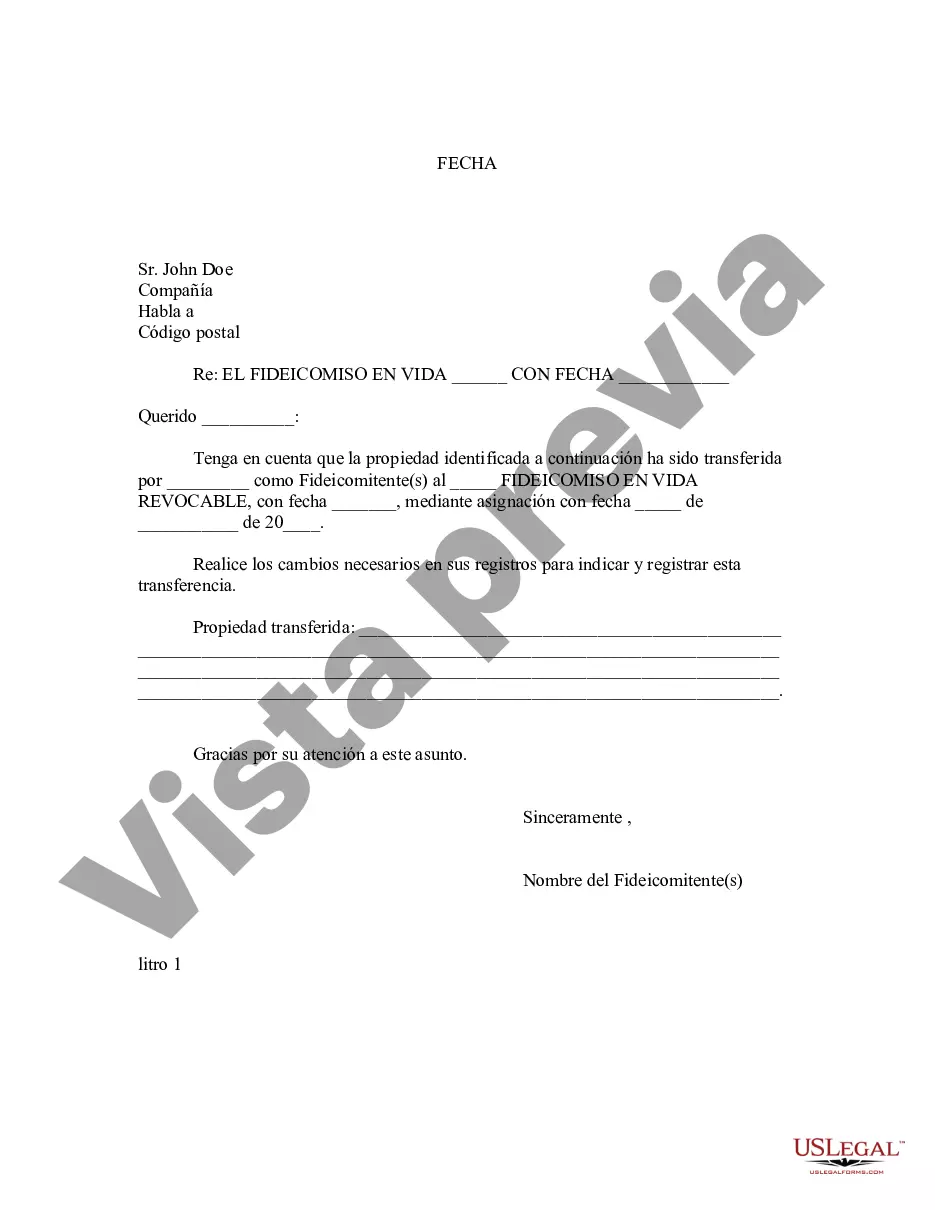

Miramar, Florida Letter to Lien holder to Notify of Trust — Detailed Description In Miramar, Florida, when an individual creates a trust to protect and manage their assets, it is necessary to inform the lien holder about this legal entity. By sending a letter to the lien holder, one can ensure that the trust is recognized, and the lien holder acknowledges its existence and the potential impact it may have on any financial transactions. The purpose of the Miramar, Florida Letter to Lien holder to Notify of Trust is to officially notify the lien holder that certain assets have been transferred into a trust and are no longer available for personal liability or attachment. This document provides a clear understanding of the intent behind establishing the trust and informs the lien holder about the new owner of the assets. Key elements that should be included in the letter are: 1. Trust Information: — Full legal namthrustersus— - Date of trust creation — Identification of thgranteror (trust creator) and the trustee(s) appointed to manage the trust 2. Lien holder Details: — NamAtheneesoldererer — Contact information (address, phone number, email) 3. Asset Description: — Precise identification and description of the assets that have been placed into the trust (e.g., real estate, vehicles, financial accounts) 4. Intent and Purpose: — Clearly state that the purpose of the letter is to notify the lien holder about the establishment of the trust and potential limitations it may impose on personal liability or attachment to the mentioned assets. 5. Request for Confirmation: Atheneen holderer to acknowledge receipt of the letter and confirm their understanding of the impact the trust may have on potential future transactions involving the assets. Different Types of Miramar, Florida Letter to Lien holder to Notify of Trust: 1. Irrevocable Trust Letter to Lien holder: This type of letter is used to notify the lien holder specifically about an irrevocable trust, which means the terms of the trust cannot be altered or terminated without the consent of the beneficiaries. 2. Revocable Trust Letter to Lien holder: In contrast to an irrevocable trust, this letter is utilized to inform the lien holder about a revocable trust that can be modified or revoked by the granter during their lifetime. 3. Testamentary Trust Letter to Lien holder: When a trust is established upon the granter's death, this letter is sent to the lien holder to notify them about a testamentary trust. Such trusts are created according to the instructions specified in the granter's will. In summary, the Miramar, Florida Letter to Lien holder to Notify of Trust serves as an essential legal communication to inform lien holders about the establishment of a trust and provide them with the necessary details about the assets involved. It is crucial to choose the appropriate type of letter based on the nature of the trust (irrevocable, revocable, testamentary) and ensure that the lien holder acknowledges and understands the implications of the trust on future transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miramar Florida Carta al acreedor prendario para notificar el fideicomiso - Florida Letter to Lienholder to Notify of Trust

Description

How to fill out Miramar Florida Carta Al Acreedor Prendario Para Notificar El Fideicomiso?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Miramar Florida Letter to Lienholder to Notify of Trust becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Miramar Florida Letter to Lienholder to Notify of Trust takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Miramar Florida Letter to Lienholder to Notify of Trust. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!