Gainesville Florida Notice of Dishonored Check — Criminal: A Comprehensive Guide Keywords: bad check, bounced check Introduction: In Gainesville, Florida, a Notice of Dishonored Check — Criminal is issued when individuals or businesses fail to honor their financial commitments, resulting in a bounced or bad check. This comprehensive guide aims to provide a detailed description of the notice, its implications, and various types of bad checks commonly encountered. 1. What is a Bad Check? A bad check refers to a check that is unable to be processed due to insufficient funds in the account or any other reason that renders it unpayable. Writing a bad check knowingly or with fraudulent intent can have serious legal consequences. 2. Understanding a Bounced Check: A bounced check is another term used to describe a bad check. This occurs when a check is presented for payment but is returned by the bank due to non-sufficient funds or any other unresolved discrepancy. Bounced checks can result in penalties, fees, and potential criminal charges. Types of Gainesville Florida Notice of Dishonored Check — Criminal: 1. Insufficient Funds Check: This type of bad check occurs when the issuer's account lacks sufficient funds to cover the amount mentioned on the check. The check is returned by the bank, and a Notice of Dishonored Check may be generated. 2. Closed Account Check: A closed account check occurs when an individual or business attempts to use a check from an account that has been closed or is inactive. The bank will decline the payment, leading to the issuance of a Notice of Dishonored Check — Criminal. 3. Stolen Check: In cases where a check has been reported as stolen, using such a check for payment purposes can lead to a bad check. The rightful owner would typically discover the fraudulent activity and inform their bank, resulting in the notice being issued. 4. Post-Dated Check: A post-dated check is one that includes a future date, indicating that it should not be cashed until that date arrives. Presenting a post-dated check prematurely and it being dishonored by the bank can result in a bad check notice being issued. Conclusion: Gainesville, Florida takes the matter of bad checks very seriously, and anyone found guilty of using a bad check may face various consequences, including criminal charges, civil lawsuits, fines, and even imprisonment. It is crucial to ensure that checks are issued with sufficient funds and that any financial discrepancies are resolved promptly to avoid the issuance of a Gainesville Florida Notice of Dishonored Check — Criminal.

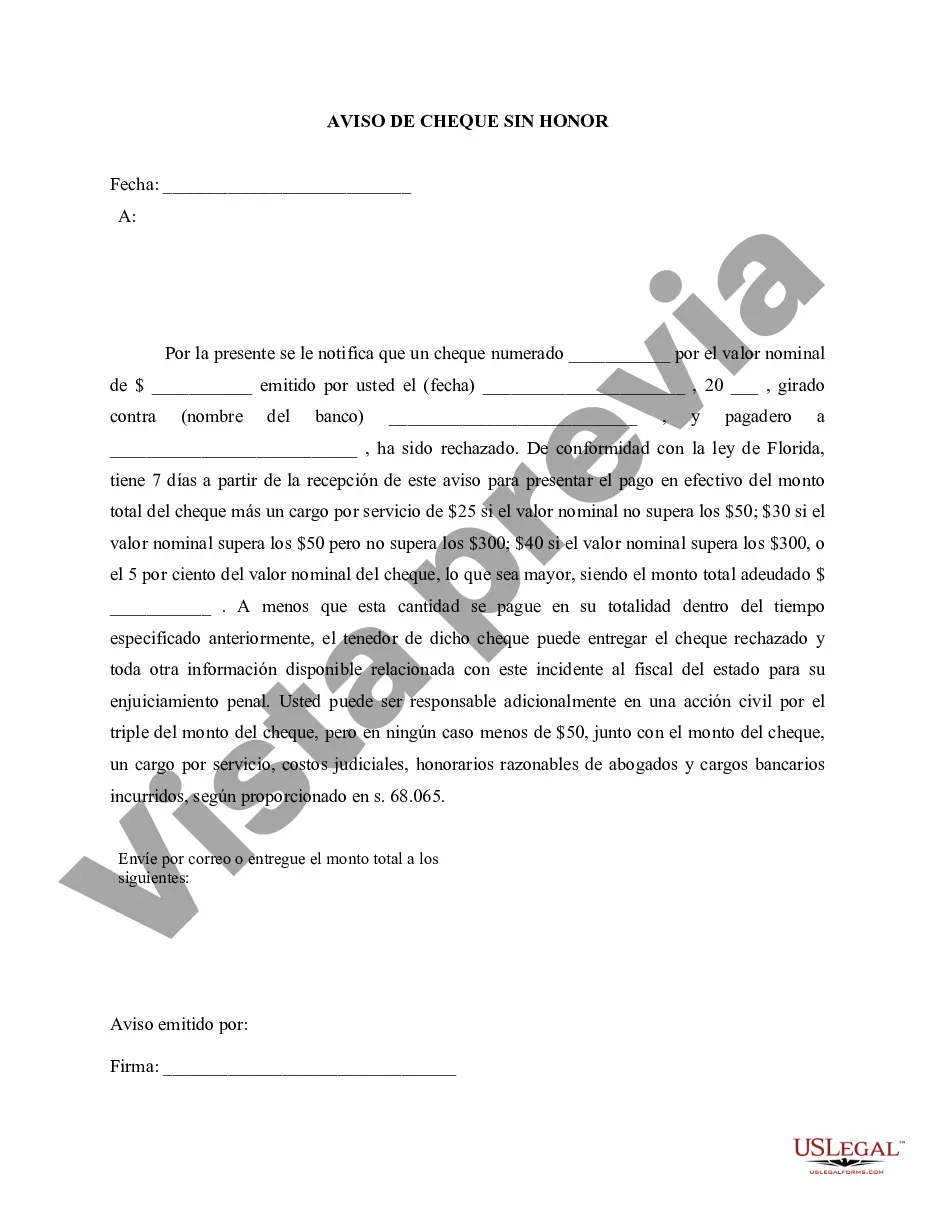

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Gainesville Florida Aviso de cheque sin fondos - Penal - Palabras clave: cheque sin fondos, cheque sin fondos - Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check

Description

How to fill out Gainesville Florida Aviso De Cheque Sin Fondos - Penal - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Gainesville Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Gainesville Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a few more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Gainesville Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!