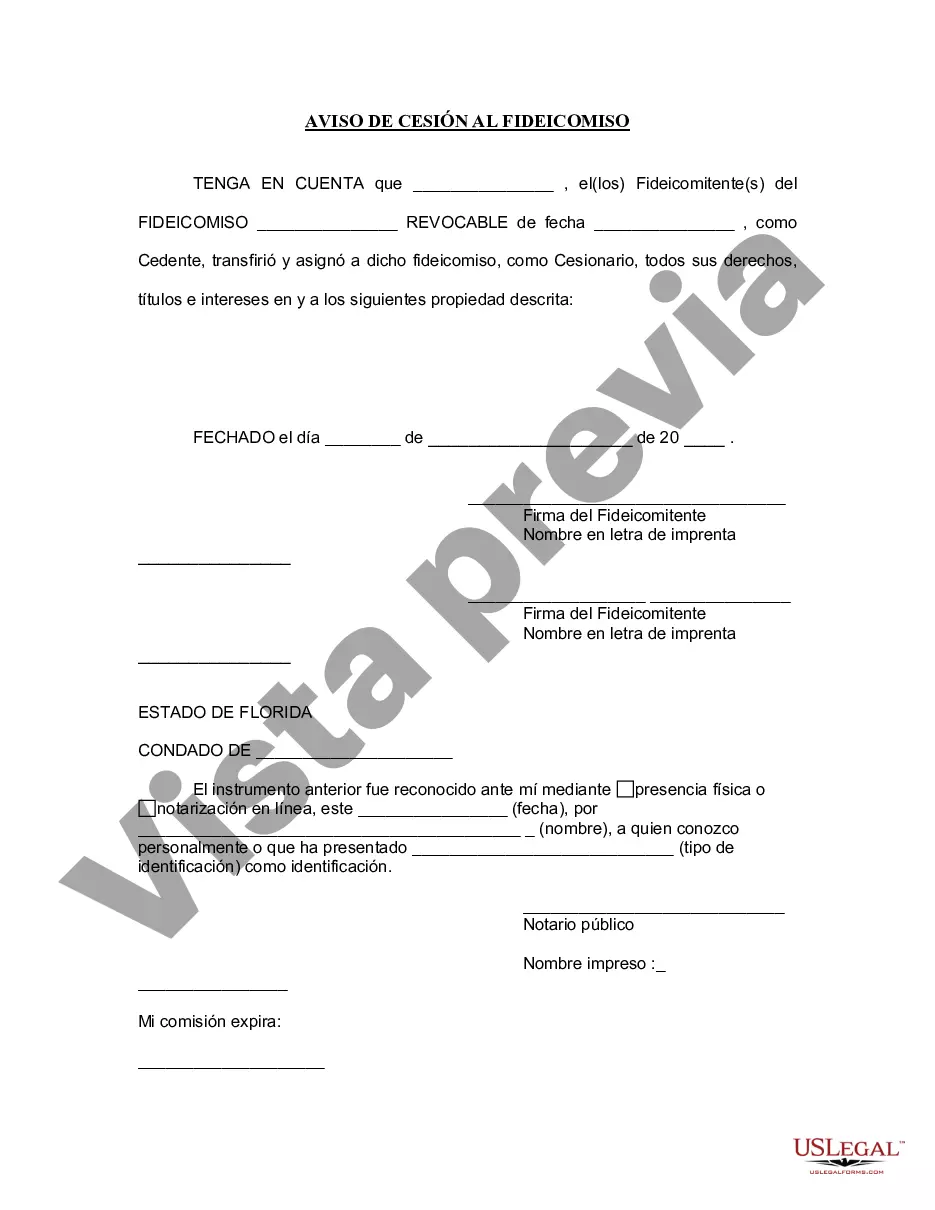

Gainesville Florida Notice of Assignment to Living Trust is a legal document that conveys a property owner's intention to transfer their assets into a living trust. This notice is a crucial step in the estate planning process and ensures seamless asset management and distribution, both during the owner's lifetime and after their demise. The Notice of Assignment to Living Trust effectively transfers the ownership of various assets, such as real estate, stocks, bonds, bank accounts, and personal belongings, to the trust. By creating a living trust, individuals in Gainesville, Florida can enjoy several benefits, including asset protection, avoiding probate, maintaining privacy, and facilitating the transfer of assets to beneficiaries. A Notice of Assignment to Living Trust specifically identifies the property being transferred, establishes the trust as the new legal owner, and provides instructions for any necessary legal procedures. It's important to note that there are different types of Gainesville Florida Notice of Assignment to Living Trust, depending on the specific assets being transferred. For instance, if the property owner wants to transfer real estate, a separate Notice of Assignment to Living Trust for real property is required. Similarly, there are different forms for vehicles, bank accounts, investment accounts, and personal belongings. These variations ensure that each asset category is adequately accounted for and included in the living trust. To properly complete a Gainesville Florida Notice of Assignment to Living Trust, it is advisable to consult with an experienced estate planning attorney. The attorney will guide individuals through the process, ensuring that all legal requirements are fulfilled. This includes properly identifying and labeling each asset, obtaining necessary signatures and witness verifications, and filing the notice with the appropriate agencies, such as the county recorder's office. In conclusion, Gainesville Florida Notice of Assignment to Living Trust is a vital legal document used to transfer ownership of various assets into a living trust. By executing this notice, individuals can effectively plan for the management and distribution of their assets, ensuring a seamless transition both during their lifetime and after their passing. It is crucial to consult with an attorney to ensure compliance with all legal requirements and to address any specific asset types that may require separate notices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Gainesville Florida Aviso de cesión a un fideicomiso en vida - Florida Notice of Assignment to Living Trust

Description

How to fill out Gainesville Florida Aviso De Cesión A Un Fideicomiso En Vida?

Benefit from the US Legal Forms and obtain instant access to any form template you want. Our helpful platform with a huge number of templates makes it easy to find and get almost any document sample you require. You can download, complete, and certify the Gainesville Florida Notice of Assignment to Living Trust in a matter of minutes instead of browsing the web for many hours seeking an appropriate template.

Using our catalog is a superb way to raise the safety of your record filing. Our professional attorneys on a regular basis check all the documents to make sure that the templates are relevant for a particular state and compliant with new laws and regulations.

How can you get the Gainesville Florida Notice of Assignment to Living Trust? If you have a profile, just log in to the account. The Download button will be enabled on all the documents you look at. Additionally, you can get all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions below:

- Open the page with the template you need. Make certain that it is the template you were hoping to find: examine its title and description, and take take advantage of the Preview function when it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the downloading process. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Export the document. Indicate the format to get the Gainesville Florida Notice of Assignment to Living Trust and modify and complete, or sign it for your needs.

US Legal Forms is probably the most significant and reliable form libraries on the web. We are always happy to help you in any legal process, even if it is just downloading the Gainesville Florida Notice of Assignment to Living Trust.

Feel free to take advantage of our platform and make your document experience as convenient as possible!