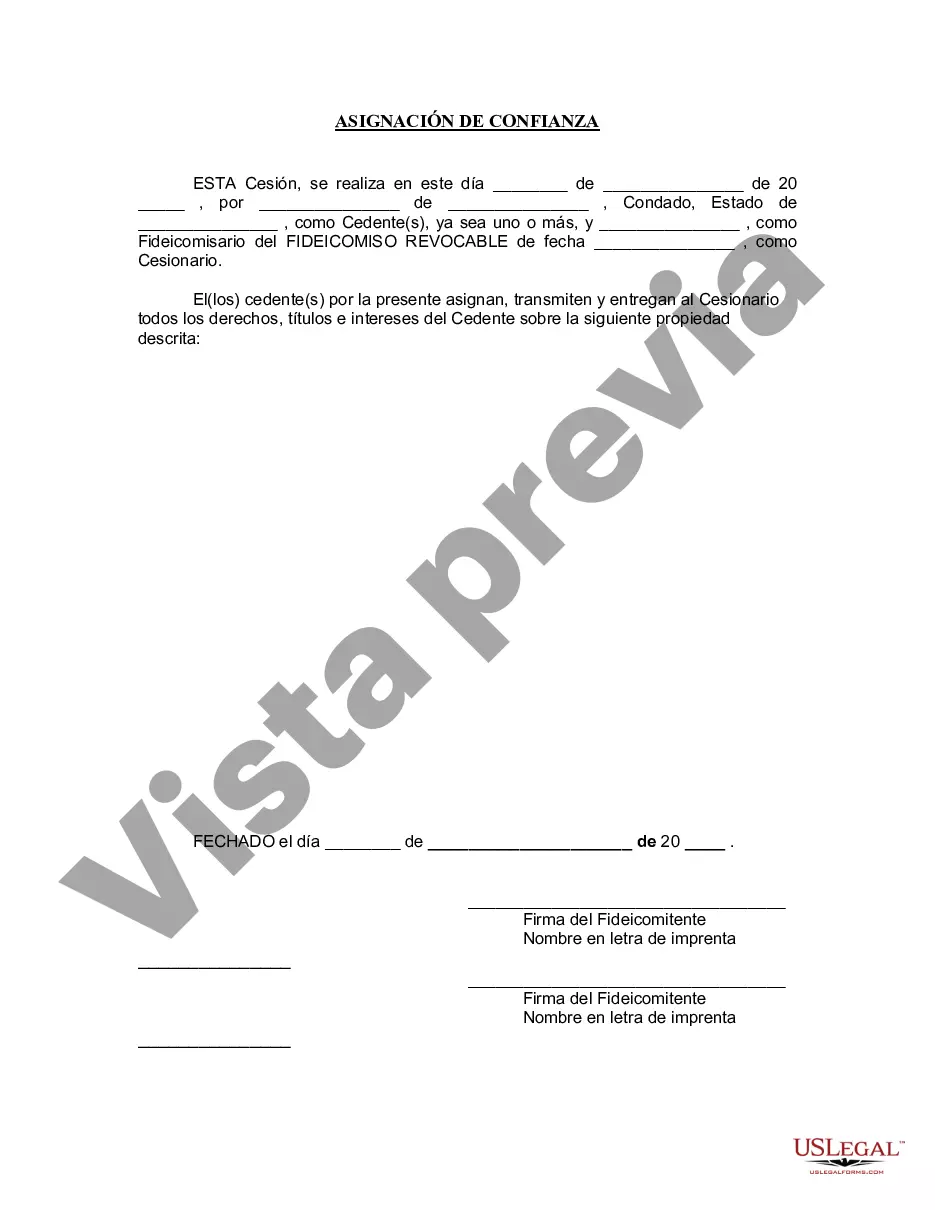

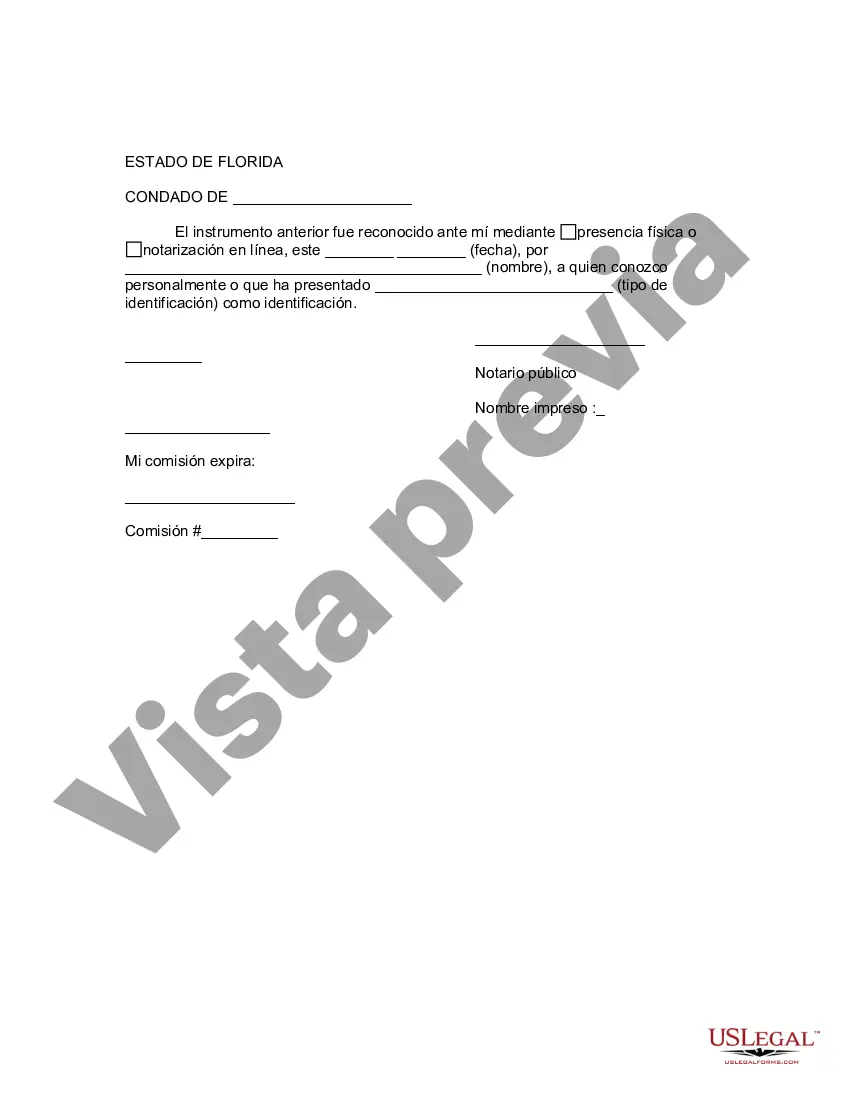

Pembroke Pines, Florida Assignment to Living Trust: A Comprehensive Overview In Pembroke Pines, Florida, an assignment to living trust is a legal document executed by an individual (referred to as the "granter" or "settler") to transfer their assets and properties into a living trust for the benefit of their chosen beneficiaries. This assignment serves to ensure the seamless transfer of assets, avoid probate, and provide flexibility in managing and distributing one's estate. The Pembroke Pines Assignment to Living Trust is regarded as an essential component of comprehensive estate planning. By establishing a living trust, individuals can determine how their assets will be managed during their lifetime, designate successor trustees to handle the trust in case of incapacity or death, and specify the distribution of assets upon their passing. This process ensures a smoother transition of wealth to beneficiaries and allows for customization according to the granter's specific wishes. Types of Pembroke Pines Florida Assignment to Living Trust: 1. Revocable Living Trust: This is the most common type of living trust established in Pembroke Pines, Florida. It allows the granter to retain control over the trust assets during their lifetime, amend or revoke the trust at any time, and make changes to beneficiaries or distribution instructions. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be modified or revoked once established, except under limited circumstances. It offers tax advantages and asset protection, making it an attractive option for individuals looking to protect their wealth from estate taxes, creditors, or long-term care costs. 3. Testamentary Living Trust: This type of living trust is created through a last will and testament and only comes into effect upon the granter's death. It allows for more flexibility in the distribution of assets and ensures the assets are administered according to the granter's specific instructions. 4. Special Needs Trust: A special needs trust is designed to provide financial support for individuals with disabilities while allowing them to retain eligibility for government benefits. It helps protect the assets for the beneficiary's care and support, supplementing any public assistance they may receive. 5. Charitable Remainder Trust: This trust allows the granter to contribute assets to benefit a charitable organization while retaining a stream of income during their lifetime. It provides tax benefits and allows individuals to support the causes they care about while enjoying financial security. In conclusion, the Pembroke Pines, Florida Assignment to Living Trust plays a crucial role in estate planning for individuals who wish to protect their assets, avoid probate, and ensure that their loved ones are properly provided for. Whether it is a revocable or irrevocable living trust, or a specialized trust such as a testamentary trust, special needs trust, or charitable remainder trust, seeking professional legal advice is highly recommended to address individual needs and ensure compliance with state laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pembroke Pines Florida Asignación a un fideicomiso en vida - Florida Assignment to Living Trust

Description

How to fill out Pembroke Pines Florida Asignación A Un Fideicomiso En Vida?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone without any law background to draft this sort of papers cfrom the ground up, mainly due to the convoluted jargon and legal nuances they come with. This is where US Legal Forms can save the day. Our service offers a massive library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you want the Pembroke Pines Florida Assignment to Living Trust or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Pembroke Pines Florida Assignment to Living Trust quickly using our reliable service. In case you are presently a subscriber, you can go ahead and log in to your account to download the appropriate form.

However, if you are a novice to our platform, make sure to follow these steps prior to obtaining the Pembroke Pines Florida Assignment to Living Trust:

- Be sure the template you have found is suitable for your location since the regulations of one state or county do not work for another state or county.

- Review the form and go through a short description (if provided) of cases the paper can be used for.

- In case the form you selected doesn’t suit your needs, you can start over and look for the needed document.

- Click Buy now and pick the subscription plan that suits you the best.

- Access an account {using your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Pembroke Pines Florida Assignment to Living Trust once the payment is through.

You’re good to go! Now you can go ahead and print out the form or complete it online. In case you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.