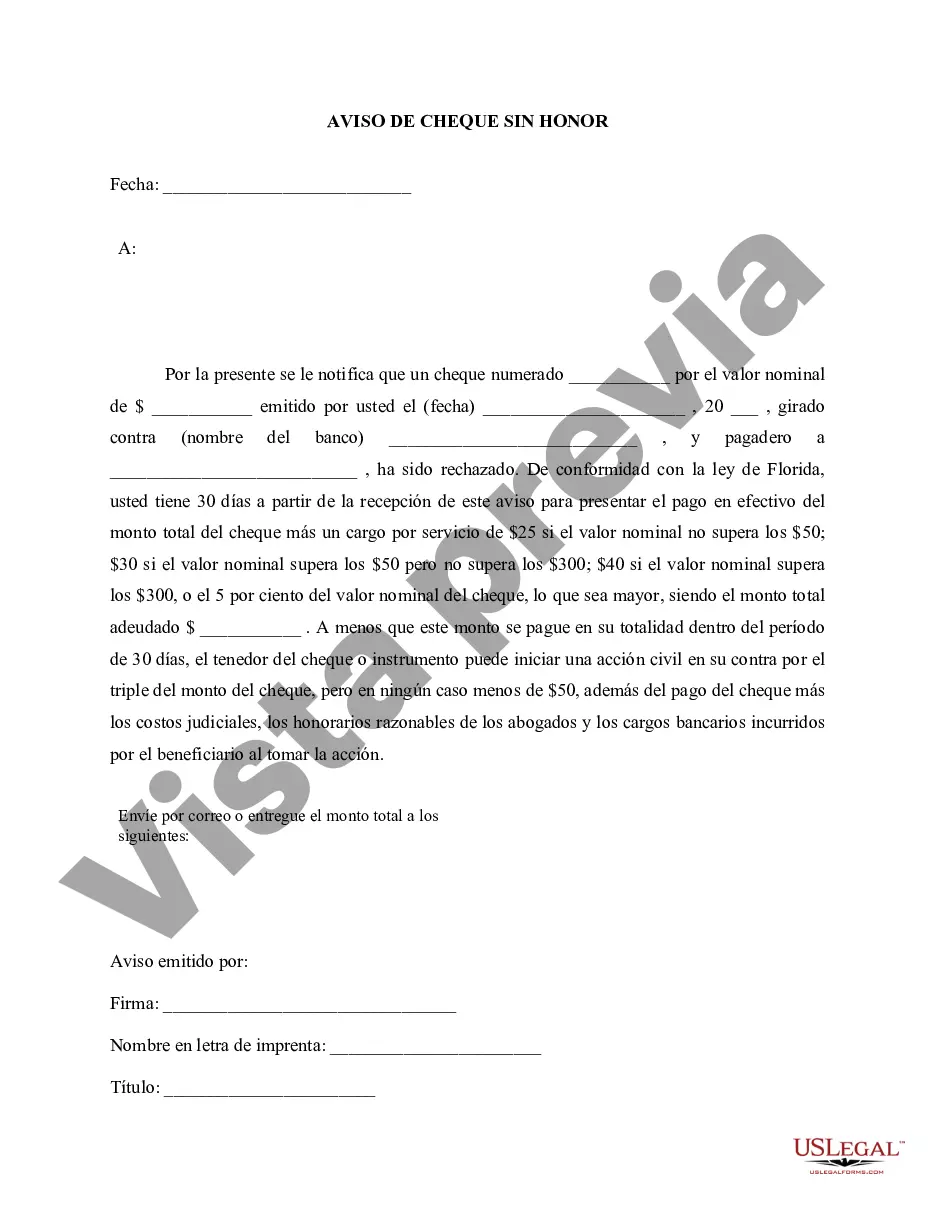

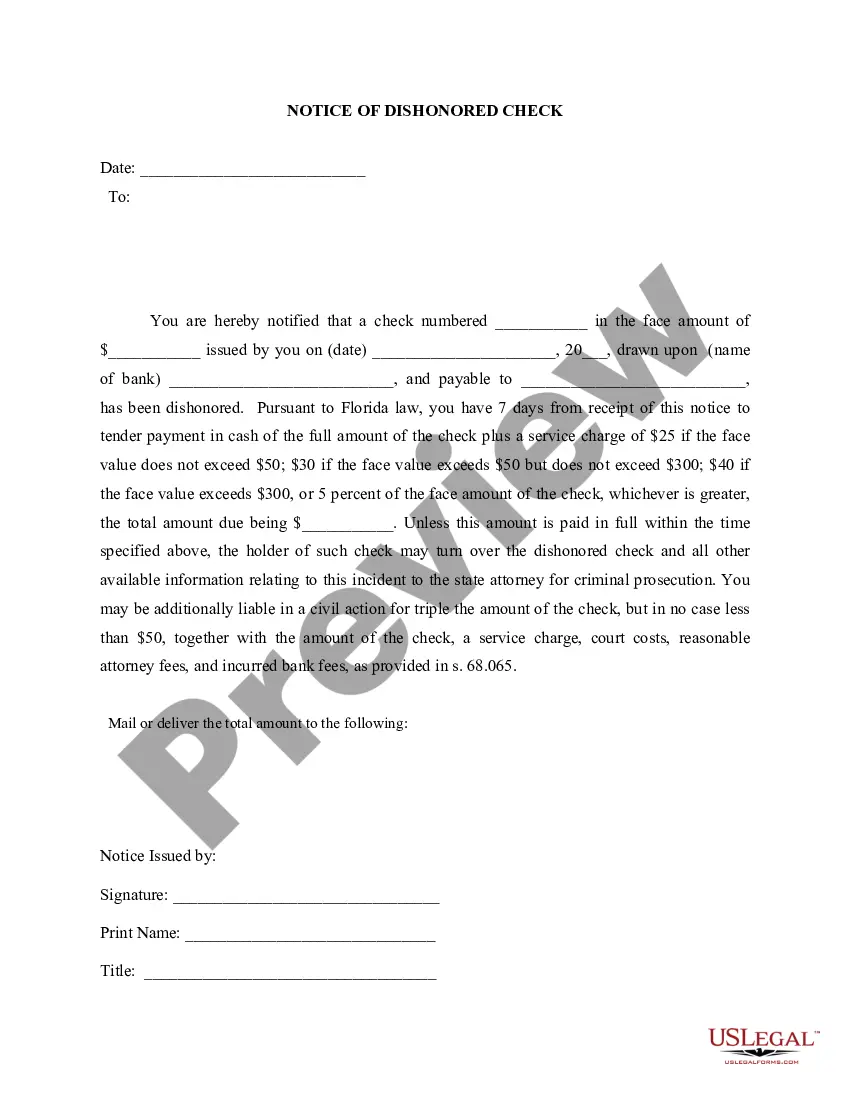

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Port St. Lucie Florida Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Florida Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

State:

Florida

City:

Port St. Lucie

Control #:

FL-401N

Format:

Word

Instant download

Description

Formulario de aviso de cheque sin fondos.

The Port St. Lucie Florida Notice of Dishonored Check — Civil is a crucial legal document used when a check bounces or is deemed "bad" due to insufficient funds. It is important for both individuals and businesses to understand the consequences of writing or receiving a bad or bounced check, as outlined in the laws of Port St. Lucie, Florida. A bad check, also known as a dishonored or bounced check, occurs when the issuer's bank refuses to honor the check due to lack of funds in the account. This can happen unintentionally, such as if a person mistakenly writes a check without considering their available balance, or intentionally, when a person knowingly writes a check with insufficient funds. Regardless of the intent, a dishonored check can lead to legal implications. When a check bounces, the payee (the person or entity who received the check) typically issues a Port St. Lucie Notice of Dishonored Check — Civil to the check issuer, notifying them of the insufficient funds and demanding payment to rectify the situation. This notice serves as a formal warning, informing the check writer of the consequences they may face if they fail to resolve the matter promptly. In Port St. Lucie, Florida, the laws regarding bad checks are governed by the Florida Statutes under Chapter 832. According to these laws, when a person fails to pay or make the check right within 30 days of receiving the Port St. Lucie Notice of Dishonored Check — Civil, they may be subjected to both civil and criminal penalties. Civil penalties for a bad check in Port St. Lucie include mandatory damages up to three times the amount of the check (with a minimum of $50 and a maximum of $500), plus attorney's fees and court costs. The payee may also have the option to directly file a civil lawsuit against the check writer to recover the money owed. Criminal penalties, on the other hand, can result in misdemeanor or felony charges, depending on the circumstances. Typically, if the value of the bad check is less than $150, it is considered a first-degree misdemeanor, punishable by incarceration for up to one year and/or fines of up to $1,000. For checks exceeding $150, the offense may be classified as a third-degree felony, leading to potential imprisonment for up to five years and/or fines not exceeding $5,000. It is important to note that a Port St. Lucie Notice of Dishonored Check — Civil should be taken seriously. Ignoring or failing to respond to the notice can escalate the situation and lead to further legal complications. It is advisable for the check writer to immediately contact the payee and arrange payment or discuss a resolution to avoid more severe penalties. In conclusion, a Port St. Lucie Florida Notice of Dishonored Check — Civil is a legally binding document sent to individuals or entities who have written a bad check within the jurisdiction. Understanding the consequences of bouncing a check is essential to avoid civil and criminal penalties, which may include substantial fines, potential incarceration, and even a tarnished personal or business reputation.

Free preview

How to fill out Port St. Lucie Florida Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

If you’ve already used our service before, log in to your account and download the Port St. Lucie Florida Notice of Dishonored Check - Civil - Keywords: bad check, bounced check on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Port St. Lucie Florida Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!