Hialeah Florida Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: In Hialeah, Florida, individuals and families have the option to transfer their financial accounts to a living trust. This legal process allows them to efficiently manage, protect, and distribute their assets during their lifetime and after their passing. Understanding the intricacies of a financial account transfer to a living trust is essential for residents of Hialeah who seek to preserve their wealth and simplify the estate planning process. In this article, we will delve into the various types of account transfers that can be made to a living trust and highlight the key benefits they provide. 1. Bank Account Transfer to Living Trust: One common type of financial account transfer is moving traditional checking, savings, money market, or certificate of deposit (CD) accounts into a living trust. By doing so, individuals can consolidate their funds, streamline financial management, and enjoy added protection. 2. Investment Account Transfer to Living Trust: Hialeah residents with investments such as stocks, bonds, mutual funds, or brokerage accounts can opt to transfer them to a living trust. This type of transfer helps manage investment portfolios, simplifies record-keeping, and facilitates the seamless transfer of assets upon the account owner's death. 3. Retirement Account Transfer to Living Trust: Individuals who have retirement accounts, such as IRAs or 401(k)s, can transfer these assets to their living trust. While there are specific rules and considerations to navigate, this type of transfer can provide beneficiaries with a more favorable tax treatment and protect the retirement assets within the trust. 4. Real Estate Property Transfer to Living Trust: In addition to financial accounts, Hialeah residents can transfer real estate properties, including primary residences, vacation homes, or investment properties, to their living trusts. By doing so, they can maintain control over their properties, avoid probate, and ensure a smooth transfer to their chosen beneficiaries. Benefits of Hialeah Florida Financial Account Transfer to Living Trust: — Avoidance of Probate: One of the primary advantages of transferring financial accounts to a living trust is the ability to bypass probate. This enables beneficiaries to access their inheritance without delays caused by court proceedings, providing them with immediate financial support when needed. — Privacy Protection: Unlike a will, which becomes a public record upon probate, a living trust allows for the private distribution of assets. This ensures that personal financial information and the beneficiaries' details remain confidential. — Incapacity Planning: A living trust incorporates provisions for incapacity, ensuring that designated individuals can seamlessly step in and manage the trust's assets if the account owner becomes unable to do so themselves. This provides a safeguard against financial mismanagement during incapacitation. — Flexibility and Control: Hialeah residents can retain substantial control over their assets even after they pass away. Living trusts allow owners to specify how and when the assets should be distributed, ensuring their wishes are upheld and loved ones are provided for according to their vision. — Potential Tax Benefits: Depending on individual circumstances, transferring financial accounts to a living trust can result in certain tax benefits. Consultation with a qualified estate planning professional is recommended to assess specific tax implications. Conclusion: In Hialeah, Florida, individuals and families can secure their financial future and streamline the estate planning process by transferring their various financial accounts into a living trust. Whether it's bank accounts, investments, retirement assets, or real estate properties, a living trust offers numerous benefits such as probate avoidance, privacy protection, incapacity planning, flexibility, and potential tax advantages. Seek guidance from an experienced estate planning attorney to ensure a smooth and effective transfer of your financial accounts to a living trust, tailored to your specific needs and objectives.

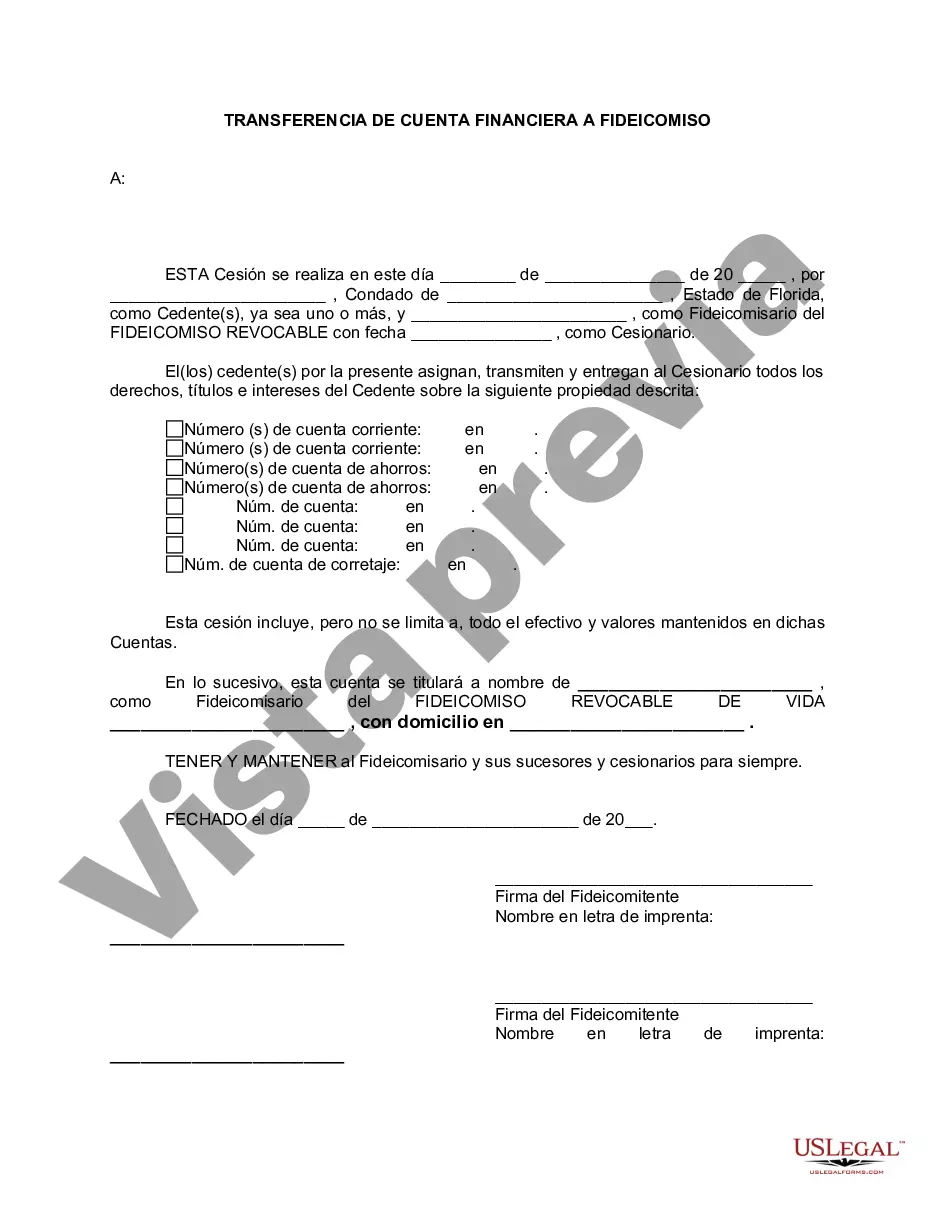

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hialeah Florida Transferencia de cuenta financiera a fideicomiso en vida - Florida Financial Account Transfer to Living Trust

Description

How to fill out Hialeah Florida Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Do you need a reliable and affordable legal forms provider to buy the Hialeah Florida Financial Account Transfer to Living Trust? US Legal Forms is your go-to solution.

No matter if you require a basic agreement to set rules for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of specific state and area.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Hialeah Florida Financial Account Transfer to Living Trust conforms to the laws of your state and local area.

- Read the form’s description (if available) to find out who and what the form is intended for.

- Restart the search in case the template isn’t good for your legal situation.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Hialeah Florida Financial Account Transfer to Living Trust in any available format. You can get back to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting hours learning about legal paperwork online for good.