Pembroke Pines, Florida Amendment to Living Trust: A Comprehensive Guide Introduction: If you reside in Pembroke Pines, Florida, and have created a living trust to protect and manage your assets during your lifetime and after your death, it is crucial to understand the purpose and process of making amendments to your trust. An amendment to your living trust allows you to modify the terms, beneficiaries, or provisions as needed, ensuring your trust remains up-to-date and aligned with your evolving wishes. In this article, we will delve into the details of the Pembroke Pines, Florida Amendment to Living Trust, including important keywords to aid your understanding. 1. Understanding the Need for Amendment: The Pembroke Pines, Florida Amendment to Living Trust becomes necessary when changes are required due to various life events, such as the birth of a child, divorce, marriage, death of a beneficiary, acquisition of new assets, or simply reconsideration of your distribution plan. By making amendments, you can ensure that your living trust reflects your current intentions and wishes. 2. Key Elements of a Pembroke Pines, Florida Amendment: To ensure the effectiveness and validity of an amendment to your living trust, it is crucial to include the following elements: a. Clear Identification: Start the amendment by explicitly identifying your original trust document by its date, title, and any other relevant information necessary for its identification. b. Expressed Intention to Amend: Clearly state your intention to amend the trust, leaving no room for ambiguity or misinterpretation. c. Specific Amendments: Precisely outline the changes or modifications you intend to make to the trust, including any amendments to beneficiaries, trustees, powers, provisions, or distribution plans. d. Execution and Signature: As per Florida trust laws, an amendment must be signed and dated by the granter(s) and witnesses to be legally valid. Adhering to proper execution requirements is crucial to validate the amendment. 3. Types of Pembroke Pines, Florida Amendments to Living Trust: There could be various types of amendments depending on the changes you wish to make. Here are a few common types: a. Beneficiary Amendment: This type of amendment allows you to add, remove, or change beneficiaries of your living trust, ensuring it aligns with your current wishes and circumstances. b. Provisions and Powers Amendment: You may choose to modify specific provisions or powers within your living trust, granting or revoking certain authorities or responsibilities attributed to trustees, beneficiaries, or other parties involved. c. Asset Amendment: If you acquire or dispose of assets after establishing your living trust, you might require an amendment to accurately reflect your current asset portfolio within the trust. d. Successor Trustee Amendment: In case of changes in your chosen successor trustee, such as their unavailability or inability to fulfill the role, an amendment can be made to appoint a new trustee. 4. Seeking Professional Assistance: While amendments to a living trust may seem straightforward, it is prudent to consult an experienced estate planning attorney specializing in Pembroke Pines, Florida law. They can guide you through the process, ensure the amendment is drafted correctly, and offer valuable advice on the potential implications of the changes you wish to make. Conclusion: A Pembroke Pines, Florida Amendment to Living Trust is a crucial instrument for ensuring your trust remains effective, reflective of your wishes, and capable of addressing unforeseen changes in your life. By understanding the need, key elements, types, and seeking professional guidance, you can confidently navigate the amendment process, ensuring your living trust remains a robust and accurate representation of your intentions.

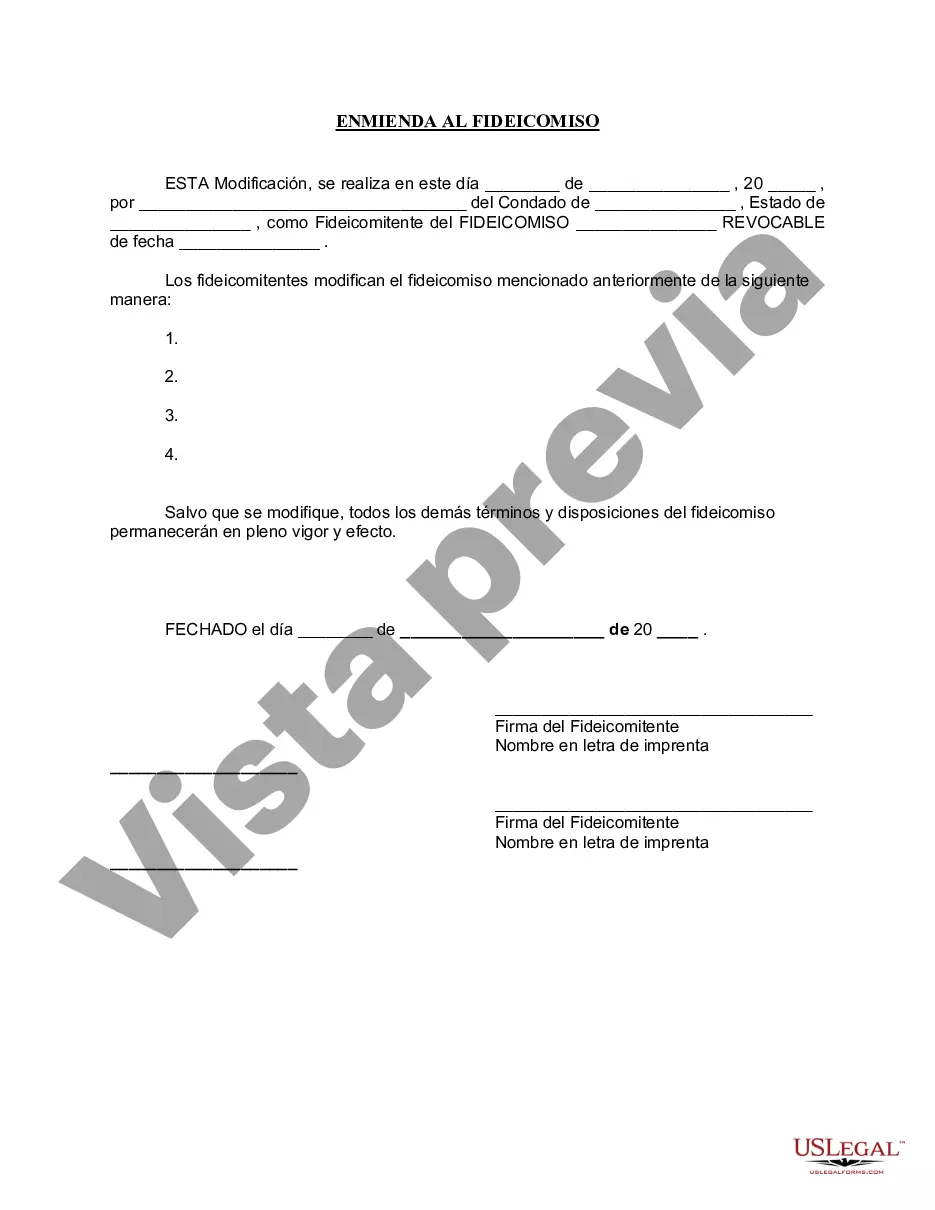

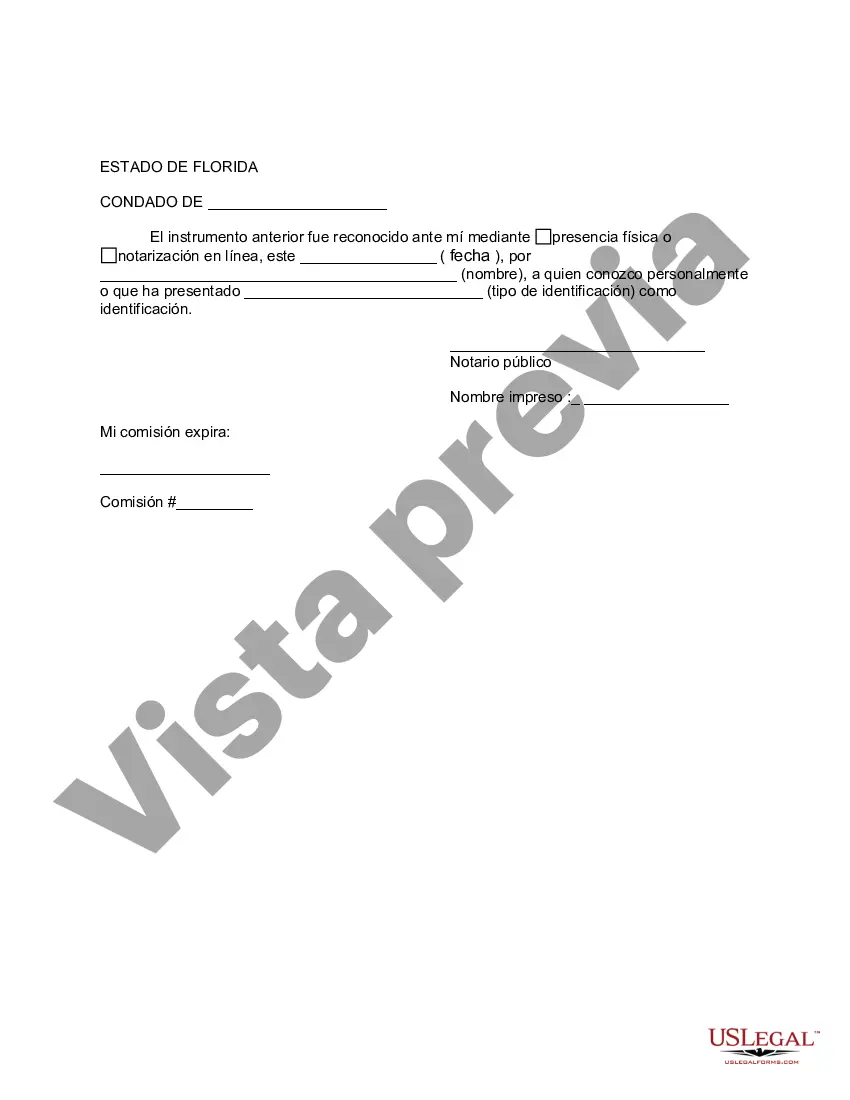

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pembroke Pines Florida Enmienda al fideicomiso en vida - Florida Amendment to Living Trust

State:

Florida

City:

Pembroke Pines

Control #:

FL-E0178A

Format:

Word

Instant download

Description

Formulario para modificar un fideicomiso en vida.

Pembroke Pines, Florida Amendment to Living Trust: A Comprehensive Guide Introduction: If you reside in Pembroke Pines, Florida, and have created a living trust to protect and manage your assets during your lifetime and after your death, it is crucial to understand the purpose and process of making amendments to your trust. An amendment to your living trust allows you to modify the terms, beneficiaries, or provisions as needed, ensuring your trust remains up-to-date and aligned with your evolving wishes. In this article, we will delve into the details of the Pembroke Pines, Florida Amendment to Living Trust, including important keywords to aid your understanding. 1. Understanding the Need for Amendment: The Pembroke Pines, Florida Amendment to Living Trust becomes necessary when changes are required due to various life events, such as the birth of a child, divorce, marriage, death of a beneficiary, acquisition of new assets, or simply reconsideration of your distribution plan. By making amendments, you can ensure that your living trust reflects your current intentions and wishes. 2. Key Elements of a Pembroke Pines, Florida Amendment: To ensure the effectiveness and validity of an amendment to your living trust, it is crucial to include the following elements: a. Clear Identification: Start the amendment by explicitly identifying your original trust document by its date, title, and any other relevant information necessary for its identification. b. Expressed Intention to Amend: Clearly state your intention to amend the trust, leaving no room for ambiguity or misinterpretation. c. Specific Amendments: Precisely outline the changes or modifications you intend to make to the trust, including any amendments to beneficiaries, trustees, powers, provisions, or distribution plans. d. Execution and Signature: As per Florida trust laws, an amendment must be signed and dated by the granter(s) and witnesses to be legally valid. Adhering to proper execution requirements is crucial to validate the amendment. 3. Types of Pembroke Pines, Florida Amendments to Living Trust: There could be various types of amendments depending on the changes you wish to make. Here are a few common types: a. Beneficiary Amendment: This type of amendment allows you to add, remove, or change beneficiaries of your living trust, ensuring it aligns with your current wishes and circumstances. b. Provisions and Powers Amendment: You may choose to modify specific provisions or powers within your living trust, granting or revoking certain authorities or responsibilities attributed to trustees, beneficiaries, or other parties involved. c. Asset Amendment: If you acquire or dispose of assets after establishing your living trust, you might require an amendment to accurately reflect your current asset portfolio within the trust. d. Successor Trustee Amendment: In case of changes in your chosen successor trustee, such as their unavailability or inability to fulfill the role, an amendment can be made to appoint a new trustee. 4. Seeking Professional Assistance: While amendments to a living trust may seem straightforward, it is prudent to consult an experienced estate planning attorney specializing in Pembroke Pines, Florida law. They can guide you through the process, ensure the amendment is drafted correctly, and offer valuable advice on the potential implications of the changes you wish to make. Conclusion: A Pembroke Pines, Florida Amendment to Living Trust is a crucial instrument for ensuring your trust remains effective, reflective of your wishes, and capable of addressing unforeseen changes in your life. By understanding the need, key elements, types, and seeking professional guidance, you can confidently navigate the amendment process, ensuring your living trust remains a robust and accurate representation of your intentions.

Free preview

How to fill out Pembroke Pines Florida Enmienda Al Fideicomiso En Vida?

If you’ve already utilized our service before, log in to your account and save the Pembroke Pines Florida Amendment to Living Trust on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make certain you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Pembroke Pines Florida Amendment to Living Trust. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!