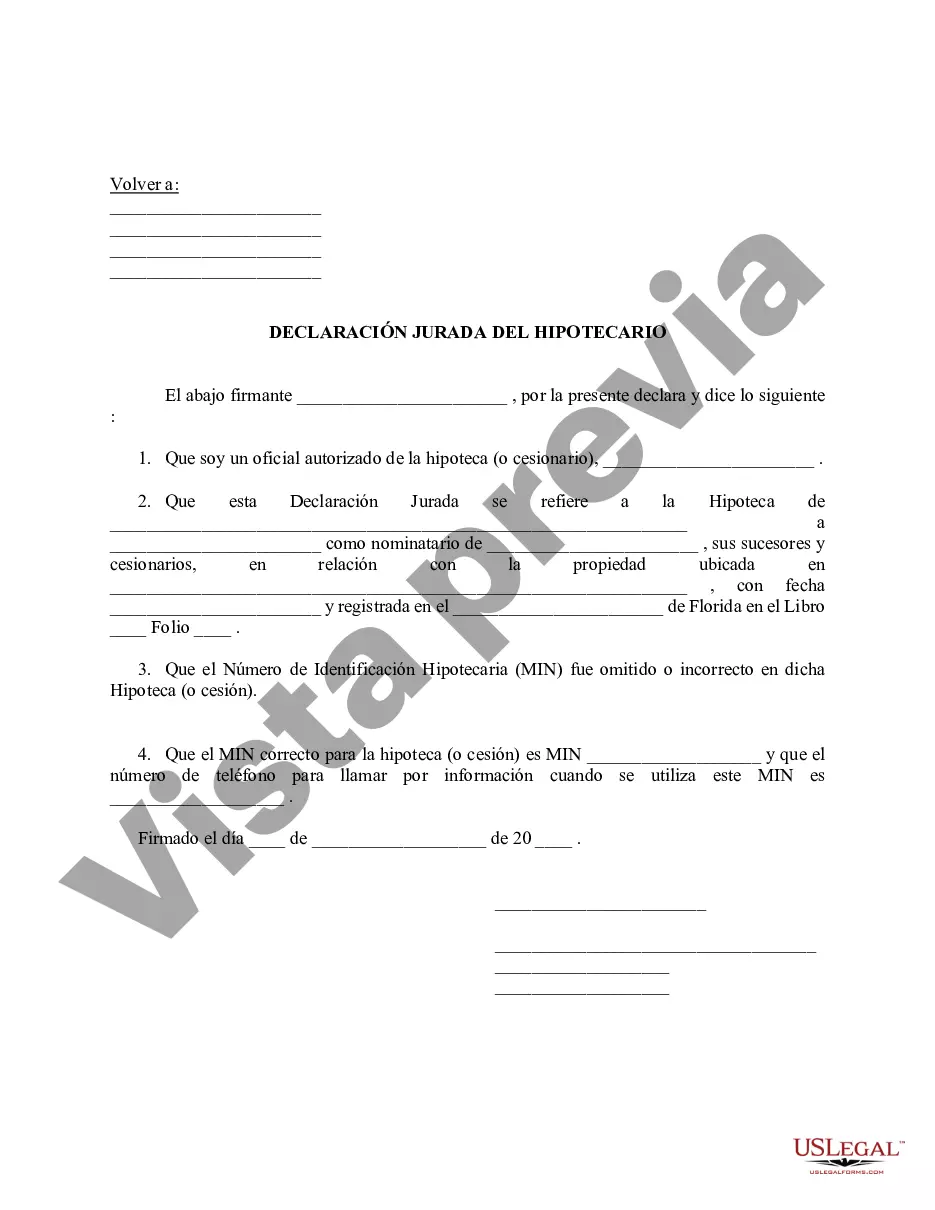

Cape Coral Florida Mortgagee's Affidavit is a legal document used in mortgage transactions within the Cape Coral area of Florida. It is a sworn statement provided by the mortgagee, who is the lender or the person/entity who holds a mortgage against a property, confirming certain key information regarding the mortgage. This document is typically required during the closing process, as it serves as a declaration from the lender verifying the details of the mortgage. The Cape Coral Florida Mortgagee's Affidavit plays a crucial role in ensuring the accuracy and validity of the transaction, protecting both the lender and the borrower. The contents of the affidavit may vary depending on the specific requirements of the transaction and the lender's preferences. However, some common elements found in a Cape Coral Florida Mortgagee's Affidavit include: 1. Identification: The affidavit will typically start with the mortgagee's identification details, including their name, address, contact information, and any other relevant identification information. 2. Mortgage Details: This section will outline essential information about the mortgage being affirmed. It typically includes details such as the mortgage amount, the interest rate, the loan term, the date of the mortgage, and any additional terms or conditions associated with the loan. 3. Borrower Information: The affidavit will contain the borrower's name(s), address, and other necessary personal details. This ensures the lender acknowledges the correct individual(s) associated with the mortgage. 4. Loan Repayment: The affidavit will state if the borrower is current on their payments and, if not, whether the lender has taken any actions to address the delinquency. This section helps establish the loan's status and any potential issues or actions related to the borrower's payment history. 5. Collateral Description: The affidavit will describe the property associated with the mortgage, including its address, legal description, and any other pertinent details. This section helps establish the property that serves as collateral for the loan. 6. Liabilities and Encumbrances: The affidavit may include a statement confirming that there are no additional liens, encumbrances, or legal claims against the property, other than those specifically mentioned in the mortgage. This declaration assures the borrower, buyer, and other parties involved that the property being mortgaged is free of any potential disputes or claims. It is important to note that while Cape Coral Florida Mortgagee's Affidavit generally covers the above-mentioned areas, specific lenders or transactions may require additional information or clauses based on their unique requirements. Regarding different types of Cape Coral Florida Mortgagee's Affidavit, it is crucial to consult with a qualified legal professional or contact the lender directly to determine if there are any specific variations or specialized affidavits applicable to certain situations, such as refinancing, second mortgages, or foreclosure proceedings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cape Coral Florida Declaración jurada del acreedor hipotecario - Florida Mortagee's Affidavit

Description

How to fill out Cape Coral Florida Declaración Jurada Del Acreedor Hipotecario?

Finding validated templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents for both personal and professional requirements and various real-world situations.

All the papers are accurately organized by usage area and jurisdiction topics, making it as simple as ABC to look for the Cape Coral Florida Mortagee's Affidavit.

Click on the Buy Now button and select your desired subscription plan. You will need to create an account to access the library’s resources.

- Check out the Preview mode and form details.

- Ensure you’ve selected the correct one that fulfills your needs and aligns with your local jurisdiction standards.

- Look for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the accurate one. If it works for you, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

A person can file a quitclaim deed by (1) entering the relevant information on a quitclaim deed form, (2) signing the deed with two witnesses and a notary, and (3) recording the deed at the county comptroller's office. In Florida, quitclaim deeds must have the name and address of both the grantor and the grantee.

70 per $100 (or portion thereof) on documents that transfer interest in Florida real property, such as warranty deeds and quit claim deeds. This tax is based on the sale, consideration or transfer amount and is usually paid to the Clerk of Court when the document is recorded.

Cost of Warranty Deed in Florida The amount of the fee is based on the amount of the mortgage of the property or the sale price. The preparation cost is charged by the attorney preparing the deed. An experienced attorney will charge between $250 and $600 for the preparation of the warranty deed in most cases.

695.27 Uniform Real Property Electronic Recording Act.

28.222, F.S., does authorize the clerk to accept certified copies for recording and, as a certified copy, a facsimile document is entitled to recording as is any other.

The per page cost to record a document is $10.00 for the first page and $8.50 for each additional page. If there are more than four names on the document, each additional name costs $1.00, and any variation of the name is counted as a separate name.

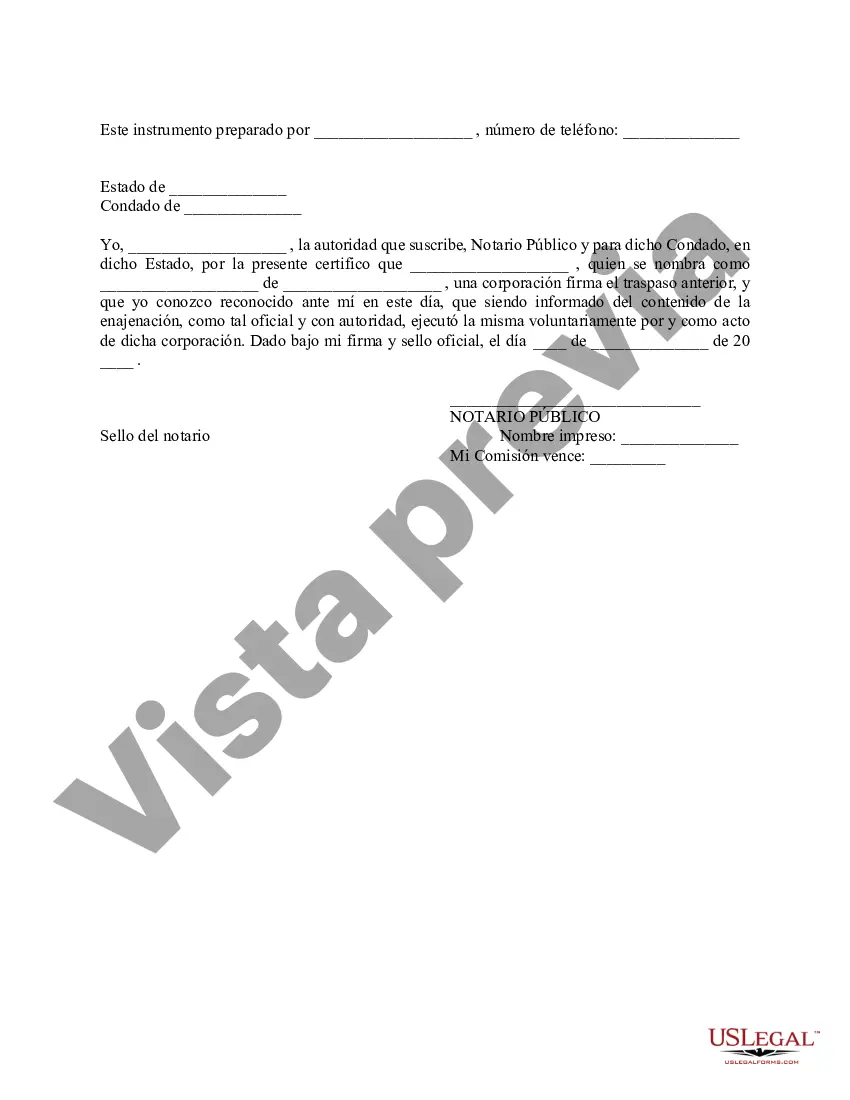

Witness Requirements Deeds of Conveyance: Requires two witnesses and a notary acknowledgment. Mortgages: Do not require witnesses but must be acknowledged to be recorded.

Deed Recording Requirements Grantees' mailing address. Legal description of property (must be located in Broward County). Signatures of Grantors (names printed underneath). Signatures of two (2) Witnesses (names printed underneath).

Deed Recording Fee The logic that the seller provides the buyer with a recordable deed, further requires the buyer to pay the cost of recording that deed, because recordation is solely for the benefit of the buyer. Florida recording costs at this time are $10.00 for the first page, and $8.50 for any additional page.

The following documents can be recorded: Deed's, Mortgages, Satisfactions, Releases, Liens, Assignments, other instruments relating to the ownership, transfer or encumbrance of real property and any other documents which are received or authorized by law to be recorded.