Title: Palm Bay Florida Financial Account Transfer to Living Trust: A Detailed Guide Keywords: Palm Bay Florida, financial account transfer, living trust, types Introduction: In Palm Bay, Florida, individuals often consider transferring their financial accounts to a living trust to protect and manage their assets efficiently. This comprehensive guide explores the process, benefits, and different types of financial account transfers to a living trust in Palm Bay, Florida. 1. What is a Living Trust? A living trust is a legal entity created during an individual's lifetime to hold and distribute assets. It allows the granter (the person creating the trust) to retain control over their financial accounts while planning for the management and distribution of these assets after their passing. 2. Importance of Transferring Financial Accounts to a Living Trust: Transferring financial accounts to a living trust offers several advantages, including: — Probate avoidance: By placing assets in a living trust, they bypass the probate process, saving time and costs. — Control and flexibilityGrantersrs can maintain complete control over their assets during their lifetime, determining how they are managed and distributed after their passing. — Privacy: Unlike the probate process, living trusts remain confidential, preventing public access to asset details and distribution plans. — Incapacity planning: Living trusts provide a framework for managing assets and healthcare decisions should the granter become incapacitated. 3. Process of Palm Bay Florida Financial Account Transfer to Living Trust: The financial account transfer process involves the following steps: — Consult with an estate planning attorney: Seek professional advice to understand the legal requirements and implications of the transfer. — Identify financial accounts: Compile a comprehensive list of all financial accounts, including savings, checking, retirement plans, investment portfolios, and life insurance policies. — Revise beneficiary designations: Update beneficiary designations to ensure they align with the living trust's distribution plan. — Prepare necessary legal documents: Work with an attorney to draft or amend the necessary legal documents, including a revocable living trust and funding documents. — Notify financial institutions: Inform each financial institution holding the accounts about the transfer and provide the required documentation for them to process the change. — Execute the transfer: Work with the financial institutions to complete the transfer process, which may involve signing transfer forms, submitting documentation, and following specific procedures. Types of Palm Bay Florida Financial Account Transfer to Living Trust: 1. Bank accounts: This includes savings accounts, checking accounts, certificates of deposit (CDs), and money market accounts. 2. Retirement accounts: Transferring retirement accounts, such as IRAs, 401(k)s, and pensions, to a living trust allows for efficient management and potential tax benefits. 3. Investment portfolios: Stocks, bonds, mutual funds, and other investment holdings can be transferred to a living trust to ensure their proper management and distribution. 4. Life insurance policies: Granters can designate a living trust as the beneficiary of their life insurance policies, ensuring that the proceeds are managed according to their wishes. Conclusion: The Palm Bay Florida Financial Account Transfer to Living Trust process provides individuals with a means to protect and manage their assets effectively. By understanding the different types and benefits of financial account transfers to a living trust, individuals in Palm Bay, Florida can secure their assets and ensure a smooth transition of wealth to their chosen beneficiaries. Seek professional advice to navigate this process and develop a comprehensive estate plan tailored to your specific needs.

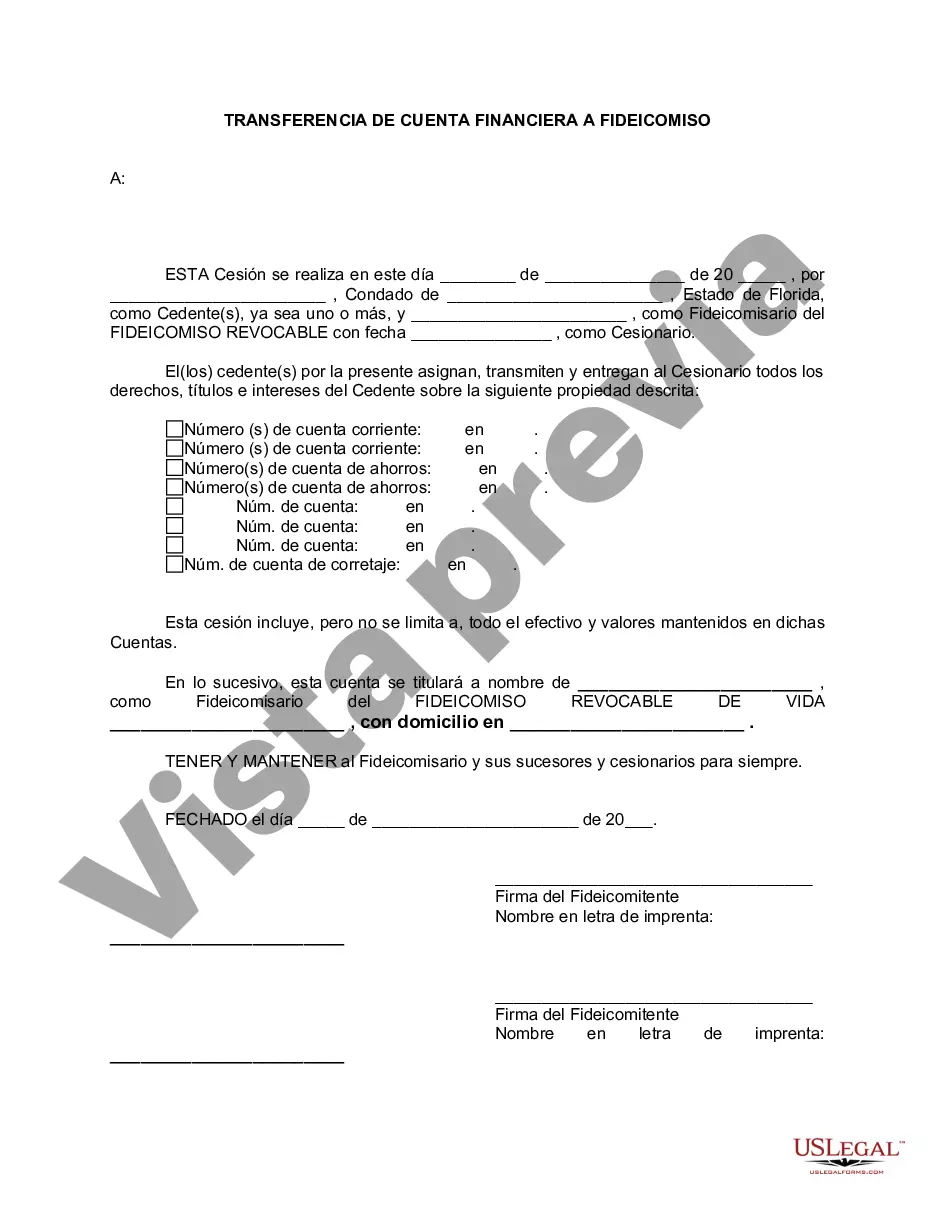

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Bay Florida Transferencia de cuenta financiera a fideicomiso en vida - Florida Financial Account Transfer to Living Trust

Description

How to fill out Palm Bay Florida Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Do you need a reliable and inexpensive legal forms provider to buy the Palm Bay Florida Financial Account Transfer to Living Trust? US Legal Forms is your go-to solution.

No matter if you require a basic arrangement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of specific state and area.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Palm Bay Florida Financial Account Transfer to Living Trust conforms to the regulations of your state and local area.

- Read the form’s details (if available) to find out who and what the form is good for.

- Start the search over if the template isn’t suitable for your specific situation.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Palm Bay Florida Financial Account Transfer to Living Trust in any available file format. You can get back to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending hours researching legal paperwork online for good.