Hollywood Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

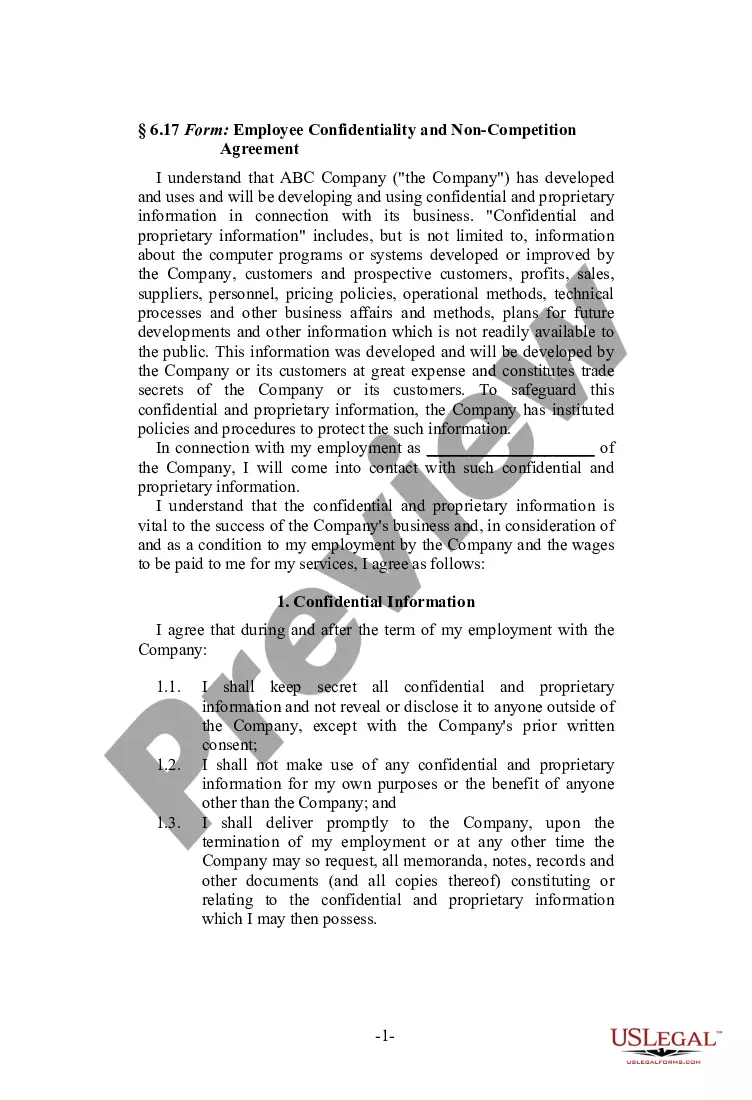

How to fill out Florida Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children?

Are you seeking a trustworthy and cost-effective legal forms provider to purchase the Hollywood Florida Living Trust for an Individual Who is Single, Divorced, or a Widow/Widower without Children? US Legal Forms is your ideal answer.

Whether you require a basic agreement to establish guidelines for living with your partner or a thorough set of documents to facilitate your divorce process through the court, we have you covered. Our platform provides over 85,000 current legal document templates for both personal and business use. All templates that we provide access to are not generic and are formatted according to the requirements of specific states and areas.

To obtain the document, you need to Log In to your account, locate the necessary form, and click the Download button beside it. Please note that you can download your previously acquired form templates at any moment from the My documents section.

Is this your first visit to our website? No problem. You can set up an account in just a few minutes, but first, ensure you do the following: Check if the Hollywood Florida Living Trust for an Individual Who is Single, Divorced, or a Widow/Widower without Children complies with your state and local regulations. Read the form’s description (if present) to understand who and what the document is designed for. Restart the search if the form isn’t suitable for your legal circumstances.

Try US Legal Forms today, and say goodbye to wasting your precious time searching for legal documents online for good.

- Now you can create your account.

- Then select the subscription plan and proceed to payment.

- Once the payment is processed, download the Hollywood Florida Living Trust for an Individual Who is Single, Divorced, or a Widow/Widower without Children in any available file format.

- You can return to the website at any time and redownload the document without incurring additional costs.

- Finding current legal documents has never been simpler.

Form popularity

FAQ

Yes, you can prepare your own living trust in Florida. However, creating a Hollywood Florida Living Trust for an Individual Who is Single, Divorced or Widow or Widower with No Children requires careful consideration of specific legal requirements and your personal circumstances. While there are templates available online, using a platform like uslegalforms can simplify the process and ensure that your trust documents meet all legal standards. Ultimately, a well-prepared trust can provide peace of mind and help manage your assets effectively.

In a divorce, certain assets may remain untouched, such as assets acquired before marriage, inheritances, or gifts given specifically to one spouse. Additionally, a Hollywood Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children can protect your assets from division should it be structured properly. Understanding the laws surrounding asset protection can be complex, so seeking advice from professionals can be beneficial. This approach helps you maintain clarity and enforce your rights.

While you can create a living trust on your own in Florida, having an attorney can streamline the process, especially for a Hollywood Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children. An attorney can ensure that the trust complies with state laws and reflects your specific wishes. They can help you avoid common errors that might arise due to misunderstandings. Investing in legal guidance can safeguard your assets and provide peace of mind.

When a divorce occurs, a Hollywood Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children may be affected depending on how the trust is structured. If you are the sole grantor, you might retain control; however, in many cases, the terms of the trust could alter or even necessitate a complete review. It's smart to consult an attorney to understand how changes in marital status might influence your living trust. Proper adjustments can prevent complications down the line.

If you have no children, you can choose a variety of beneficiaries for your Hollywood Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children. Common choices include siblings, nieces, or nephews, close friends, or even charitable organizations that are meaningful to you. It is essential to reflect on your relationships and values when making this decision. Setting your beneficiaries can ensure your assets go where you intend and help you leave a lasting legacy.

Not everyone needs a trust; some individuals may find that a basic will is sufficient for their estate planning needs. For example, if your financial situation is straightforward and your assets are limited, a Hollywood Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children might not be necessary. Additionally, if you are not ready to manage the complexities of a trust, it may be better to explore more straightforward estate planning options. Always consider your unique situation, and consulting an expert can provide clarity.

Yes, a Hollywood Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children can provide numerous benefits even without children. A trust can help you manage your assets, avoid probate, and ensure your estate is distributed according to your wishes. It can also protect your assets from creditors and provide you with peace of mind. By setting up a trust, you can streamline your estate planning, making it easier for your loved ones.

When one spouse in a Hollywood Florida Living Trust passes away, the trust typically continues to function, allowing the surviving spouse to maintain control over the assets. The trust assets bypass probate, facilitating a smoother transition and quicker availability of funds. It's important to review and potentially amend the trust to reflect the changed circumstances. This proactive approach ensures your estate meets your wishes and needs effectively.

Divorce can significantly impact a Hollywood Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children. Upon divorce, assets initially placed in the trust may need to be reassessed and potentially redistributed. Updating the trust after a divorce is essential to ensure it aligns with your new circumstances and intentions. Consulting with a professional can provide clarity on how to navigate these changes effectively.

In Florida, the downside of a Hollywood Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children includes the possibility of ongoing expenses associated with its maintenance. Some individuals find that the complexity of the trust requires professional management, which can incur fees. Furthermore, if assets are not correctly funded into the trust, it may not provide the intended advantages. It's crucial to understand these factors before proceeding.