Hillsborough Florida Financial Account Transfer to Living Trust: A Comprehensive Guide to Ensure Secure Wealth Management Keywords: Hillsborough Florida, financial account transfer, living trust, wealth management Introduction: In Hillsborough County, Florida, individuals looking to safeguard their financial accounts and ensure a seamless transfer of assets upon their passing often opt for a Financial Account Transfer to a Living Trust. This method of estate planning not only offers enhanced protection and privacy but also allows beneficiaries to avoid the lengthy probate process. Here, we provide a detailed description of the Hillsborough Florida Financial Account Transfer to Living Trust, its importance, benefits, and different types available. What is a Hillsborough Florida Financial Account Transfer to Living Trust? A Hillsborough Florida Financial Account Transfer to Living Trust involves re-titling one's financial accounts such as bank accounts, investment portfolios, and retirement funds into the ownership of a revocable living trust. This trust serves as a legal entity that allows individuals to retain control over their assets during their lifetime, while also providing a streamlined transfer to designated beneficiaries upon their demise. Different Types of Hillsborough Florida Financial Account Transfer to Living Trust: 1. Revocable Living Trust: This popular type of trust allows individuals to retain full control and amend or revoke the trust during their lifetime. It ensures that their financial accounts are protected, managed, and transferred to beneficiaries of their choice with ease. 2. Irrevocable Living Trust: As the name suggests, this type of living trust cannot be modified or revoked once established. It provides enhanced asset protection, potential tax benefits, and helps individuals avoid probate. However, the trade-off is relinquishing control over the assets transferred. Importance and Benefits: — Probate Avoidance: One of the primary advantages of a financial account transfer to a living trust is the ability to bypass the probate process. Unlike a will, which is subject to probate, a living trust ensures a private and efficient transfer of assets without court intervention. — Asset Protection: By transferring financial accounts to a living trust, individuals shield their assets from potential creditors, lawsuits, and other external financial threats. This protection is particularly beneficial for high net worth individuals or those with complex estates. — Incapacity Planning: A living trust enables seamless management of financial affairs in the event of incapacitation. By naming a successor trustee, individuals have a designated person to handle their financial accounts and make crucial decisions on their behalf. — Enhanced Privacy: Unlike probate, which is a public process, a living trust offers privacy and prevents the disclosure of personal financial details to the public. Only the beneficiaries and named parties have access to the trust's information and distribution details. — Efficient Distribution: Upon the passing of the trust granter, the assets are promptly distributed to the designated beneficiaries as outlined in the trust document. This expedites the transfer process, ensuring the intended beneficiaries receive their inheritances in a timely manner. Conclusion: In Hillsborough County, Florida, individuals seeking to secure their financial accounts, streamline wealth management, and ensure a seamless transfer of assets opt for a Financial Account Transfer to a Living Trust. With different types of living trusts available, individuals can choose one that suits their unique circumstances and goals. This estate planning strategy offers numerous benefits, including probate avoidance, asset protection, incapacity planning, privacy, and efficient asset distribution. It is prudent for individuals to consult a qualified estate planning attorney in Hillsborough County, Florida, to guide them through the process and ensure their financial accounts are safeguarded for future generations.

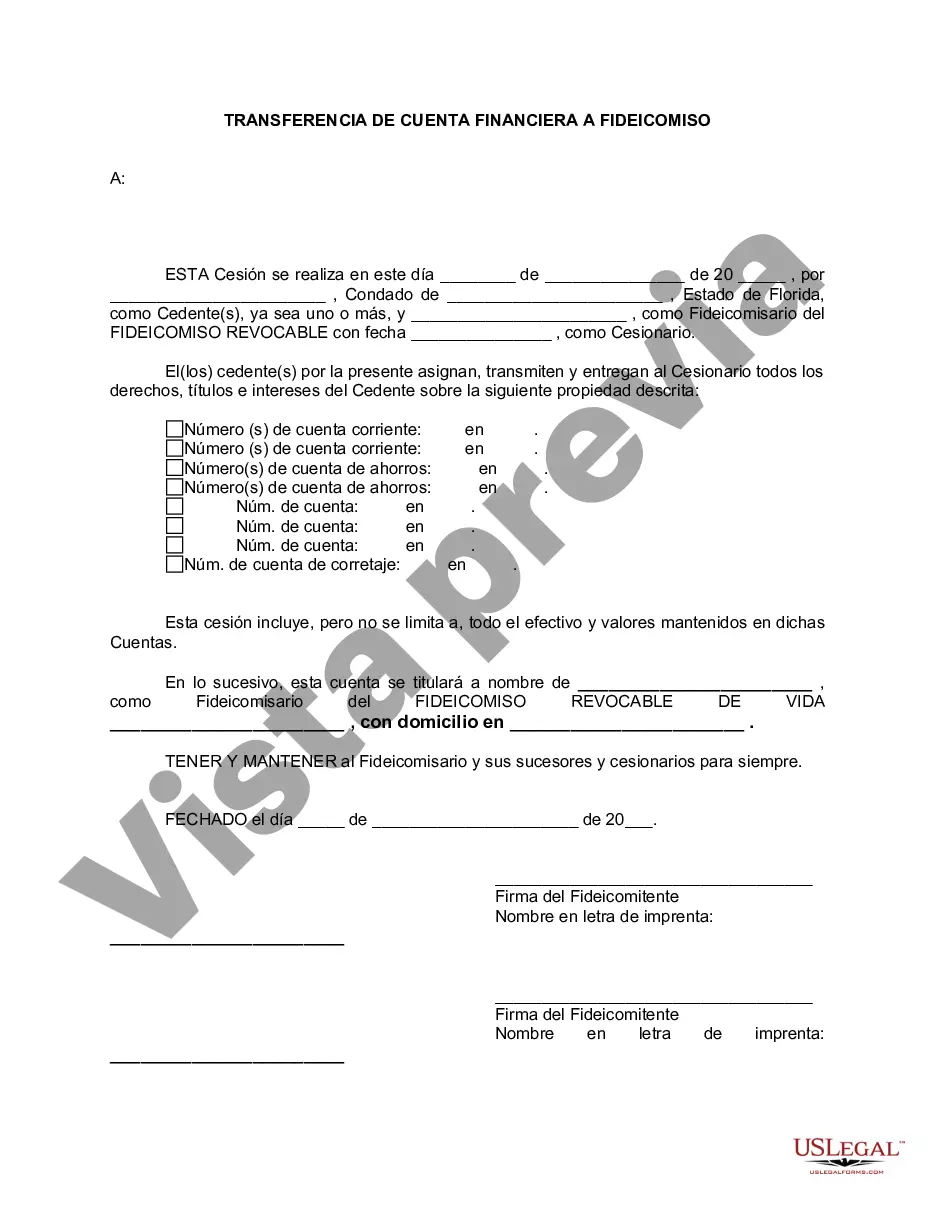

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Transferencia de cuenta financiera a fideicomiso en vida - Florida Financial Account Transfer to Living Trust

Description

How to fill out Hillsborough Florida Transferencia De Cuenta Financiera A Fideicomiso En Vida?

We always strive to minimize or avoid legal issues when dealing with nuanced legal or financial matters. To do so, we apply for legal services that, as a rule, are extremely costly. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of a lawyer. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Hillsborough Florida Financial Account Transfer to Living Trust or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is just as effortless if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Hillsborough Florida Financial Account Transfer to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Hillsborough Florida Financial Account Transfer to Living Trust is suitable for you, you can select the subscription option and proceed to payment.

- Then you can download the document in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!