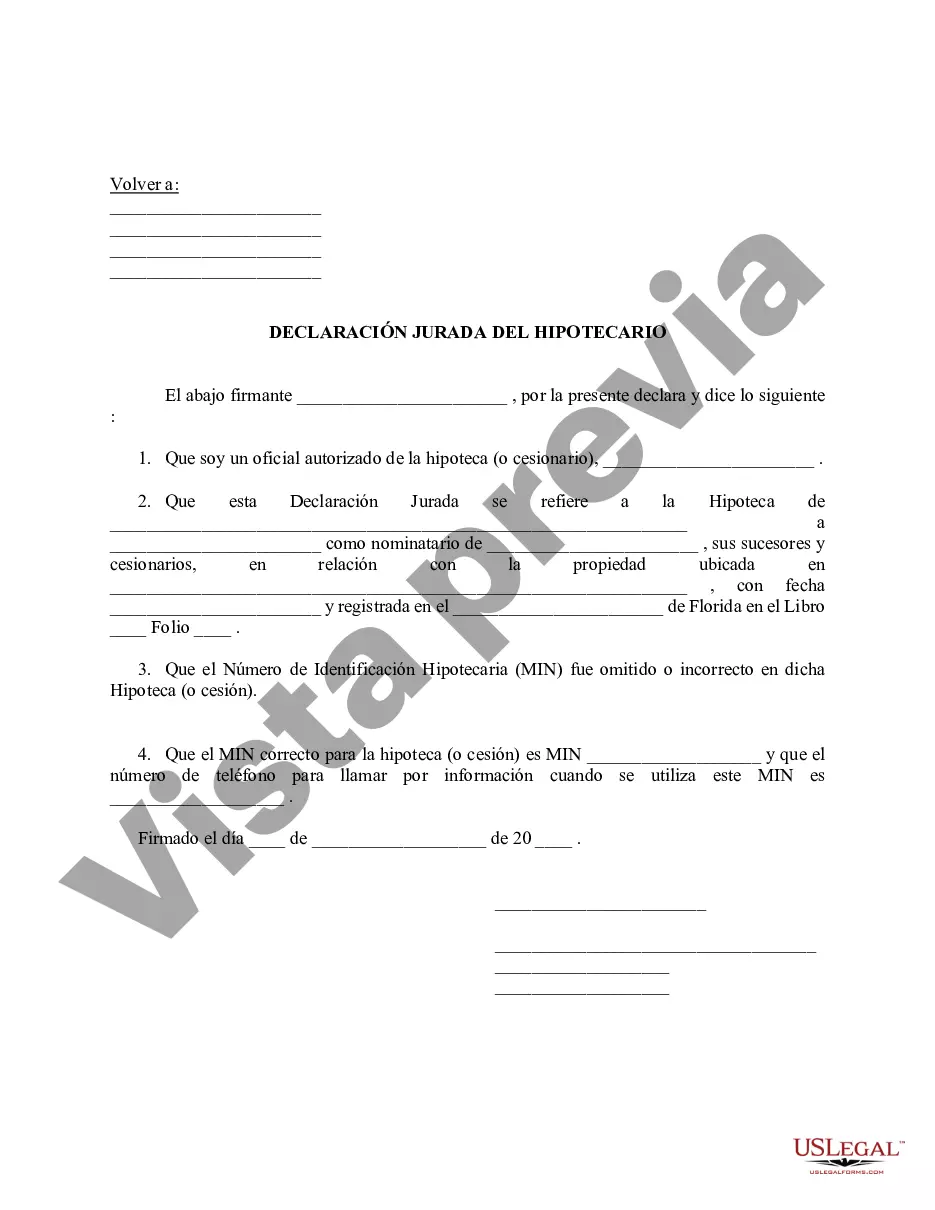

Miami-Dade Florida Mortgagee's Affidavit is a legal document that plays a vital role in real estate transactions involving mortgaged properties within Miami-Dade County, Florida. It serves as an essential component in various mortgage-related processes, ensuring compliance with state laws and regulations. This affidavit is typically prepared and signed by the loan originating institution (mortgagee) and attests to specific facts related to the mortgage and property involved. The Miami-Dade Florida Mortgagee's Affidavit serves to authenticate the institution's involvement in the mortgage transaction and provides supporting evidence for the mortgagee's claims, ensuring a transparent and legally binding relationship between the parties. This affidavit is often required during foreclosure proceedings, property sales, refinancing, or when transferring mortgage interests. Keywords: Miami-Dade Florida, Mortgagee's Affidavit, legal document, real estate transactions, mortgaged properties, compliance, state laws, regulations, loan originating institution, attests, facts, mortgage, property, authentication, claims, transparent, legally binding, foreclosure proceedings, property sales, refinancing, mortgage interests. Types of Miami-Dade Florida Mortgagee's Affidavit: 1. Loan Origination Affidavit: This type of affidavit is prepared and signed by the mortgagee (loan originating institution) during the initial loan application process. It attests to the borrower's ability to repay the loan, the terms and conditions of the mortgage agreement, and other relevant financial information. 2. Foreclosure Affidavit: In cases of mortgage default or foreclosure, this affidavit is prepared and filed by the mortgagee to provide evidence of the borrower's failure to meet payment obligations. It includes details such as the amount owed, missed payments, and explanation of the foreclosure process. 3. Refinancing Affidavit: When refinancing a mortgage, the mortgagee may be required to provide an affidavit that confirms the borrower's creditworthiness, the refinancing terms, and any changes made to the original mortgage agreement. 4. Assignment Affidavit: This affidavit is used when there is a transfer of mortgage interests between different institutions or parties. It certifies the assignment of the mortgage from one entity to another, ensuring the validity and clear ownership of the mortgage. 5. Satisfaction of Mortgage Affidavit: Once a mortgage has been fully paid off, the mortgagee may file a Satisfaction of Mortgage Affidavit, attesting that the outstanding debt has been satisfied, and the mortgage lien on the property is released. Keywords: Loan Origination Affidavit, Foreclosure Affidavit, Refinancing Affidavit, Assignment Affidavit, Satisfaction of Mortgage Affidavit, mortgage default, loan application process, borrower, repayment, terms and conditions, financial information, foreclosure, evidence, missed payments, refinancing, creditworthiness, transfer of mortgage interests, validity, ownership, satisfaction of mortgage.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Declaración jurada del acreedor hipotecario - Florida Mortagee's Affidavit

Description

How to fill out Miami-Dade Florida Declaración Jurada Del Acreedor Hipotecario?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Miami-Dade Florida Mortagee's Affidavit gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Miami-Dade Florida Mortagee's Affidavit takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Miami-Dade Florida Mortagee's Affidavit. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!