Port St. Lucie Florida Financial Account Transfer to Living Trust

Description

How to fill out Florida Financial Account Transfer To Living Trust?

Regardless of social or professional standing, completing legal documents is an unfortunate requirement in today's workplace.

Often, it is nearly impossible for an individual without any legal training to create these types of documents from scratch, primarily because of the intricate terminology and legal nuances they entail.

This is where US Legal Forms becomes invaluable.

Make sure the template you have located is appropriate for your area, as regulations of one state or county may not apply to another.

Review the form and read a short overview (if available) of situations for which the document can be utilized.

- Our platform provides an extensive library with over 85,000 ready-to-use state-specific templates that cater to nearly every legal scenario.

- US Legal Forms also acts as an exceptional resource for associates or legal advisors aiming to enhance their efficiency by using our DIY forms.

- Whether you require the Port St. Lucie Florida Financial Account Transfer to Living Trust or any other document valid in your state or county, with US Legal Forms, everything is readily accessible.

- Here's how you can obtain the Port St. Lucie Florida Financial Account Transfer to Living Trust in just a few minutes using our dependable platform.

- If you are currently a subscriber, you can go ahead and Log In to your account to access the correct form.

- However, if you are unfamiliar with our library, be sure to follow these steps before downloading the Port St. Lucie Florida Financial Account Transfer to Living Trust.

Form popularity

FAQ

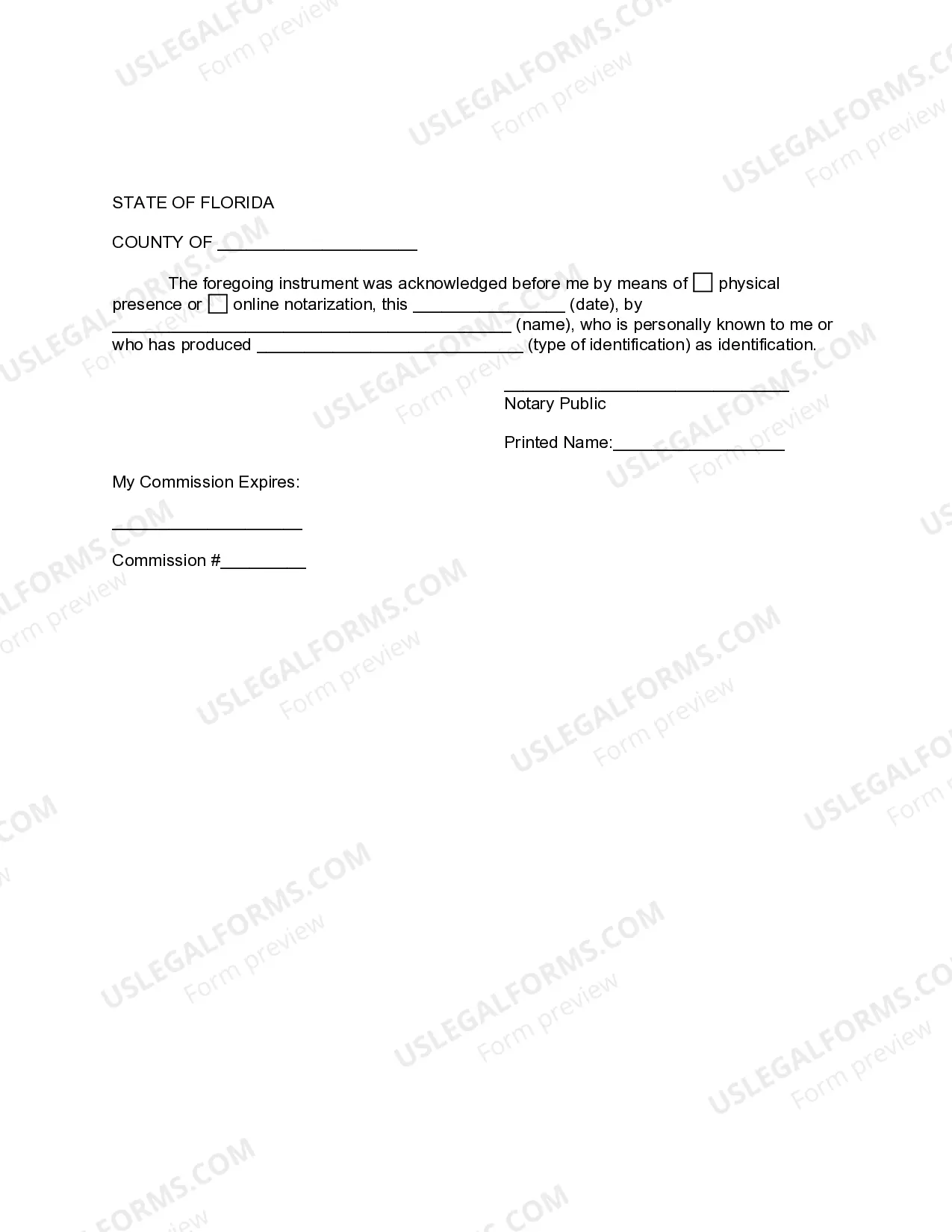

To transfer your property to a living trust in Florida, you need to execute a deed that conveys the property to your trust. This process typically requires signing the new deed before a notary and recording it with the county. Using specialized services, such as those offered by US Legal Forms, can simplify your Port St. Lucie Florida Financial Account Transfer to Living Trust, ensuring accuracy and compliance with state laws.

In Florida, a trust does not need to be filed with the state to be effective. However, maintaining proper documentation and records is vital for the trust's administration. Using a platform like US Legal Forms can help you create and maintain the necessary documents for a seamless Port St. Lucie Florida Financial Account Transfer to Living Trust.

Typically, transferring your property into a trust does not trigger a reassessment in Florida. However, certain situations may alter this outcome, such as changing the ownership structure of the property. It is crucial to consult with a tax advisor or legal expert to navigate the complexities surrounding a Port St. Lucie Florida Financial Account Transfer to Living Trust.

While putting your house in a trust can simplify estate management, it may have drawbacks. For instance, transferring a home into a trust usually requires paperwork and might incur costs. Additionally, it could restrict your ability to refinance easily. Thus, understanding the implications of a Port St. Lucie Florida Financial Account Transfer to Living Trust is essential for proper decision-making.

One common mistake is failing to properly fund the trust. Parents may create a trust but forget to transfer their financial accounts and assets into it. This mistake can lead to complications in the distribution of assets, especially in cases of unexpected events. When considering a Port St. Lucie Florida Financial Account Transfer to Living Trust, ensure all assets are correctly placed within the trust.

Transferring property to a trust in Florida involves several straightforward steps. First, you need to create the trust document, which outlines the terms and beneficiaries of the trust. Then, you must execute a new deed to transfer the property title into the trust’s name. It’s essential to follow the specific laws regarding property transfer in Port St. Lucie, Florida, to ensure a smooth financial account transfer to your living trust.

No, you do not have to record a trust in Florida. The trust operates as a private agreement between the grantor and trustee. However, if the trust holds certain assets, such as real estate, those assets must be retitled to reflect the trust's ownership. For a seamless Port St. Lucie Florida Financial Account Transfer to Living Trust, consider using a reliable platform, like US Legal Forms, to help you navigate the process with ease.

In Florida, a living trust does not need to be recorded with any government entity. Living trusts are private documents and generally remain confidential, which can be advantageous for those concerned about privacy. However, certain assets, like real property, may require further action to retitle in the trust's name. If you are considering a Port St. Lucie Florida Financial Account Transfer to Living Trust, ensure all necessary assets are properly titled.

One downside to a living trust in Florida is that it may not provide comprehensive protection against creditors. While a living trust effectively manages your assets during your lifetime, it does not shield those assets from lawsuits or claims made by creditors. Additionally, setting up a living trust can require significant time and financial investment, particularly when transferring financial accounts. Therefore, if you consider a Port St. Lucie Florida Financial Account Transfer to Living Trust, weigh these factors carefully.

To transfer accounts to a trust, start by identifying the financial accounts you wish to place into your living trust. Next, contact your financial institutions to request the necessary documentation or forms for a Port St. Lucie Florida Financial Account Transfer to Living Trust. Once completed, you will need to submit these forms along with your trust documents to the institutions. This process ensures that your assets are properly managed under your trust, offering enhanced control and protection for your beneficiaries.