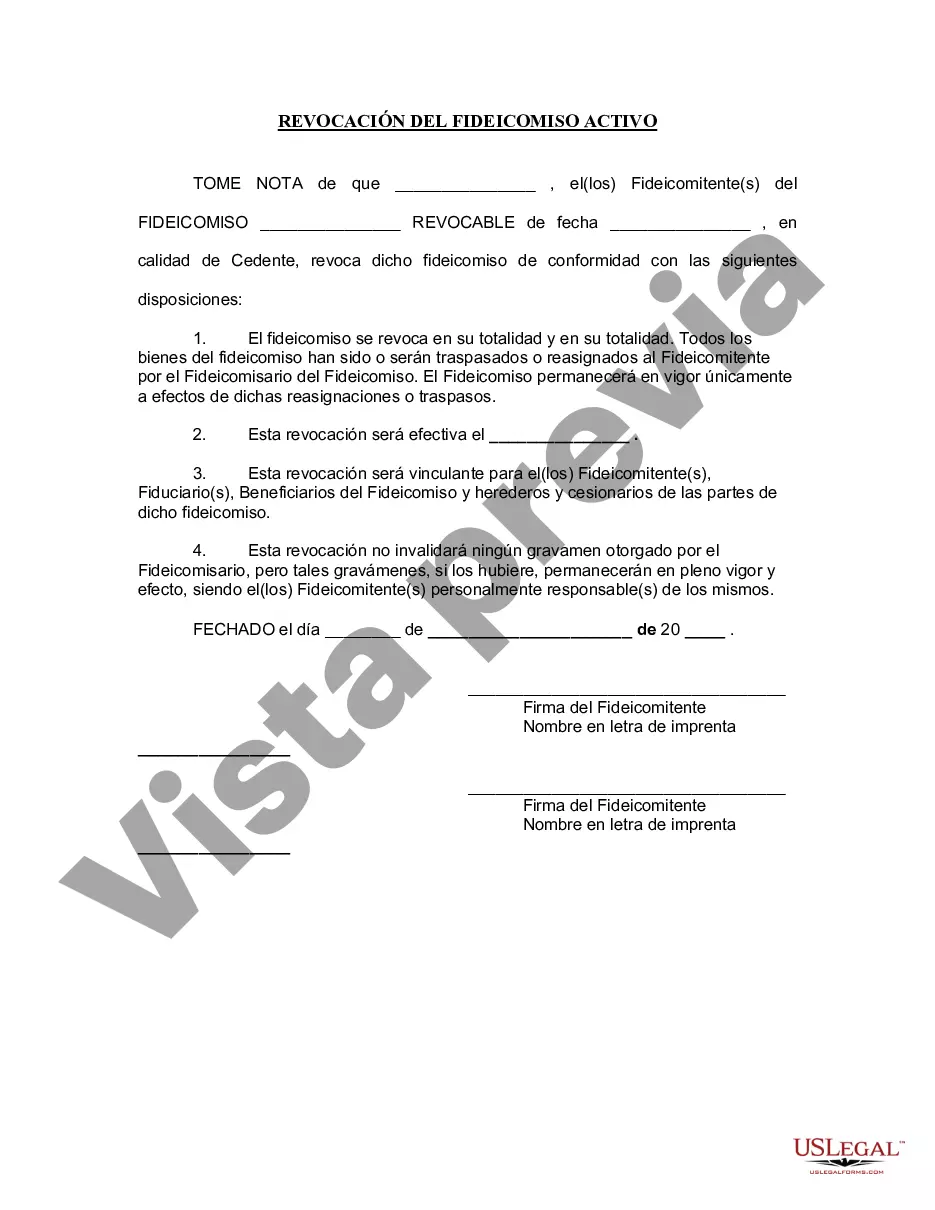

Coral Springs Florida Revocation of Living Trust: A Comprehensive Guide Introduction: In Coral Springs, Florida, revoking a living trust is a critical legal process that allows individuals to modify or cancel the terms of their existing living trust. A living trust is a legal document created by individuals to hold and manage their assets during their lifetime and control their distribution upon death. However, circumstances may arise where the original terms of the trust need to be altered or terminated. This article will provide a detailed description of the Coral Springs Florida Revocation of Living Trust process, including its legal implications and potential reasons for revocation. 1. What is a Living Trust? A living trust, also known as an inter vivos trust, is a legal arrangement where an individual (the granter or settler) transfers their assets into a trust during their lifetime. The granter retains control over the trust assets as the trustee, and also names beneficiaries who will benefit from the assets upon the granter's death. However, circumstances may change over time, leading to the need for revocation. 2. Reasons for Revoking a Living Trust: a) Change in Circumstances: Life is unpredictable, and situations such as divorce, remarriage, birth, death, or changes in financial status can necessitate modifications to the living trust to ensure it aligns with the granter's current wishes. b) Change in Property: If the granter acquires or disposes of significant assets, they may decide to update the living trust accordingly to include or exclude these new assets. c) Beneficiary Alterations: The original beneficiaries named in the trust may no longer be appropriate due to changed relationships, estrangement, or personal preferences. Revocation allows for the reshuffling of beneficiaries. 3. Types of Coral Springs Florida Revocation of Living Trust: a) Partial Revocation: This form of revocation allows the granter to modify specific provisions or assets within the living trust while keeping the remaining terms intact. For instance, if the granter wants to remove one beneficiary and replace them with another, a partial revocation would be appropriate. b) Full Revocation: In this scenario, the entire living trust is canceled, rendering it null and void. Full revocation is often pursued when the granter intends to create a new living trust or wishes to terminate the trust entirely. c) Temporary Suspension: In some cases, a granter may want to temporarily suspend the living trust, perhaps to address specific legal or financial matters. This suspension allows for flexibility in managing the trust while maintaining its overall structure and intent. 4. The Revocation Process: a) Review the Trust Document: The granter should carefully review the original living trust document to understand its terms, conditions, and any stipulations related to revocation or modification. b) Consult an Attorney: Seeking professional legal advice is crucial to ensure compliance with Florida state laws governing living trusts and to draft a valid revocation document that adheres to specific requirements. c) Drafting Revocation Document: A revocation document must be appropriately formatted, signed, dated, and notarized to hold legal validity. The document should clearly state the granter's intent to revoke, any specific modifications, and reference the original living trust. d) Serving Notice: It is essential to inform all interested parties, including beneficiaries and co-trustees, about the revocation to avoid any potential disputes or challenges to its validity. e) Filing and Record Keeping: The revocation document should be properly filed along with any necessary fees required by the Coral Springs court or relevant authorities. Maintaining copies of the revocation and all associated documents is imperative for future reference. Conclusion: The revocation of a living trust in Coral Springs, Florida, enables granters to adapt their estate plans to changing circumstances, ensuring their wishes are accurately reflected. Whether through partial or full revocation, the process involves careful planning, legal expertise, and thoughtful consideration of the trust's terms and beneficiaries. Consulting an experienced attorney throughout the revocation process is highly recommended ensuring compliance with state laws and to protect the granter's interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Coral Springs Florida Revocación de fideicomiso en vida - Florida Revocation of Living Trust

Description

How to fill out Coral Springs Florida Revocación De Fideicomiso En Vida?

Are you looking for a trustworthy and inexpensive legal forms provider to get the Coral Springs Florida Revocation of Living Trust? US Legal Forms is your go-to solution.

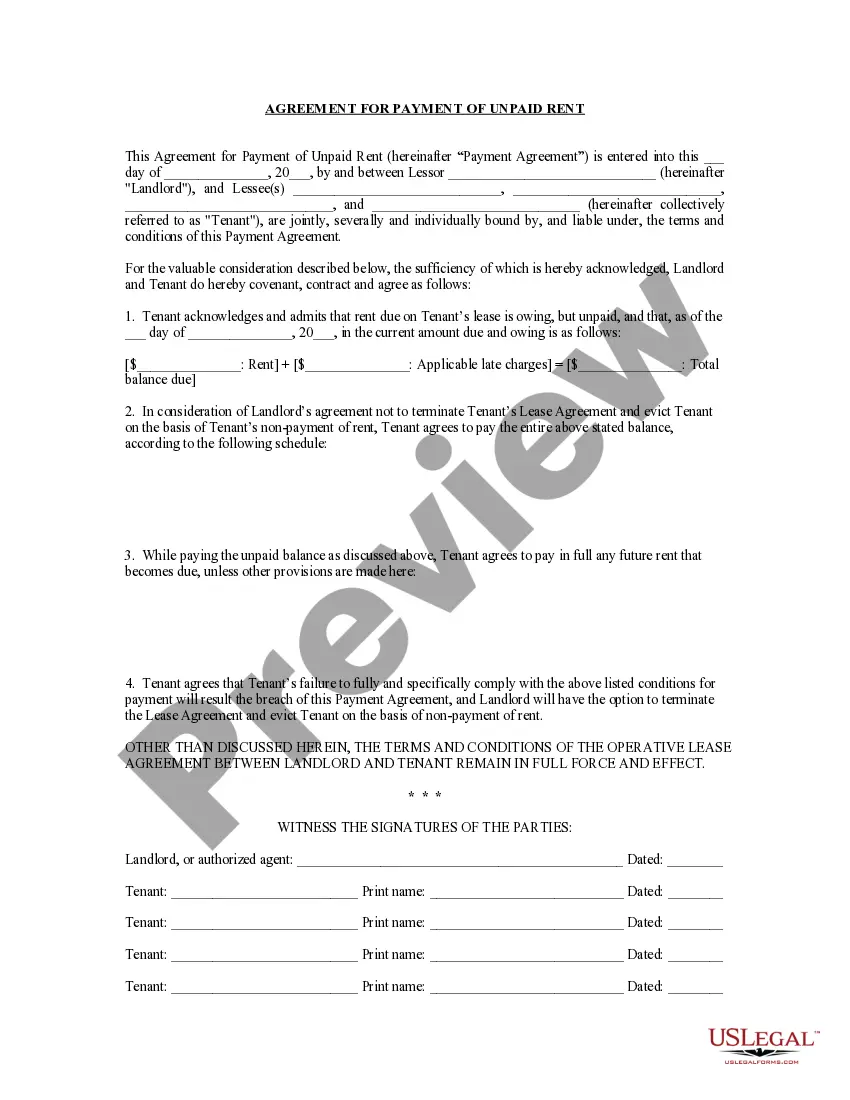

No matter if you need a basic agreement to set regulations for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed based on the requirements of separate state and area.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Coral Springs Florida Revocation of Living Trust conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the form is intended for.

- Start the search over in case the template isn’t suitable for your legal situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is done, download the Coral Springs Florida Revocation of Living Trust in any available format. You can return to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online once and for all.