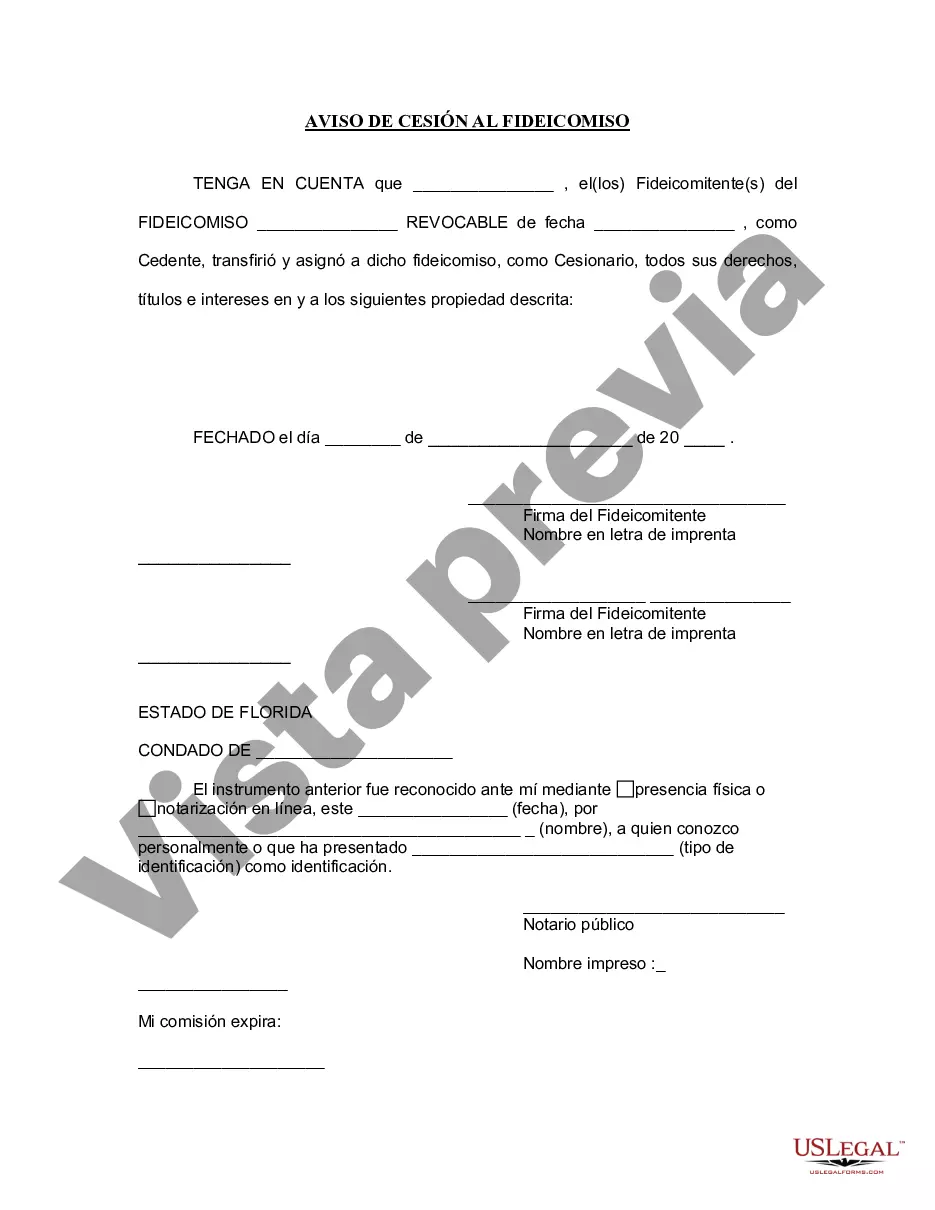

The Broward Florida Notice of Assignment to Living Trust is a legal document that facilitates the transfer of assets into a living trust in Broward County, Florida. This notice serves as formal notification to creditors, beneficiaries, and interested parties that specific assets have been assigned to a living trust. A living trust is a popular estate planning tool that allows individuals to manage and distribute their assets during their lifetime and upon their death. By placing assets into a living trust, they can avoid probate, maintain privacy, and ensure a smooth transfer of wealth to their desired beneficiaries. There are different types of Broward Florida Notices of Assignment to Living Trust that cater to specific scenarios and asset types. These may include: 1. Real Estate Notice of Assignment to Living Trust: This type of notice is utilized when real property, such as a house, apartment, or land, is transferred into a living trust. 2. Financial Account Notice of Assignment to Living Trust: This notice is used when financial accounts, such as bank accounts, retirement accounts, or investment accounts, are assigned to a living trust. 3. Personal Property Notice of Assignment to Living Trust: This type of notice is applicable when personal assets, such as jewelry, artwork, vehicles, or furniture, are assigned to a living trust. 4. Business Interests Notice of Assignment to Living Trust: This notice is used when ownership interests in a business, including shares of stock, partnership interests, or membership interests, are transferred into a living trust. It is essential to prepare and file the Broward Florida Notice of Assignment to Living Trust accurately, as any errors or omissions may lead to complications or the assets being excluded from the trust. Consulting an estate planning attorney is highly recommended ensuring compliance with Florida laws and to address any specific concerns or requirements. With the Broward Florida Notice of Assignment to Living Trust, individuals can proactively manage their estate, protect their assets, and ensure a smooth transition of wealth to their loved ones.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Aviso de cesión a un fideicomiso en vida - Florida Notice of Assignment to Living Trust

Description

How to fill out Broward Florida Aviso De Cesión A Un Fideicomiso En Vida?

Take advantage of the US Legal Forms and get immediate access to any form sample you require. Our helpful platform with thousands of templates allows you to find and obtain almost any document sample you need. You are able to download, fill, and sign the Broward Florida Notice of Assignment to Living Trust in just a matter of minutes instead of surfing the Net for several hours seeking the right template.

Using our collection is a superb way to improve the safety of your form filing. Our experienced legal professionals on a regular basis review all the records to ensure that the templates are relevant for a particular state and compliant with new acts and regulations.

How do you obtain the Broward Florida Notice of Assignment to Living Trust? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. Furthermore, you can get all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions listed below:

- Open the page with the form you need. Make certain that it is the form you were seeking: examine its title and description, and use the Preview function when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the downloading procedure. Select Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order with a credit card or PayPal.

- Download the file. Choose the format to obtain the Broward Florida Notice of Assignment to Living Trust and change and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and reliable document libraries on the web. We are always ready to assist you in any legal case, even if it is just downloading the Broward Florida Notice of Assignment to Living Trust.

Feel free to make the most of our form catalog and make your document experience as efficient as possible!