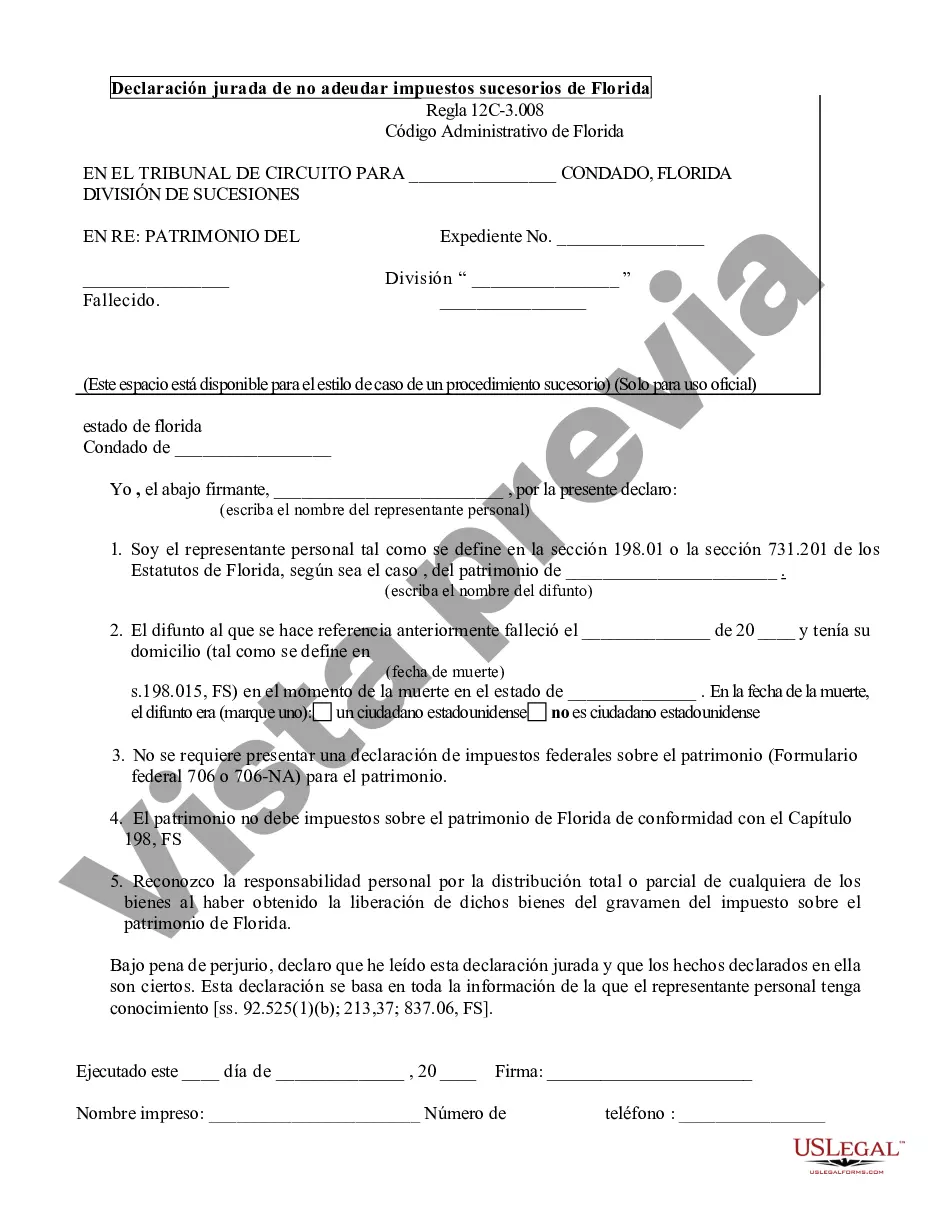

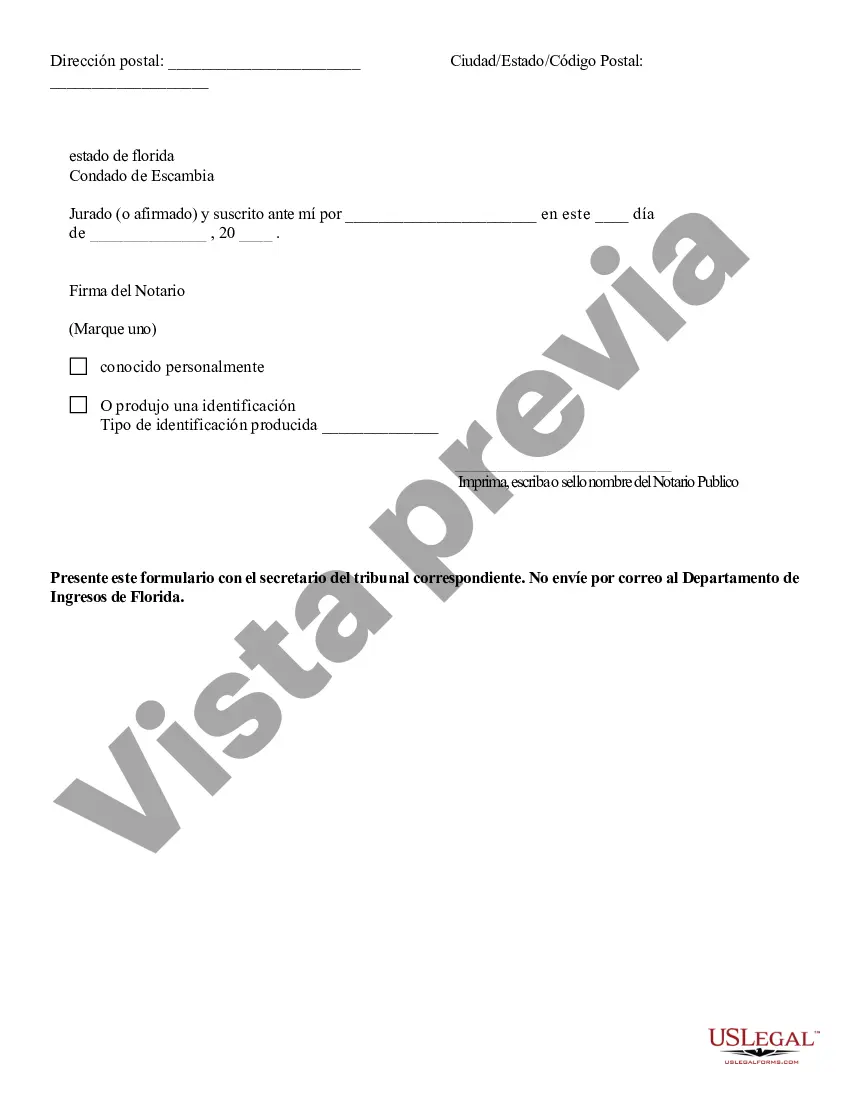

The Fort Lauderdale Affidavit of No Florida Estate Tax Due is a legal document used in Broward County, Florida to declare that no estate taxes are owed on a deceased person's estate. This affidavit is typically required when settling the estate and distributing the decedent's assets to heirs and beneficiaries. One type of Fort Lauderdale Affidavit of No Florida Estate Tax Due is the Affidavit of No Florida Estate Tax Due for Estates with a Date of Death on or after January 1, 2005. This affidavit is used for estates where the date of death of the decedent falls on or after January 1, 2005, and no Florida estate taxes are owed. Another type is the Affidavit of No Florida Estate Tax Due for Estates with a Date of Death before January 1, 2005. This affidavit is used for estates where the date of death of the decedent is before January 1, 2005, and no Florida estate taxes are owed. To complete the Fort Lauderdale Affidavit of No Florida Estate Tax Due, the executor or personal representative of the estate must provide key information such as the decedent's name, date of death, and social security number. It may also require details about the estate assets, including real estate properties, bank accounts, investments, and other valuable possessions. The affidavit must be supported by relevant documentation, such as a certified copy of the decedent's death certificate and any other relevant documents pertaining to the assets and liabilities of the estate. It is important to ensure the accuracy of the information provided in the affidavit, as any false statements can result in legal consequences. Once the Fort Lauderdale Affidavit of No Florida Estate Tax Due is completed and signed by the executor or personal representative, it should be filed with the Broward County Clerk of Courts. The filing fee should be paid, and the affidavit should be submitted within the required timeframe, as failure to do so may lead to penalties or delays in the estate settlement process. In conclusion, the Fort Lauderdale Affidavit of No Florida Estate Tax Due is a crucial document used in Broward County to declare that no estate taxes are owed on an individual's estate. It is essential to accurately complete the affidavit and provide supporting documentation to ensure a smooth estate settlement process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fort Lauderdale Declaración jurada de no adeudar impuestos sucesorios de Florida - Affidavit of No Florida Estate Tax Due

Description

How to fill out Fort Lauderdale Declaración Jurada De No Adeudar Impuestos Sucesorios De Florida?

Take advantage of the US Legal Forms and have instant access to any form template you need. Our useful platform with a huge number of templates makes it simple to find and obtain virtually any document sample you will need. You are able to download, fill, and certify the Fort Lauderdale Affidavit of No Florida Estate Tax Due in a couple of minutes instead of surfing the Net for many hours attempting to find an appropriate template.

Using our catalog is an excellent strategy to improve the safety of your form submissions. Our experienced lawyers on a regular basis check all the records to ensure that the templates are appropriate for a particular region and compliant with new laws and polices.

How do you obtain the Fort Lauderdale Affidavit of No Florida Estate Tax Due? If you have a profile, just log in to the account. The Download button will appear on all the documents you look at. Furthermore, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the tips listed below:

- Open the page with the template you require. Ensure that it is the form you were looking for: verify its headline and description, and make use of the Preview option when it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the saving process. Click Buy Now and select the pricing plan that suits you best. Then, create an account and process your order utilizing a credit card or PayPal.

- Download the file. Indicate the format to obtain the Fort Lauderdale Affidavit of No Florida Estate Tax Due and revise and fill, or sign it for your needs.

US Legal Forms is among the most considerable and reliable template libraries on the web. We are always ready to help you in any legal case, even if it is just downloading the Fort Lauderdale Affidavit of No Florida Estate Tax Due.

Feel free to make the most of our service and make your document experience as convenient as possible!