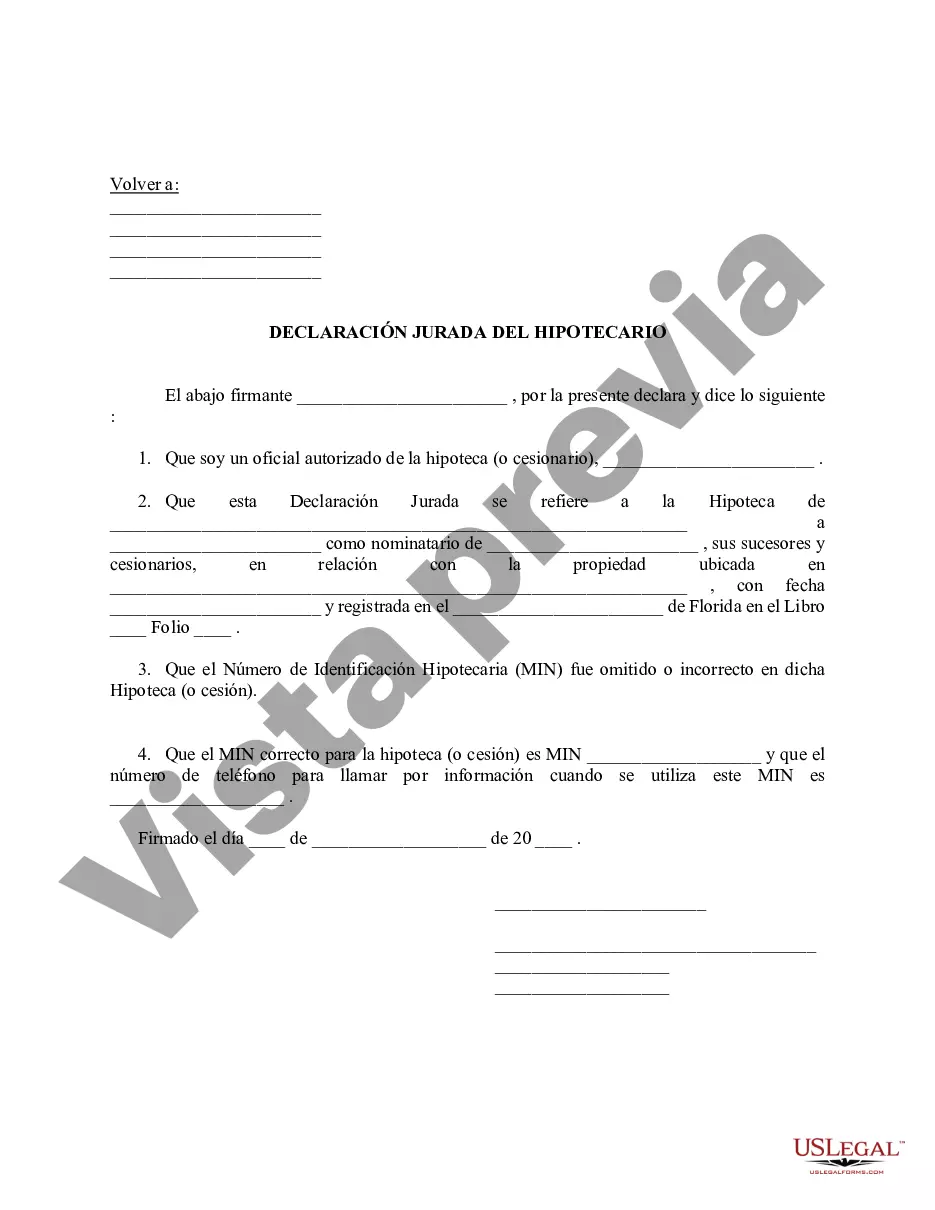

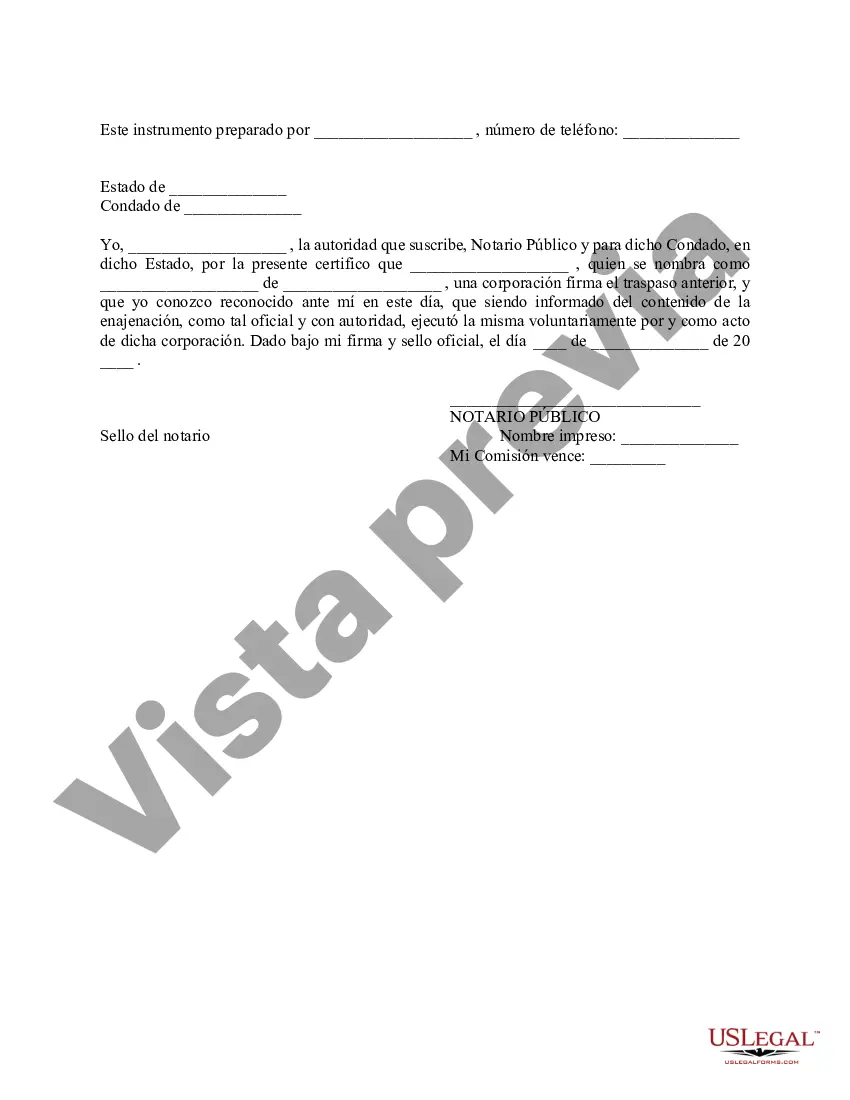

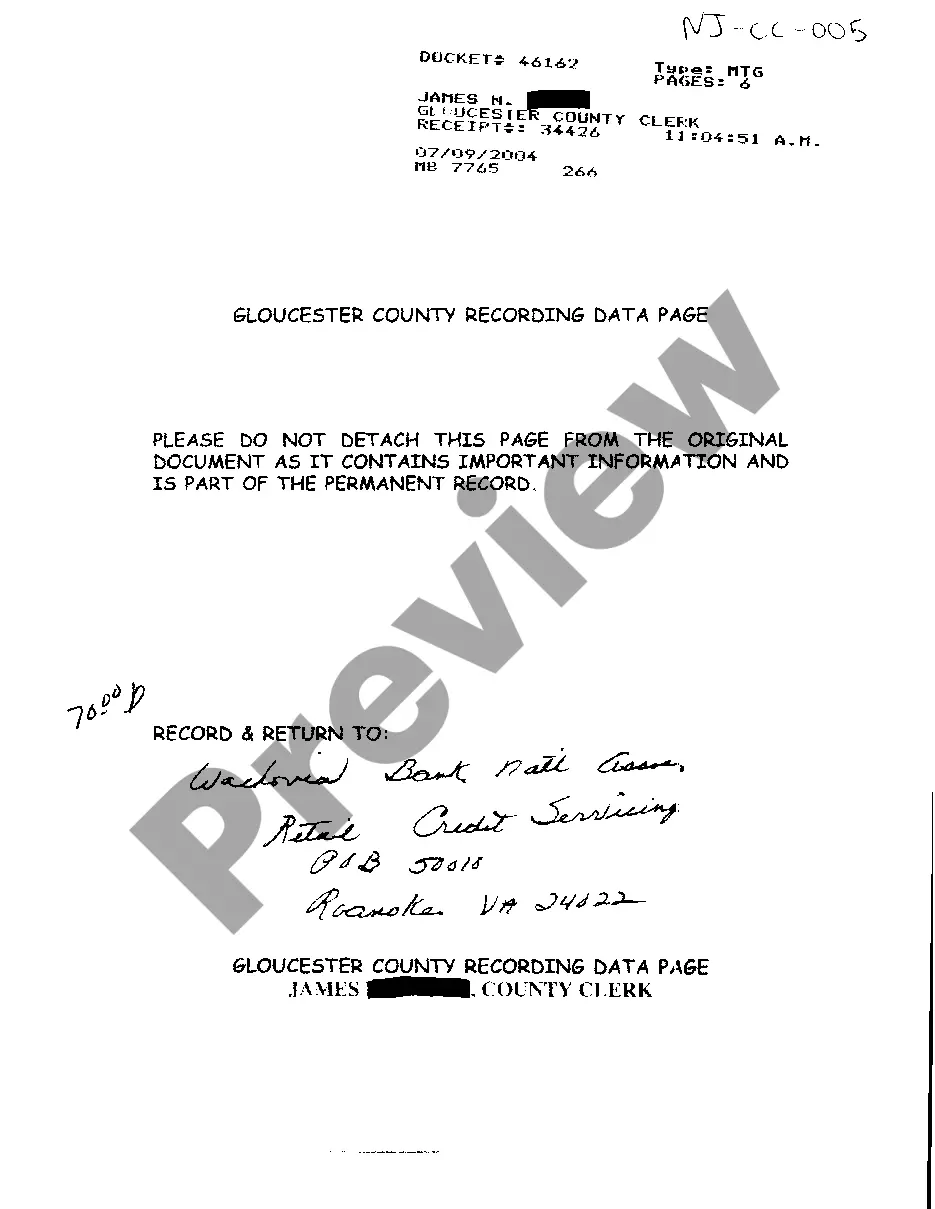

Coral Springs Florida Mortgagee's Affidavit refers to a legal document commonly used in real estate transactions in Coral Springs, Florida. This affidavit plays a crucial role in the mortgage process, detailing important information related to the mortgagee (the lender) and the mortgagor (the borrower). It serves as a sworn statement by the mortgagee, certifying certain facts about the mortgage loan and the property being mortgaged. The Coral Springs Florida Mortgagee's Affidavit typically includes key elements such as the lender's name, contact information, and mortgage identification number. It will also outline the terms and conditions of the mortgage agreement between the lender and the borrower. This may include the loan amount, interest rate, repayment schedule, and any applicable fees or penalties. Furthermore, this affidavit typically confirms that the mortgage has been properly executed, signed, and notarized by all parties involved. It also assures that the mortgage is a valid lien against the property and that all necessary legal steps have been taken to establish the mortgagee's interest in the property. In addition to the standard Coral Springs Florida Mortgagee's Affidavit, there may be different types that can be specified based on the specific requirements of the mortgage transaction. Some common examples include: 1. Corrective Mortgagee's Affidavit: This type of affidavit is used to rectify any errors or discrepancies in the original mortgage documentation. It may be necessary when correcting misspelled names, inaccurate loan amounts, or any other mistakes that were overlooked during the initial mortgage process. 2. Lost Mortgagee's Affidavit: If the original mortgage document is misplaced, lost, or destroyed, a Lost Mortgagee's Affidavit may be required. This affidavit allows the mortgagee to legally certify the existence and terms of the mortgage loan in the absence of the original document. This is important for future reference and potential foreclosure proceedings. 3. Satisfaction or Release Mortgagee's Affidavit: When a mortgage is paid off in full, the lender must file a Satisfaction or Release Mortgagee's Affidavit. This affidavit confirms that the borrower has successfully fulfilled all financial obligations, and the mortgage lien is fully released. This document is essential to clear the property title from any encumbrances caused by the mortgage. 4. Subordination Mortgagee's Affidavit: In some cases, a Subordination Mortgagee's Affidavit may be required when a second mortgage is placed on a property. This affidavit acknowledges that the mortgagee who held the original mortgage is willing to subordinate their lien priority to a new lender. In summary, the Coral Springs Florida Mortgagee's Affidavit is a crucial legal document in real estate transactions, serving as a sworn statement by the lender to certify important loan and property-related information. Different types of affidavits may be required depending on specific circumstances, such as corrective measures, lost documents, released mortgages, or subordination agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Coral Springs Florida Declaración jurada del acreedor hipotecario - Florida Mortagee's Affidavit

State:

Florida

City:

Coral Springs

Control #:

FL-CL010

Format:

Word

Instant download

Description

A mortgage affidavit is a written statement signed by a party in a real estate transaction under penalties of perjury that attests to certain conditions of the property.

Coral Springs Florida Mortgagee's Affidavit refers to a legal document commonly used in real estate transactions in Coral Springs, Florida. This affidavit plays a crucial role in the mortgage process, detailing important information related to the mortgagee (the lender) and the mortgagor (the borrower). It serves as a sworn statement by the mortgagee, certifying certain facts about the mortgage loan and the property being mortgaged. The Coral Springs Florida Mortgagee's Affidavit typically includes key elements such as the lender's name, contact information, and mortgage identification number. It will also outline the terms and conditions of the mortgage agreement between the lender and the borrower. This may include the loan amount, interest rate, repayment schedule, and any applicable fees or penalties. Furthermore, this affidavit typically confirms that the mortgage has been properly executed, signed, and notarized by all parties involved. It also assures that the mortgage is a valid lien against the property and that all necessary legal steps have been taken to establish the mortgagee's interest in the property. In addition to the standard Coral Springs Florida Mortgagee's Affidavit, there may be different types that can be specified based on the specific requirements of the mortgage transaction. Some common examples include: 1. Corrective Mortgagee's Affidavit: This type of affidavit is used to rectify any errors or discrepancies in the original mortgage documentation. It may be necessary when correcting misspelled names, inaccurate loan amounts, or any other mistakes that were overlooked during the initial mortgage process. 2. Lost Mortgagee's Affidavit: If the original mortgage document is misplaced, lost, or destroyed, a Lost Mortgagee's Affidavit may be required. This affidavit allows the mortgagee to legally certify the existence and terms of the mortgage loan in the absence of the original document. This is important for future reference and potential foreclosure proceedings. 3. Satisfaction or Release Mortgagee's Affidavit: When a mortgage is paid off in full, the lender must file a Satisfaction or Release Mortgagee's Affidavit. This affidavit confirms that the borrower has successfully fulfilled all financial obligations, and the mortgage lien is fully released. This document is essential to clear the property title from any encumbrances caused by the mortgage. 4. Subordination Mortgagee's Affidavit: In some cases, a Subordination Mortgagee's Affidavit may be required when a second mortgage is placed on a property. This affidavit acknowledges that the mortgagee who held the original mortgage is willing to subordinate their lien priority to a new lender. In summary, the Coral Springs Florida Mortgagee's Affidavit is a crucial legal document in real estate transactions, serving as a sworn statement by the lender to certify important loan and property-related information. Different types of affidavits may be required depending on specific circumstances, such as corrective measures, lost documents, released mortgages, or subordination agreements.

Free preview

How to fill out Coral Springs Florida Declaración Jurada Del Acreedor Hipotecario?

If you’ve already utilized our service before, log in to your account and download the Coral Springs Florida Mortagee's Affidavit on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make sure you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Coral Springs Florida Mortagee's Affidavit. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!