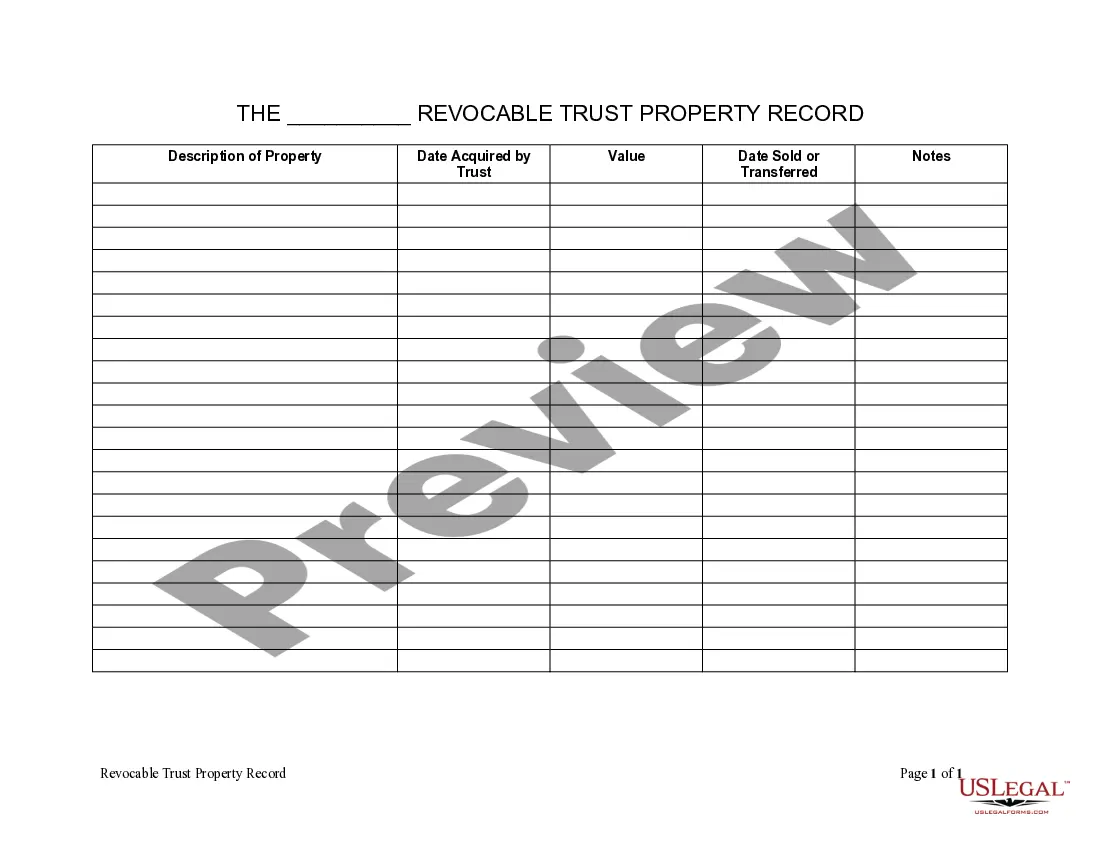

A living trust property record in Tampa, Florida is a comprehensive document or database that contains detailed information about properties owned by individuals or families who have established living trusts. This record serves as a legal and financial resource for estate planning and management purposes. Keywords: Tampa Florida, living trust, property record, detailed description, types 1. Tampa Florida Living Trust Property Record Overview: A Tampa Florida living trust property record is a compilation of pertinent information about real estate holdings owned by individuals or families who have established living trusts in the city of Tampa, Florida. This record ensures efficient and organized management of properties within the scope of a living trust, which offers numerous benefits and flexibility in estate planning. 2. Importance of a Living Trust Property Record: The Tampa Florida living trust property record plays a crucial role in maintaining an accurate and up-to-date inventory of assets included in a living trust. It provides a consolidated view of property ownership, transfer details, taxation information, and other essential data. A comprehensive record allows trustees to effectively administer the trust, make informed decisions, and protect the interests of beneficiaries. 3. Key Components of a Tampa Florida Living Trust Property Record: The record typically includes essential details such as property addresses, legal descriptions, current market values, tax assessment records, and history of property transfers within the living trust. Additional information like mortgages, liens, property insurance, and recent appraisals may also be included. These details enable trustee(s) to have a clear understanding of the trust's real estate assets and ensure their proper management. 4. Types of Tampa Florida Living Trust Property Records: a. Residential Property Record: This type of record specifically focuses on residential properties owned within a living trust. It contains details of single-family homes, townhouses, condominiums, or multi-unit residential buildings held within the trust. b. Commercial Property Record: A commercial property record primarily comprises information about non-residential or income-generating properties held within a living trust, such as office buildings, retail spaces, industrial warehouses, or commercial land. c. Vacant Land or Development Property Record: This type of record pertains to undeveloped land or parcels held within a living trust, which may be designated for future construction or investment purposes. It provides essential details about the location, zoning, and potential use of the land. d. Rental Property Record: For individuals who include rental properties in their living trusts, this record type focuses on providing property-specific information pertaining to tenant leases, rental income, expenses, and maintenance history. Overall, a Tampa Florida living trust property record ensures efficient management, organization, and oversight of properties held within a living trust in the city. By maintaining accurate records, trustees can effectively navigate legal requirements, make educated decisions, and safeguard the interests of beneficiaries under the living trust arrangement.

Tampa Florida Living Trust Property Record

Description

How to fill out Florida Living Trust Property Record?

Finding authenticated templates tailored to your local laws can be challenging unless you utilize the US Legal Forms collection.

This is an online repository of over 85,000 legal documents for both personal and business purposes and various real-life situations.

All the forms are properly categorized by field of application and jurisdictional areas, so accessing the Tampa Florida Living Trust Property Record becomes as simple and straightforward as 1-2-3.

Having paperwork organized and compliant with legal standards is crucial. Make the most of the US Legal Forms library to always have essential document templates readily available for any of your requirements!

- Review the Preview mode and form description.

- Ensure you’ve selected the right one that fulfills your needs and completely aligns with your local jurisdiction criteria.

- Search for another template, if necessary.

- If you detect any discrepancies, utilize the Search tab above to locate the correct one. If it fits your requirements, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

In Florida, trusts do not require filing with the state. The trust operates privately, allowing for flexibility in managing and distributing your assets according to your wishes. However, proper documentation of your Tampa Florida Living Trust Property Record is essential, especially for asset transfers and estate planning.

In Florida, a certificate of trust does not need to be recorded for the trust to function properly. However, recording it can provide a summary of the trust’s provisions and may be beneficial for certain transactions. Ensure your Tampa Florida Living Trust Property Record is accurate and up-to-date for best results.

Living trusts are typically not recorded in Florida, as they operate privately until the trust creator passes away. However, the assets within the trust may need to be recorded separately, depending on the type of property involved. Keeping track of your Tampa Florida Living Trust Property Record remains crucial during this process.

Writing a living trust in Florida involves several key steps: define your assets, identify the beneficiaries, and outline the terms of the trust. It’s important to comply with state laws to ensure your trust is valid and enforceable. Using uslegalforms can simplify this process as you create your Tampa Florida Living Trust Property Record.

It’s not necessary to record a living trust in Florida, but doing so can offer additional protection and clarity for your beneficiaries. Recording the trust can provide a public record that might help prevent disputes about your Tampa Florida Living Trust Property Record later on. Consider your unique situation before making a decision.

Filling out a trust form requires attention to detail. Start by providing your personal information and listing your assets. Be sure to specify the beneficiaries and the trust terms clearly. If this process seems daunting, you can use uslegalforms for guided assistance in managing your Tampa Florida Living Trust Property Record.

Generally, transferring property into a living trust does not trigger a property tax reassessment in Florida. The law allows the property to remain under the same ownership status as long as it stays under the control of the original owner. This can be beneficial for maintaining tax benefits associated with your Tampa Florida Living Trust Property Record.

In Florida, a living trust does not need to be recorded to be valid. However, it’s essential to ensure that the trust document is prepared correctly and that the assets are transferred into the trust. Consider using our service for easy trust creation, especially when dealing with a Tampa Florida Living Trust Property Record.

A trust transfers assets after death automatically, without the need for probate. The trustee retains the responsibility of managing and distributing the assets according to the trust's instructions. This efficient transfer process is what makes maintaining your Tampa Florida Living Trust Property Record beneficial. It provides peace of mind for you and your beneficiaries.

Changing ownership of property after death in Florida can be done through a will or trust. If the property is in a trust, the trustee can transfer ownership according to the trust's terms without going through probate. Maintaining accurate records of your Tampa Florida Living Trust Property Record ensures a smooth transition of ownership. Professional assistance may help streamline this process.