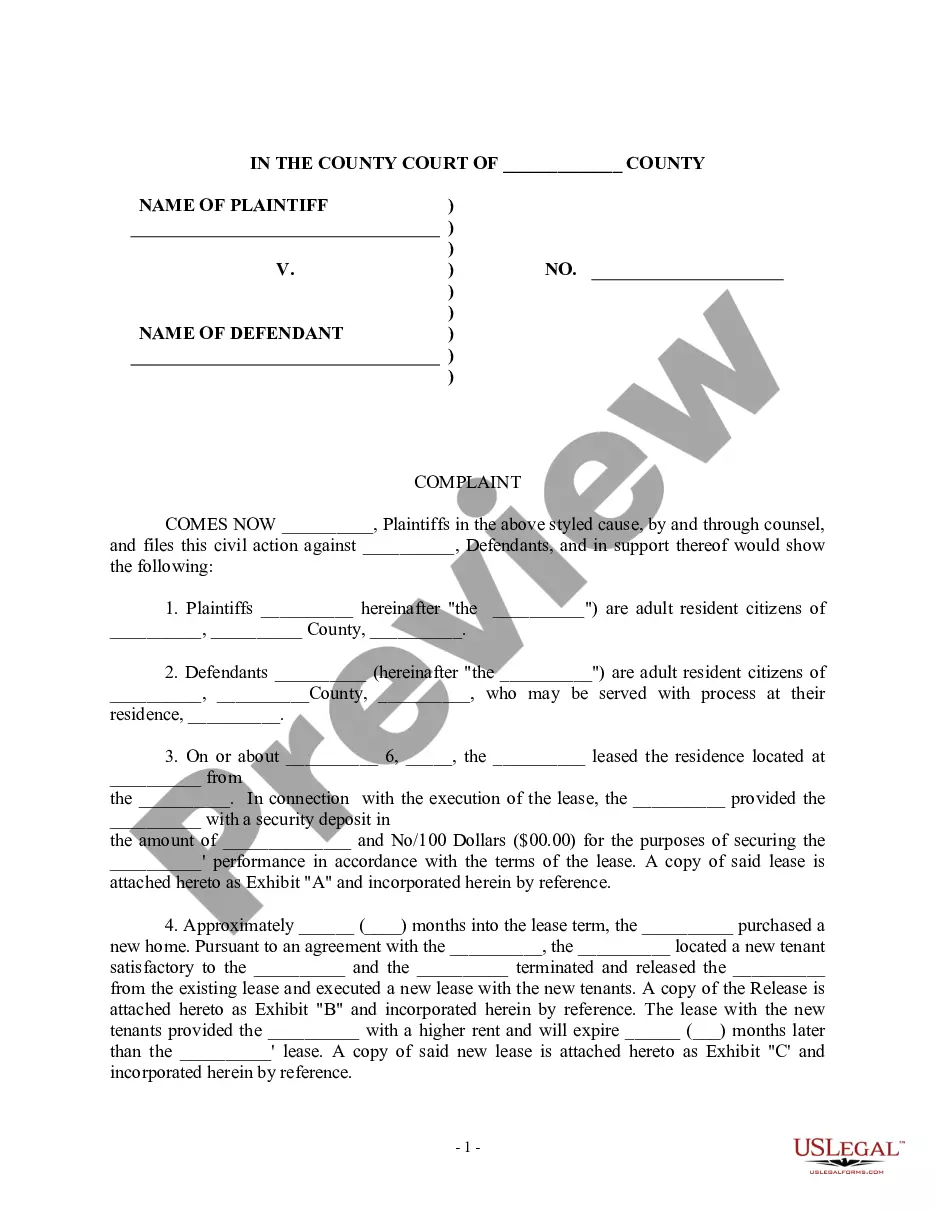

Palm Bay Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children: A Comprehensive Guide In Palm Bay, Florida, individuals who are single, divorced, widow or widower, and have no children often opt for a living trust to ensure their assets are managed and distributed according to their wishes. A living trust is a legal document that allows you to transfer your assets into a trust while you are still alive, and have them distributed to your chosen beneficiaries after your passing. This article aims to provide a detailed description of what a Palm Bay Florida Living Trust for individuals in such circumstances entails. Key Benefits of a Living Trust: 1. Probate Avoidance: Creating a living trust helps your loved ones bypass the probate process, which can be time-consuming, costly, and public. Assets placed within the trust can be distributed directly to beneficiaries, bypassing the need for court involvement. 2. Asset Management: A living trust allows you to appoint a trustee, who can be a trusted family member, friend, or a professional, to manage your assets in your best interests if you become incapacitated or unable to do so. 3. Privacy: Unlike a will, a living trust remains private. It does not become a public document, so the details of your assets, beneficiaries, and distribution plans are kept confidential. 4. Flexibility and Control: You have the freedom to update or modify your living trust at any time during your lifetime if your circumstances or priorities change. Types of Palm Bay Florida Living Trusts for Individuals Who Are Single, Divorced, or Widow or Widower with No Children: 1. Revocable Living Trust: A revocable living trust is the most common type of trust that individuals in Palm Bay prefer. It allows you to retain control over your assets during your lifetime, including the ability to modify or revoke the trust if necessary. Upon your passing, the assets are seamlessly transferred to your designated beneficiaries. 2. Irrevocable Living Trust: An irrevocable living trust in Palm Bay, Florida, is another option to consider. Once assets are transferred into this trust, you relinquish complete control over them. However, it may offer certain tax benefits and protection from creditors. 3. Single-Source Living Trust: For individuals who want to consolidate all their assets into a single trust, a single-source living trust could be a viable option. With this trust, you can add and manage all your personal and financial assets, ensuring a seamless distribution plan. 4. Charitable Living Trust: If you wish to support charitable organizations or causes in Palm Bay, a charitable living trust allows you to do so while ensuring your other financial needs are met during your lifetime. This trust enables you to leave a lasting impact by designating specific assets or a portion of your estate to charitable organizations upon your passing. In conclusion, Palm Bay Florida Living Trusts for individuals who are single, divorced, widow or widower with no children provide flexibility, control, and privacy over asset management and distribution. Whether you opt for a revocable or irrevocable living trust, a single-source or charitable trust, creating a living trust tailored to your specific circumstances is a wise decision to ensure your estate is handled according to your wishes. Consult a knowledgeable estate planning attorney in Palm Bay, Florida, to guide you through the process of establishing the right living trust for your unique situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Bay Florida Fideicomiso en Vida para Individuos Solteros, Divorciados o Viudos o Viudos sin Hijos - Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

How to fill out Palm Bay Florida Fideicomiso En Vida Para Individuos Solteros, Divorciados O Viudos O Viudos Sin Hijos?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Palm Bay Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children? US Legal Forms is your go-to choice.

No matter if you require a basic arrangement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of particular state and area.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Palm Bay Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is intended for.

- Restart the search if the template isn’t good for your legal situation.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Palm Bay Florida Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children in any provided file format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting hours learning about legal papers online for good.