West Palm Beach Florida Financial Account Transfer to Living Trust: A Comprehensive Guide In West Palm Beach, Florida, transferring financial accounts to a living trust can be a crucial step in estate planning, ensuring a smooth and efficient management of your assets both during your lifetime and after your passing. This comprehensive guide will walk you through the process and shed light on different types of West Palm Beach Florida financial account transfers to living trusts. A living trust, also known as a revocable trust, is a legal document that allows you to transfer your assets, including financial accounts, into a trust during your lifetime. This ensures that your assets are properly managed and distributed according to your wishes, while also avoiding the probate process. By establishing a living trust, you have control over your financial accounts and the ability to make changes or revoke the trust as long as you are mentally capable. There are several types of financial account transfers to living trusts in West Palm Beach, Florida, based on the nature and ownership of the accounts. Let's explore these options: 1. Bank Accounts: This includes checking, savings, money market accounts, and certificates of deposit (CDs). By re-titling these accounts in the name of your living trust, they become trust assets. You retain control as the trustee and can freely manage and access funds as needed during your lifetime. 2. Investment Accounts: Transferring investment accounts to your living trust can encompass stocks, bonds, mutual funds, brokerage accounts, and other securities. By changing the ownership to the trust, you ensure that these assets smoothly transition to your designated beneficiaries upon your passing, avoiding the delay and cost associated with probate. 3. Retirement Accounts: These are accounts that include IRAs (Individual Retirement Accounts), 401(k)s, and pension plans. Although it's generally not recommended to transfer retirement accounts to a living trust, you may name your trust as the primary or contingent beneficiary, ensuring seamless distribution to your intended beneficiaries. 4. Real Estate: While not an account per se, transferring real estate properties you own in West Palm Beach, Florida, to your living trust is crucial. By doing so, you maintain control over these properties during your lifetime, and upon your passing, they can be efficiently managed and distributed according to your wishes, avoiding the probate process. 5. Business Accounts: If you own a business in West Palm Beach, Florida, transferring your business accounts, such as business checking or savings accounts, to your living trust can provide a clear succession plan and ensure the continuity of your business operations after your passing. It's important to note that the process of transferring financial accounts to a living trust requires diligent documentation and coordination with the financial institutions involved. Seek the guidance of an experienced estate planning attorney in West Palm Beach, Florida, who can provide personalized advice and assist in ensuring that your financial account transfers to your living trust are done correctly. In summary, West Palm Beach Florida financial account transfers to living trusts allow individuals to proactively manage and preserve their wealth, ensuring a smooth transition of assets to their intended beneficiaries. By understanding the various types of accounts eligible for transfer, you can make informed decisions to protect your financial future and ensure the maximum benefits of a living trust.

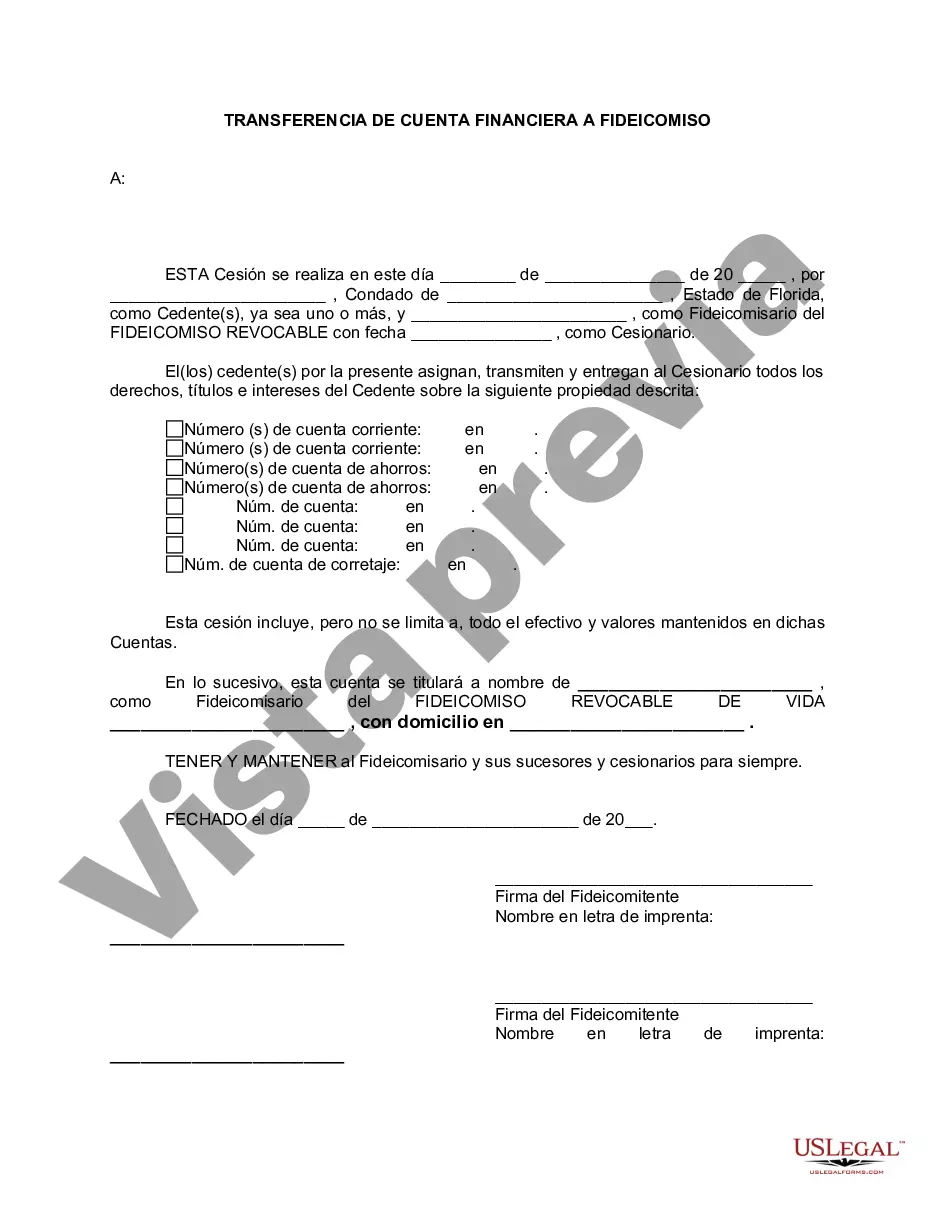

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Palm Beach Florida Transferencia de cuenta financiera a fideicomiso en vida - Florida Financial Account Transfer to Living Trust

Description

How to fill out West Palm Beach Florida Transferencia De Cuenta Financiera A Fideicomiso En Vida?

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for attorney services that, as a rule, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the West Palm Beach Florida Financial Account Transfer to Living Trust or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the West Palm Beach Florida Financial Account Transfer to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the West Palm Beach Florida Financial Account Transfer to Living Trust would work for your case, you can select the subscription plan and make a payment.

- Then you can download the form in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!