Hollywood Florida Financial Account Transfer to Living Trust: Understanding the Process and Benefits When it comes to estate planning in Hollywood, Florida, one crucial aspect is the transfer of financial accounts to a living trust. This process ensures the seamless transfer of assets and wealth to designated beneficiaries and offers various advantages, including privacy, probate avoidance, and efficient management of assets. In this article, we will provide a detailed description of Hollywood Florida Financial Account Transfer to Living Trust, shedding light on its significance and the different types available. What is a living trust? A living trust, also known as a revocable trust, is a legal entity established while the trust or (or granter) is still alive. It serves as a vehicle for holding and transferring assets, including financial accounts, real estate, investments, and personal property, to beneficiaries upon the trust or's death or incapacity. Additionally, living trusts allow individuals to retain control and use of their assets during their lifetime. Why transfer financial accounts to a living trust? Transferring financial accounts to a living trust in Hollywood, Florida, offers several benefits. Firstly, it ensures privacy as trust documents are not subject to public scrutiny like a will, preserving confidentiality for both the trust or and beneficiaries. Trust administration remains confidential, unlike a probated will, which becomes a matter of public record. The second advantage of a living trust is the avoidance of probate. Probate is a legal process that validates a will and oversees the distribution of assets upon an individual's death. By placing financial accounts in a living trust, they are no longer considered part of the probate estate. This circumvents the potentially lengthy and expensive probate process, providing a faster and more cost-effective distribution of assets to beneficiaries. Types of Hollywood Florida Financial Account Transfer to Living Trust: 1. Bank account transfers: Financial accounts, such as checking, savings, money market accounts, and certificates of deposit, can be transferred to a living trust. Most banks and financial institutions provide account transfer forms, requiring the trust or to specify the trust as the new owner of the account. 2. Investment account transfers: Transfer of investment accounts, including brokerage accounts, stocks, bonds, mutual funds, and retirement accounts (such as IRAs or 401(k)s), to a living trust is also possible. Contacting the financial institution or investment advisor is necessary to initiate the transfer process. 3. Real estate transfers: In addition to financial accounts, real estate properties in Hollywood, Florida, can be transferred to a living trust. The trust becomes the official owner of the property, eliminating the need for probate in case of the trust or's incapacity or death. Legal assistance from a qualified attorney is recommended for real estate transfers. 4. Business account transfers: For business owners, transferring business accounts to a living trust offers peace of mind and simplifies the transition of business ownership upon the trust or's incapacitation or passing. In conclusion, Hollywood Florida Financial Account Transfer to Living Trust is a crucial step in estate planning to ensure the seamless transfer of financial accounts to designated beneficiaries. The advantages of this process include privacy, probate avoidance, and efficient asset management. Various types of accounts can be transferred, such as bank accounts, investment accounts, real estate, and business accounts. To make the most informed decisions, consulting with a knowledgeable attorney or financial advisor specializing in estate planning is highly recommended.

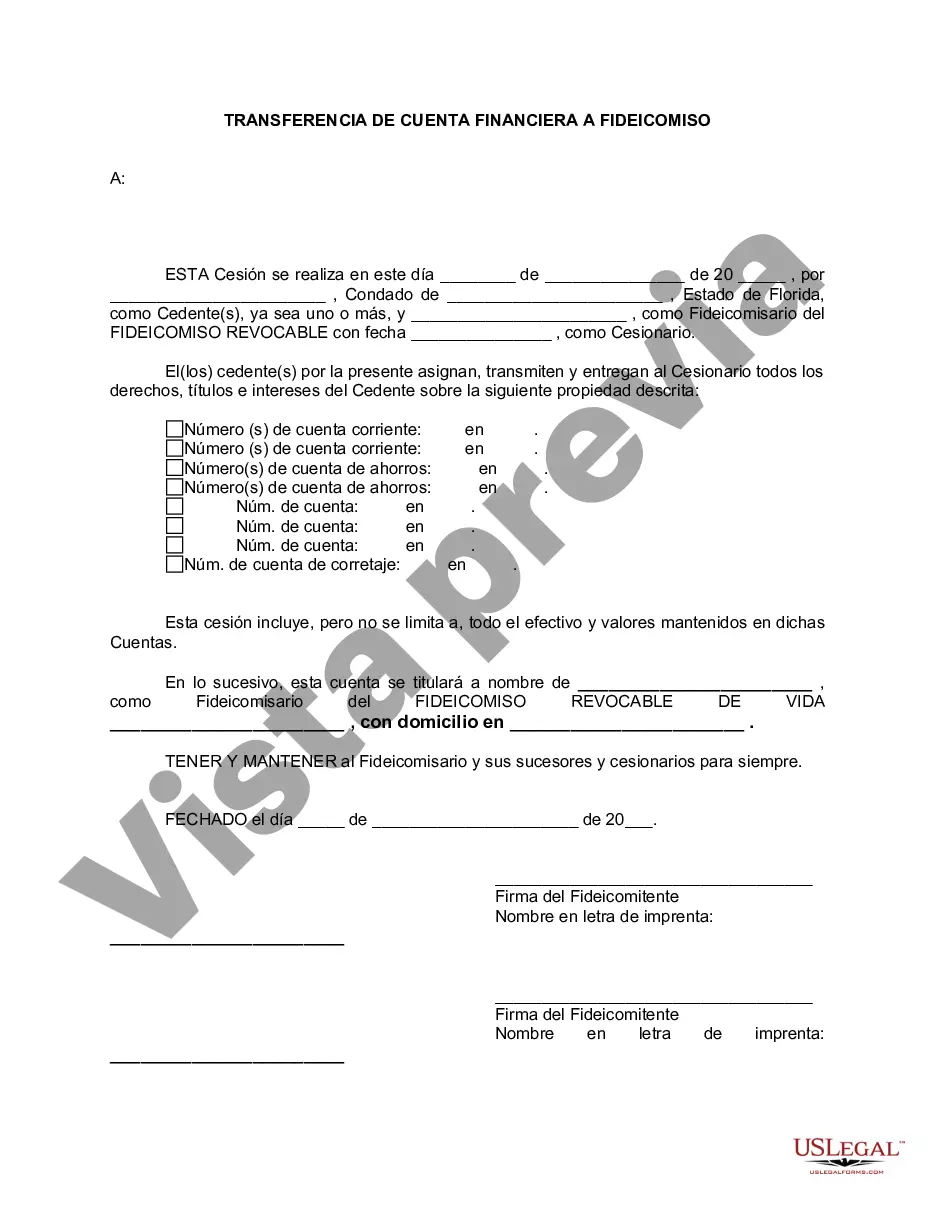

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hollywood Florida Transferencia de cuenta financiera a fideicomiso en vida - Florida Financial Account Transfer to Living Trust

Description

How to fill out Hollywood Florida Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person with no legal education to create this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service offers a massive catalog with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Hollywood Florida Financial Account Transfer to Living Trust or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Hollywood Florida Financial Account Transfer to Living Trust quickly employing our trustworthy service. If you are presently an existing customer, you can go on and log in to your account to get the needed form.

However, in case you are a novice to our library, make sure to follow these steps before obtaining the Hollywood Florida Financial Account Transfer to Living Trust:

- Ensure the form you have chosen is good for your location since the rules of one state or county do not work for another state or county.

- Preview the document and go through a brief outline (if provided) of cases the paper can be used for.

- In case the one you picked doesn’t suit your needs, you can start again and look for the suitable form.

- Click Buy now and choose the subscription plan that suits you the best.

- utilizing your login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Hollywood Florida Financial Account Transfer to Living Trust as soon as the payment is through.

You’re good to go! Now you can go on and print the document or complete it online. If you have any problems locating your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.