The cosigner is also sometimes be called a guarantor. A guaranty is a contract under which one person (guarantor) agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

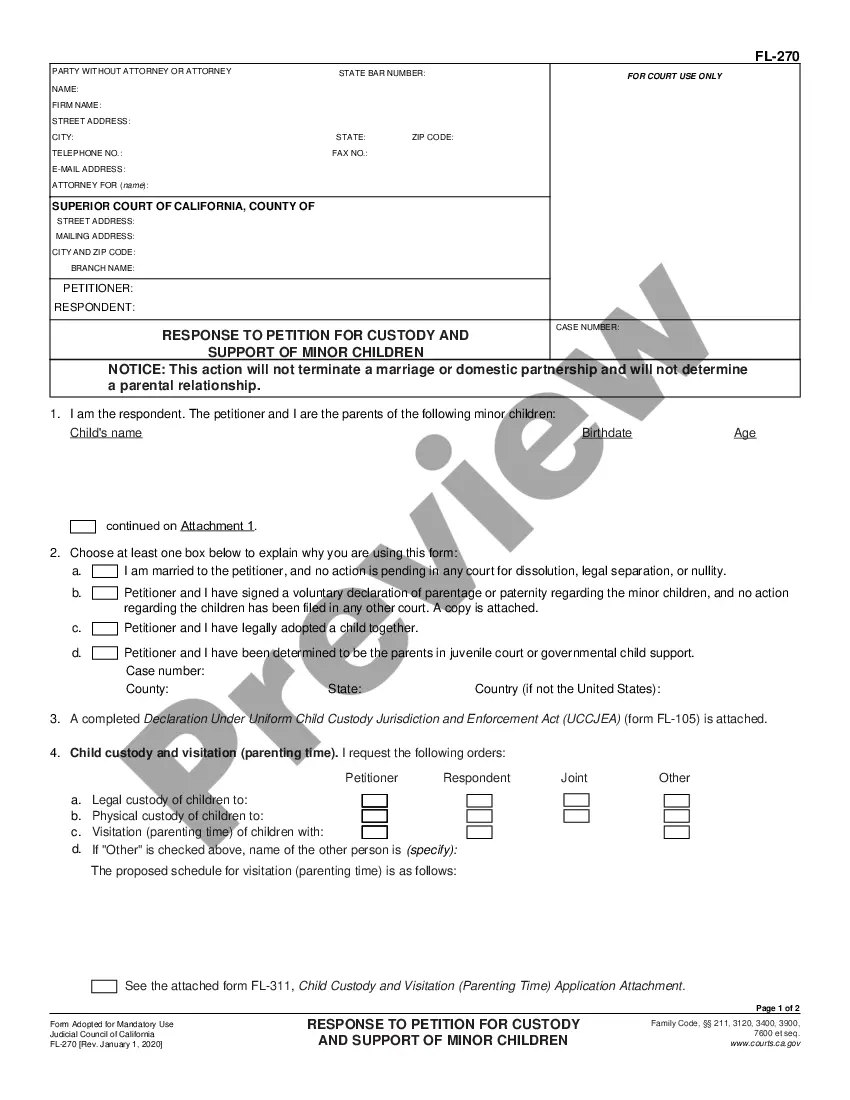

The Jacksonville Florida Landlord Tenant Lease Co-Signer Agreement is a legally binding document that establishes the obligations and responsibilities of a co-signer in a rental agreement between a landlord and tenant. A co-signer is a third party who agrees to assume financial liability for the tenant's obligations, such as rental payments and damages, in the event that the tenant fails to fulfill their contractual obligations. This agreement is particularly relevant in situations where the tenant may have insufficient income, poor credit history, or limited rental history, making it difficult for them to secure a lease independently. The co-signer serves as a guarantor and provides an added layer of security for the landlord, ensuring that any potential financial losses will be covered. This arrangement allows tenants with less-than-ideal financial backgrounds to secure a rental property, while providing landlords with the assurance of receiving rent payments and recovering potential damages. Key elements typically included in the Jacksonville Florida Landlord Tenant Lease Co-Signer Agreement are: 1. Parties involved: The agreement identifies the landlord, tenant, and the co-signer, including their full legal names and contact information. It is crucial to accurately identify all parties to ensure enforceability. 2. Lease details: The agreement specifies the terms and conditions of the lease agreement, such as the duration of the lease, rent amount, payment schedule, and any special provisions or restrictions outlined in the original lease. 3. Co-signer obligations: The co-signer acknowledges and agrees to assume financial responsibility for the tenant's obligations under the lease agreement. This includes the payment of rent, fees, charges, and any damages caused by the tenant's negligence. 4. Termination and default: The agreement outlines the circumstances under which the co-signer's obligations may be terminated, such as when the tenant successfully fulfills their contractual obligations, the lease ends, or if the co-signer provides written notice of termination. It also defines the consequences of default, such as the co-signer becoming liable for outstanding rent and fees. 5. Indemnification and release: The co-signer agrees to indemnify and hold harmless the landlord from any claims, damages, or losses arising from the tenant's actions or omissions. This clause helps protect the landlord from potential legal complications. 6. Severability and integration clauses: These clauses state that if any provision of the agreement is deemed unenforceable, it will not affect the validity of the remaining provisions. The integration clause ensures that the agreement represents the entirety of the parties' agreement, superseding any prior discussions or representations. It is important to note that there may be different types or variations of the Jacksonville Florida Landlord Tenant Lease Co-Signer Agreement, depending on the specific requirements and preferences of the landlord or property management company. However, the basic elements mentioned above are commonly included in any co-signer agreement to establish a clear understanding between the parties involved.

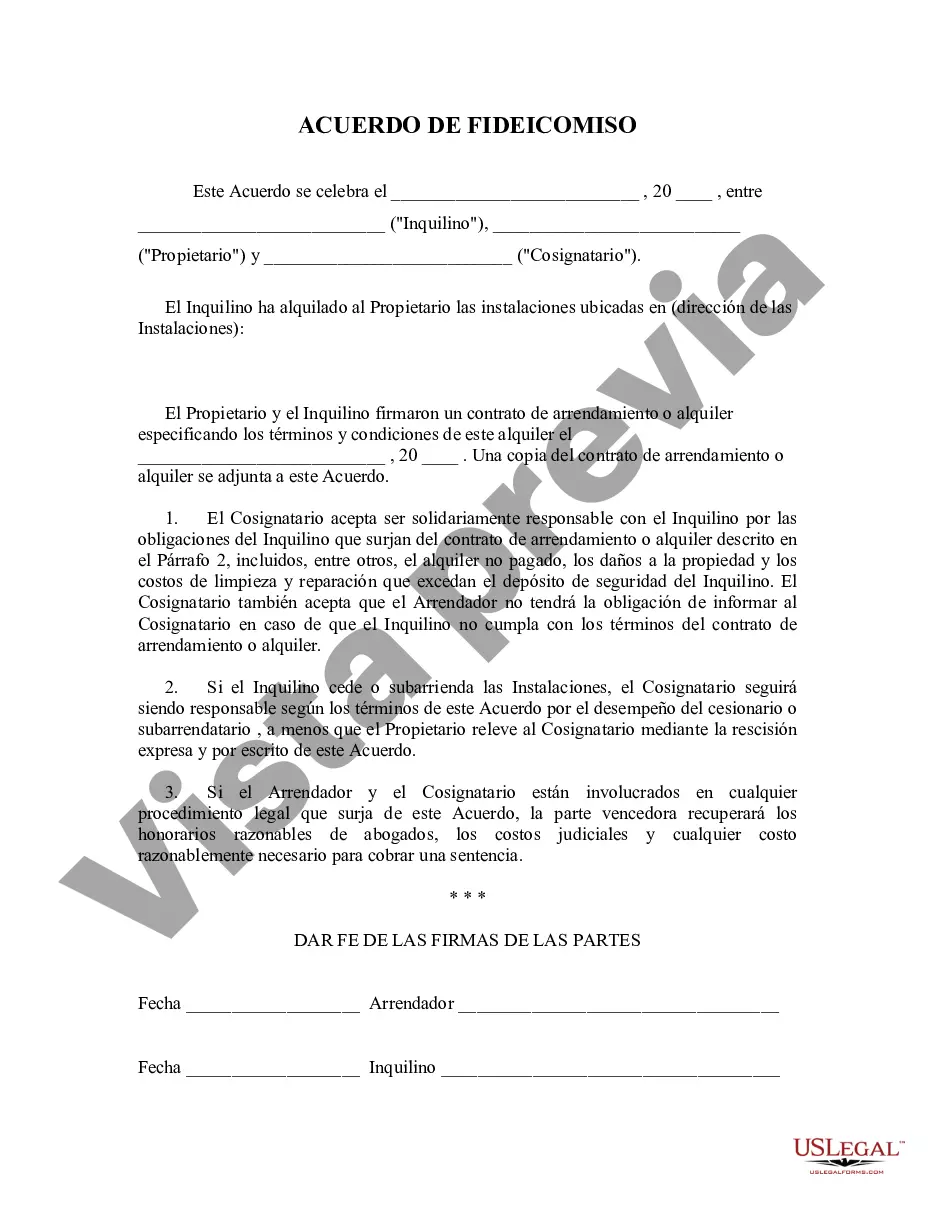

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.