- US Legal Forms

- Localized Forms

- Florida

- Hialeah

-

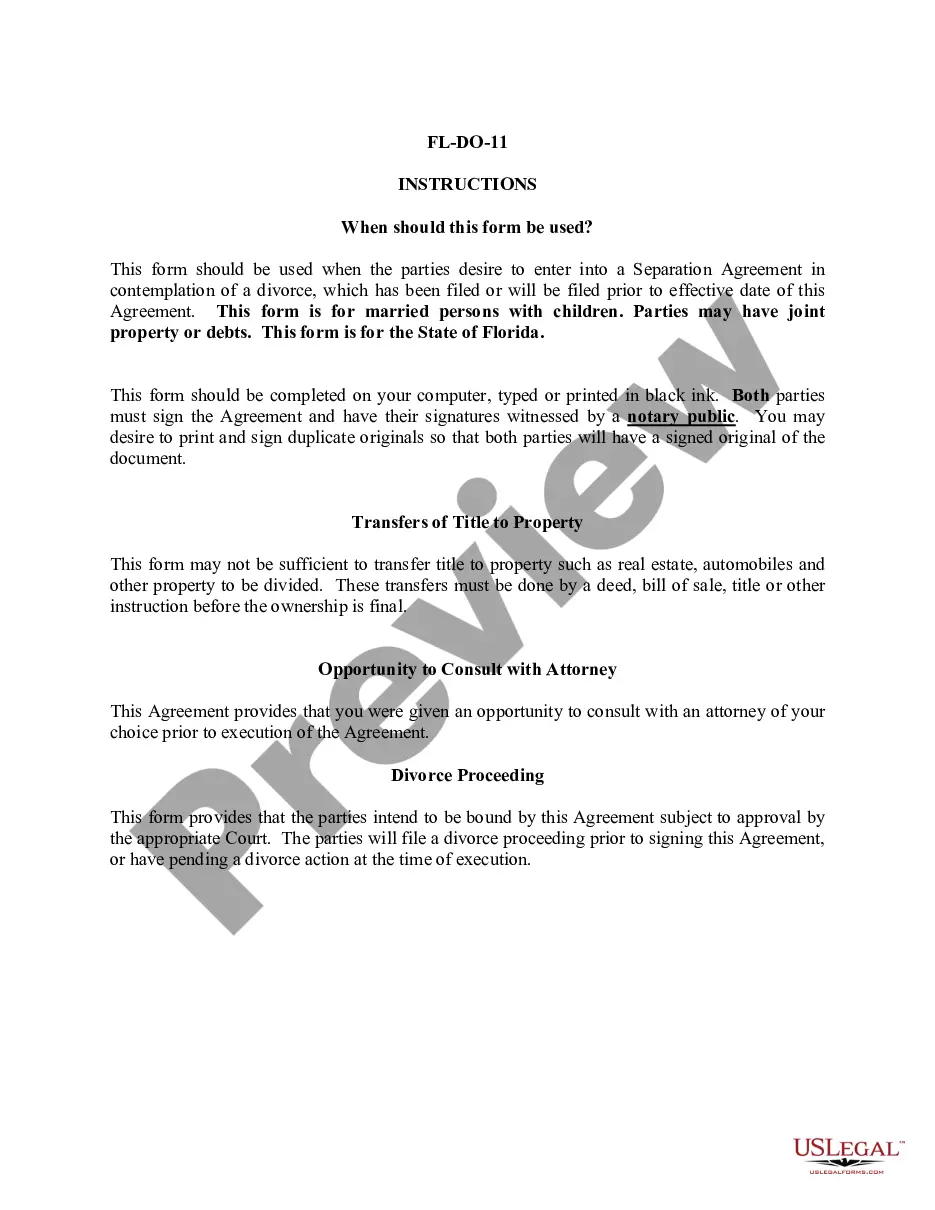

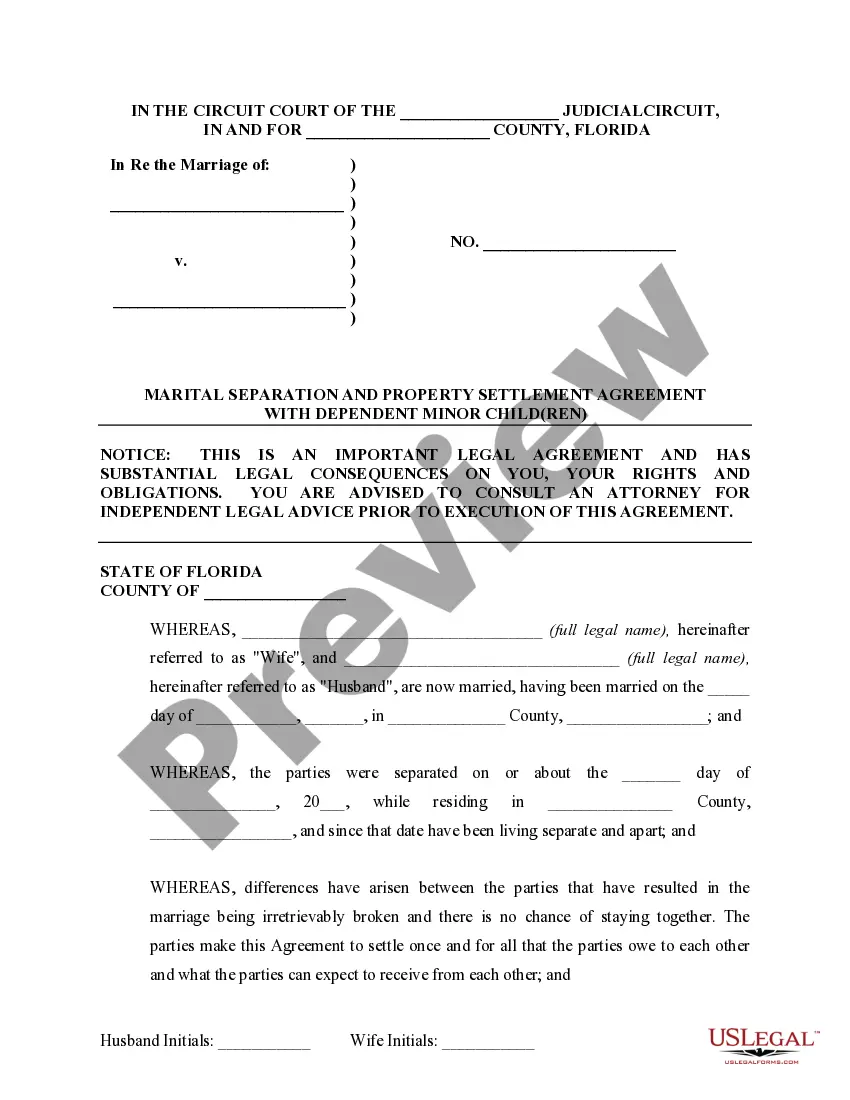

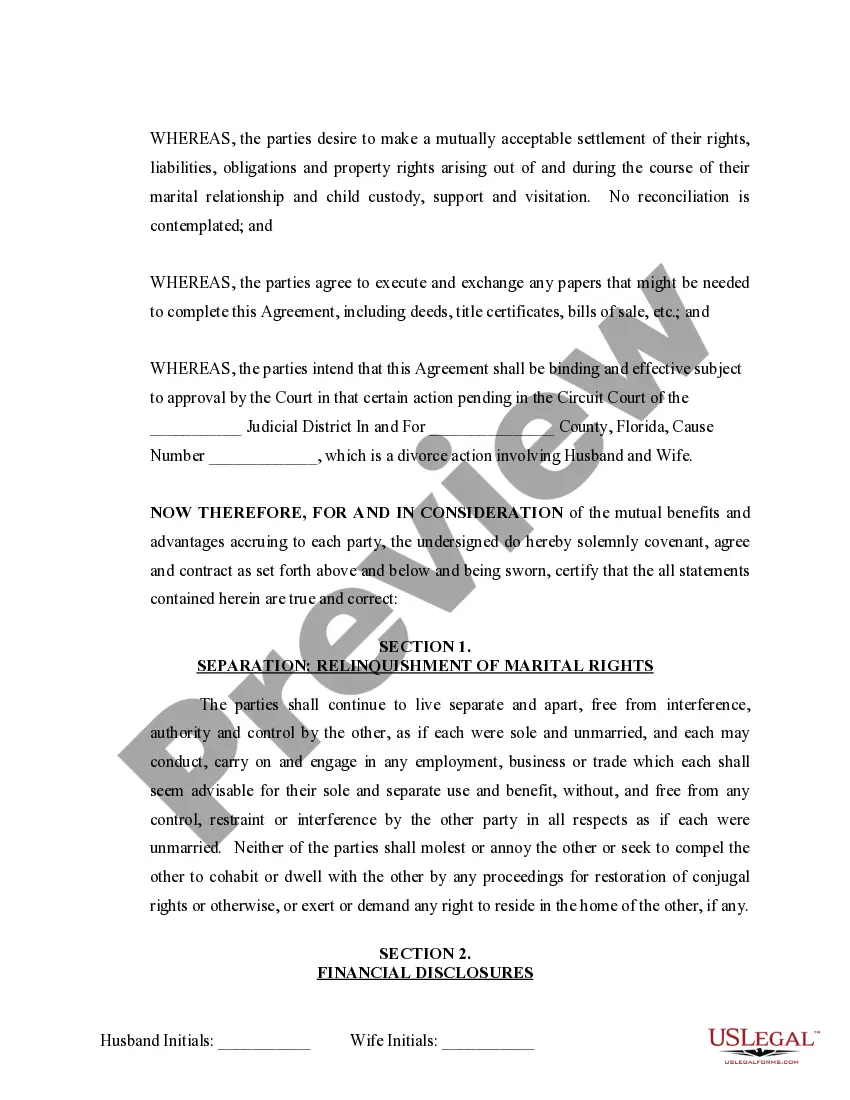

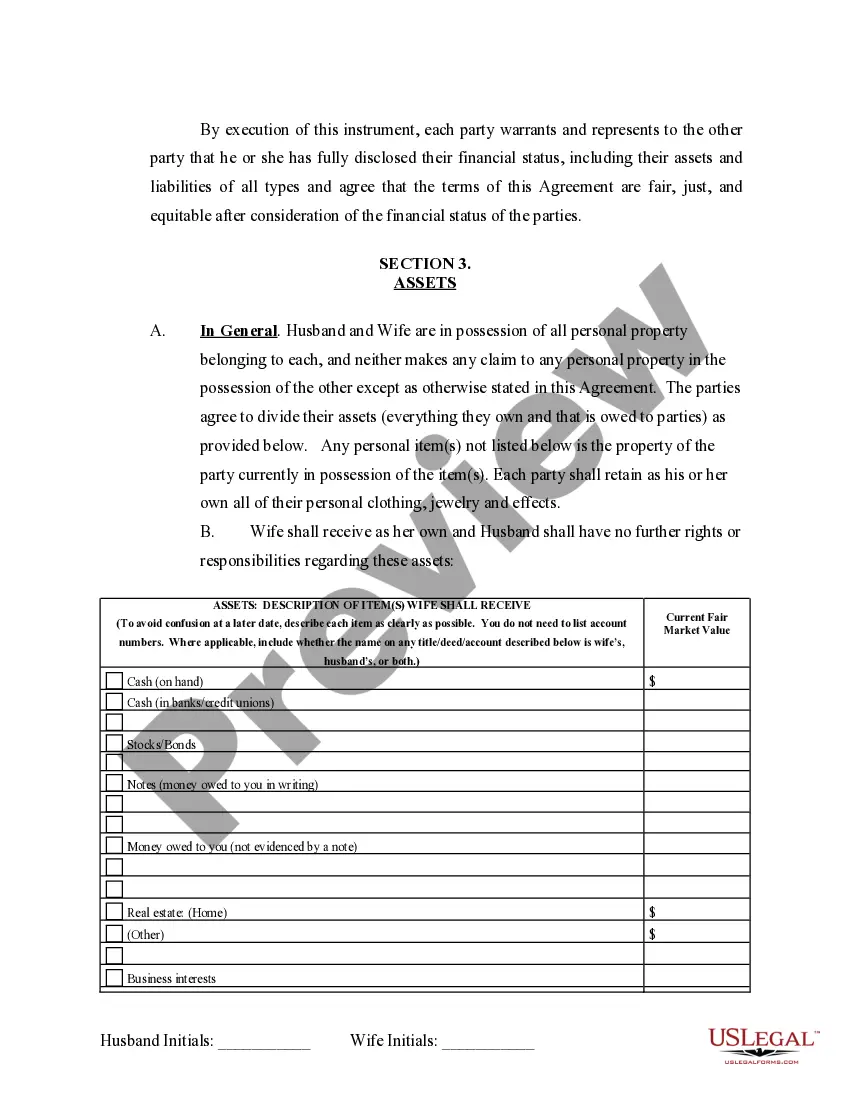

Florida Marital Legal Separation and Property Settlement Agreement...

Hialeah Florida Marital Legal Separation and Property Settlement Agreement Minor Children Parties May have Joint Property or Debts where Divorce Action Filed

Description

Related forms

Related legal definitions

Viewed forms

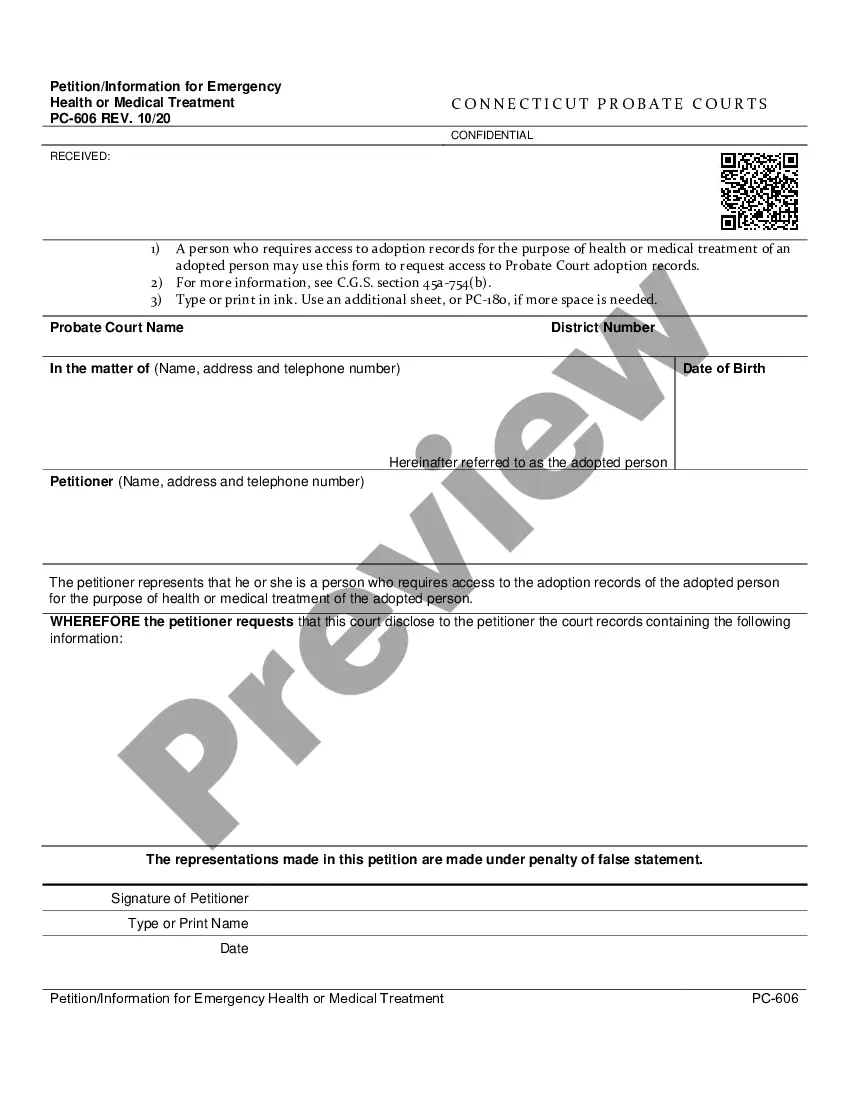

Petition/Information for Emergency Health or Medical Treatment (Rev. 10/99)

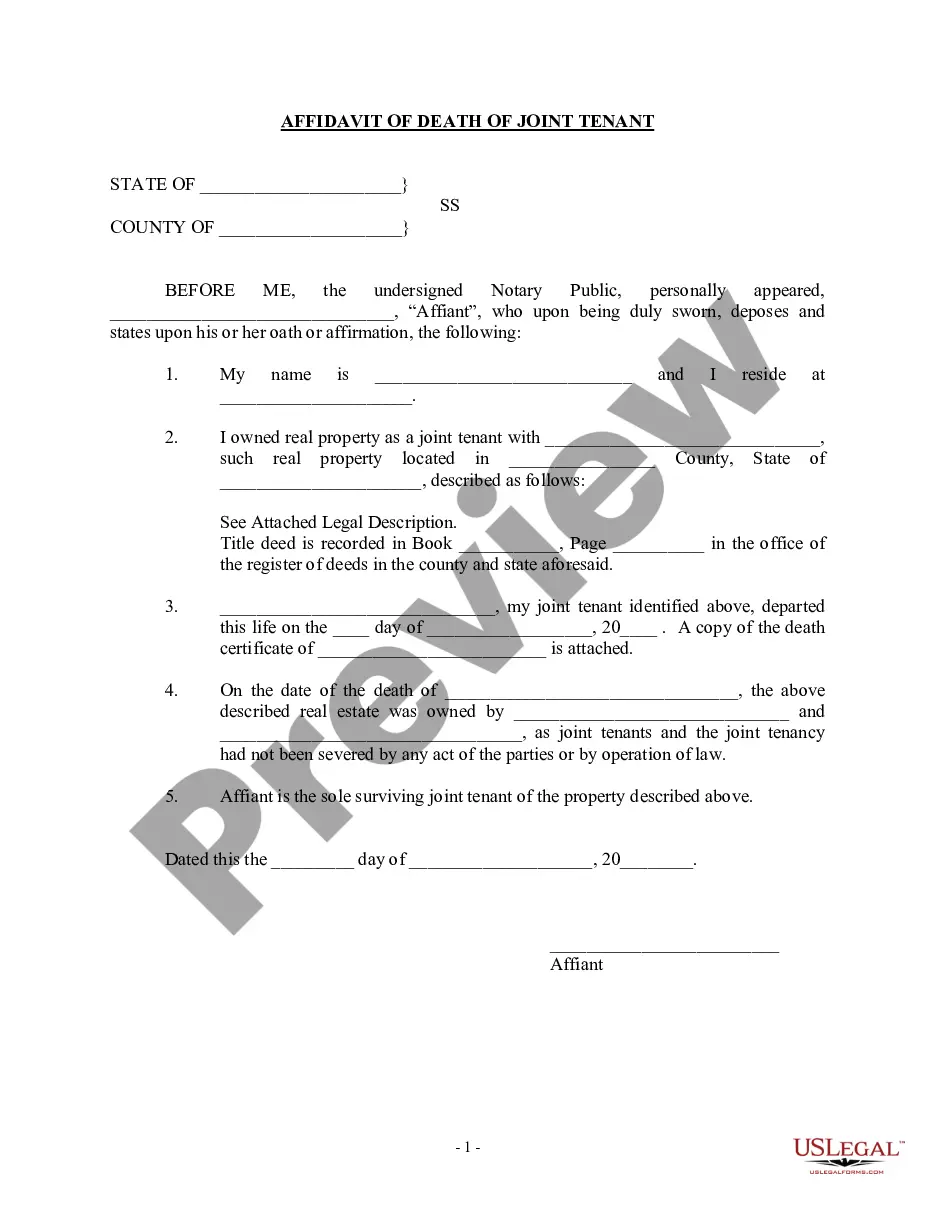

Affidavit of Death of Joint Tenant by Surviving Joint Tenant

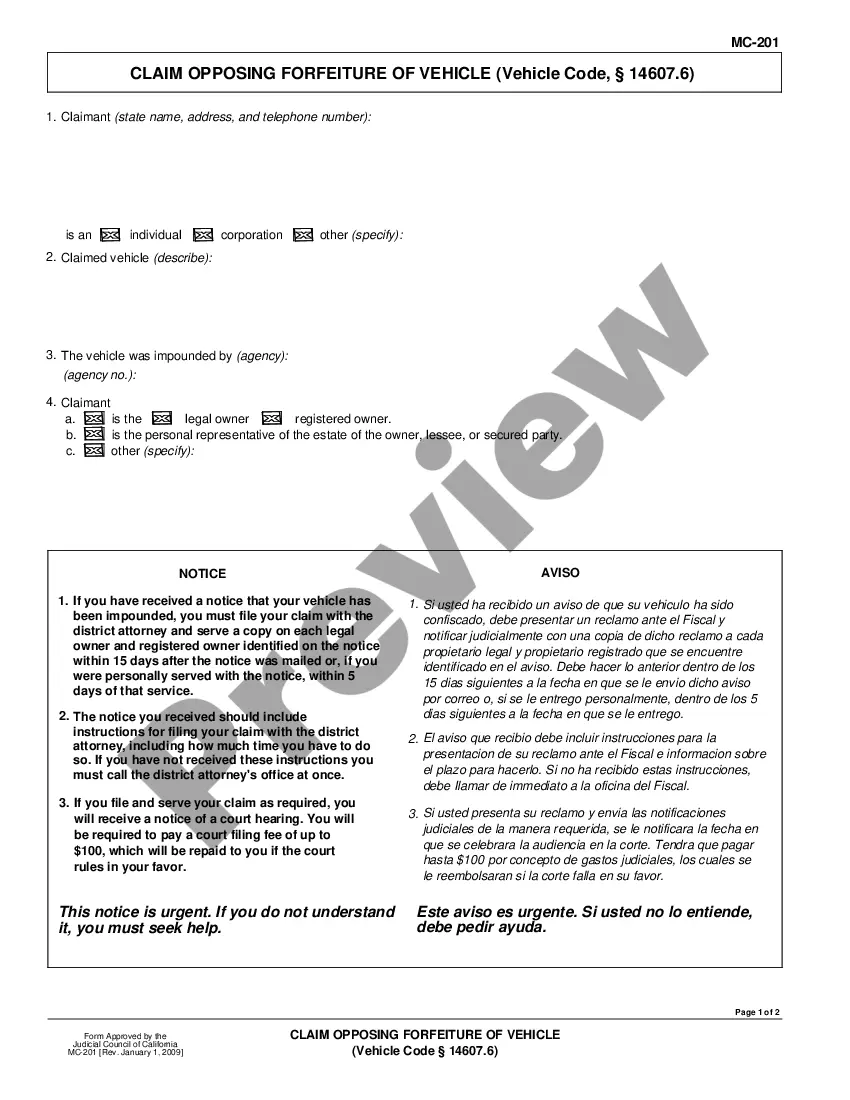

Claim Opposing Forfeiture of Vehicle

How to fill out Hialeah Florida Marital Legal Separation And Property Settlement Agreement Minor Children Parties May Have Joint Property Or Debts Where Divorce Action Filed?

No matter the social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person with no law education to create this sort of paperwork from scratch, mainly because of the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes in handy. Our service provides a huge library with more than 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you need the Hialeah Florida Marital Legal Separation and Property Settlement Agreement Minor Children Parties May have Joint Property or Debts where Divorce Action Filed or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Hialeah Florida Marital Legal Separation and Property Settlement Agreement Minor Children Parties May have Joint Property or Debts where Divorce Action Filed in minutes using our trustworthy service. In case you are presently an existing customer, you can proceed to log in to your account to download the needed form.

However, in case you are unfamiliar with our library, ensure that you follow these steps prior to obtaining the Hialeah Florida Marital Legal Separation and Property Settlement Agreement Minor Children Parties May have Joint Property or Debts where Divorce Action Filed:

- Be sure the template you have chosen is suitable for your area because the rules of one state or county do not work for another state or county.

- Preview the form and go through a brief outline (if available) of cases the document can be used for.

- In case the form you picked doesn’t meet your needs, you can start again and search for the suitable document.

- Click Buy now and pick the subscription plan you prefer the best.

- with your credentials or create one from scratch.

- Pick the payment method and proceed to download the Hialeah Florida Marital Legal Separation and Property Settlement Agreement Minor Children Parties May have Joint Property or Debts where Divorce Action Filed once the payment is done.

You’re all set! Now you can proceed to print out the form or complete it online. If you have any issues locating your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.

Form Rating

Form popularity

FAQ

It is a legally-binding contract and both partners must adhere to the conditions within it. However, a separation agreement may be invalidated if it can be proven that it was not created fairly. Typically, this occurs if one partner knowingly tricks or threatens the other in order to gain an unfair advantage.

This can be due to changing circumstances as the divorce approaches; or alternatively, one or both parties may not be following the terms of the negotiated agreement to the letter. In such situations, the separation agreement can be amended in one of several ways.

In Florida, property is divided 50-50 if it is considered ?marital property? ? or property that was acquired by either spouse during the marriage. Non-marital property, which is property either spouse acquired before the marriage, is not divided equally.

See Florida divorce law 61.075. Usually, the court will divide marital assets and liabilities 50/50 unless there are factors that would make an equal split inequitable. Usually, the first step is to determine if the asset or debt is marital or separate property.

Coercion, fraud, undue influence or lack of knowledge will void the terms of a separation agreement. A separation agreement is not proof of the parties' separation. It is not required for a divorce in North Carolina, and it doesn't make a divorce in North Carolina easier or more difficult to obtain.

Length of Marriage and Alimony In Florida, a short marriage is one that lasts less than seven years. If one spouse wants to pursue alimony, they generally should have been married for at least seven years.

A Separation and Property Division Agreement (also known as a settlement agreement) is a written agreement setting out how a couple's property is to be divided following their separation.

No, Florida is one of a handful of states that doesn't offer legal separation as a formal legal process. Within the state, spouses can live separate and apart from each other without the need for a court order, which can be beneficial if you wish to avoid divorce for religious, social, or financial reasons.

The separation agreement can be considered null and void if it is found that the party failed to disclose any important information about the assets. The court can also give stay orders on the separation agreement if it is found that the agreement is being enforced on one of the parties.

The duration of your marriage may impact the type and amount of alimony awarded to either you or your spouse during a divorce. Alimony for short-term marriages is rarely awarded by the court, especially if the party seeking alimony is employable.

It is a legally-binding contract and both partners must adhere to the conditions within it. However, a separation agreement may be invalidated if it can be proven that it was not created fairly. Typically, this occurs if one partner knowingly tricks or threatens the other in order to gain an unfair advantage.

This can be due to changing circumstances as the divorce approaches; or alternatively, one or both parties may not be following the terms of the negotiated agreement to the letter. In such situations, the separation agreement can be amended in one of several ways.

In Florida, property is divided 50-50 if it is considered ?marital property? ? or property that was acquired by either spouse during the marriage. Non-marital property, which is property either spouse acquired before the marriage, is not divided equally.

See Florida divorce law 61.075. Usually, the court will divide marital assets and liabilities 50/50 unless there are factors that would make an equal split inequitable. Usually, the first step is to determine if the asset or debt is marital or separate property.

Coercion, fraud, undue influence or lack of knowledge will void the terms of a separation agreement. A separation agreement is not proof of the parties' separation. It is not required for a divorce in North Carolina, and it doesn't make a divorce in North Carolina easier or more difficult to obtain.

Length of Marriage and Alimony In Florida, a short marriage is one that lasts less than seven years. If one spouse wants to pursue alimony, they generally should have been married for at least seven years.

A Separation and Property Division Agreement (also known as a settlement agreement) is a written agreement setting out how a couple's property is to be divided following their separation.

No, Florida is one of a handful of states that doesn't offer legal separation as a formal legal process. Within the state, spouses can live separate and apart from each other without the need for a court order, which can be beneficial if you wish to avoid divorce for religious, social, or financial reasons.

The separation agreement can be considered null and void if it is found that the party failed to disclose any important information about the assets. The court can also give stay orders on the separation agreement if it is found that the agreement is being enforced on one of the parties.

The duration of your marriage may impact the type and amount of alimony awarded to either you or your spouse during a divorce. Alimony for short-term marriages is rarely awarded by the court, especially if the party seeking alimony is employable.

It is a legally-binding contract and both partners must adhere to the conditions within it. However, a separation agreement may be invalidated if it can be proven that it was not created fairly. Typically, this occurs if one partner knowingly tricks or threatens the other in order to gain an unfair advantage.

This can be due to changing circumstances as the divorce approaches; or alternatively, one or both parties may not be following the terms of the negotiated agreement to the letter. In such situations, the separation agreement can be amended in one of several ways.

In Florida, property is divided 50-50 if it is considered ?marital property? ? or property that was acquired by either spouse during the marriage. Non-marital property, which is property either spouse acquired before the marriage, is not divided equally.

See Florida divorce law 61.075. Usually, the court will divide marital assets and liabilities 50/50 unless there are factors that would make an equal split inequitable. Usually, the first step is to determine if the asset or debt is marital or separate property.

Coercion, fraud, undue influence or lack of knowledge will void the terms of a separation agreement. A separation agreement is not proof of the parties' separation. It is not required for a divorce in North Carolina, and it doesn't make a divorce in North Carolina easier or more difficult to obtain.

Length of Marriage and Alimony In Florida, a short marriage is one that lasts less than seven years. If one spouse wants to pursue alimony, they generally should have been married for at least seven years.

A Separation and Property Division Agreement (also known as a settlement agreement) is a written agreement setting out how a couple's property is to be divided following their separation.

No, Florida is one of a handful of states that doesn't offer legal separation as a formal legal process. Within the state, spouses can live separate and apart from each other without the need for a court order, which can be beneficial if you wish to avoid divorce for religious, social, or financial reasons.

The separation agreement can be considered null and void if it is found that the party failed to disclose any important information about the assets. The court can also give stay orders on the separation agreement if it is found that the agreement is being enforced on one of the parties.

The duration of your marriage may impact the type and amount of alimony awarded to either you or your spouse during a divorce. Alimony for short-term marriages is rarely awarded by the court, especially if the party seeking alimony is employable.

It is a legally-binding contract and both partners must adhere to the conditions within it. However, a separation agreement may be invalidated if it can be proven that it was not created fairly. Typically, this occurs if one partner knowingly tricks or threatens the other in order to gain an unfair advantage.

This can be due to changing circumstances as the divorce approaches; or alternatively, one or both parties may not be following the terms of the negotiated agreement to the letter. In such situations, the separation agreement can be amended in one of several ways.

In Florida, property is divided 50-50 if it is considered ?marital property? ? or property that was acquired by either spouse during the marriage. Non-marital property, which is property either spouse acquired before the marriage, is not divided equally.

See Florida divorce law 61.075. Usually, the court will divide marital assets and liabilities 50/50 unless there are factors that would make an equal split inequitable. Usually, the first step is to determine if the asset or debt is marital or separate property.

Coercion, fraud, undue influence or lack of knowledge will void the terms of a separation agreement. A separation agreement is not proof of the parties' separation. It is not required for a divorce in North Carolina, and it doesn't make a divorce in North Carolina easier or more difficult to obtain.

Length of Marriage and Alimony In Florida, a short marriage is one that lasts less than seven years. If one spouse wants to pursue alimony, they generally should have been married for at least seven years.

A Separation and Property Division Agreement (also known as a settlement agreement) is a written agreement setting out how a couple's property is to be divided following their separation.

No, Florida is one of a handful of states that doesn't offer legal separation as a formal legal process. Within the state, spouses can live separate and apart from each other without the need for a court order, which can be beneficial if you wish to avoid divorce for religious, social, or financial reasons.

The separation agreement can be considered null and void if it is found that the party failed to disclose any important information about the assets. The court can also give stay orders on the separation agreement if it is found that the agreement is being enforced on one of the parties.

The duration of your marriage may impact the type and amount of alimony awarded to either you or your spouse during a divorce. Alimony for short-term marriages is rarely awarded by the court, especially if the party seeking alimony is employable.

It is a legally-binding contract and both partners must adhere to the conditions within it. However, a separation agreement may be invalidated if it can be proven that it was not created fairly. Typically, this occurs if one partner knowingly tricks or threatens the other in order to gain an unfair advantage.

This can be due to changing circumstances as the divorce approaches; or alternatively, one or both parties may not be following the terms of the negotiated agreement to the letter. In such situations, the separation agreement can be amended in one of several ways.

In Florida, property is divided 50-50 if it is considered ?marital property? ? or property that was acquired by either spouse during the marriage. Non-marital property, which is property either spouse acquired before the marriage, is not divided equally.

See Florida divorce law 61.075. Usually, the court will divide marital assets and liabilities 50/50 unless there are factors that would make an equal split inequitable. Usually, the first step is to determine if the asset or debt is marital or separate property.

Coercion, fraud, undue influence or lack of knowledge will void the terms of a separation agreement. A separation agreement is not proof of the parties' separation. It is not required for a divorce in North Carolina, and it doesn't make a divorce in North Carolina easier or more difficult to obtain.

Length of Marriage and Alimony In Florida, a short marriage is one that lasts less than seven years. If one spouse wants to pursue alimony, they generally should have been married for at least seven years.

A Separation and Property Division Agreement (also known as a settlement agreement) is a written agreement setting out how a couple's property is to be divided following their separation.

No, Florida is one of a handful of states that doesn't offer legal separation as a formal legal process. Within the state, spouses can live separate and apart from each other without the need for a court order, which can be beneficial if you wish to avoid divorce for religious, social, or financial reasons.

The separation agreement can be considered null and void if it is found that the party failed to disclose any important information about the assets. The court can also give stay orders on the separation agreement if it is found that the agreement is being enforced on one of the parties.

The duration of your marriage may impact the type and amount of alimony awarded to either you or your spouse during a divorce. Alimony for short-term marriages is rarely awarded by the court, especially if the party seeking alimony is employable.

Hialeah Florida Marital Legal Separation and Property Settlement Agreement Minor Children Parties May have Joint Property or Debts where Divorce Action Filed Related Searches

-

not legally separated but living apart

-

stipulated judgment california divorce sample

-

legally separated in florida taxes

-

legal separation in florida vs divorce

-

spouse won't sign separation agreement nc

-

legal separation in florida rules

-

nc divorce laws 2021

-

nc separation agreement statute

-

marital settlement agreement for simplified dissolution of marriage

-

california marital settlement agreement requirements

Interesting Questions

A marital legal separation in Hialeah is a legal status that allows couples to live separately while still remaining legally married.

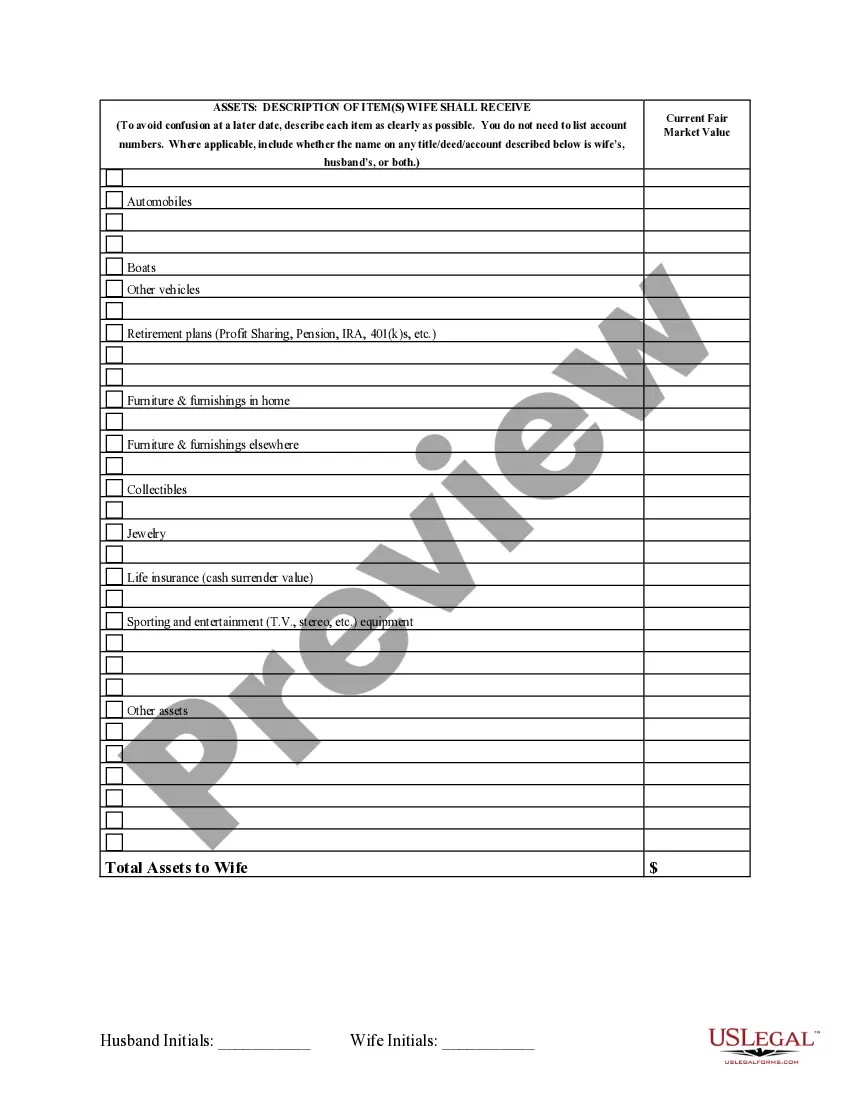

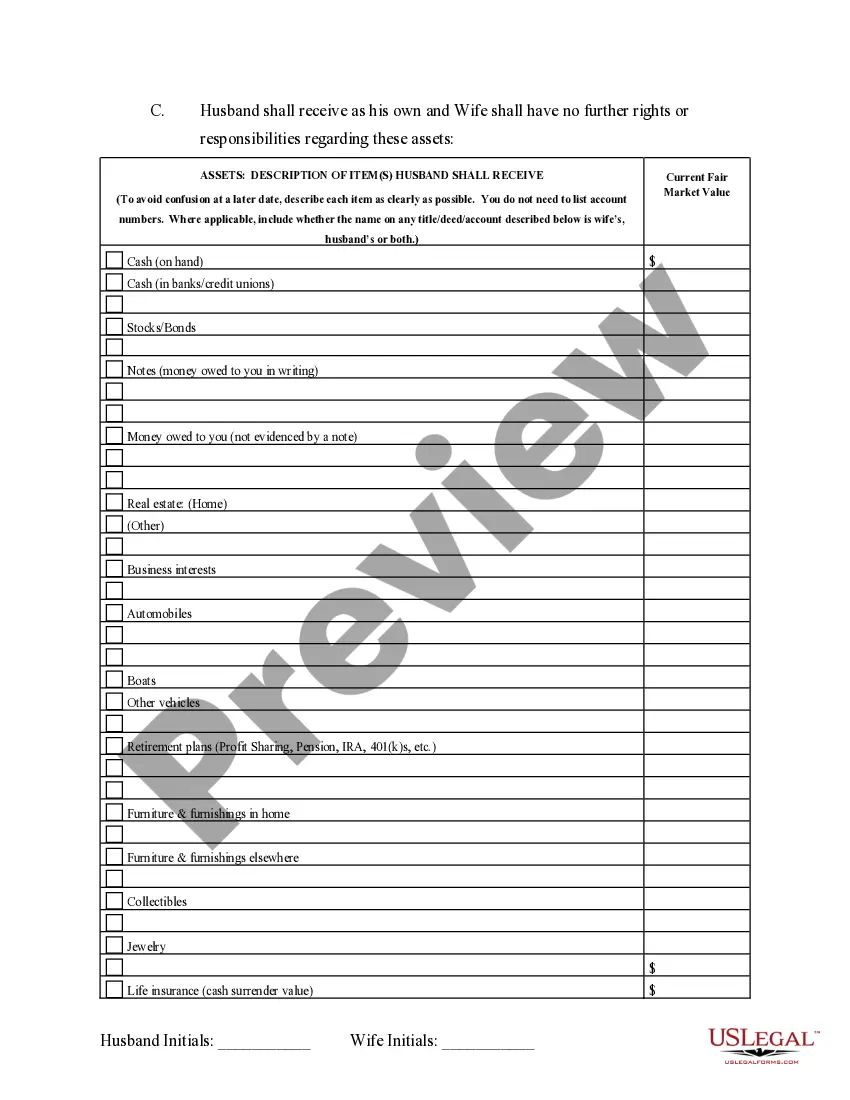

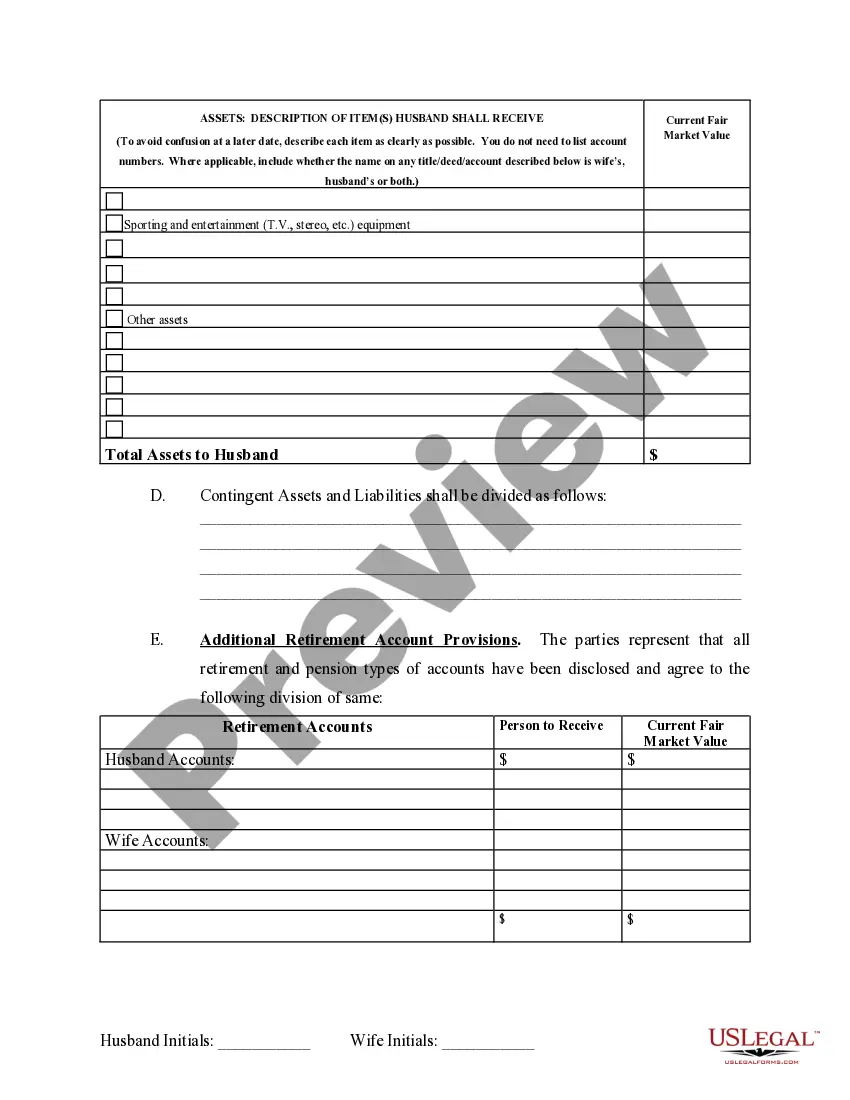

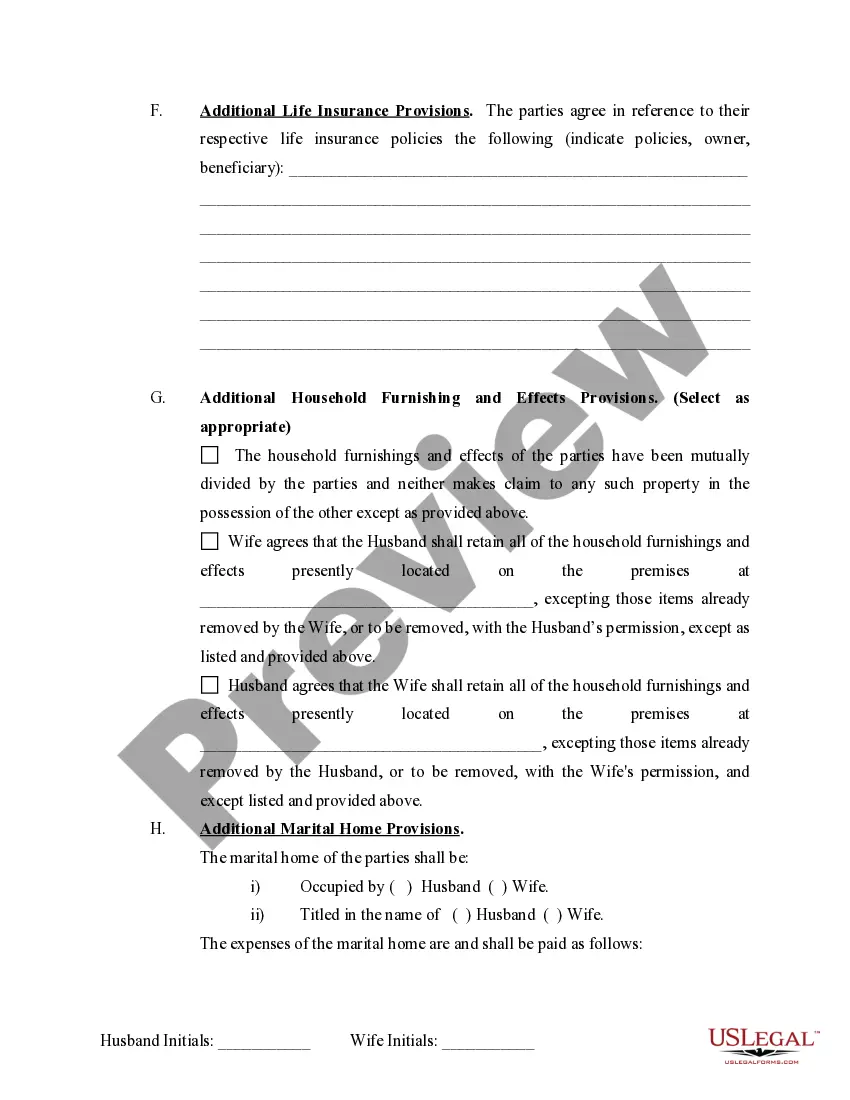

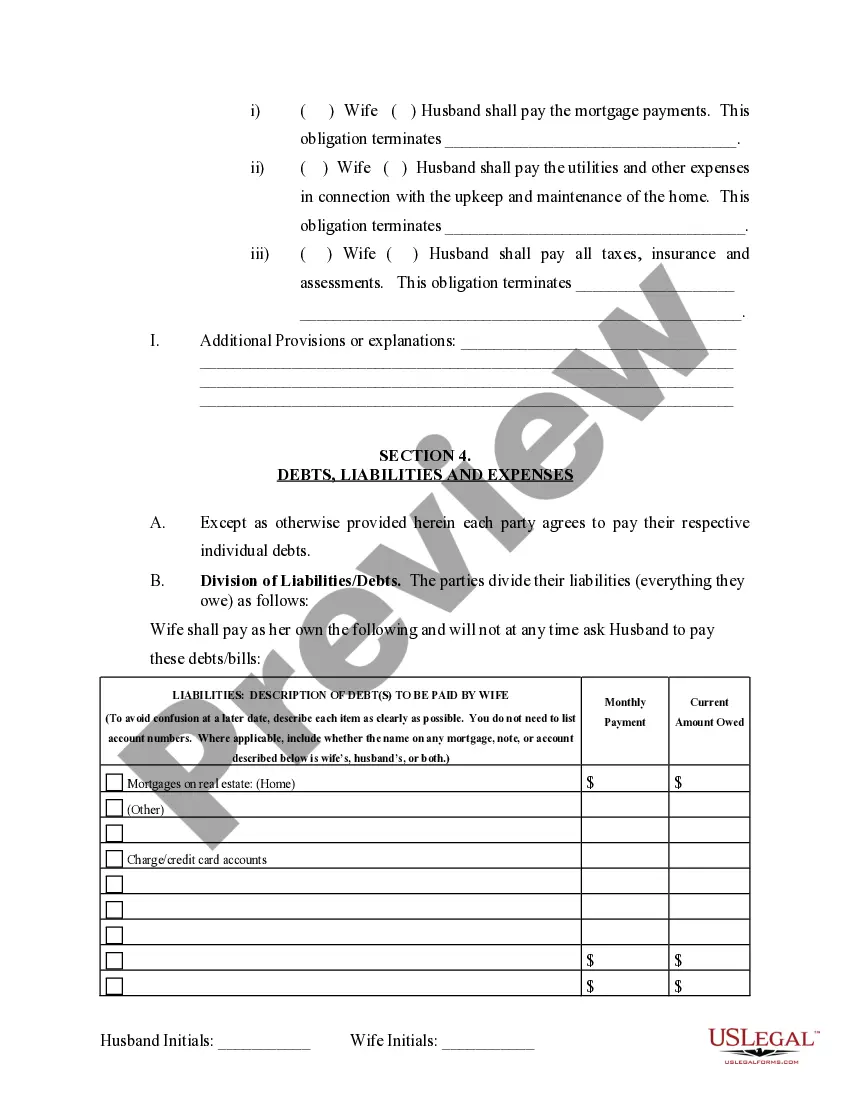

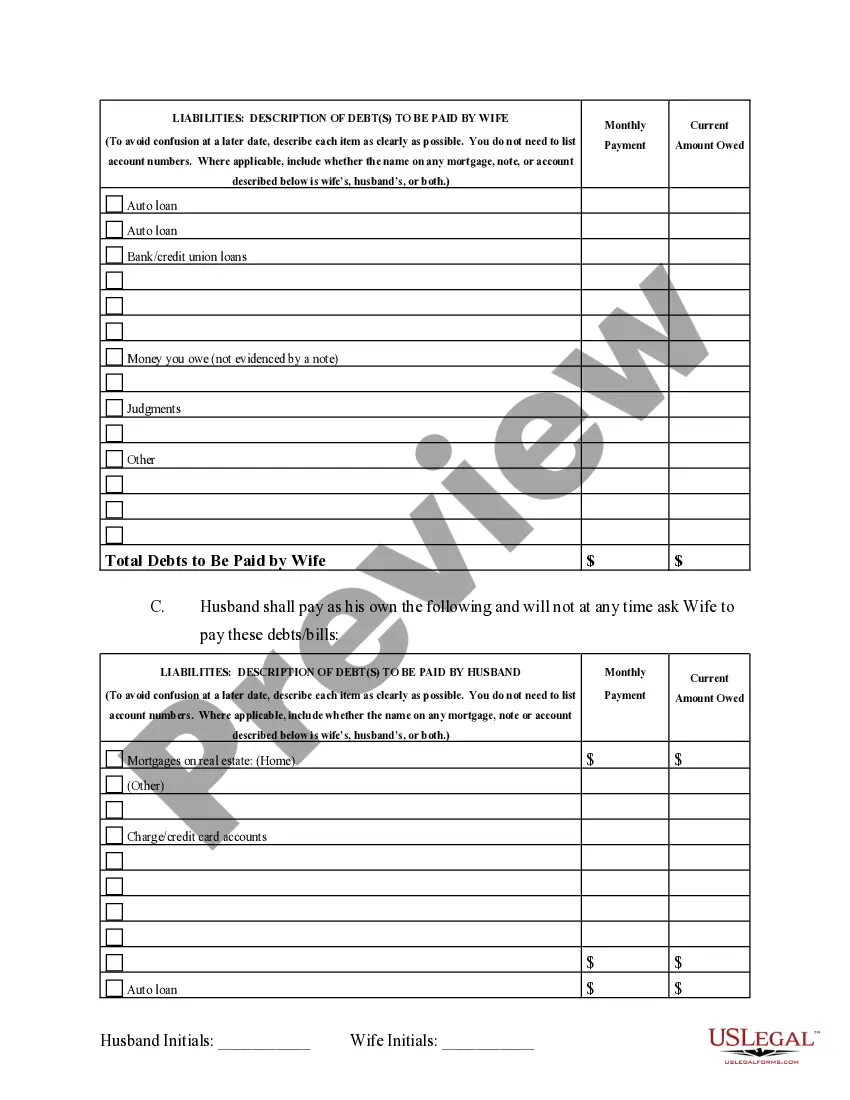

A property settlement agreement is a legally binding document that outlines how a couple's assets and debts will be divided during a divorce or legal separation.

In a legal separation with minor children, joint property and debts are typically divided or managed according to the terms agreed upon in the property settlement agreement. It is important to consult with a lawyer to understand your specific situation.

When dividing joint property and debts in a legal separation, factors such as each party's financial contributions, the length of the marriage, and the needs of the children may be taken into consideration.

Ideally, both parties should agree on the terms of the property settlement agreement. However, if an agreement cannot be reached, the court may need to intervene and make decisions regarding the division of property and debts.

If there is a disagreement over child custody in a legal separation with minor children, it is essential to seek legal guidance. The court will ultimately make decisions based on the best interests of the children.

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Florida

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Dakota

-

Tennessee

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

General Summary: Separation and Property Agreements may be entered into before a divorce is filed to be effective when signed, or may ne entered into after the divorce is filed.

In divorce property division, Florida follows the theory of equitable distribution. In the absence of an agreement, the court will make an "equitable" distribution of the property and assets of the marriage based on the circustances of the parties. A Separation and Property Agreement that is fair, equitable and grounded in full disclosure by the parties will be enforced by the court.

Statutes:

Florida Statutes

Title VI Civil Practice and Procedure

Chapter 61 Dissolution Of Marriage; Support; Custody

Equitable distribution of marital assets and liabilities:

(1) In a proceeding for dissolution of marriage, in addition to all other remedies available to a court to do equity between the parties, or in a proceeding for disposition of assets following a dissolution of marriage by a court which lacked jurisdiction over the absent spouse or lacked jurisdiction to dispose of the assets, the court shall set apart to each spouse that spouse's nonmarital assets and liabilities, and in distributing the marital assets and liabilities between the parties, the court must begin with the premise that the distribution should be equal, unless there is a justification for an unequal distribution based on all relevant factors, including:

(a) The contribution to the marriage by each spouse,

including contributions to the care and education of the children and services

as homemaker.

(b) The economic circumstances of the parties.

(c) The duration of the marriage.

(d) Any interruption of personal careers or educational opportunities

of either party.

(e) The contribution of one spouse to the personal career

or educational opportunity of the other spouse.

(f) The desirability of retaining any asset, including an

interest in a business, corporation, or professional practice, intact and

free from any claim or interference by the other party.

(g) The contribution of each spouse to the acquisition, enhancement,

and production of income or the improvement of, or the incurring of liabilities

to, both the marital assets and the nonmarital assets of the parties.

(h) The desirability of retaining the marital home as a residence

for any dependent child of the marriage, or any other party, when it would

be equitable to do so, it is in the best interest of the child or that

party, and it is financially feasible for the parties to maintain the residence

until the child is emancipated or until exclusive possession is otherwise

terminated by a court of competent jurisdiction. In making this determination,

the court shall first determine if it would be in the best interest of

the dependent child to remain in the marital home; and, if not, whether

other equities would be served by giving any other party exclusive use

and possession of the marital home.

(i) The intentional dissipation, waste, depletion, or destruction

of marital assets after the filing of the petition or within 2 years prior

to the filing of the petition.

(j) Any other factors necessary to do equity and justice

between the parties.

(2) If the court awards a cash payment for the purpose of equitable distribution of marital assets, to be paid in full or in installments, the full amount ordered shall vest when the judgment is awarded and the award shall not terminate upon remarriage or death of either party, unless otherwise agreed to by the parties, but shall be treated as a debt owed from the obligor or the obligor's estate to the obligee or the obligee's estate, unless otherwise agreed to by the parties.

(3) In any contested dissolution action wherein a stipulation and agreement has not been entered and filed, any distribution of marital assets or marital liabilities shall be supported by factual findings in the judgment or order based on competent substantial evidence with reference to the factors enumerated in subsection (1). The distribution of all marital assets and marital liabilities, whether equal or unequal, shall include specific written findings of fact as to the following:

(a) Clear identification of nonmarital assets and

ownership interests;

(b) Identification of marital assets, including the individual

valuation of significant assets, and designation of which spouse shall

be entitled to each asset;

(c) Identification of the marital liabilities and designation

of which spouse shall be responsible for each liability;

(d) Any other findings necessary to advise the parties or

the reviewing court of the trial court's rationale for the distribution

of marital assets and allocation of liabilities.

(4) The judgment distributing assets shall have the effect of a duly executed instrument of conveyance, transfer, release, or acquisition which is recorded in the county where the property is located when the judgment, or a certified copy of the judgment, is recorded in the official records of the county in which the property is located.

(5) As used in this section:

(a) "Marital assets and liabilities" include:

1. Assets acquired and liabilities incurred during

the marriage, individually by either spouse or jointly by them;

2. The enhancement in value and appreciation of nonmarital

assets resulting either from the efforts of either party during the marriage

or from the contribution to or expenditure thereon of marital funds or

other forms of marital assets, or both;

3. Interspousal gifts during the marriage;

4. All vested and nonvested benefits, rights, and funds accrued

during the marriage in retirement, pension, profit-sharing, annuity, deferred

compensation, and insurance plans and programs; and

5. All real property held by the parties as tenants by the

entireties, whether acquired prior to or during the marriage, shall

be presumed to be a marital asset. If, in any case, a party makes a claim

to the contrary, the burden of proof shall be on the party asserting the

claim for a special equity.

(b) "Nonmarital assets and liabilities" include:

1. Assets acquired and liabilities incurred by either

party prior to the marriage, and assets acquired and liabilities incurred

in exchange for such assets and liabilities;

2. Assets acquired separately by either party by noninterspousal

gift, bequest, devise, or descent, and assets acquired in exchange for

such assets;

3. All income derived from nonmarital assets during the marriage

unless the income was treated, used, or relied upon by the parties as a

marital asset; and

4. Assets and liabilities excluded from marital assets and

liabilities by valid written agreement of the parties, and assets acquired

and liabilities incurred in exchange for such assets and liabilities.

(6) The cut-off date for determining assets and liabilities to be identified or classified as marital assets and liabilities is the earliest of the date the parties enter into a valid separation agreement, such other date as may be expressly established by such agreement, or the date of the filing of a petition for dissolution of marriage. The date for determining value of assets and the amount of liabilities identified or classified as marital is the date or dates as the judge determines is just and equitable under the circumstances. Different assets may be valued as of different dates, as, in the judge's discretion, the circumstances require.

(7) All assets acquired and liabilities incurred by either spouse subsequent to the date of the marriage and not specifically established as nonmarital assets or liabilities are presumed to be marital assets and liabilities. Such presumption is overcome by a showing that the assets and liabilities are nonmarital assets and liabilities. The presumption is only for evidentiary purposes in the dissolution proceeding and does not vest title. Title to disputed assets shall vest only by the judgment of a court. This section does not require the joinder of spouses in the conveyance, transfer, or hypothecation of a spouse's individual property; affect the laws of descent and distribution; or establish community property in this state.

(8) The court may provide for equitable distribution of the marital assets and liabilities without regard to alimony for either party. After the determination of an equitable distribution of the marital assets and liabilities, the court shall consider whether a judgment for alimony shall be made.

(9) To do equity between the parties, the court may, in lieu of or to supplement, facilitate, or effectuate the equitable division of marital assets and liabilities, order a monetary payment in a lump sum or in installments paid over a fixed period of time. Section 61.075.

Case Law:

It is well settled that "[a] pure property settlement agreement is not subject to modification by the trial court without the consent of the parties." Kirchen v. Kirchen, 484 So.2d 1308, 1311 (Fla. 2d DCA 1986). However, a property settlement agreement which also makes provision for periodic alimony is separable and modifiable insofar as the support portion of the agreement is concerned. Jantzen v. Cotner, 513 So.2d 683 (Fla. 3d DCA 1987).

The nature of the agreement must be determined by an examination of the language of the agreement, the surrounding circumstances, and the parties' apparent purpose when they entered into the agreement. Underwood v. Underwood, 64 So.2d 281, 288 (Fla.1953). The test for determining when periodic payments constitute support or a methodology for division of property, seems to be whether the payor spouse's payments are given in exchange for a reciprocal exchange of property interests from the recipient spouse. In other words, the question is whether the recipient spouse bought and paid for the payments and is therefore entitled to receive them as written as a matter of contract. See Salomon v. Salomon, 196 So.2d 111 (Fla. 1967).

A party seeking modification of a property settlement agreement

must satisfy the heavy burden of showing that the settlement is the product

of fraud, duress, misrepresentation, or overreaching, or that the

settlement is unfair or unreasonable.

Work v. Provine, 632 So.2d 1119, 1121 (Fla. 1st DCA 1994).

Property settlement agreements are not subject to modification when the agreements are incorporated into final judgments of dissolution of marriage, Karch v. Karch, 445 So.2d 1077 (Fla. 3d DCA 1984).

A true property settlement agreement, in which one party gives up valuable property rights in exchange for the right to receive periodic payments, is not subject to modification. Hughes v. Hughes, 553 So.2d 197 (Fla. 2d DCA 1989).

Generally speaking, in the absence of a specific reservation of jurisdiction to make a later adjudication of property rights, a lower court does not have jurisdiction to modify property rights after an adjudication of those rights has been made in a judgment of dissolution. Harman v. Harman, 523 So.2d 187 (Fla. 2d DCA 1988). Modification of a property settlement incorporated into a final judgment of dissolution may only be had if the party seeking modification can satisfy the exceptionally heavy burden of showing that the settlement is the product of fraud, duress, deceit, misrepresentation, or overreaching, or that the settlement is unfair or unreasonable. McMahan v. McMahan, 567 So.2d 976 (Fla. 1st DCA 1990).

Even if a specific reservation of jurisdiction is made, it has been held that such only affords a court authority to address property rights not previously settled by the final judgment. Brandt v. Brandt, 525 So.2d 1017 (Fla.4th DCA 1988).

Where the agreement contains a provision by which each of the parties have explicitly waived the right to seek modification of the alimony payments. Such a provision removes any basis for the court to ignore their valid and binding contract. Hughes v. Hughes, 553 So.2d 197 (Fla. 2d DCA 1989).

Unless both spouses have separate counsel at the time of preparation and execution of the agreement, the marital relationship remains in a non-adversarial stance, and each party has fiduciary-like responsibility to the other. Fleming v. Fleming, 474 So.2d 1247,1249 (Fla. 4th DCA 1985); Baker v. Baker, 394 So.2d at 468.

General Summary: Separation and Property Agreements may be entered into before a divorce is filed to be effective when signed, or may ne entered into after the divorce is filed.

In divorce property division, Florida follows the theory of equitable distribution. In the absence of an agreement, the court will make an "equitable" distribution of the property and assets of the marriage based on the circustances of the parties. A Separation and Property Agreement that is fair, equitable and grounded in full disclosure by the parties will be enforced by the court.

Statutes:

Florida Statutes

Title VI Civil Practice and Procedure

Chapter 61 Dissolution Of Marriage; Support; Custody

Equitable distribution of marital assets and liabilities:

(1) In a proceeding for dissolution of marriage, in addition to all other remedies available to a court to do equity between the parties, or in a proceeding for disposition of assets following a dissolution of marriage by a court which lacked jurisdiction over the absent spouse or lacked jurisdiction to dispose of the assets, the court shall set apart to each spouse that spouse's nonmarital assets and liabilities, and in distributing the marital assets and liabilities between the parties, the court must begin with the premise that the distribution should be equal, unless there is a justification for an unequal distribution based on all relevant factors, including:

(a) The contribution to the marriage by each spouse,

including contributions to the care and education of the children and services

as homemaker.

(b) The economic circumstances of the parties.

(c) The duration of the marriage.

(d) Any interruption of personal careers or educational opportunities

of either party.

(e) The contribution of one spouse to the personal career

or educational opportunity of the other spouse.

(f) The desirability of retaining any asset, including an

interest in a business, corporation, or professional practice, intact and

free from any claim or interference by the other party.

(g) The contribution of each spouse to the acquisition, enhancement,

and production of income or the improvement of, or the incurring of liabilities

to, both the marital assets and the nonmarital assets of the parties.

(h) The desirability of retaining the marital home as a residence

for any dependent child of the marriage, or any other party, when it would

be equitable to do so, it is in the best interest of the child or that

party, and it is financially feasible for the parties to maintain the residence

until the child is emancipated or until exclusive possession is otherwise

terminated by a court of competent jurisdiction. In making this determination,

the court shall first determine if it would be in the best interest of

the dependent child to remain in the marital home; and, if not, whether

other equities would be served by giving any other party exclusive use

and possession of the marital home.

(i) The intentional dissipation, waste, depletion, or destruction

of marital assets after the filing of the petition or within 2 years prior

to the filing of the petition.

(j) Any other factors necessary to do equity and justice

between the parties.

(2) If the court awards a cash payment for the purpose of equitable distribution of marital assets, to be paid in full or in installments, the full amount ordered shall vest when the judgment is awarded and the award shall not terminate upon remarriage or death of either party, unless otherwise agreed to by the parties, but shall be treated as a debt owed from the obligor or the obligor's estate to the obligee or the obligee's estate, unless otherwise agreed to by the parties.

(3) In any contested dissolution action wherein a stipulation and agreement has not been entered and filed, any distribution of marital assets or marital liabilities shall be supported by factual findings in the judgment or order based on competent substantial evidence with reference to the factors enumerated in subsection (1). The distribution of all marital assets and marital liabilities, whether equal or unequal, shall include specific written findings of fact as to the following:

(a) Clear identification of nonmarital assets and

ownership interests;

(b) Identification of marital assets, including the individual

valuation of significant assets, and designation of which spouse shall

be entitled to each asset;

(c) Identification of the marital liabilities and designation

of which spouse shall be responsible for each liability;

(d) Any other findings necessary to advise the parties or

the reviewing court of the trial court's rationale for the distribution

of marital assets and allocation of liabilities.

(4) The judgment distributing assets shall have the effect of a duly executed instrument of conveyance, transfer, release, or acquisition which is recorded in the county where the property is located when the judgment, or a certified copy of the judgment, is recorded in the official records of the county in which the property is located.

(5) As used in this section:

(a) "Marital assets and liabilities" include:

1. Assets acquired and liabilities incurred during

the marriage, individually by either spouse or jointly by them;

2. The enhancement in value and appreciation of nonmarital

assets resulting either from the efforts of either party during the marriage

or from the contribution to or expenditure thereon of marital funds or

other forms of marital assets, or both;

3. Interspousal gifts during the marriage;

4. All vested and nonvested benefits, rights, and funds accrued

during the marriage in retirement, pension, profit-sharing, annuity, deferred

compensation, and insurance plans and programs; and

5. All real property held by the parties as tenants by the

entireties, whether acquired prior to or during the marriage, shall

be presumed to be a marital asset. If, in any case, a party makes a claim

to the contrary, the burden of proof shall be on the party asserting the

claim for a special equity.

(b) "Nonmarital assets and liabilities" include:

1. Assets acquired and liabilities incurred by either

party prior to the marriage, and assets acquired and liabilities incurred

in exchange for such assets and liabilities;

2. Assets acquired separately by either party by noninterspousal

gift, bequest, devise, or descent, and assets acquired in exchange for

such assets;

3. All income derived from nonmarital assets during the marriage

unless the income was treated, used, or relied upon by the parties as a

marital asset; and

4. Assets and liabilities excluded from marital assets and

liabilities by valid written agreement of the parties, and assets acquired

and liabilities incurred in exchange for such assets and liabilities.

(6) The cut-off date for determining assets and liabilities to be identified or classified as marital assets and liabilities is the earliest of the date the parties enter into a valid separation agreement, such other date as may be expressly established by such agreement, or the date of the filing of a petition for dissolution of marriage. The date for determining value of assets and the amount of liabilities identified or classified as marital is the date or dates as the judge determines is just and equitable under the circumstances. Different assets may be valued as of different dates, as, in the judge's discretion, the circumstances require.

(7) All assets acquired and liabilities incurred by either spouse subsequent to the date of the marriage and not specifically established as nonmarital assets or liabilities are presumed to be marital assets and liabilities. Such presumption is overcome by a showing that the assets and liabilities are nonmarital assets and liabilities. The presumption is only for evidentiary purposes in the dissolution proceeding and does not vest title. Title to disputed assets shall vest only by the judgment of a court. This section does not require the joinder of spouses in the conveyance, transfer, or hypothecation of a spouse's individual property; affect the laws of descent and distribution; or establish community property in this state.

(8) The court may provide for equitable distribution of the marital assets and liabilities without regard to alimony for either party. After the determination of an equitable distribution of the marital assets and liabilities, the court shall consider whether a judgment for alimony shall be made.

(9) To do equity between the parties, the court may, in lieu of or to supplement, facilitate, or effectuate the equitable division of marital assets and liabilities, order a monetary payment in a lump sum or in installments paid over a fixed period of time. Section 61.075.

Case Law:

It is well settled that "[a] pure property settlement agreement is not subject to modification by the trial court without the consent of the parties." Kirchen v. Kirchen, 484 So.2d 1308, 1311 (Fla. 2d DCA 1986). However, a property settlement agreement which also makes provision for periodic alimony is separable and modifiable insofar as the support portion of the agreement is concerned. Jantzen v. Cotner, 513 So.2d 683 (Fla. 3d DCA 1987).

The nature of the agreement must be determined by an examination of the language of the agreement, the surrounding circumstances, and the parties' apparent purpose when they entered into the agreement. Underwood v. Underwood, 64 So.2d 281, 288 (Fla.1953). The test for determining when periodic payments constitute support or a methodology for division of property, seems to be whether the payor spouse's payments are given in exchange for a reciprocal exchange of property interests from the recipient spouse. In other words, the question is whether the recipient spouse bought and paid for the payments and is therefore entitled to receive them as written as a matter of contract. See Salomon v. Salomon, 196 So.2d 111 (Fla. 1967).

A party seeking modification of a property settlement agreement

must satisfy the heavy burden of showing that the settlement is the product

of fraud, duress, misrepresentation, or overreaching, or that the

settlement is unfair or unreasonable.

Work v. Provine, 632 So.2d 1119, 1121 (Fla. 1st DCA 1994).

Property settlement agreements are not subject to modification when the agreements are incorporated into final judgments of dissolution of marriage, Karch v. Karch, 445 So.2d 1077 (Fla. 3d DCA 1984).

A true property settlement agreement, in which one party gives up valuable property rights in exchange for the right to receive periodic payments, is not subject to modification. Hughes v. Hughes, 553 So.2d 197 (Fla. 2d DCA 1989).

Generally speaking, in the absence of a specific reservation of jurisdiction to make a later adjudication of property rights, a lower court does not have jurisdiction to modify property rights after an adjudication of those rights has been made in a judgment of dissolution. Harman v. Harman, 523 So.2d 187 (Fla. 2d DCA 1988). Modification of a property settlement incorporated into a final judgment of dissolution may only be had if the party seeking modification can satisfy the exceptionally heavy burden of showing that the settlement is the product of fraud, duress, deceit, misrepresentation, or overreaching, or that the settlement is unfair or unreasonable. McMahan v. McMahan, 567 So.2d 976 (Fla. 1st DCA 1990).

Even if a specific reservation of jurisdiction is made, it has been held that such only affords a court authority to address property rights not previously settled by the final judgment. Brandt v. Brandt, 525 So.2d 1017 (Fla.4th DCA 1988).

Where the agreement contains a provision by which each of the parties have explicitly waived the right to seek modification of the alimony payments. Such a provision removes any basis for the court to ignore their valid and binding contract. Hughes v. Hughes, 553 So.2d 197 (Fla. 2d DCA 1989).

Unless both spouses have separate counsel at the time of preparation and execution of the agreement, the marital relationship remains in a non-adversarial stance, and each party has fiduciary-like responsibility to the other. Fleming v. Fleming, 474 So.2d 1247,1249 (Fla. 4th DCA 1985); Baker v. Baker, 394 So.2d at 468.