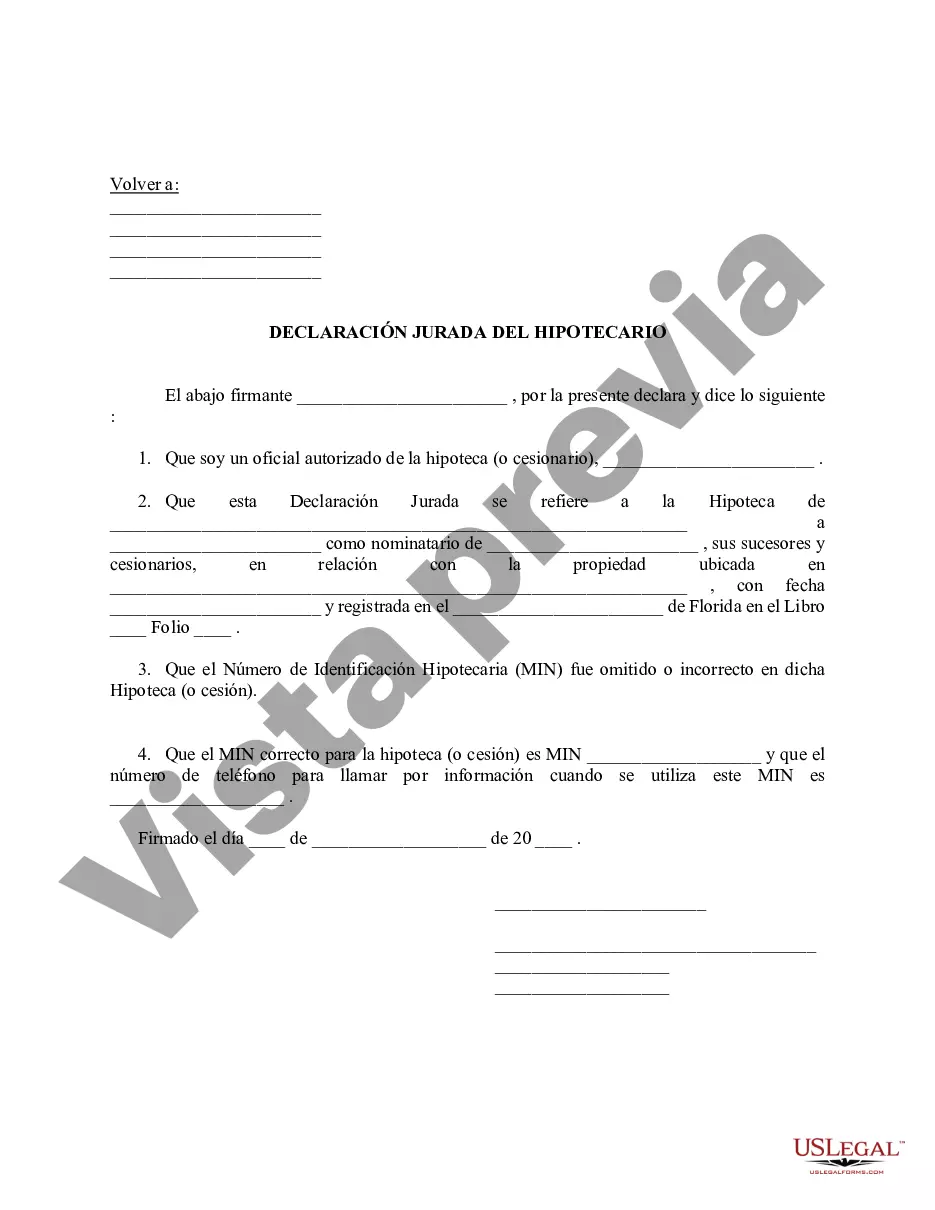

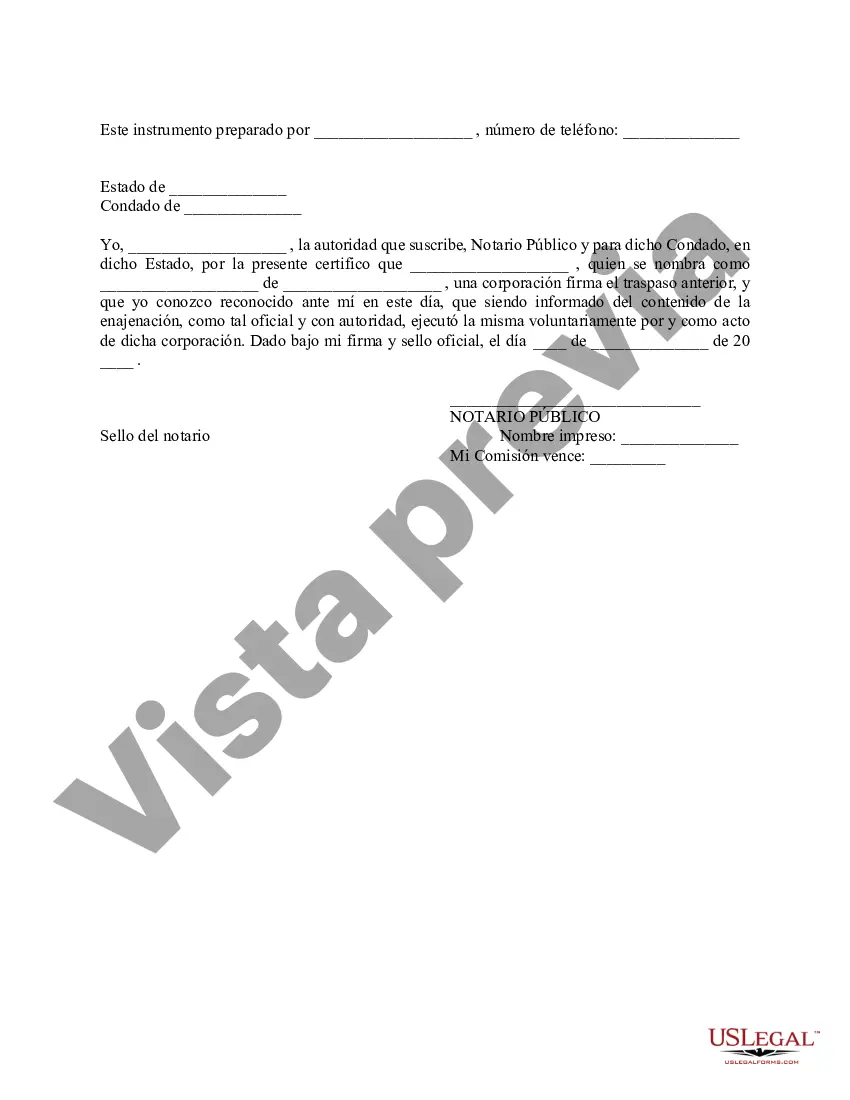

Miramar, Florida Mortgagee's Affidavit is a legal document commonly used in the state of Florida during mortgage transactions. This affidavit is typically provided by the mortgage lender or the mortgagee, and it acts as a sworn statement regarding certain aspects of the mortgage agreement. The purpose of this affidavit is to ensure that all necessary information and conditions are accurately disclosed to the borrower or mortgagor. The content of the Miramar, Florida Mortgagee's Affidavit may vary depending on the specific transaction and requirements. However, some general information typically included in this affidavit may encompass the following: 1. Identification: The affidavit will typically contain the names and contact information of the mortgagee, borrower, and any co-borrowers involved in the mortgage agreement. It may also include their relevant identification numbers such as social security numbers. 2. Property Information: This section will describe the property being mortgaged, including its legal description, address, and any other unique identifiers. It may also specify any use restrictions, if applicable. 3. Loan Details: The affidavit will outline the specifics of the mortgage loan, such as the principal amount, interest rate, term, and payment schedule. It may include details about any adjustable rate features or special provisions. 4. Affirmations: The affidavit may require the mortgagee to make various affirmations and declarations related to the mortgage agreement. This could include confirming that the mortgage is a legally binding agreement, that all provided information is accurate, and that the mortgagee has the authority to make such representations. 5. Liens and Encumbrances: The affidavit might require the mortgagee to disclose any known liens, encumbrances, or legal claims against the property. This ensures transparency and avoids potential issues for the borrower. 6. Certifications: The affidavit may contain certifications regarding the authenticity and accuracy of attached documents concerning the mortgage transaction. These attachments may include the mortgage note, security instruments, and any other supporting paperwork. 7. Notary and Signature: Once the content is completed, the mortgagee will typically sign the affidavit before a notary public, attesting to the truthfulness of the statements made within. Regarding different types of Miramar Florida Mortgagee's Affidavits, it's important to note that the specific names may vary from lender to lender or transaction to transaction. However, some common variations might include the Affidavit of Mortgagee, Mortgagee Affidavit of Title, Mortgagee Affidavit of Identity, or Affidavit of Mortgage Debt. In conclusion, the Miramar, Florida Mortgagee's Affidavit serves as a crucial document in mortgage transactions within the state. Its purpose is to provide a legally binding statement ensuring the accuracy and validity of the mortgage agreement and related information.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miramar Florida Declaración jurada del acreedor hipotecario - Florida Mortagee's Affidavit

Description

How to fill out Miramar Florida Declaración Jurada Del Acreedor Hipotecario?

Do you need a reliable and inexpensive legal forms supplier to get the Miramar Florida Mortagee's Affidavit? US Legal Forms is your go-to choice.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed in accordance with the requirements of separate state and county.

To download the form, you need to log in account, locate the required form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Miramar Florida Mortagee's Affidavit conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is good for.

- Restart the search if the form isn’t good for your legal situation.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Miramar Florida Mortagee's Affidavit in any provided format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal paperwork online once and for all.