Jacksonville Florida Living Trust for Husband and Wife with No Children

Description

How to fill out Florida Living Trust For Husband And Wife With No Children?

If you have previously made use of our service, sign in to your account and retrieve the Jacksonville Florida Living Trust for Husband and Wife with No Children on your device by selecting the Download option. Ensure that your subscription is active. If it is not, renew it according to your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to all documents you have acquired: you can access them in your profile within the My documents section whenever you need to use them again. Take full advantage of the US Legal Forms service to conveniently find and save any template for your personal or professional requirements!

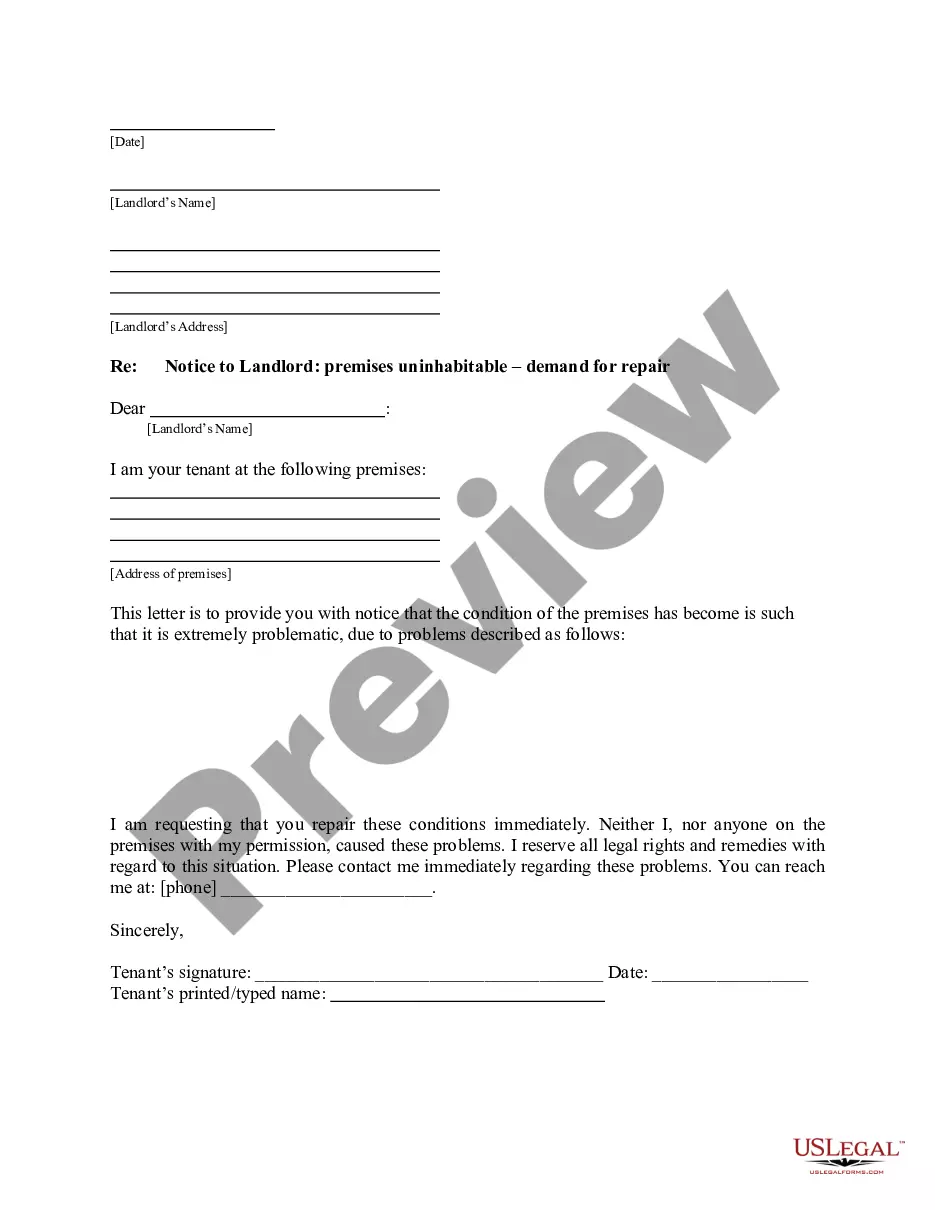

- Ensure you have found a suitable document. Browse the description and utilize the Preview feature, if available, to determine if it aligns with your needs. If it doesn't suit you, employ the Search tab above to discover the right one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Enter your credit card information or the PayPal option to finalize the purchase.

- Obtain your Jacksonville Florida Living Trust for Husband and Wife with No Children. Choose the file format for your document and download it to your device.

- Complete your form. Print it out or make use of professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

Yes, a deed to a trustee requires acknowledgement by a notary to be recorded in the public records.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay in the range of $1,500 to $2,500, depending on whether you are single or married, how complex the trust needs to be and what state you are in.

Common Types of Trusts Inter vivos trusts or living trusts: created and active during the lifetime of the grantor. Testamentary trusts: trusts formed after the death of the grantor. Revocable trusts: can be changed or revoked entirely by the grantor.

When you create a living trust in Florida you are the grantor of the trust, the one who decides its terms and places assets in it. You select a trustee who manages the assets. It is common to choose yourself as trustee, but you can pick anyone you want.

If you use an online program, it won't cost more than a few hundred dollars. The other option is to enlist the help of an attorney. Though this option will make the process easier, it's also much more expensive. The exact cost will depend on the attorney's fees, but you could end up paying more than $1,000.

The length of time it takes to settle the trust really depends on the provisions of any particular trust document and what types of assets you're dealing with. If the assets need to be liquidated, it can take up to six months.

(1) Upon the death of a settlor of a trust described in s. 733.707(3), the trustee must file a notice of trust with the court of the county of the settlor's domicile and the court having jurisdiction of the settlor's estate.

When you create a living trust in Florida you are the grantor of the trust, the one who decides its terms and places assets in it. You select a trustee who manages the assets. It is common to choose yourself as trustee, but you can pick anyone you want.

While a person can get a free or low-cost will form online, or a simple will with an attorney, a living trust is a more complicated document that legally must be prepared by an attorney in Florida.