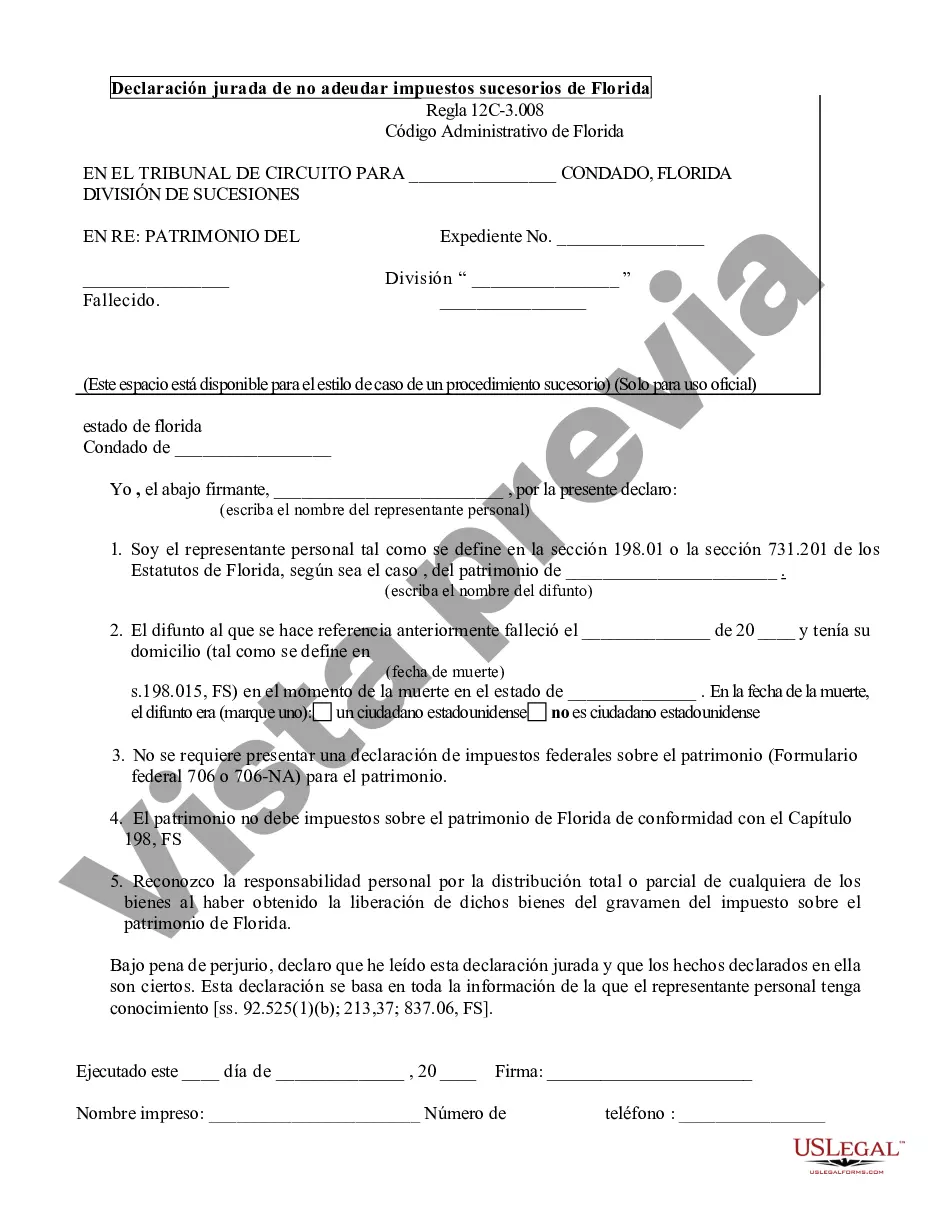

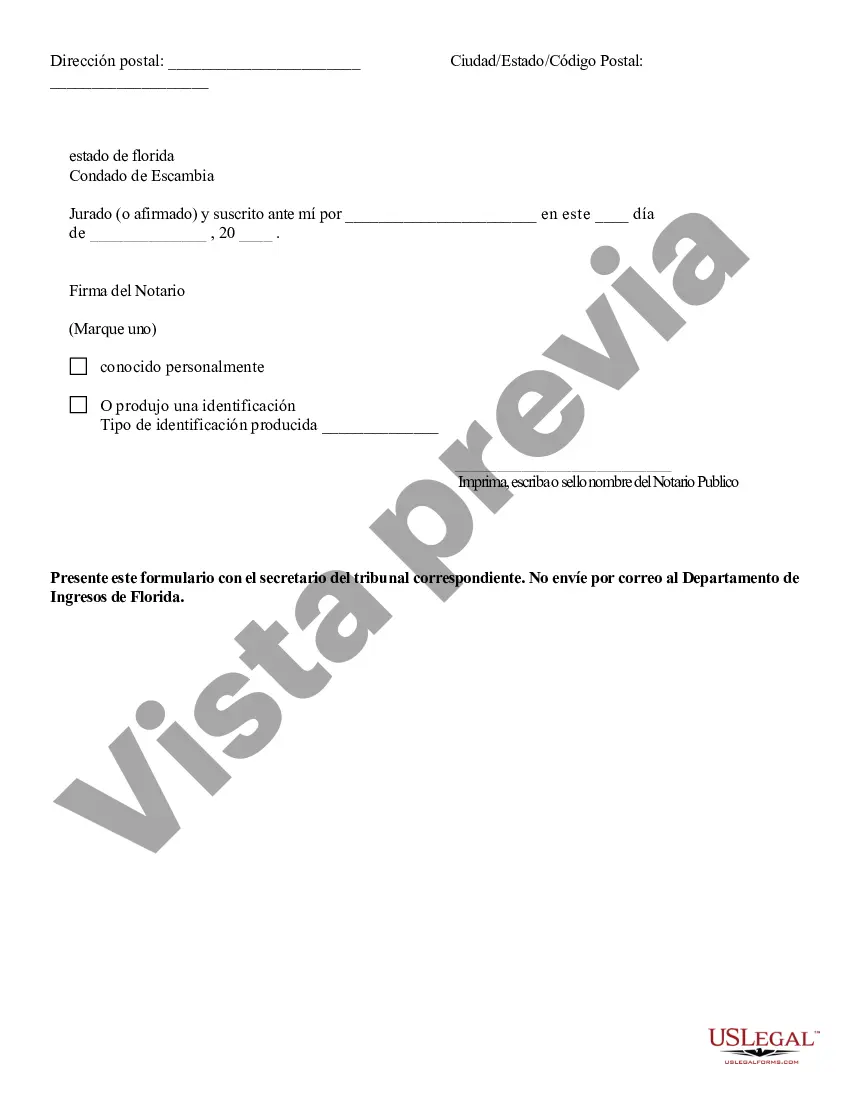

The Hollywood Affidavit of No Florida Estate Tax Due is a legal document used in the state of Florida to establish that no estate tax is owed upon the death of an individual. This affidavit is often required as part of the probate process to certify that the deceased person's estate falls below the threshold for Florida estate tax liability. When a person passes away in Florida, their estate may be subject to taxation if its value exceeds a certain threshold. The threshold for Florida estate tax liability varies depending on the year in which the individual passed away. However, if the total value of the estate falls below this threshold, no estate tax is due, and the Hollywood Affidavit of No Florida Estate Tax Due can be filed. The purpose of the Hollywood Affidavit of No Florida Estate Tax Due is to provide evidence to the court and relevant authorities that the estate does not meet the criteria for estate tax assessment. This document is typically prepared by the personal representative or executor of the estate and must include all necessary information such as the deceased person's name, date of death, and estimated value of the estate. It is important to note that there are different types of Hollywood Affidavit of No Florida Estate Tax Due, depending on the specific circumstances of the estate. Some common variations include: 1. Hollywood Affidavit of No Florida Estate Tax Due for Resident Decedents: This type of affidavit is used when the deceased person was a legal resident of Florida at the time of their passing. It certifies that their estate does not exceed the threshold for Florida estate tax liability. 2. Hollywood Affidavit of No Florida Estate Tax Due for Non-Resident Decedents: This variation applies when the deceased person was not a resident of Florida but had assets located within the state. It establishes that the non-resident's estate is not subject to Florida estate tax. 3. Hollywood Affidavit of No Florida Estate Tax Due for Portability Election: Portability refers to the ability to transfer any unused estate tax exemption to a surviving spouse. This type of affidavit is used when the deceased person's estate elects to transfer their unused exemption to their surviving spouse, potentially reducing or eliminating future estate tax liability. It is crucial to consult with an attorney or estate planning professional to ensure the correct type of Hollywood Affidavit of No Florida Estate Tax Due is prepared and filed accurately. Making any errors or omissions in this document could result in unnecessary tax liabilities or complications during the probate process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hollywood Declaración jurada de no adeudar impuestos sucesorios de Florida - Affidavit of No Florida Estate Tax Due

Description

How to fill out Hollywood Declaración Jurada De No Adeudar Impuestos Sucesorios De Florida?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person with no law education to draft this sort of papers cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms can save the day. Our service offers a massive catalog with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you need the Hollywood Affidavit of No Florida Estate Tax Due or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Hollywood Affidavit of No Florida Estate Tax Due quickly employing our trustworthy service. In case you are already a subscriber, you can go on and log in to your account to download the needed form.

Nevertheless, if you are new to our library, make sure to follow these steps prior to downloading the Hollywood Affidavit of No Florida Estate Tax Due:

- Be sure the form you have chosen is specific to your area considering that the regulations of one state or area do not work for another state or area.

- Preview the form and go through a quick description (if available) of cases the document can be used for.

- In case the one you chosen doesn’t meet your needs, you can start over and search for the necessary form.

- Click Buy now and pick the subscription option that suits you the best.

- Log in to your account credentials or create one from scratch.

- Choose the payment method and proceed to download the Hollywood Affidavit of No Florida Estate Tax Due as soon as the payment is completed.

You’re good to go! Now you can go on and print the form or complete it online. Should you have any problems getting your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.