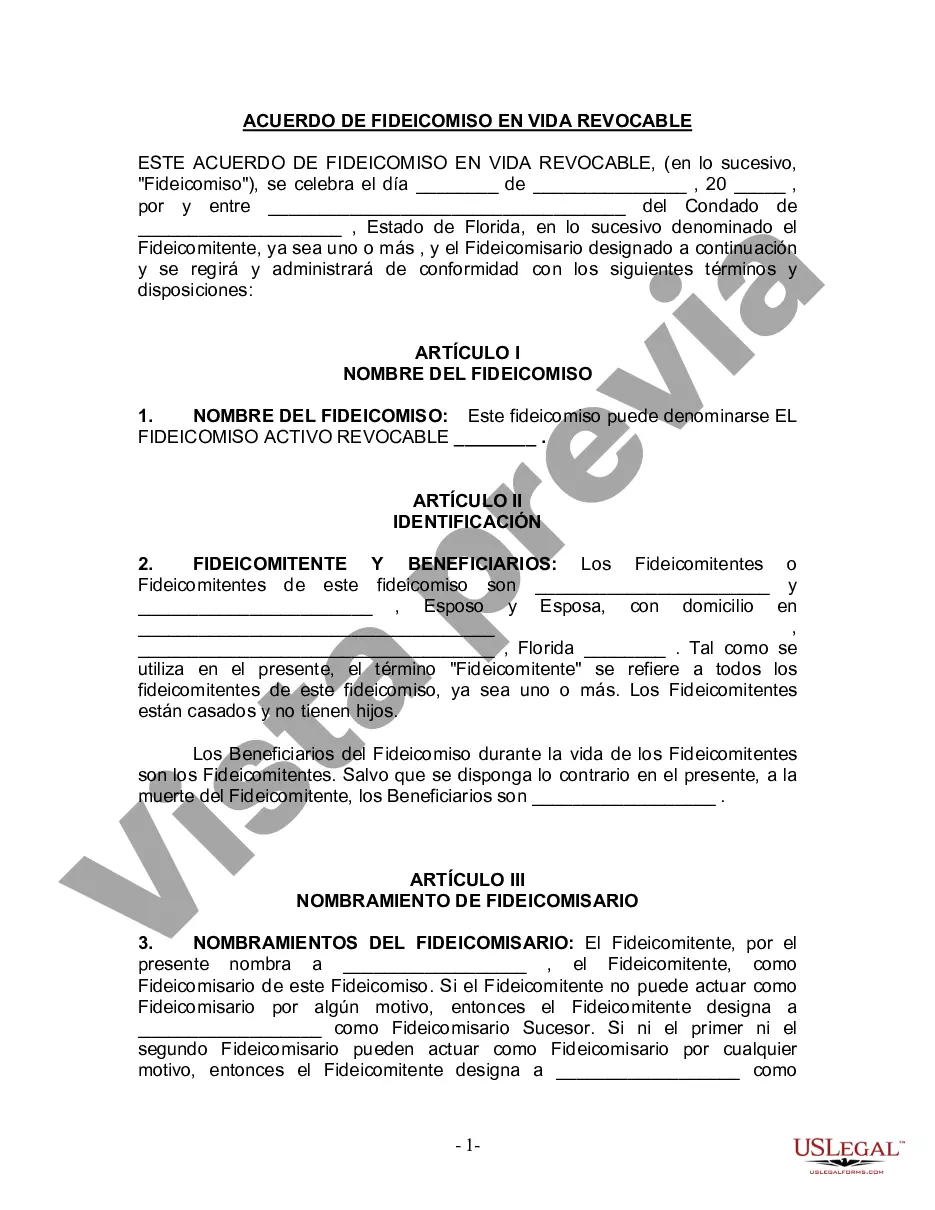

Miami-Dade Florida Fideicomiso en vida para esposo y esposa sin hijos - Florida Living Trust for Husband and Wife with No Children

Description

How to fill out Florida Fideicomiso En Vida Para Esposo Y Esposa Sin Hijos?

Irrespective of one's social or professional standing, filling out legal forms is an unfortunate requirement in the current professional landscape.

Often, it’s nearly impossible for someone without a legal background to generate such documents from scratch, primarily due to the complex terminology and legal subtleties involved.

This is where US Legal Forms can be a game changer.

Ensure that the form you have located is tailored to your region, as the regulations of one state do not apply to another.

Examine the document and read a brief overview (if available) of the situations in which the form may be utilized.

- Our platform provides an extensive database of over 85,000 ready-to-use state-specific forms suited for almost any legal circumstance.

- US Legal Forms acts as an excellent tool for associates or legal advisors looking to maximize their time efficiency using our DIY forms.

- Whether you require the Miami-Dade Florida Living Trust for a Husband and Wife without Children or any other documentation valid in your jurisdiction, US Legal Forms makes everything accessible.

- Here’s a quick guide on how to obtain the Miami-Dade Florida Living Trust for a Husband and Wife with No Children in just minutes using our reliable platform.

- If you are a returning customer, you can proceed to Log In to your account to retrieve the appropriate form.

- However, if you are new to our collection, ensure to follow these steps prior to downloading the Miami-Dade Florida Living Trust for a Husband and Wife with No Children.

Form popularity

FAQ

Para que exista el contrato de Fideicomiso basta con que esten estas dos partes; es decir, el Fideicomitente y el Fiduciario, y que los fines sean licitos y determinados. El (Los) Fideicomisario(s) son las personas fisicas o morales que reciben el o los provechos que el fideicomiso implica.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Para establecer un fideicomiso, cualquiera de los bancos en Mexico cobrara una cuota anual por mantener el fideicomiso, un promedio de $450 a $550 USD por ano.

El Fideicomiso familiar o sucesorio, tecnicamente llamado Fideicomiso de Administracion y Sucesion (FAS), es un instrumento legal cada vez mas utilizado por los usos y beneficios que ofrece. Veamos algunos de ellos: - "Blinda" los activos personales -inmuebles, participaciones societarias, activos financieros, etc.

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.