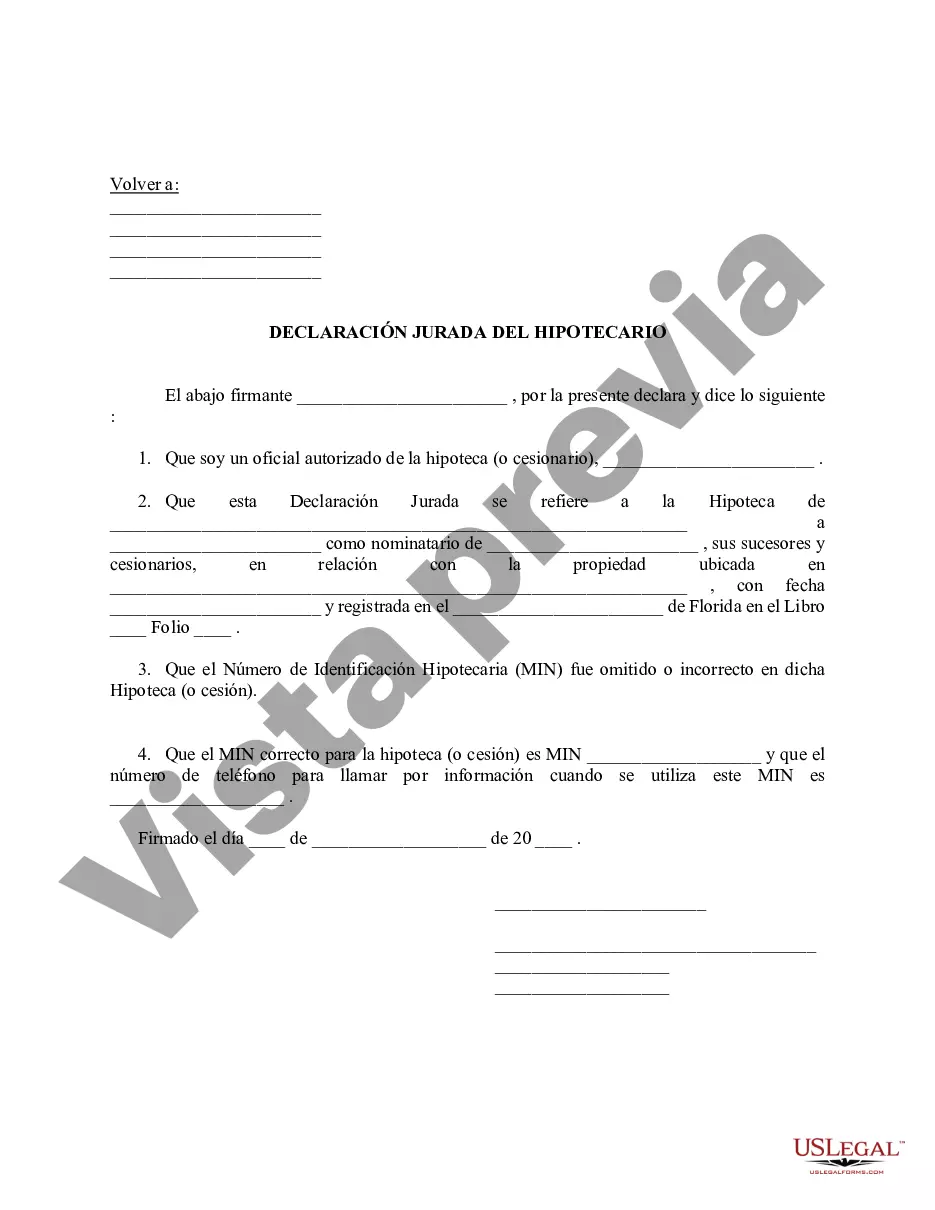

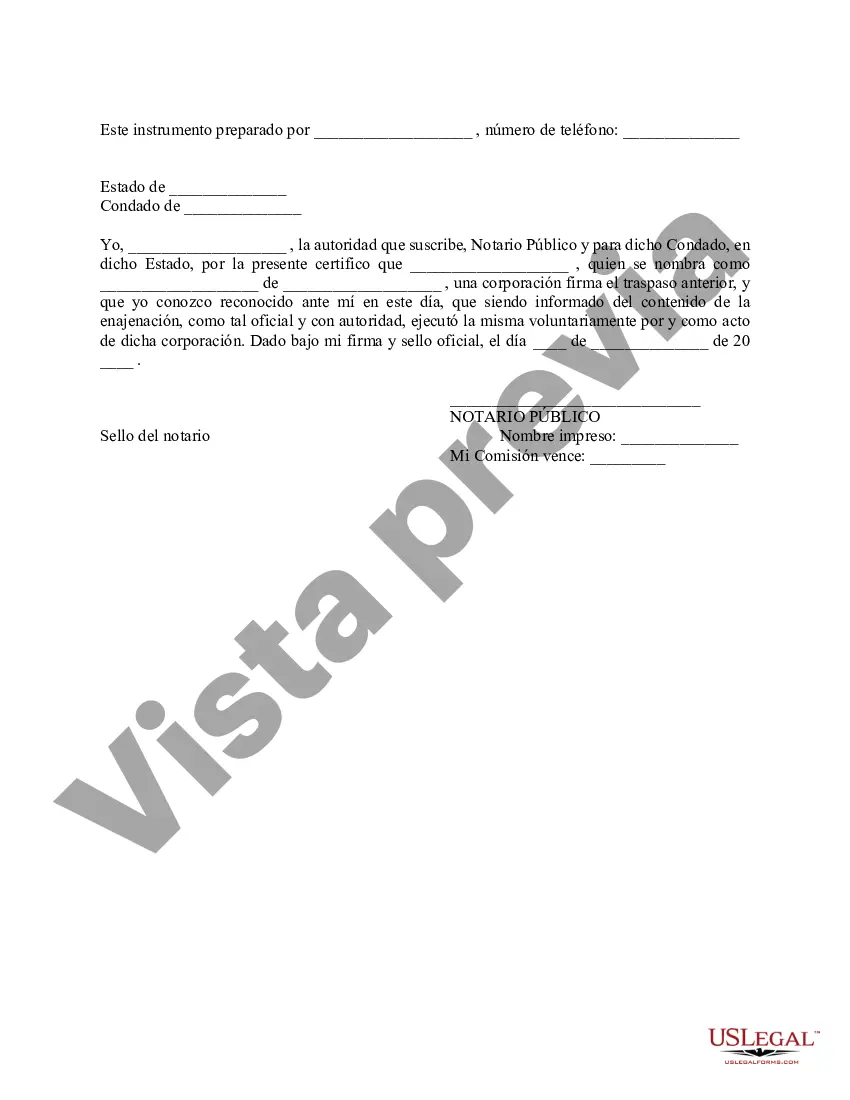

A mortgagee's affidavit is a legal document commonly used in Hollywood, Florida, and other jurisdictions to confirm the accuracy and validity of certain information regarding a mortgage. This affidavit is typically signed by the mortgagee, who is the lender or the entity holding the mortgage on a property. It serves as a declaration under oath, affirming specific facts related to the mortgage transaction. The Hollywood Florida Mortgagee's Affidavit is an important document that provides assurance to all parties involved in a real estate transaction, including the borrower, the lender, and the title company. It is used during the closing process to establish the chain of title and verify the mortgage details, ensuring that all necessary steps have been taken and that the mortgage is legally binding. The contents of the Hollywood Florida Mortgagee's Affidavit may vary depending on the requirements of the jurisdiction and the specific mortgage transaction. However, it generally includes the following key elements: 1. Identification of Parties: The affidavit will identify the mortgagee, the borrower, and any other relevant parties involved in the mortgage transaction. 2. Mortgage Details: It will specify essential information about the mortgage, such as the loan amount, interest rate, maturity date, and any applicable fees or charges. 3. Title Information: The affidavit may contain a confirmation that the mortgagee holds a valid lien on the property and has the legal authority to enforce it. 4. Payment Information: It may include details about the borrower's payment history, confirming if there are any outstanding payments, late fees, or penalties. 5. Collateral Confirmation: The affidavit may state that the mortgagee has a first lien position on the property, which means that in case of default, they have priority in receiving payment from the sale proceeds. 6. Documentation Requirements: The affidavit might outline the documents and paperwork pertaining to the mortgage that have been reviewed and verified by the mortgagee. 7. Compliance with State Laws: It could confirm that the mortgagee has complied with all applicable state and federal laws and regulations while executing the mortgage transaction. Different types of Hollywood Florida Mortgagee's Affidavits might exist depending on the specific situation and requirements. For instance, there could be a Mortgagee's Affidavit for a refinancing transaction, a Mortgagee's Affidavit for a reverse mortgage, or a Mortgagee's Affidavit for a home equity loan. These different types focus on particular aspects or purposes of the mortgage process, while still serving the overarching goal of verifying and confirming the mortgage details for the parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hollywood Florida Declaración jurada del acreedor hipotecario - Florida Mortagee's Affidavit

Description

How to fill out Hollywood Florida Declaración Jurada Del Acreedor Hipotecario?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Hollywood Florida Mortagee's Affidavit becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Hollywood Florida Mortagee's Affidavit takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Hollywood Florida Mortagee's Affidavit. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!